Updated on July 21st, 2025 by Bob Ciura

The Russell 2000 Index is arguably the world’s best-known benchmark for small-cap U.S. stocks.

Small-cap stocks have historically outperformed their larger counterparts. Accordingly, the Russell 2000 Index can be an intriguing place to look for new investment opportunities.

You can download your free Excel list of Russell 2000 stocks, along with relevant financial metrics like dividend yields and P/E ratios, by clicking on the link below:

We typically rank stocks based on their five-year expected annual returns, as stated in the Sure Analysis Research Database.

But for investors primarily interested in income, it is also useful to rank small-cap stocks according to their dividend yields.

This article will rank the 20 highest-yielding small cap stocks in our coverage universe (excluding REITs, MLPs, BDCs, and royalty trusts).

Table of Contents

Why Invest In Small-Cap Stocks?

The Russell 2000 Index contains the domestic U.S. stocks that rank 1,001 through 3,000 by descending market capitalization.

The Russell 2000 is an excellent benchmark for small-cap stocks. The average market capitalization within the Russell 2000 is ~currently $2.9 billion.

Why does this matter? There are a number of advantages to investing in small-cap stocks, which we explore in the following video:

Small-cap stocks have historically outperformed large-cap stocks for two reasons.

Firstly, small-cap stocks tend to grow more quickly than their larger counterparts. There is simply less competition and more room to grow when your market capitalization is, say, $1 billion when compared to mega-cap stocks with market caps above $200 billion.

Secondly, many small-cap securities are outside the investment universes of some larger institutional investment managers. This creates less demand for shares, which reduces their prices and creates better buying opportunities.

For this reason, there are typically more mispriced investment opportunities in a small-cap index like the Russell 2000 than a large-cap stock index like the S&P 500.

The following section ranks the 20 highest-yielding small-cap stocks in the U.S. that are covered in the Sure Analysis Research Database. The stocks are ranked in order of lowest dividend yield to highest.

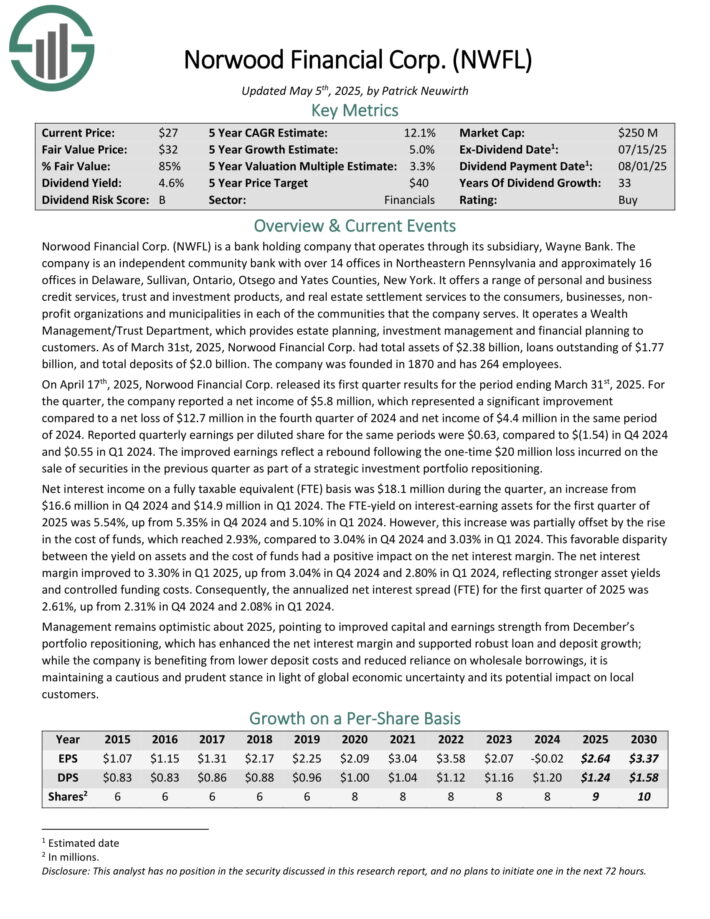

High Yield Small Cap #20: Norwood Financial (NWFL)

Norwood Financial is a bank holding company that operates through its subsidiary, Wayne Bank. The company is an independent community bank with over 14 offices in Northeastern Pennsylvania and approximately 16 offices in Delaware, Sullivan, Ontario, Otsego and Yates Counties, New York.

It operates a Wealth Management/Trust Department, which provides estate planning, investment management and financial planning to customers. As of March 31st, 2025, Norwood Financial Corp. had total assets of $2.38 billion, loans outstanding of $1.77 billion, and total deposits of $2.0 billion.

On April 17th, 2025, Norwood Financial Corp. released its first quarter results for the period ending March 31st, 2025. For the quarter, the company reported a net income of $5.8 million, which represented a significant improvement compared to a net loss of $12.7 million in the fourth quarter of 2024 and net income of $4.4 million in the same period of 2024.

Reported quarterly earnings per diluted share for the same periods were $0.63, compared to $(1.54) in Q4 2024 and $0.55 in Q1 2024. The improved earnings reflect a rebound following the one-time $20 million loss incurred on the sale of securities in the previous quarter as part of a strategic investment portfolio repositioning.

Click here to download our most recent Sure Analysis report on NWFL (preview of page 1 of 3 shown below):

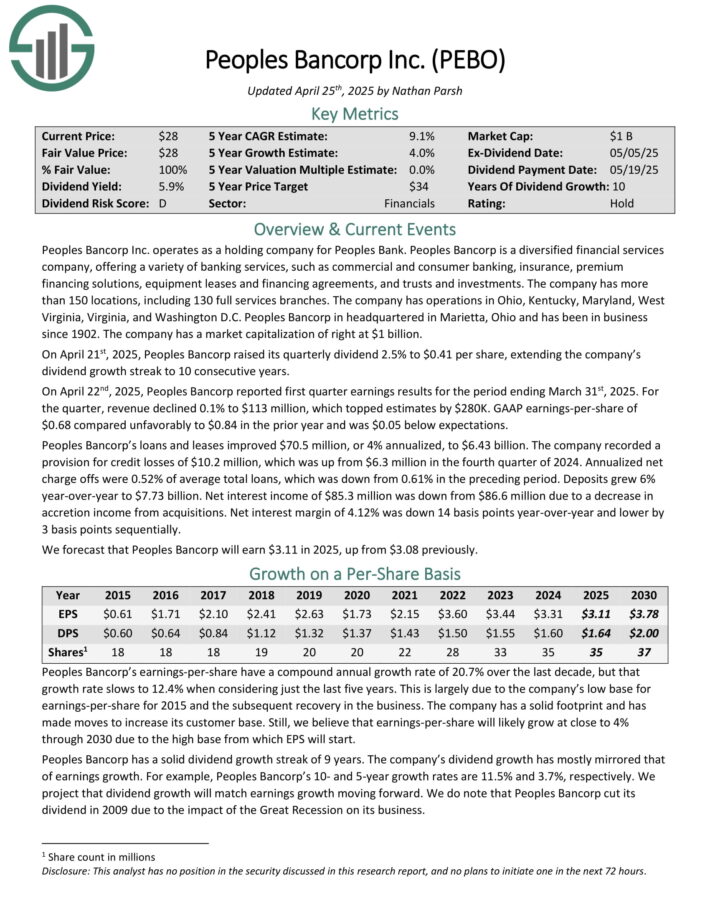

High Yield Small Cap #19: Peoples Bancorp (PEBO)

Peoples Bancorp operates as a holding company for Peoples Bank. Peoples Bancorp is a diversified financial services company, offering a variety of banking services, such as commercial and consumer banking, insurance, premium financing solutions, equipment leases and financing agreements, and trusts and investments.

