Medical outpatient buildings are poised for double-digit development, in response to JLL’s newest analysis.

A surge in outpatient demand, spurred by an getting old inhabitants with even higher health-care providers wants and rising illness prevalence, places outpatient volumes within the U.S. on observe to develop by 10.6 p.c over the following 5 years.

JLL’s report signifies restricted development for purpose-built MOBs, significantly within the Solar Belt, which is an space that has resulted in regular hire development and continued stability for buyers and well being methods actual property.

Expertise has assisted in a continued shift from inpatient to outpatient providers, making remedies cheaper, safer and fewer invasive.

Subsequently, well being methods are increasing their actual property presence and are buying or contracting with doctor teams so as to add specialty providers. From 2022 to 2023, 16,000 extra physicians grew to become staff of a hospital system, and well being methods accounted for 46 p.c of MOB leases that JLL tracked in 2024.

Specialty suppliers comprised 31 p.c of the MOB leases. Psychiatrists and behavioral well being suppliers are the main specialty segments, accounting for 18 p.c of sq. footage.

Savills identified that in response to Definitive Healthcare’s 2023 survey of 195 leaders amongst health-care supplier organizations, 60 p.c of respondents’ strategic objectives for the following 24 months included aligning services and providers with altering affected person demand. Moreover, ambulatory health-care employment is projected to develop 12 p.c by way of 2028.

Well being-care suppliers providing low- to mid-acuity providers more and more take into account workplace and retail areas close to sufferers or hospitals, in response to JLL’s report. This transfer could make conversion difficult for high-acuity or resource-intensive providers similar to imaging.

A resilient trade

Some will discover the excessive stage of resiliency by medical outpatient buildings amid important financial challenges considerably shocking, Cheryl Carron, COO at JLL’s Work Dynamics Americas & president of the Healthcare Division, informed Business Property Government.

“Whereas many actual property sectors grapple with oversupply, MOB development stays constrained, with fourth-quarter 2024 begins at a file low of 0.8 p.c of stock,” she stated.

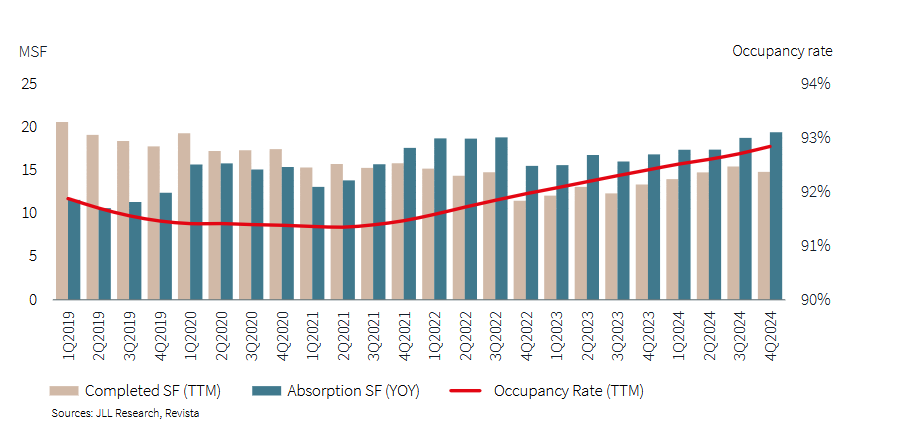

MOBs are seeing rising occupancy charges and regular hire development, in response to JLL’s analysis. Absorption accelerated within the fourth quarter of 2024, surpassing 19 million sq. toes for the highest 100 markets, and marking a rise of 15 p.c from full-year 2023.

Carron stated that health-care suppliers are looking for to develop to serve a rising want from affected person populations. Nonetheless, they accomplish that with declining Medicare and Medicaid reimbursements and slim margins, averaging simply 4.9 p.c in December 2024, in response to the Kaufman Corridor Flash Report.

“As health-care margins proceed to tighten, optimizing facility effectivity has turn out to be crucial for suppliers to keep up monetary viability whereas assembly rising affected person demand,” in response to Carron.

Agentic AI creates higher effectivity

For instance, synthetic intelligence and different kinds of expertise allow MOB operators to make data-driven selections that cut back vitality and upkeep prices and supply a more healthy surroundings for sufferers and staff.

The Wall Road Journal reported that enormous language fashions can higher perceive context and supply efficient agentic AI.

READ ALSO: Why the Medical Outpatient Sector Is Poised for Development in 2025

These brokers can converse with sufferers of human-help health-care suppliers when dealing with duties similar to prescreening and scheduling, decreasing clinicians’ workloads given shortages of docs and nurses. A few of at present’s AI-based tech platforms can carry out about 100 actions, similar to automated calls to sufferers after a hospital discharge.

