Key danger indicators sign warning as sentiment soars.

Traders face a troublesome balancing act in as we speak’s market.

The market has come a great distance for the reason that October 2022 low, with optimism creeping again in. However with this renewed confidence comes a must tread fastidiously. As investor sentiment heats up, some key elements demand nearer consideration.

Is Optimism Working Too Excessive?

Howard Marks, a revered voice in investing, typically breaks down market cycles into two broad phases: aggressive intervals and cautious ones. Proper now, we’re seemingly coming into a type of occasions the place warning is essential. In the event you’ve adopted my evaluation over the previous few years, you’ll know that I used to be one of many first to take a constructive view through the Bear Market of 2022, and I’ve maintained that stance all through 2023 and into 2024.

However as we speak? After a powerful rally, optimism is making a powerful comeback—and maybe, simply possibly, it’s turning into a bit an excessive amount of. In actual fact, market sentiment could also be reaching ranges that would quickly problem the bullish outlook we’ve seen in current months.

Check out the charts I shared this morning on my Telegram Channel. They paint a transparent image of the present market local weather.

For one, the US inventory market’s valuation is on the fourth-highest level ever, primarily based on trailing P/E ratios. This, mixed with different indicators, reveals that investor sentiment—and danger urge for food—are at elevated ranges. It is clear that optimism is widespread, however is it turning into extreme?

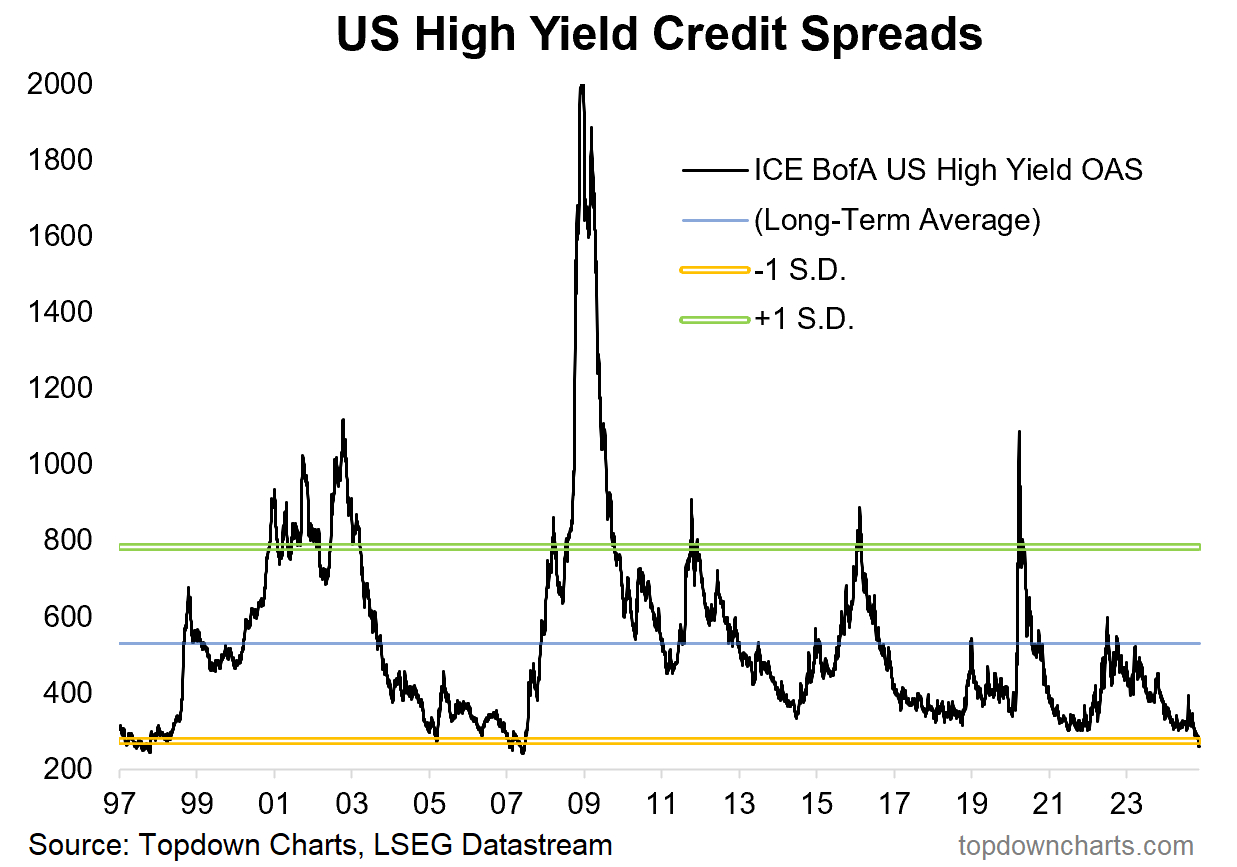

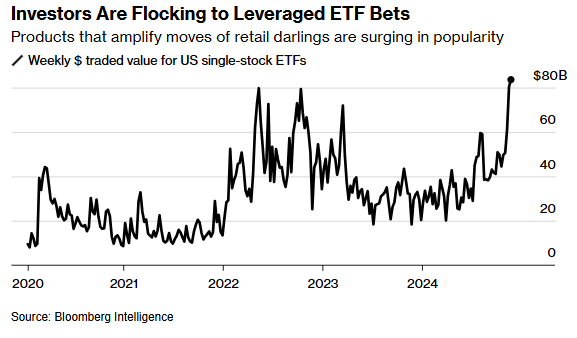

The charts under present that each high-yield spreads (which generally transfer in sync with equities) and riskier devices like leveraged ETFs are all flashing warning indicators of utmost optimism. When these indicators attain such excessive ranges, it’s an indication that traders are prepared to tackle extra danger in hopes of upper returns. Confidence out there is excessive, however is it too excessive?

The massive query on many minds is whether or not this indicators the onset of a Bear Market. The reality is, nobody can predict that with certainty. As historical past exhibits, Bull Markets can stretch far past what logic would anticipate. Whereas we may very well be going through heightened danger, there’s additionally an opportunity that the markets may proceed their upward march, probably pushing valuations even additional.

What to Do Now

So, what’s the investor to do in these unsure occasions? It is a balancing act. We’re at some extent of excessive valuations and sky-high optimism, however there’s additionally the danger of lacking out on additional positive aspects if the market continues to rise. A “expensive” market may get even “dearer.” And whereas the potential for a pullback exists, ready on the sidelines might imply lacking out on the subsequent part of market progress.

The reply, as at all times, seemingly lies someplace in between. We have to keep conscious of present dangers whereas persevering with to place portfolios to seize potential upside within the months and years forward. The secret is sustaining flexibility—being ready for a possible downturn whereas staying open to the potential for additional positive aspects.

In abstract, it’s not a simple atmosphere, and future returns could also be decrease than previously because of excessive valuations and the necessity for extra warning. However be ready. Sooner or later, when the state of affairs seems to be worse than it does as we speak, there might be a chance to step again in aggressively—able to seize the second when the time is correct.

Till subsequent time!

***

Disclaimer: This text is written for informational functions solely. It isn’t supposed to encourage the acquisition of property in any approach, nor does it represent a solicitation, supply, suggestion or suggestion to take a position. I want to remind you that each one property are evaluated from a number of views and are extremely dangerous, so any funding choice and the related danger belongs to the investor. We additionally don’t present any funding advisory providers.