The company has more than 150 locations, including 130 full services branches. The company has operations in Ohio, Kentucky, Maryland, West Virginia, Virginia, and Washington D.C.

On April 21st, 2025, Peoples Bancorp raised its quarterly dividend 2.5% to $0.41 per share, extending the company’s dividend growth streak to 10 consecutive years.

On April 22nd, 2025, Peoples Bancorp reported first quarter earnings results for the period ending March 31st, 2025. For the quarter, revenue declined 0.1% to $113 million, which topped estimates by $280K. GAAP earnings-per-share of $0.68 compared unfavorably to $0.84 in the prior year and was $0.05 below expectations.

Peoples Bancorp’s loans and leases improved $70.5 million, or 4% annualized, to $6.43 billion. The company recorded a provision for credit losses of $10.2 million, which was up from $6.3 million in the fourth quarter of 2024. Net interest margin of 4.12% was down 14 basis points year-over-year and lower by 3 basis points sequentially.

Click here to download our most recent Sure Analysis report on PEBO (preview of page 1 of 3 shown below):

High Yield Small Cap #18: Centerspace (CSR)

Centerspace owns and operates 71 apartment communities comprised of 13,012 homes in Colorado, Minnesota,Montana, Nebraska, North Dakota and South Dakota. The company was founded in 1970.

On May 1st, 2025, Centerspace published its Q1 results for the period ending March 31st, 2025. Same-store revenues increased 3.5% year-over-year. Core FFO declined by two pennies to $1.21, and missed analyst estimates by one cent.

Centerspace’s same-store weighted average occupancy was 95.8%, a 120 basis point year-over-year improvement. During Q1, Centerspace had no acquisition or disposition activities.

The company ended the quarter with just over $223 million in total available liquidity. Management provided 2025 guidance, expecting core FFO for the year between $4.86 to $5.10, which represents a 2% increase at the midpoint.

This guidance assumes same-store capex of $1,125 to $1,175 per home, and value-add expenditures of approximately $17 million.

Click here to download our most recent Sure Analysis report on CSR (preview of page 1 of 3 shown below):

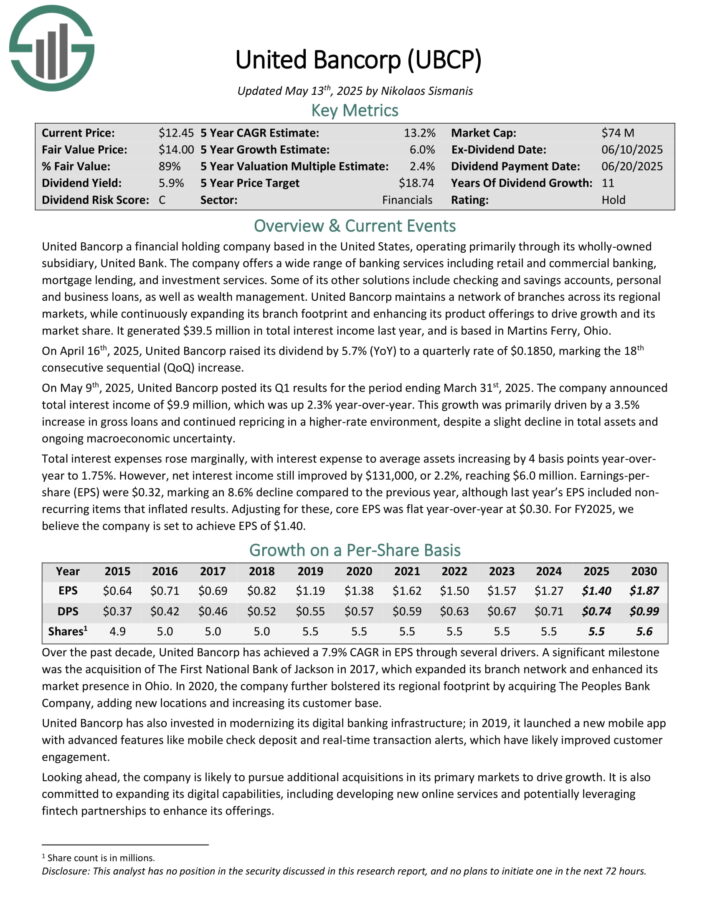

High Yield Small Cap #17: United Bancorp Inc. (UBCP)

United Bancorp a financial holding company based in the United States, operating primarily through its wholly-owned subsidiary, United Bank. The company offers a wide range of banking services including retail and commercial banking, mortgage lending, and investment services.

Some of its other solutions include checking and savings accounts, personal and business loans, as well as wealth management. United Bancorp maintains a network of branches across its regional markets, while continuously expanding its branch footprint and enhancing its product offerings to drive growth and its market share.

It generated $39.5 million in total interest income last year, and is based in Martins Ferry, Ohio.

On April 16th, 2025, United Bancorp raised its dividend by 5.7% (YoY) to a quarterly rate of $0.1850, marking the 18th consecutive sequential (QoQ) increase.

On May 9th, 2025, United Bancorp posted its Q1 results for the period ending March 31st, 2025. The company announced total interest income of $9.9 million, which was up 2.3% year-over-year.

This growth was primarily driven by a 3.5% increase in gross loans and continued repricing in a higher-rate environment, despite a slight decline in total assets and ongoing macroeconomic uncertainty.

Total interest expenses rose marginally, with interest expense to average assets increasing by 4 basis points year-over-year to 1.75%. However, net interest income still improved by $131,000, or 2.2%, reaching $6.0 million. Earnings-per-share (EPS) were $0.32, marking an 8.6% decline compared to the previous year.

Click here to download our most recent Sure Analysis report on UBCP (preview of page 1 of 3 shown below):

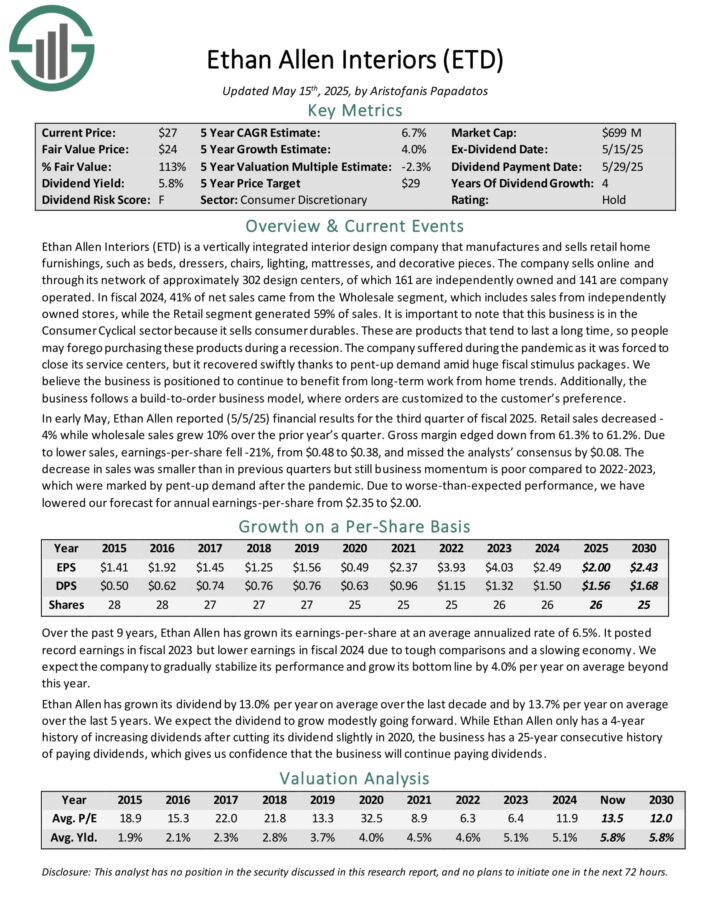

High Yield Small Cap #16: Ethan Allen Interiors (ETD)

