Yen weak point push Nikkei 225 futures in direction of key resistance

Fed and BoJ fee selections on Wednesday and Thursday respectively

Bullish setups emerge for each USD/JPY and Nikkei 225 futures

Overview

The upside transfer in benchmark US Treasury yields anticipated in final Friday’s outlook has materialised, lifting the pair to contemporary weekly highs. The tight interaction between technicals and correlations stays intact, regardless of the backdrop of great threat occasions. This dynamic gives a possible framework for setups within the coming week.

The yen’s weak point has additionally caught the eye of merchants. Bettering company earnings prospects are starting to counterbalance issues about US President-elect Donald Trump’s proposed tariff measures, producing near-term tailwinds for Japanese equities.

Bond Massacre Boosts USD/JPY Bulls

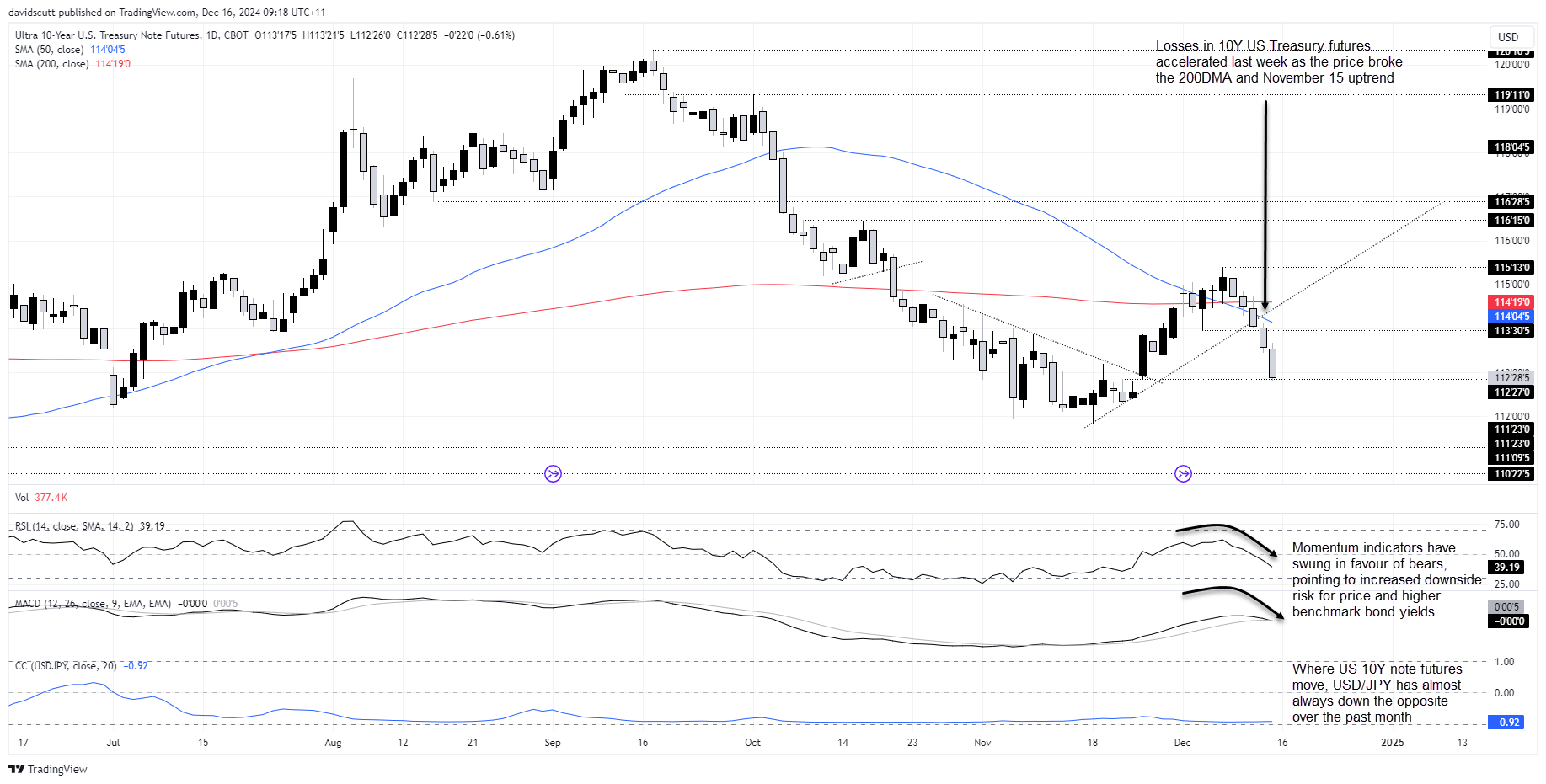

Final week was a massacre for US bonds, particularly on the lengthy finish of the curve. Benchmark yields spiked 24.6bps, sending them to inside touching distance of the highs struck instantly after Donald Trump’s victory within the US Presidential election.

Supply; TradingView

A 16bps discount within the scale of fee cuts anticipated from the Fed by the top of 2025 might have been an element, serving to to carry yields additional out the curve in anticipation of a hawkish reduce on Wednesday, however technicals arguably offered the clearest sign on the looming carry in yields.

Technical Tea Leaves Show Correct

You may see that within the 10-year US Treasury be aware futures chart, with losses accelerating final week as the worth broke by the 200-day transferring common and uptrend assist relationship again to November 15. The rout subsequently stalled at identified horizontal assist on Friday, additional bolstering the message coming from technicals.

Supply: TradingView

With RSI (14) and MACD producing bearish alerts, the trail of least resistance comes throughout as decrease, not greater. On the very least, promoting rallies and bearish breaks is most well-liked near-term.

Observe the robust inverse correlation between benchmark Treasury futures and USD/JPY within the backside pane, sitting at -0.92 over the previous month. As value strikes inversely to yields, the readthrough is USD/JPY stays extremely influenced by the US rate of interest outlook.

