Este artículo también está disponible en español.

Crypto analyst Darkish Defender (@DefendDark) has launched an up to date technical chart that signifies XRP might be on observe to achieve the long-anticipated $8 value degree within the “upcoming days.” The chart, shared on X yesterday, depicts an Elliott Wave construction full with clearly outlined help and resistance ranges, together with a noteworthy correction at present going down beneath the $3 value zone.

The analyst first teased the chart on X: I’ll clarify how XRP is anticipated to focus on $8 within the upcoming days with key ranges and my enter and exit methods […] I’ll share it on X […].” He later shared the chart and defined: “XRP continues the day by day correction and consolidates beneath the $3 degree, which would be the breakeven level for persevering with with our targets. Wave 3 signifies $5.85 is at sight and nearer than ever earlier than. This construction goals at $8+ ranges with its fifth Wave shortly.”

The XRP Value Evaluation Damaged Down

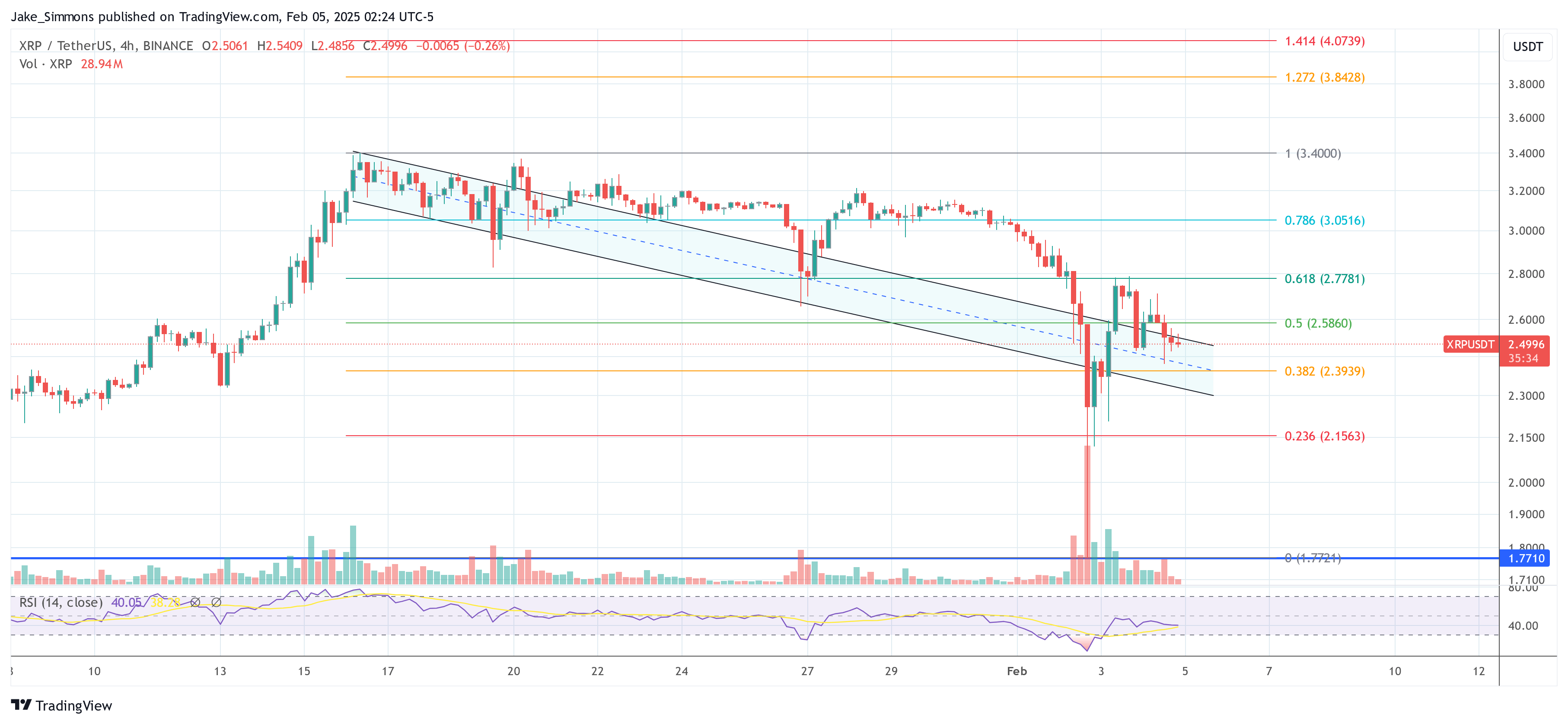

Based on Darkish Defender’s newest day by day chart, XRP has been buying and selling inside a descending channel (recognized by two white pattern traces), from which it beforehand broke out. The analyst denotes 5 impending waves (labeled (1) by (5)) in an Elliott Wave formation. Wave (1) peaks close to $3.3999, whereas the following correction, labeled (2), dips again contained in the Ichimoku Cloud area on the chart.

Associated Studying

On the chart, XRP hovers round $2.56, and the analyst emphasizes the $3 essential degree as the required “breakeven level” for resuming bullish momentum towards increased targets. The XRP value wants to interrupt by the highest white trendline on the chart to construct momentum in Wave (3).

The chart additionally contains a highlighted 261.8% Fibonacci extension line round $5.8563, signaling a projected Wave (3) goal. After a presumed Wave (4) pullback beneath $4.50, Wave (5) targets $8+ — a zone that Darkish Defender believes XRP may attain “shortly.”

Within the remark part beneath the put up, one person, @pommapomatum, questioned whether or not XRP’s second wave legitimately dipped beneath the beginning of Wave (1), a transfer usually inconsistent with classical Elliott Wave idea. Darkish Defender responded by citing a historic precedent from December 6, 2017.

“You might be proper. Nevertheless, after we test XRP historical past, we see comparable wicks all the way down to clear the best way for the subsequent transfer. We had such a extraordinary transfer on December 6, 2017. XRP went from 30 cents to 0.002 cents after which inside a month, XRP hit the ATH at $3.82,” Darkish Defender said.

Associated Studying

@pommapomatum countered that the 2017 wick has been exchange-specific and never indicative of market-wide situations. Darkish Defender acknowledged this concern, noting that not all platforms confirmed the dramatic wick in 2017 and that the identical discrepancy appeared yesterday on sure exchanges.

“It was the identical case yesterday. Not all of the exchanges had the identical wick. E.g. Kraken. I feel that’s an exception and chosen to exclude that wick however candle shut,” the analyst remarked.

Notably, the Ichimoku Cloud on the chart underscores ongoing consolidation as XRP’s value strikes beneath the $3 threshold. Darkish Defender describes this help zone as key for bullish continuation, noting {that a} decisive break above $3 would affirm the subsequent main wave towards $5.85 (Wave (3)) and, in the end, an $8+ goal (Wave (5)) if the sample follows by as envisaged.

At press time, XRP traded at $2.50.

Featured picture created with DALL.E, chart from TradingView.com