Ethan Allen Interiors is a vertically integrated interior design company that manufactures and sells retail home furnishings, such as beds, dressers, chairs, lighting, mattresses, and decorative pieces.

The company sells online and through its network of approximately 302 design centers, of which 161 are independently owned and 141 are company operated. In fiscal 2024, 41% of net sales came from the Wholesale segment, which includes sales from independently owned stores, while the Retail segment generated 59% of sales.

In early May, Ethan Allen reported (5/5/25) financial results for the third quarter of fiscal 2025. Retail sales decreased 4% while wholesale sales grew 10% over the prior year’s quarter. Gross margin edged down from 61.3% to 61.2%. Due to lower sales, earnings-per-share fell -21%, from $0.48 to $0.38, and missed the analysts’ consensus by $0.08.

Ethan Allen has averaged a payout ratio of 52% over the past decade. With earnings-per-share expected to grow faster than dividends, we expect that the business will continue to have a decent payout ratio over the intermediate term.

Ethan Allen has no debt, which adds a strong level of safety to the company, but investors should understand that this business is vulnerable to economic downturns.

Click here to download our most recent Sure Analysis report on ETD (preview of page 1 of 3 shown below):

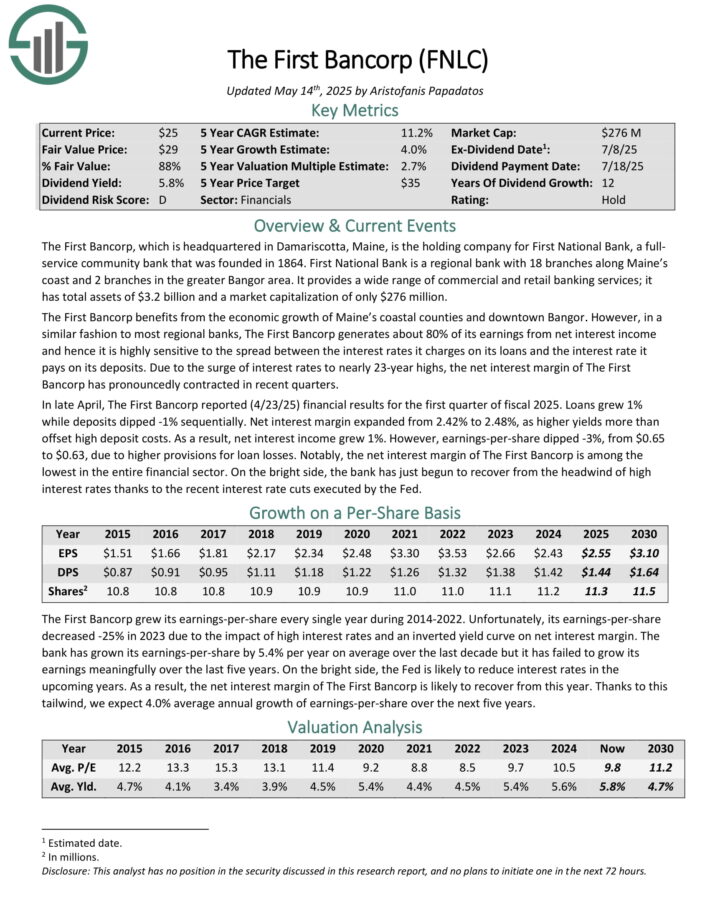

High Yield Small Cap #15: First Bancorp Inc. (FNLC)

The First Bancorp, which is headquartered in Damariscotta, Maine, is the holding company for First National Bank, a full-service community bank that was founded in 1864. First National Bank is a regional bank with 18 branches along Maine’s coast and 2 branches in the greater Bangor area.

It provides a wide range of commercial and retail banking services. It has total assets of $3.2 billion.

The First Bancorp benefits from the economic growth of Maine’s coastal counties and downtown Bangor. The First Bancorp generates about 80% of its earnings from net interest income and hence it is highly sensitive to the spread between the interest rates it charges on its loans and the interest rate it pays on its deposits.

In late April, The First Bancorp reported (4/23/25) financial results for the first quarter of fiscal 2025. Loans grew 1% while deposits dipped -1% sequentially. Net interest margin expanded from 2.42% to 2.48%, as higher yields more than offset high deposit costs.

As a result, net interest income grew 1%. However, earnings-per-share dipped -3%, from $0.65 to $0.63, due to higher provisions for loan losses.

Click here to download our most recent Sure Analysis report on FNLC (preview of page 1 of 3 shown below):

High Yield Small Cap #14: Canandaigua National Corporation (CNND)

Canandaigua National Corporation (CNC) is the parent company of The Canandaigua National Bank & Trust Company (CNB) and Canandaigua National Trust Company of Florida (CNTF), offering a wide range of financial services, including banking, lending, mortgage services, trust, investment management, and insurance.

With 23 branches across its service areas, CNC is focus on serving local communities by providing personalized financial solutions to individuals, businesses, and municipalities.

CNC emphasizes community banking, focusing on reinvesting in the local economy through a diverse lending portfolio. As of December 31st, 2024, CNC reported total deposits of $4.0 billion.

In early March, Canandaigua National released its full-year results for the period ending December 31st, 2024. For the year, total interest income grew 13% to $248 million.

Total interest expenses grew 29% to $111 million. Net interest income grew by 3% to $137 million. Total other income (service charges on deposit accounts and trust and investment services) increased 6% to $54 million.

Total other expenses (Inc. salaries, occupancy, and marketing) grew 6% to $125 million. Net income was $45 million, relatively flat year-over-year. EPS was $24.15.