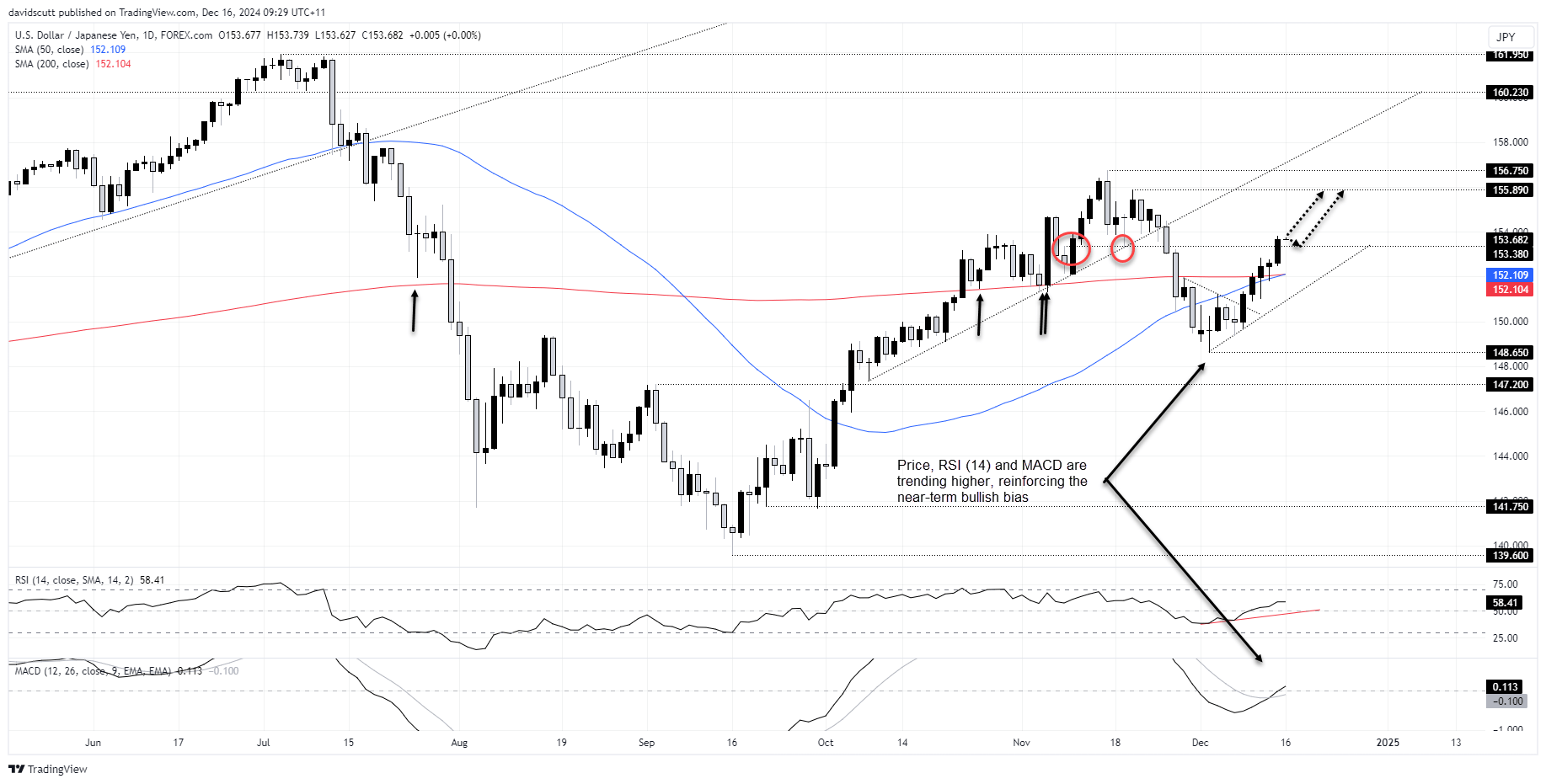

USD/JPY Takes Out One other Resistance Stage

Supply: TtradingView

With US benchmark yields pushing greater, it’s fuelling USD/JPY upside, seeing the worth take out resistance at 153.38 on Friday after putting off the 50 and 200-day transferring averages earlier within the week. With RSI (14) and MACD offering bullish alerts on momentum, the bias is to purchase dips and bullish breaks.

The transfer above of 153.38 gives a bullish setup for these searching for concepts, with potential pullbacks in direction of the extent permitting for longs to be established with a decent cease beneath for cover. Doable topside targets embrace 155.89 and 156.75.

If the worth have been to reverse again by 153.38, potential brief setups don’t display as notably interesting with the important thing 200-day transferring common positioned close by. Except you’re an intraday scalper, the risk-reward seems skinny.

