Dominated by the commercial and logistics sector, internet lease funding quantity elevated by 19 % quarter-over-quarter and 57 % year-over-year within the fourth quarter of 2024, reaching $13.7 billion, in response to a brand new report from CBRE.

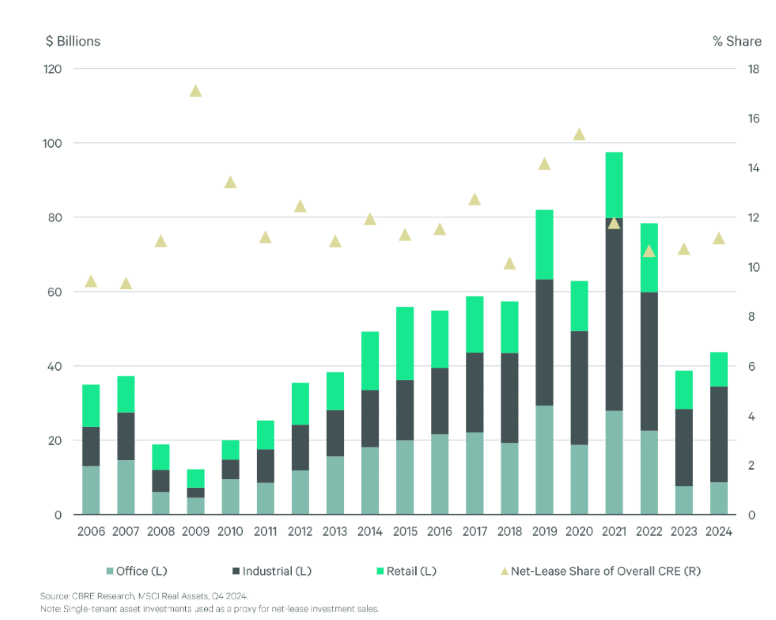

That quarter helped to create a 13 % improve in full-year 2024 internet lease funding quantity, totaling $43.7 billion.

Industrial and logistics elevated its share to 64 % within the fourth quarter from 54 % a yr earlier. Final yr, internet lease funding quantity for industrial belongings elevated 87 % from the prior yr.

Web lease properties are characterised by a lease construction by which the tenant agrees to pay a portion or the entire taxes, insurance coverage charges and upkeep prices along with lease.

Predictable money circulate

The web lease sector’s sturdy efficiency was generated by its predictable money circulate, and mass attraction to traders searching for strong risk-adjusted returns, Will Pike, vice chairman of internet lease properties for capital markets at CBRE, instructed Business Property Government.

“We count on continued momentum this yr, particularly in retail and the commercial sector, as capital has confirmed to prioritize low-risk alternatives amid potential capital markets volatility in 2025,” he stated.

Joseph Yiu, a accomplice at Leste Group, a worldwide different funding supervisor, instructed CPE he was not shocked as a result of the asset class has at all times carried out nicely in occasions of uncertainty.

“With fundamentals and lease development beginning to deteriorate and plateau in different industrial actual property asset lessons, 2 % to three % annual escalations on long-term internet leases are starting to look engaging on a relative worth foundation,” in response to Yiu. “Cap charges on internet leases have additionally widened over the past 24 months, so acquiring impartial or constructive leverage is slowly turning into accessible for creditworthy debtors.”

Offers consummated at year-end

As some conventional retailers wrestle to keep up their clients or credit score rankings, Damon Juha, accomplice & actual property follow vice chair at Saul Ewing, sees traders discover exterior the normal single-tenant NNN retail offers into different product varieties, corresponding to industrial.

“There appeared to be a convergence of influences: traders responding to the Fed’s rate of interest cuts, traders paying all money (significantly for smaller offers such that the curiosity didn’t matter) and events needing to consummate offers earlier than year-end, significantly in gentle of the change of the administration,” Juha stated.

READ ALSO: Understanding the Web Lease Reset

Web lease offers have traditionally offered a comparatively low-risk different at worth factors the place personal traders can enter the market with out financing, Juha added. ”Our shoppers proceed to need to do offers, however time will inform if inflation threat and rates of interest quell this sentiment.”

Development in logistics and distribution services displays developments just like the continued enlargement of e-commerce, provide chain shifts and the necessity for strategically positioned belongings, in response to Lanie Beck, Northmarq senior director, content material & advertising analysis.

“Personal traders drive the majority of transaction exercise, at the same time as financial pressures like elevated rates of interest and inflation affect the market,” Beck stated.

Latest cap fee will increase point out a recalibration of threat, whereas stabilized single-tenant internet lease properties proceed to draw the eye of each personal and institutional patrons, she noticed.

“Industrial belongings, as famous beforehand, have outperformed. Alternatively, retail and workplace sectors face combined dynamics, with traders specializing in important tenants and area of interest alternatives like well being care or medtail,” Beck added. “Finally, the web lease market’s resilience comes from its knack for putting the appropriate steadiness between stability and alternative. The sector affords traders a relative haven in unsure occasions.”

NNN vitality leases

It’s additionally price trying on the rise of triple-net multifamily leases, in response to Sean Doak, chief income officer at PearlX.

“Whereas most frequently employed in mixed-use developments, NNN vitality leases that present multifamily properties with vitality facilities like solar energy have been on the rise within the sector as an answer to numerous issues, most notably as a inventive supply of capital in a constrained funding atmosphere,” Doak stated.

“With elevated rates of interest, restricted capital availability, rising development prices and aggressive constructing code laws, multifamily builders are having to suppose exterior of the field to make tasks financially viable.”

By an NNN vitality lease, multifamily builders can decrease growth prices, adjust to stringent laws and improve money circulate after the property’s supply, all whereas offloading the insurance coverage, taxes and upkeep overhead onto the tenant—a key function of what makes NNN leases engaging within the first place, Doak stated.

Nevertheless, not all internet lease is similar, Dave Sobelman, founder & CEO of publicly traded REIT Technology Revenue Properties, instructed CPE.

“It might be vital to disaggregate the information into extra outlined classes contemplating extra particular outlooks,” Sobelman stated.

“As an example, industrial has turn out to be a highly regarded asset class for the reason that creation of the pandemic. Nevertheless, the majority of business transactions in right now’s market are usually sale-leaseback transactions to non-investment grade tenants who require capital and may now not borrow at charges accretive to their steadiness sheets. These transactions had been few and much between earlier than 2020.”

Moreover, he famous that late in 2024, total internet lease transaction quantity could have elevated barely from 2023, however it’s nonetheless at traditionally low ranges, mirrored in a Northmarq report.

“These low ranges of transactions haven’t been seen since roughly 2009 to 2010, instantly after the GFC,” he stated.