Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

The Bitcoin worth could possibly be headed for extra ache, as a crypto analyst has recognized a brand new bear market indicator that implies a crash to $40,000 is imminent. The analyst has predicted when this deep worth decline is ready to happen, warning traders to stay cautious or danger promoting at a loss.

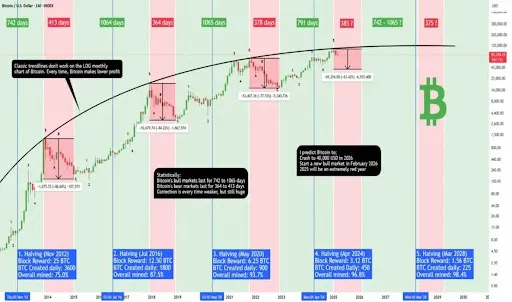

Xanrox, a crypto analyst on TradingView, shared a detailed worth evaluation of Bitcoin on March 17, predicting that the pioneer cryptocurrency is ready to crash to $40,000 by 2026. The analyst revealed that Bitcoin follows a predictable cycle sample tied to its halving occasions, which happen each 4 years. Throughout these years, the market alternates between bull markets, the place costs skyrocket, and bear markets, marked by extreme corrections.

Bear Market Indicator Predicts Subsequent Bitcoin Worth Crash

Associated Studying

In each cycle, Bitcoin’s worth crashes after a bull market, finally experiencing a decline between 77% to 86%. Reflecting on this recurring pattern, Xanrox forecasts a significant Bitcoin worth correction, albeit a weaker one than these of earlier cycles. The analyst believes that the cryptocurrency will crash 65% to $40,000, citing its considerably bigger market capitalization and quickly rising institutional adoption.

He shared a worth chart that highlights the varied halving cycles and the magnitude of every bull market rally and bear market crash since Bitcoin’s inception. He identified that statistically, predicting Bitcoin’s actions with a easy chart has all the time been correct, suggesting that his 65% crash prediction was inevitable.

At the moment, Bitcoin’s appreciable market capitalization of $1.63 trillion makes it unrealistic to attain the acute progress wanted to succeed in a goal of $300,000, $500,000, and even $1 million, as some moon analysts predict. Xanrox means that 2025 could also be a bearish 12 months, with the following Bitcoin bull run set to start in 2026, after the bear market.

CryptoQuant Says BTC Bull Cycle Is Over

Sharing the same bearish sentiment concerning the present market, CryptoQuant’s founder and Chief Govt Officer (CEO), Ki Younger Ju, has introduced the unlucky finish of the Bitcoin bull cycle. Ju revealed that the market ought to count on 6 – 12 months of uneven worth motion, indicating the beginning of the bear market.

Associated Studying

He additionally highlights that each on-chain metric for Bitcoin is signaling a bear market, with recent liquidity depleting whereas new whales are promoting BTC at a considerably lower cost. Furthermore, Bitcoin is buying and selling at $82,549, marking an over 20% worth crash since its all-time excessive of greater than $109,000 this 12 months.

Featured picture from Unsplash, chart from Tradingview.com