Click here to download our most recent Sure Analysis report on CNND (preview of page 1 of 3 shown below):

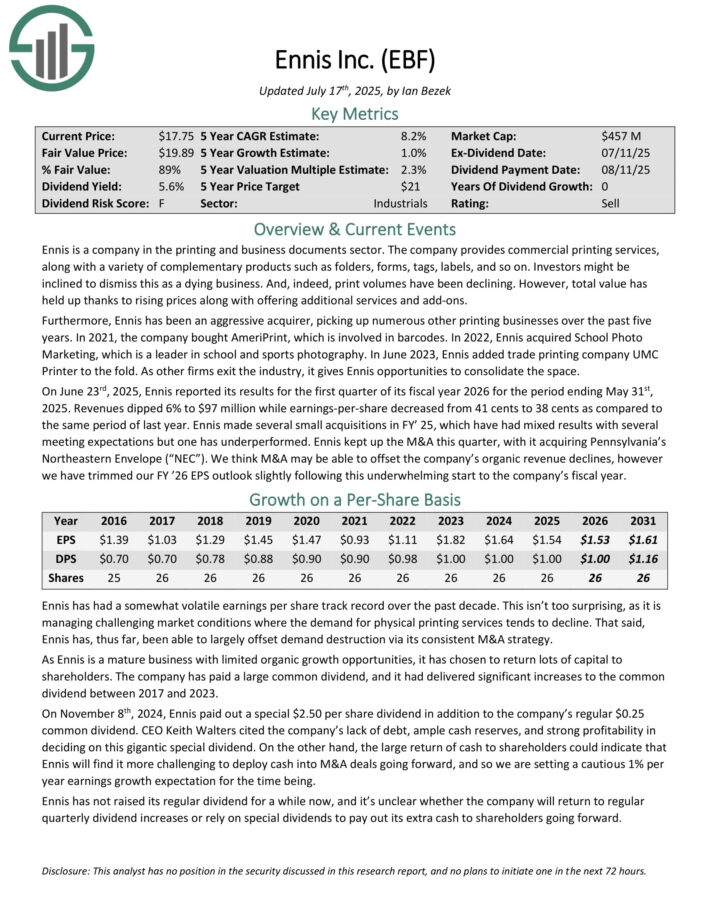

High Yield Small Cap #13: Ennis Inc. (EBF)

Ennis is a company in the printing and business documents sector. The company provides commercial printing services, along with a variety of complementary products such as folders, forms, tags, labels, and so on.

Investors might be inclined to dismiss this as a dying business. And, indeed, print volumes have been declining. However, total value has held up thanks to rising prices along with offering additional services and add-ons.

Furthermore, Ennis has been an aggressive acquirer, picking up numerous other printing businesses over the past five years.

On June 23rd, 2025, Ennis reported its results for the first quarter of its fiscal year 2026 for the period ending May 31st, 2025. Revenues dipped 6% to $97 million while earnings-per-share decreased from 41 cents to 38 cents as compared to the same period of last year.

Ennis made several small acquisitions in FY’ 25, which have had mixed results with several meeting expectations but one has under-performed. Ennis kept up the M&A this quarter, with it acquiring Pennsylvania’s Northeastern Envelope (“NEC”).

Click here to download our most recent Sure Analysis report on EBF (preview of page 1 of 3 shown below):

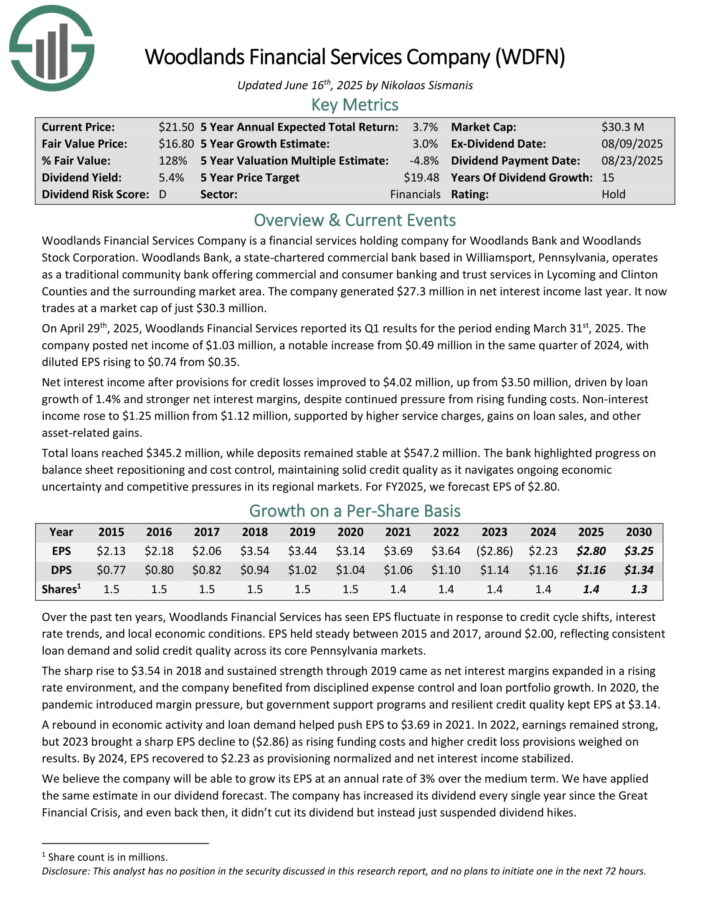

High Yield Small Cap #12: Woodlands Financial Services (WDFN)

Woodlands Financial Services Company is a financial services holding company for Woodlands Bank and Woodlands Stock Corporation.

Woodlands Bank, a state-chartered commercial bank based in Williamsport, Pennsylvania, operates as a traditional community bank offering commercial and consumer banking and trust services in Lycoming and Clinton Counties and the surrounding market area. The company generated $27.3 million in net interest income last year.

On April 29th, 2025, Woodlands Financial Services reported its Q1 results for the period ending March 31st, 2025. The company posted net income of $1.03 million, a notable increase from $0.49 million in the same quarter of 2024, with diluted EPS rising to $0.74 from $0.35.

Net interest income after provisions for credit losses improved to $4.02 million, up from $3.50 million, driven by loan growth of 1.4% and stronger net interest margins, despite continued pressure from rising funding costs.

Non-interest income rose to $1.25 million from $1.12 million, supported by higher service charges, gains on loan sales, and other asset-related gains. Total loans reached $345.2 million, while deposits remained stable at $547.2 million.

Click here to download our most recent Sure Analysis report on WDFN (preview of page 1 of 3 shown below):

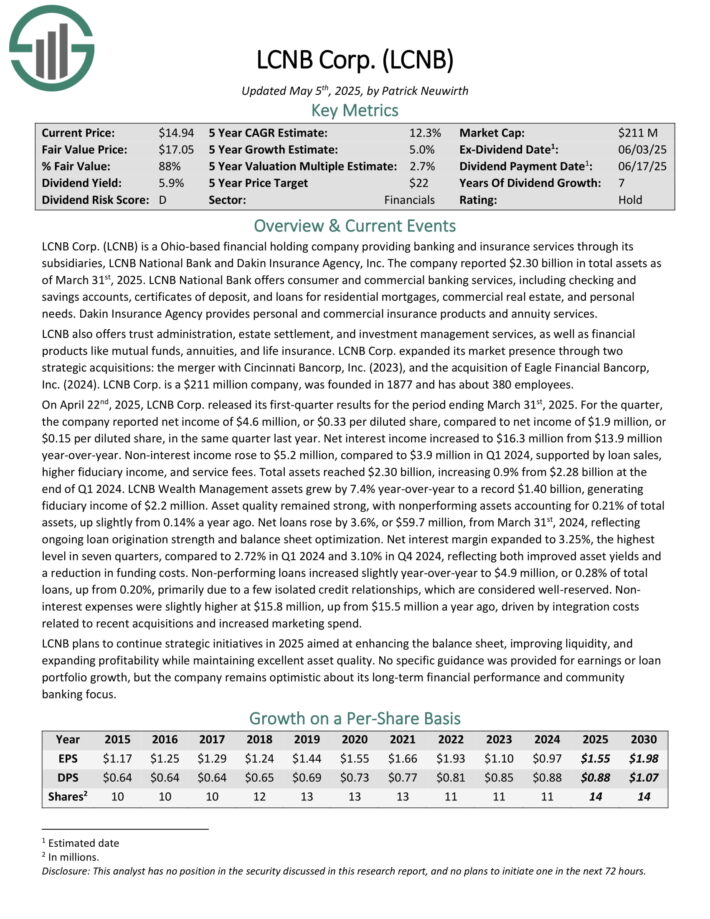

High Yield Small Cap #11: LCNB Corp. (LCNB)

LCNB is an Ohio-based financial holding company providing banking and insurance services through its subsidiaries, LCNB National Bank and Dakin Insurance Agency, Inc. The company reported $2.30 billion in total assets as of March 31st, 2025.