Subdued improvement

MOB development has been subdued as a result of builders’ want for increased returns and tenants’ need to regulate bills and elevated prices. Subsequently, health-care tenants want various areas as a result of restricted medical workplace availability.

John Wilson, president of HSA PrimeCare, informed CPE that assembly the upper demand for health-care providers is difficult.

“New health-care development has slowed over the previous couple of years as a result of excessive development prices and rates of interest,” Wilson stated. Well being-care methods are additionally going through a scarcity of physicians, he added. There are over 340 million folks within the U.S., and solely about 1.1 million physicians, almost half of whom are over age 55.

Occupancy for MOBs is shifting steadily increased. The speed was 92.8 p.c within the fourth quarter of 2024, up from 92.4 p.c one 12 months prior.

Medical workplace constructing occupancy has steadily elevated within the high U.S. metros because the second quarter of 2021, whilst the event pipeline product kind stays strong, in response to Avison Younger Principal Janet Clayton.

“High-tier medical workplace buildings have skilled the steepest hire development since 2019, whereas typical medical workplace buildings adopted regular rental charge development patterns throughout the identical time,” Clayton stated. “This may be attributed to a continued flight-to-quality development throughout the nation as tenants are prepared to pay extra for newly delivered merchandise with high-quality facilities.”

MOB rents rose in 2024 from 2023, though extra slowly. High-tier properties with rents within the ninetieth percentile of Revista’s High 100 markets grew at a 2.4 p.c CAGR from 2019 to 2024, in comparison with 1.8 p.c for median charges. JLL stated this charge enhance shall be regular, not steep, due to reimbursement pressures and tight working margins.

Aggressive growth in South Florida

The inhabitants’s shift to the Solar Belt will produce sturdy development there. Nevertheless, JLL reported that sturdy efficiency in markets similar to Northern New Jersey and Boston will profit from the presence of established, rising well being methods with sturdy model recognition.

4 Solar Belt markets are seeing hire development of over 3 p.c: Miami; Orlando, Fla.; Austin, Texas; and Tampa, Fla.

Probably the most important variety of new outpatient providers move-ins in 2024 had been in New York, and Philadelphia led all markets for MOB web absorption. Atlanta and Houston posted greater than 400,000 sq. toes of web absorption every, and the Norfolk/Hampton Roads, Va., space noticed sturdy absorption in comparison with whole stock.

One thriving Solar Belt market is South Florida, in response to Colliers.

South Florida’s favorable demographic profile, coupled with the continued development to offer medical care outdoors of a conventional hospital campus, has created a robust demand from buyers and health-care suppliers, in response to Mark Rubin, government vp at Colliers. He’s primarily based in its South Florida brokerage workplace for Palm Seashore and Broward counties.

In 2019, Florida modified its Certificates of Wants rules, which facilitated growth in South Florida by hospital methods trying to enter the market.

“Over the previous few years, we’ve seen Cleveland Clinic, Baptist, HCA, College of Miami, HSS, UF Shands, Tampa Normal, and others aggressively trying to develop their footprint in South Florida,” Rubin informed CPE.

As such, medical buyers have been very energetic in trying to buy or develop medical workplace buildings to fulfill this rising demand, Rubin added. South Florida’s present medical workplace stock contains predominantly older belongings with restricted availabilities.

Builders and customers are alternatively looking for land or different properties (conventional workplace or retail) that may be developed for medical use, Rubin defined. Whereas sturdy demand and restricted provide exist, land and development prices current important headwinds for builders, and only a few speculative developments are being constructed.

“We’ve had sturdy curiosity from each customers and builders. With all these constructive market components leading to a provide/demand imbalance, we consider the medical workplace market will proceed flourishing in South Florida,” Rubin stated.

Buyers proceed to guess on MOB

Medical workplace buildings stay a robust guess for buyers nationwide, in response to Avison Younger Senior Vice President Blake Thomas.

“Rate of interest adjustments and inflationary pressures may trigger cap charges to develop additional within the close to time period. Nonetheless, that development is anticipated to be short-lived as demand for medical workplace buildings continues to point out sturdy momentum.”

Igor Pleskov, associate & actual property observe vice chair at Saul Ewing stated demographics favorable to medical workplace constructing power would proceed for a while.

“In gentle of improvement typically being slowed by rate of interest and different financial pressures, I count on continued hire development and investor enthusiasm available in the market,” Pleskov informed CPE.

“To the extent that macroeconomic traits turn out to be extra favorable, I might anticipate extra sharp will increase in improvement. Total, the medical workplace market stays sturdy with constructive underlying fundamentals that bode effectively for future prospects.”