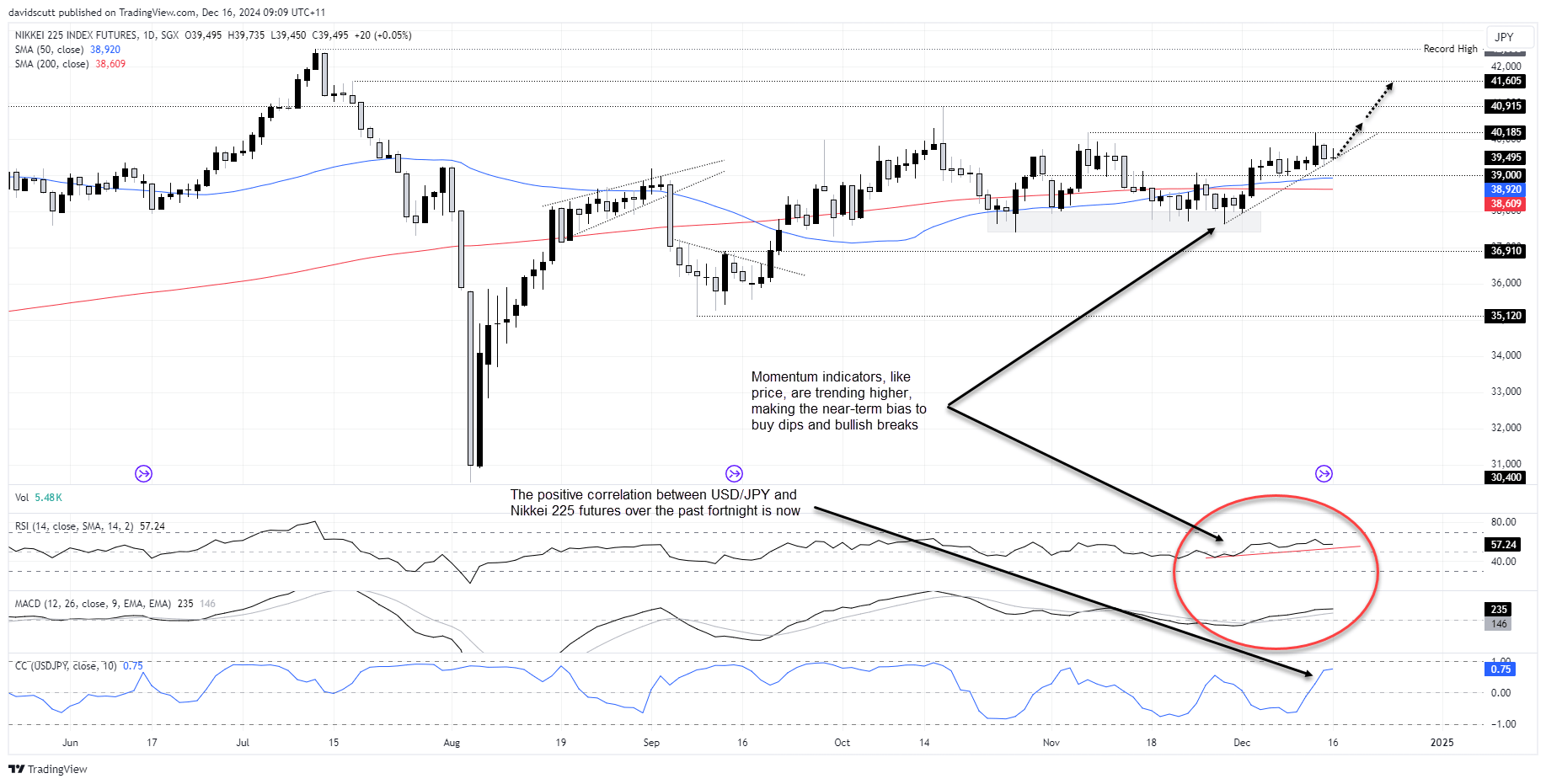

Nikkei Bulls Eye Vary Break

The bullish break in USD/JPY could also be beginning to affect with the rolling correlation between the 2 strengthening to 0.75 over the previous fortnight, a stage solely seen as soon as over the previous two months.

Nikkei futures have been rangebound for months, restricted by shopping for assist under 38000 on the draw back and sellers parked above 40000 on the topside.

Extra not too long ago, nevertheless, futures have pushed in direction of the prime quality, discovering assist at 39000 and a minor uptrend relationship again to late November. With RSI (14) and MACD signalling constructing topside momentum, merchants ought to be alert for a bullish breakout within the brief to medium-term.

Supply: TradingView

The uptrend is discovered round 39450 right this moment, near the place the worth closed on Friday night. If it have been to carry, merchants may look to purchase above it with a decent cease beneath for cover. The value has run into sellers above 40000 the previous 5 occasions it’s ventured there, making that an apparent preliminary goal.

Alternatively, if the worth have been unable to carry the uptrend, the bullish bias can be void, permitting for setups to commerce the present vary with assist positioned in between at 39000.

Now learn:

Authentic Submit