LCNB National Bank offers consumer and commercial banking services, including checking and savings accounts, certificates of deposit, and loans for residential mortgages, commercial real estate, and personal needs.

Dakin Insurance Agency provides personal and commercial insurance products and annuity services. LCNB also offers trust administration, estate settlement, and investment management services, as well as financial products like mutual funds, annuities, and life insurance.

On April 22nd, 2025, LCNB Corp. released its first-quarter results for the period ending March 31st, 2025. For the quarter, the company reported net income of $4.6 million, or $0.33 per diluted share, compared to net income of $1.9 million, or $0.15 per diluted share, in the same quarter last year.

Net interest income increased to $16.3 million from $13.9 million year-over-year. Non-interest income rose to $5.2 million, compared to $3.9 million in Q1 2024, supported by loan sales, higher fiduciary income, and service fees.

Click here to download our most recent Sure Analysis report on LCNB (preview of page 1 of 3 shown below):

High Yield Small Cap #10: Apollo Bancorp (APLO)

Apollo Bancorp, through its subsidiary Apollo Trust Company, operates five branches, all located in Pennsylvania. These branches serve communities primarily within the Kiski Valley, northeast of Pittsburgh.

The bank’s main office is in Apollo, Pennsylvania, with additional branches in North Apollo, Spring Church, Allegheny Township, and North Washington.

Apollo Trust focuses on providing personalized banking services, including residential and commercial loans, deposit accounts, and other financial services, primarily to individuals and businesses within its service area.

On July 16th, 2025, Apollo Bancorp posted its Q2 results for the period ending June 30th, 2025. For the quarter, Apollo reported net income of $505,000, or $0.98 per share, compared with net income of $450,000, or $0.87 per share, in the prior-year period.

The $55,000 year-over-year increase in earnings was powered by a $206,000 increase in net interest income, offset by a $94,000 increase in noninterest expense. For Q2, Apollo posted annualized ROA of 0.95% and annualized ROE of 8.00%.

Click here to download our most recent Sure Analysis report on APLO (preview of page 1 of 3 shown below):

High Yield Small Cap #9: Northwest Bancshares (NWBI)

Northwest Bancshares is a bank holding company that offers full-service financial institutions providing a complete line of personal and business banking products, including employee benefits, investment management services, and trust.

Northwest Bank is the leading subsidiary of Northwest Bancshares, and it operates 162 branches in central and western Pennsylvania, western New York, eastern Ohio, and Indiana.

The company reported a Q1 2025 net income of $43 million, or $0.34 per diluted share, up 49% from $29 million, or $0.23 per diluted share, in Q1 2024, and 32.7% from $33 million, or $0.26 per diluted share, in Q4 2024.

Adjusted net income rose to $44 million, or $0.35 per diluted share, from $35 million, or $0.27 per diluted share, in Q4 2024, driven by a $14 million net interest income increase, including a $13.1 million non-accrual loan interest recovery.

The net interest margin expanded to 3.87% from 3.10% in Q1 2024, marking the fourth consecutive quarter of improvement. Total revenue grew 19% year-over-year, while the cost of funds declined for the third straight quarter.

Balance sheet highlights include a 1.7% increase in average deposits to $12.09 billion and a 52.3% decrease in average borrowings from Q1 2024, reflecting strategic pay-downs from a Q2 2024 investment portfolio restructure.

Click here to download our most recent Sure Analysis report on NWBI (preview of page 1 of 3 shown below):

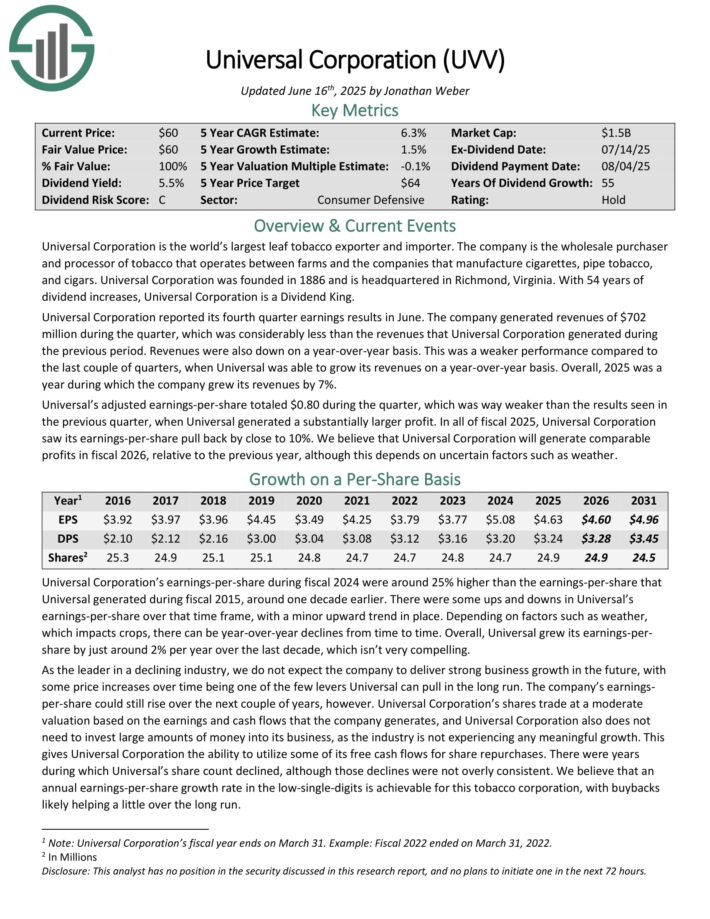

High Yield Small Cap #8: Universal Corporation (UVV)

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates between farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. Universal Corporation was founded in 1886 and is headquartered in Richmond, Virginia.

With 54 years of dividend increases, Universal Corporation is a Dividend King.

Universal Corporation reported its fourth quarter earnings results in June. The company generated revenues of $702 million during the quarter, which was considerably less than the revenues that Universal Corporation generated during the previous period. Revenues were also down on a year-over-year basis.

This was a weaker performance compared to the last couple of quarters, when Universal was able to grow its revenues on a year-over-year basis. Overall, 2025 was a year during which the company grew its revenues by 7%.

Universal’s adjusted earnings-per-share totaled $0.80 during the quarter, which was way weaker than the results seen in the previous quarter, when Universal generated a substantially larger profit. In all of fiscal 2025, Universal Corporation saw its earnings-per-share pull back by close to 10%.

Click here to download our most recent Sure Analysis report on UVV (preview of page 1 of 3 shown below):

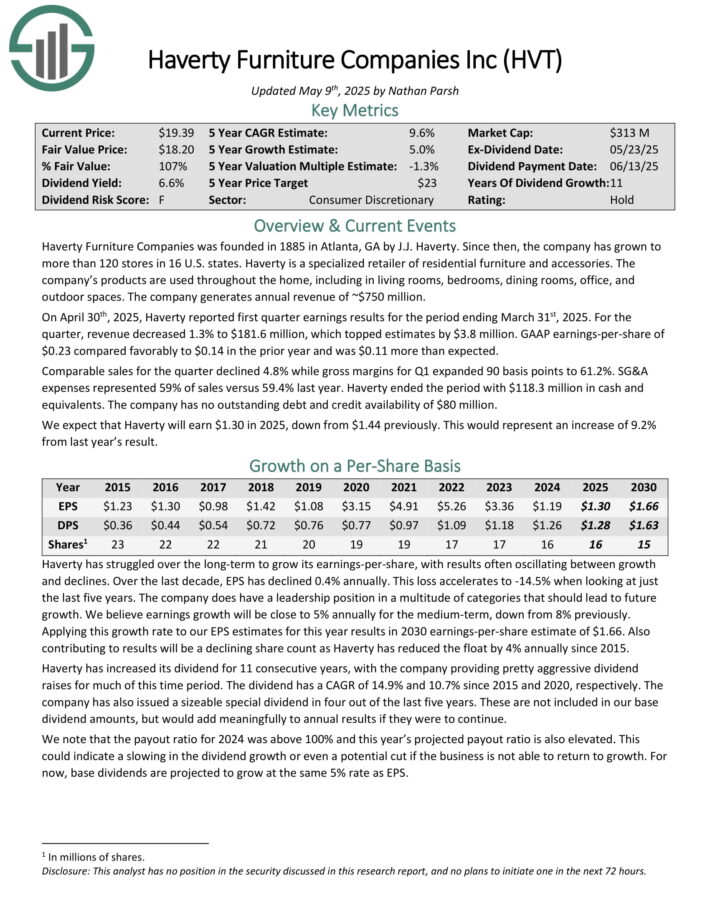

High Yield Small Cap #7: Haverty Furniture Companies (HVT)

Haverty Furniture Companies was founded in 1885 in Atlanta, GA by J.J. Haverty. Since then, the company has grown to more than 120 stores in 16 U.S. states. Haverty is a specialized retailer of residential furniture and accessories.

The company’s products are used throughout the home, including in living rooms, bedrooms, dining rooms, office, and outdoor spaces. The company generates annual revenue of ~$750 million.

On April 30th, 2025, Haverty reported first quarter earnings results for the period ending March 31st, 2025. For the quarter, revenue decreased 1.3% to $181.6 million, which topped estimates by $3.8 million. GAAP earnings-per-share of $0.23 compared favorably to $0.14 in the prior year and was $0.11 more than expected.

Comparable sales for the quarter declined 4.8% while gross margins for Q1 expanded 90 basis points to 61.2%. SG&A expenses represented 59% of sales versus 59.4% last year. Haverty ended the period with $118.3 million in cash and equivalents. The company has no outstanding debt and credit availability of $80 million.

Click here to download our most recent Sure Analysis report on HVT (preview of page 1 of 3 shown below):

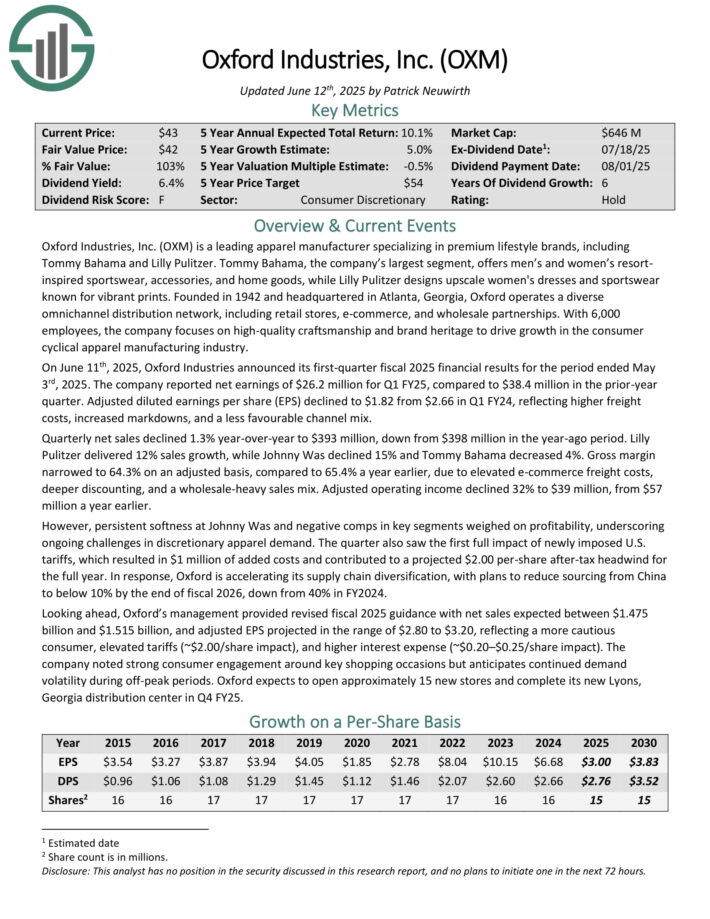

High Yield Small Cap #6: Oxford Industries (OXM)

Oxford Industries is a leading apparel manufacturer specializing in premium lifestyle brands, including Tommy Bahama and Lilly Pulitzer.

Tommy Bahama, the company’s largest segment, offers men’s and women’s resort inspired sportswear, accessories, and home goods, while Lilly Pulitzer designs upscale women’s dresses and sportswear known for vibrant prints.

Founded in 1942 and headquartered in Atlanta, Georgia, Oxford operates a diverse omni-channel distribution network, including retail stores, e-commerce, and wholesale partnerships. With 6,000 employees, the company focuses on high-quality craftsmanship and brand heritage to drive growth in the consumer cyclical apparel manufacturing industry.

On June 11th, 2025, Oxford Industries announced its first-quarter fiscal 2025 financial results for the period ended May 3rd, 2025. The company reported net earnings of $26.2 million for Q1 FY25, compared to $38.4 million in the prior-year quarter.

Adjusted diluted earnings per share (EPS) declined to $1.82 from $2.66 in Q1 FY24, reflecting higher freight costs, increased markdowns, and a less favourable channel mix.

Quarterly net sales declined 1.3% year-over-year to $393 million, down from $398 million in the year-ago period. Lilly Pulitzer delivered 12% sales growth, while Johnny Was declined 15% and Tommy Bahama decreased 4%.

Click here to download our most recent Sure Analysis report on OXM (preview of page 1 of 3 shown below):

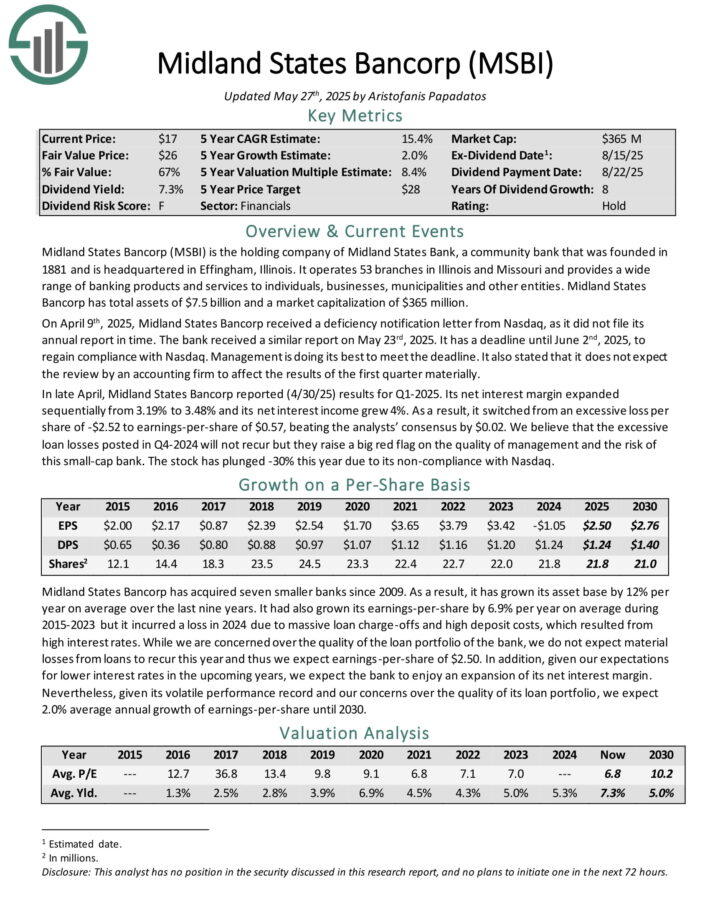

High Yield Small Cap #5: Midland States Bancorp (MSBI)

Midland States Bancorp (MSBI) is the holding company of Midland States Bank, a community bank that was founded in 1881 and is headquartered in Effingham, Illinois.

It operates 53 branches in Illinois and Missouri and provides a wide range of banking products and services to individuals, businesses, municipalities and other entities. Midland States Bancorp has total assets of $7.5 billion.

In late April, Midland States Bancorp reported (4/30/25) results for Q1-2025. Its net interest margin expanded sequentially from 3.19% to 3.48% and its net interest income grew 4%. As a result, it switched from an excessive loss per share of -$2.52 to earnings-per-share of $0.57, beating the analysts’ consensus by $0.02.

We believe that the excessive loan losses posted in Q4-2024 will not recur but they raise a big red flag on the quality of management and the risk of this small-cap bank.

Click here to download our most recent Sure Analysis report on MSBI (preview of page 1 of 3 shown below):

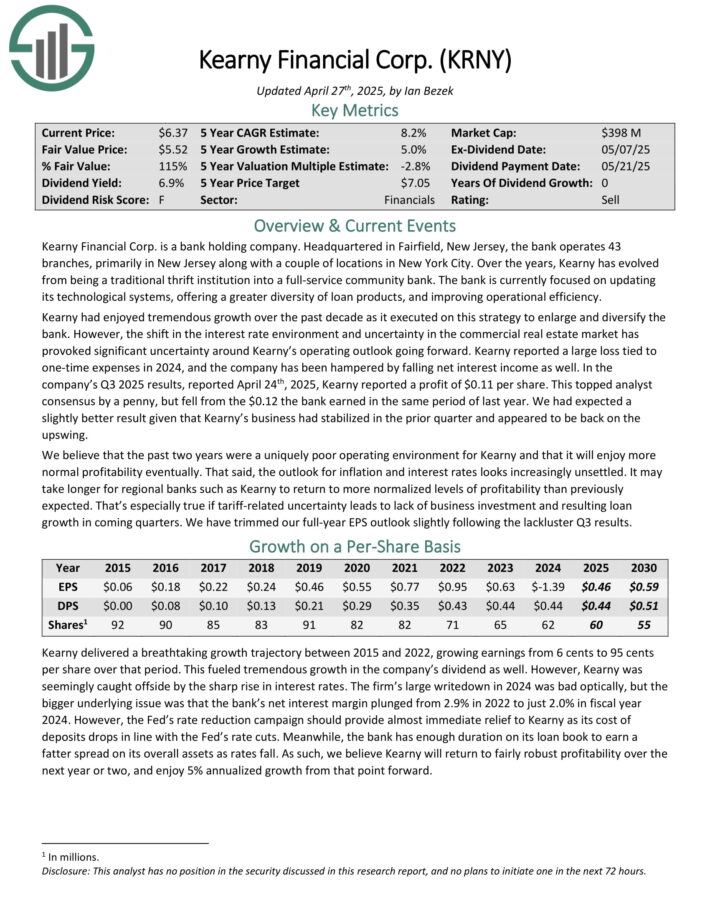

High Yield Small Cap #4: Kearny Financial (KRNY)

Kearny Financial Corp. is a bank holding company. Headquartered in Fairfield, New Jersey, the bank operates 43 branches, primarily in New Jersey along with a couple of locations in New York City.

Over the years, Kearny has evolved from being a traditional thrift institution into a full-service community bank.

Kearny had enjoyed tremendous growth over the past decade as it executed on this strategy to enlarge and diversify the bank.

In the company’s Q3 2025 results, reported April 24th, 2025, Kearny reported a profit of $0.11 per share. This topped analyst consensus by a penny, but fell from the $0.12 the bank earned in the same period of last year.

We had expected a slightly better result given that Kearny’s business had stabilized in the prior quarter and appeared to be back on the upswing.

Click here to download our most recent Sure Analysis report on KRNY (preview of page 1 of 3 shown below):

High Yield Small Cap #3: Shutterstock, Inc. (SSTK)

Shutterstock sells high-quality creative content for brands, digital media and marketing companies through its global creative platform.

Its platform hosts the most extensive and diverse collection of high-quality 3D models, videos, music, photographs, vectors and illustrations for licensing. The company reported $935 million in revenues last year.

On January 7th, 2025, Shutterstock announced it entered a merger agreement with Getty Images through a merger of equals. The combined company will retain the name Getty Images Holdings, Inc and trade on the NYSE under ticker GETY.

Getty Images shareholders will own roughly 54.6% of the entity and Shutterstock shareholders will own the remaining 45.3%. Shareholders of SSTK will receive $28.84870 of cash, or 9.17 shares of Getty Images plus $9.50 in cash per share.

The combined company would have revenue between $1,979 million and $1,993 million, 46% of it being subscription revenue. About $175 million of annual cost savings is forecast by the third year, with most of this expected after 1 to 2 years.

On January 27th, 2025, Shutterstock announced a $0.33 quarterly dividend, a 10% increase over the prior year.

On May 2nd, 2025, Shutterstock published its first quarter results for the period ending March 31, 2025. While quarterly revenue grew by a solid 13% year-on-year, it missed analyst estimates by nearly $7 million. Adjusted EPS of $1.03 increased by 12%, and also missed analyst estimates by $0.01.

Click here to download our most recent Sure Analysis report on SSTK (preview of page 1 of 3 shown below):

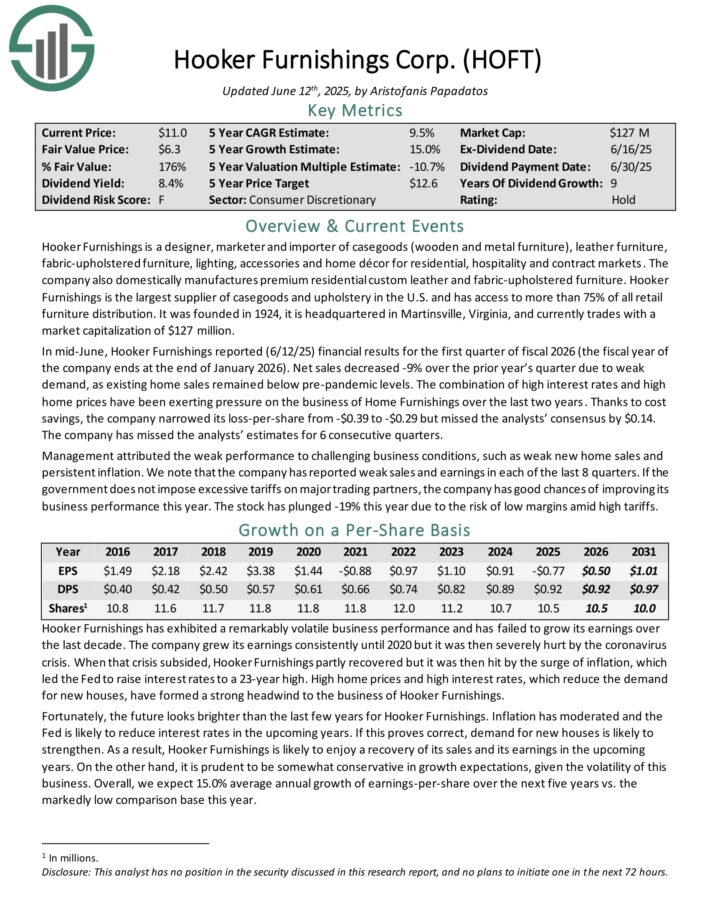

High Yield Small Cap #2: Hooker Furnishings (HOFT)

Hooker Furnishings is a designer, marketer and importer of case goods (wooden and metal furniture), leather furniture, fabric-upholstered furniture, lighting, accessories and home décor for residential, hospitality and contract markets.

The company also domestically manufactures premium residential custom leather and fabric-upholstered furniture. Hooker Furnishings is the largest supplier of case goods and upholstery in the U.S. and has access to more than 75% of all retail furniture distribution.

In mid-June, Hooker Furnishings reported (6/12/25) financial results for the first quarter of fiscal 2026 (the fiscal year of the company ends at the end of January 2026). Net sales decreased -9% over the prior year’s quarter due to weak demand, as existing home sales remained below pre-pandemic levels.

The combination of high interest rates and high home prices have been exerting pressure on the business of Home Furnishings over the last two years. Thanks to cost savings, the company narrowed its loss-per-share from -$0.39 to -$0.29 but missed the analysts’ consensus by $0.14.

The company has missed the analysts’ estimates for 6 consecutive quarters. Management attributed the weak performance to challenging business conditions, such as weak new home sales and persistent inflation. We note that the company has reported weak sales and earnings in each of the last 8 quarters.

Click here to download our most recent Sure Analysis report on HOFT (preview of page 1 of 3 shown below):

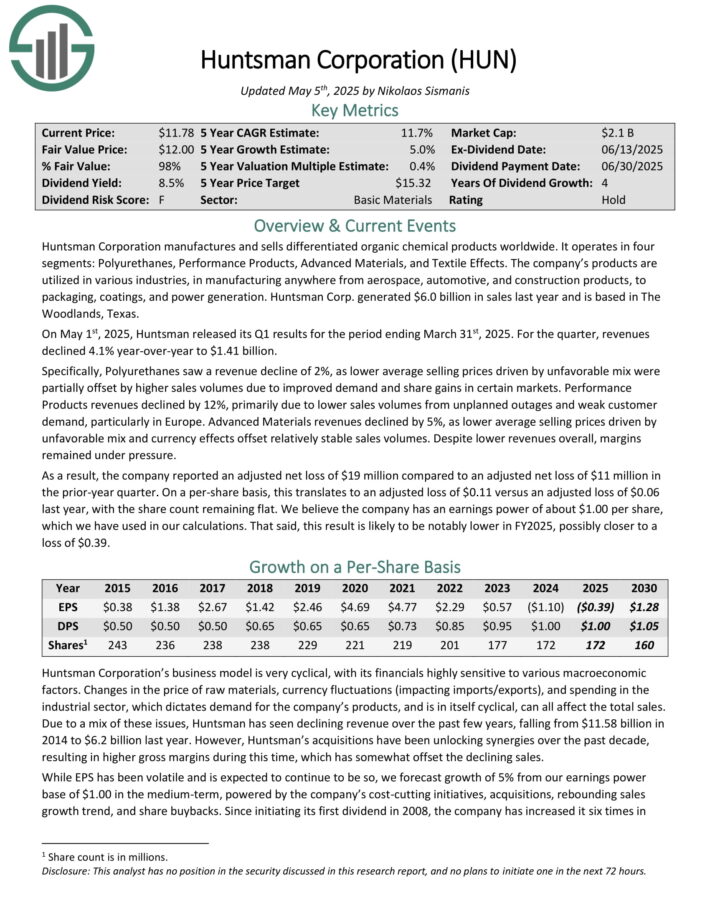

High Yield Small Cap #1: Huntsman Corp. (HUN)

Huntsman Corporation manufactures and sells differentiated organic chemical products worldwide. It operates in four segments: Polyurethanes, Performance Products, Advanced Materials, and Textile Effects.

The company’s products are utilized in various industries, in manufacturing anywhere from aerospace, automotive, and construction products, to packaging, coatings, and power generation. Huntsman Corp. generated $6.0 billion in sales last year.

On May 1st, 2025, Huntsman released its Q1 results for the period ending March 31st, 2025. For the quarter, revenues declined 4.1% year-over-year to $1.41 billion.

Specifically, Polyurethanes saw a revenue decline of 2%, as lower average selling prices driven by unfavorable mix were partially offset by higher sales volumes due to improved demand and share gains in certain markets.

Performance Products revenues declined by 12%, primarily due to lower sales volumes from unplanned outages and weak customer demand, particularly in Europe.

Advanced Materials revenues declined by 5%, as lower average selling prices driven by unfavorable mix and currency effects offset relatively stable sales volumes. Despite lower revenues overall, margins remained under pressure.

Click here to download our most recent Sure Analysis report on HUN (preview of page 1 of 3 shown below):

Final Thoughts

High yield dividend stocks have obvious appeal to income investors. The S&P 500 Index yields just ~1.3% right now on average, making high yield stocks even more attractive by comparison.

In addition, small-cap stocks could have stronger growth potential than larger competitors in their respective sectors.

Of course, investors should always do their research before buying individual stocks.

That said, the 20 stocks in this list have yields at least double the S&P 500 Index average, going all the way up to over 8.8%. As a result, income investors may find these 20 dividend stocks attractive.

Further Reading

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.