The 30-day MVRV ratio suggests XRP might have bottomed, probably setting the stage for a big worth rebound based mostly on historic patterns.

Whereas spot market exercise builds, XRP’s derivatives market reveals hesitation, with open curiosity falling by over 30% and funding charges remaining adverse.

XRP worth has risen by 2% within the preliminary Asian buying and selling session on Thursday as investor accumulation tendencies proceed to get stronger, with derivatives exercise muted. On-chain metrics point out that market individuals are making ready for a possible worth restoration.

XRP Traders Ramp Up Accumulation

Amid the crypto market decline on February 3, holders of XRP have modified their technique, with a higher predisposition towards accumulation. On-chain statistics reveal a drop in promoting stress, as measured by the Imply Coin Age indicator pointing upwards. The indicator, which reveals the typical time for XRP tokens to remain in wallets they’re in, has been growing. As talked about in our earlier story, it reveals that traders are holding onto their cash as a substitute of transferring them to exchanges on the market.

Additionally, the 30-day MVRV ratio signifies that XRP may have hit a possible backside after falling to -17% final week. Traditionally, comparable readings within the metric have led to vital worth rebounds, with XRP rallying greater than 60% the earlier time the MVRV ratio hit such ranges. If historical past repeats itself, the token might witness a big worth surge within the close to future.

Derivatives Market Registers Slipping Exercise

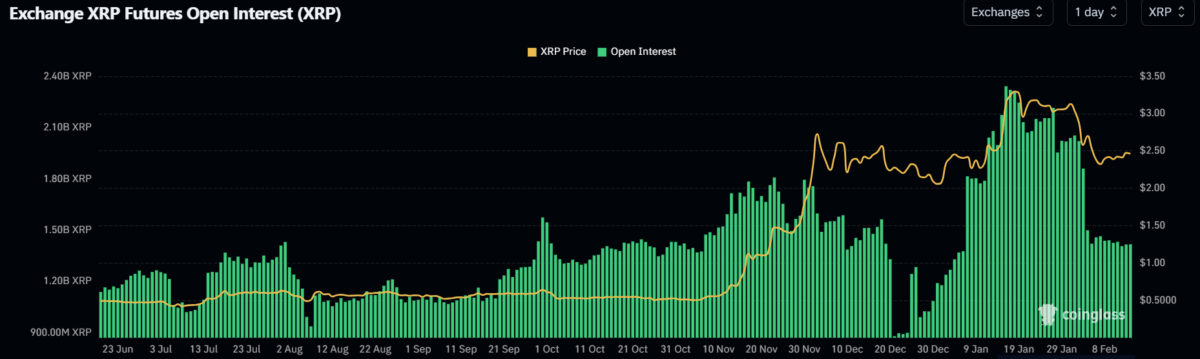

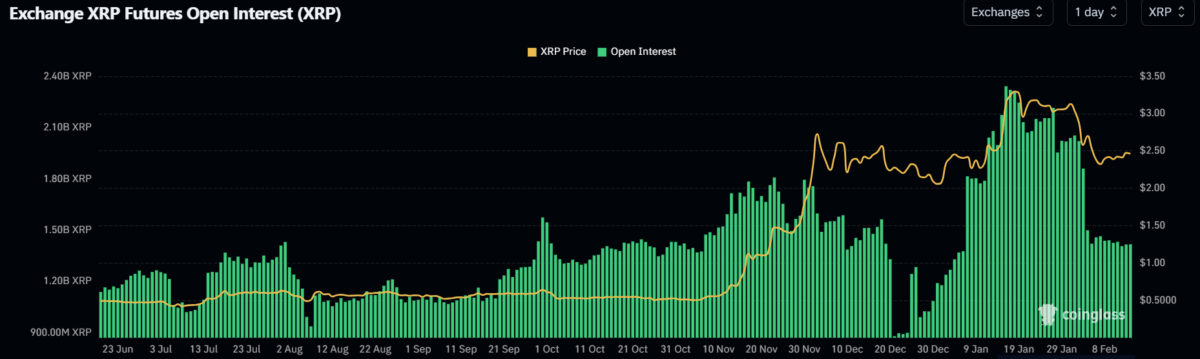

Whereas posting constructing exercise within the spot market, the derivatives market of XRP reveals a extra subdued perspective from merchants. Open curiosity—measured by the variety of lively contracts—has plummeted, slipping greater than 30% from 2.05 billion XRP to 1.42 billion XRP. Unfavourable funding charges over the previous few days additionally present that futures merchants are hesitant to put aggressive directional bets on the asset.

In the meantime, regulatory updates can also affect the worth motion of XRP, with the U.S. Securities and Trade Fee (SEC) formally acknowledging Grayscale’s submitting of XRP ETF on Tuesday. Bloomberg analysts Eric Balchunas and James Seyffart put the probabilities of approval for the applying at 65%.

Key Ranges For XRP Worth

Statistics by Coinglass present that XRP futures liquidation hit $5.91 million within the final 24 hours. Of this, $2.80 million represented lengthy liquidations, whereas brief liquidations had been at $3.11 million.

XRP has been buying and selling in a recognized vary for the reason that downward market correction, with key ranges of assist at $2.26 and resistance at $2.55. This stage has created confusion amongst merchants, particularly within the aftermath of latest volatility that washed out numerous longs.

A agency break above $2.55 would possible immediate renewed shopping for stress, and additional resistance is predicted at $2.72. Ought to bullish stress intensify above these ranges, it may lure in additional gamers amongst merchants hoping to reap the benefits of an uptrend.

But when XRP falls under $2.26, it’d provoke a critical lengthy squeeze, with greater than $80 million price of positions weak to liquidation. If that’s the case, the subsequent vital assist stage is at $1.96.

Technical indicators together with the Relative Energy Index (RSI) and the Stochastic Oscillator are presently above impartial ranges, indicating short-term bullish momentum. While, a every day shut under $1.96 would check this thesis, although.

Beneficial for you: