Up to date on January thirteenth, 2025 by Bob Ciura

The biggest Canadian financial institution shares have confirmed over the previous decade that they not solely endure recessions, however that they’ll develop at excessive charges popping out of a recession as effectively.

Canadian financial institution shares additionally pay greater dividends than many U.S. financial institution shares, making them probably extra interesting for earnings buyers.

Valuations have additionally remained fairly low lately, boosting their respective complete return profiles consequently.

On this article, we’ll check out the “Large 5” Canadian banks – Canadian Imperial Financial institution of Commerce (CM), Royal Financial institution of Canada (RY), The Financial institution of Nova Scotia (BNS), Financial institution of Montreal (BMO) and Toronto-Dominion Financial institution (TD) – and rank them so as of highest anticipated returns.

Notice: Canada imposes a 15% dividend withholding tax on U.S. buyers. In lots of circumstances, investing in Canadian shares by a U.S. retirement account waives the dividend withholding tax from Canada, however verify together with your tax preparer or accountant for extra on this challenge.

The highest 5 huge banks in Canada are very shareholder-friendly, with enticing money returns. With this in thoughts, we created a full listing of monetary shares.

You may obtain your complete listing of 245 monetary sector shares (together with necessary monetary metrics like dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Extra data may be discovered within the Positive Evaluation Analysis Database, which ranks shares based mostly on their dividend yield, earnings-per-share development potential, and adjustments within the valuation a number of.

The shares are listed so as beneath, with #1 being probably the most enticing for buyers in the present day.

Learn on to see which Canadian financial institution is ranked highest in our Positive Evaluation Analysis Database.

Desk Of Contents

You should use the next desk of contents to immediately bounce to a particular inventory:

The highest 5 Canadian financial institution shares are ranked based mostly on complete anticipated returns over the subsequent 5 years, from lowest to highest.

Canadian Financial institution Inventory #5: Canadian Imperial Financial institution of Commerce (CM)

5-year anticipated returns: 6.4%

Canadian Imperial Financial institution of Commerce is a worldwide monetary establishment that gives banking and different monetary companies to people, small companies, firms, and institutional purchasers. CIBC was based in 1961 and is headquartered in Toronto, Canada.

Along with buying and selling on the New York Inventory Change, CM inventory trades on the Toronto Inventory Change, as do the opposite shares on this article.

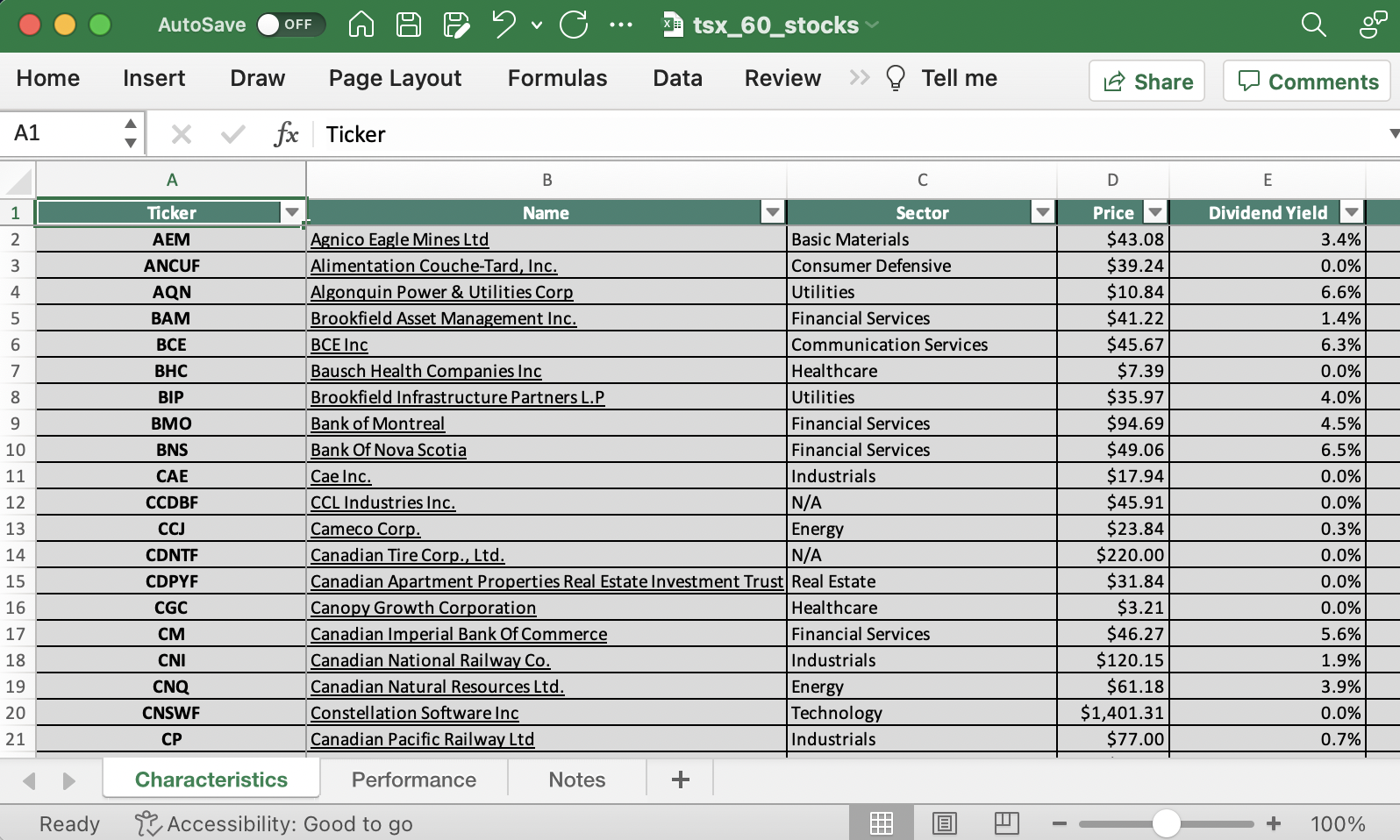

You may obtain a full listing of all TSX 60 shares beneath:

CIBC reported its fiscal This autumn and full-year 2024 earnings outcomes on 12/05/24. For the quarter, the financial institution’s income climbed 13% 12 months over 12 months (“YOY”) to C$6.6 billion. Provision for credit score losses (“PCL”) was C$419 million, down 23% from a 12 months in the past.

Naturally, the mortgage loss ratio was 0.30%, down from 0.35% a 12 months in the past. And web earnings got here in C$1.9 billion (up 27%). Adjusted web earnings got here in 24% greater at C$1.9 billion.

Finally, adjusted earnings per share (“EPS”) rose 22% to C$1.91. The adjusted return on fairness was 13.4%, down from 14.0% a 12 months in the past.

The financial institution’s capital place stays stable with a Widespread Fairness Tier 1 ratio of 13.3%, similar as a 12 months in the past. CIBC raised its quarterly dividend by 7.8% to C$0.97 per share, equating an annual payout of $3.88 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on CM (preview of web page 1 of three proven beneath):

Canadian Financial institution Inventory #4: Royal Financial institution of Canada (RY)

5-year anticipated returns: 8.0%

The Royal Financial institution of Canada is the biggest financial institution in Canada by market capitalization, and by complete property. RBC provides banking and monetary companies to prospects primarily in Canada and the U.S.

The monetary establishment operates in 4 core enterprise models: Private & Industrial Banking (39% of FY2023 income), Wealth Administration (31%), Insurance coverage (10%), and Capital Markets (20%). Its income combine is roughly 59% Canada, 25% the U.S., and 16% worldwide.

On 12/04/24, RBC reported stable fiscal This autumn and full-year 2024 earnings outcomes. In comparison with the prior 12 months’s quarter, the financial institution reported income development of 19% to C$15.1 billion. Administration put apart a reserve of C$840 million within the type of provision for credit score losses (“PCL”) that dragged down web earnings. The PCL was 17% greater than a 12 months in the past.

Moreover, non-interest expense rose 12% to $9.0 billion. Web earnings rose 7.2% 12 months over 12 months (“YOY”) to C$4.2 billion; on a per share foundation, it rose 5.4% to C$2.91.

Adjusted web earnings was 18% greater at C$4.4 billion, and its adjusted diluted earnings-per-share (“EPS”) was C$3.07 (up 16%). The financial institution’s capital place was nonetheless stable with a Widespread Fairness Tier 1 ratio at 13.2%, down from 14.5% a 12 months in the past.

The financial institution raised its quarterly dividend by 4.2% to C$1.48 per share, equating to an annualized payout of C$5.92 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on RY (preview of web page 1 of three proven beneath):

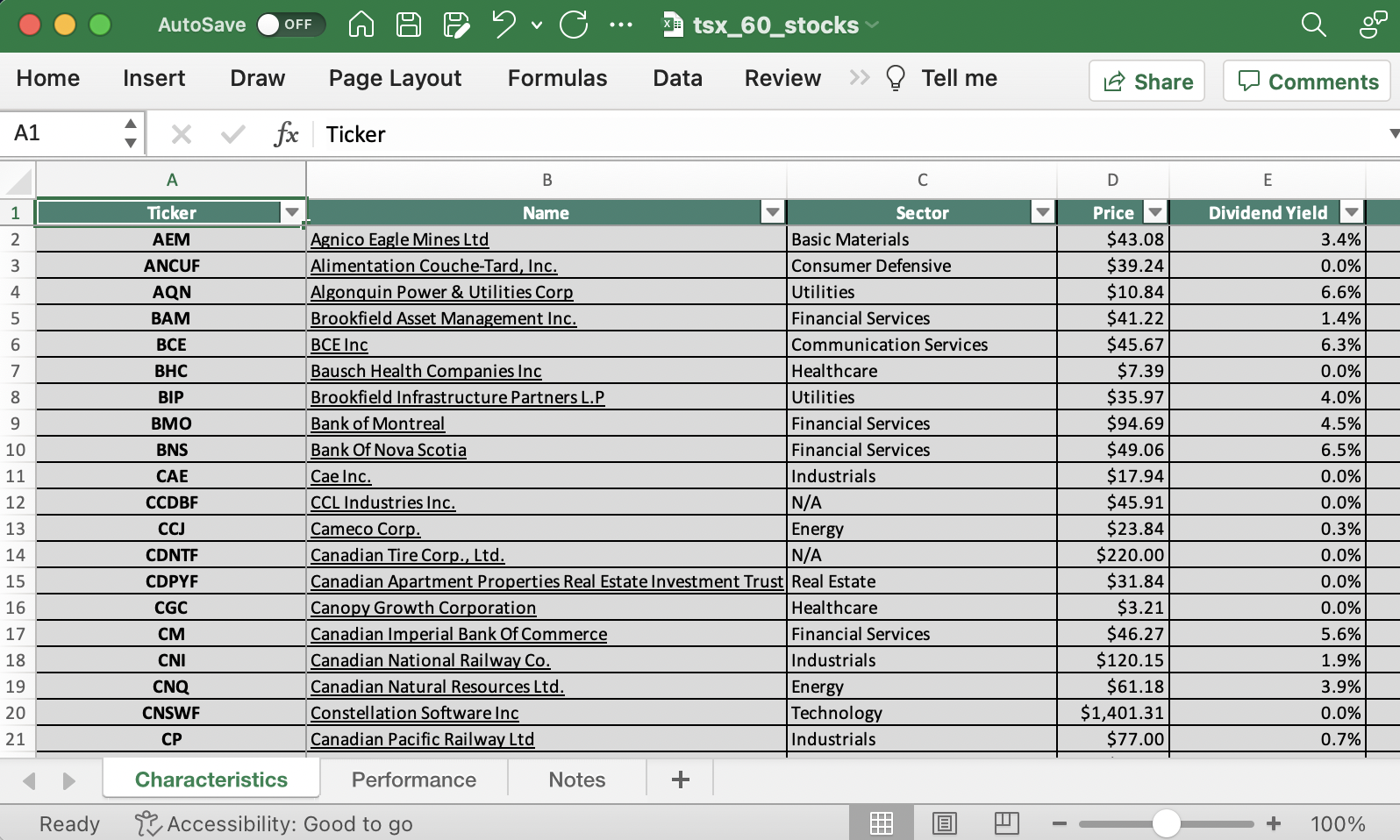

Canadian Financial institution Inventory #3: Financial institution of Montreal (BMO)

5-year anticipated annual returns: 8.2%

Financial institution of Montreal was fashioned in 1817, changing into Canada’s first financial institution. The previous two centuries have seen Financial institution of Montreal develop into a worldwide powerhouse of monetary companies and in the present day, it has about 2,000 branches (together with Financial institution of the West branches) in North America.

It generates about 45% of earnings from the U.S. (together with Financial institution of the West) and the remaining primarily from Canada. Financial institution of Montreal generates about 64% of its adjusted income from Canada and about 36% from the U.S.

Financial institution of Montreal reported its fiscal This autumn and full-year 2024 monetary outcomes on 12/05/24. For the quarter, in comparison with a 12 months in the past, income rose 7.7% to C$9.0 billion, whereas web earnings climbed 35% to C$2.3 billion and diluted earnings per share (“EPS”) rose 34% to C$2.94.

This bounce in earnings was primarily as a result of reversal of a fiscal 2022 authorized provision associated to a lawsuit related to a predecessor financial institution.

Adjusted web earnings fell 31% to C$1.5 billion and adjusted diluted EPS fell 35% to C$1.90. Increased adjusted provision for credit score losses (“PCL”) of C$1.5 billion (versus C$446 million a 12 months in the past) weighed on earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on BMO (preview of web page 1 of three proven beneath):

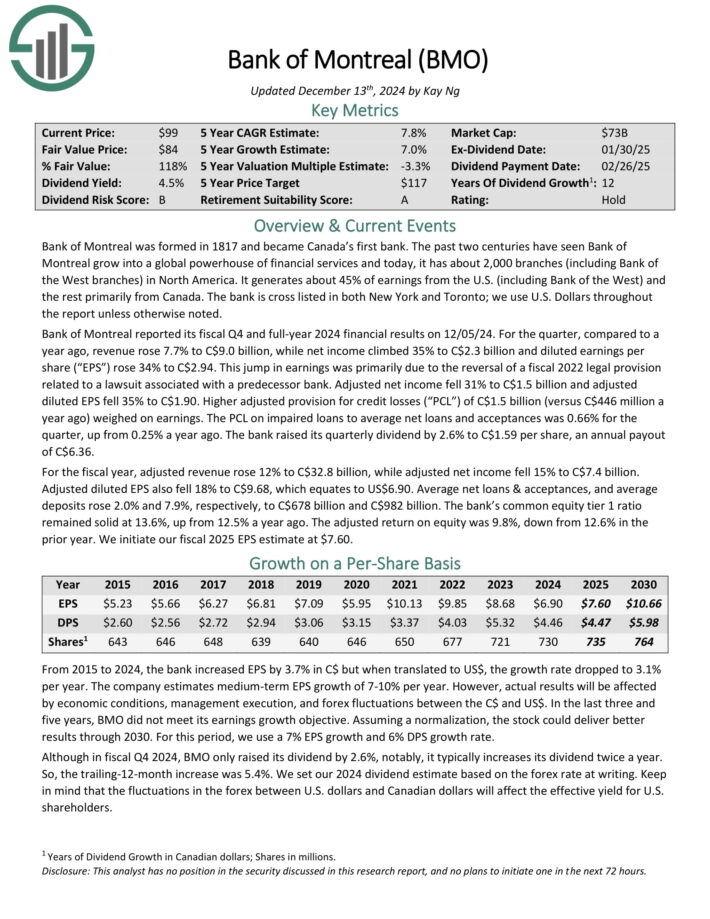

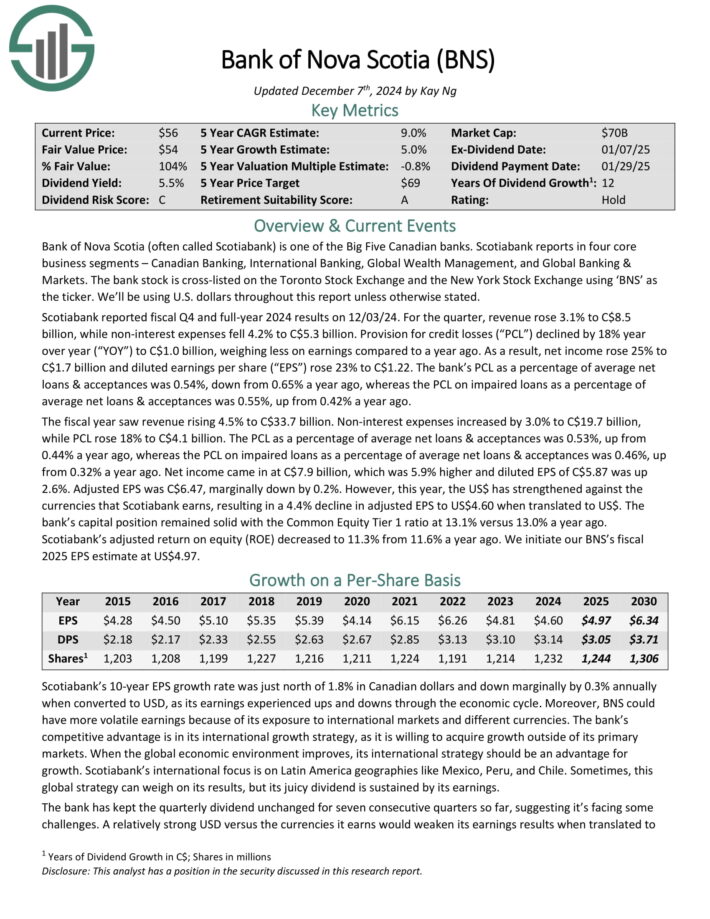

Canadian Financial institution Inventory #2: Financial institution of Nova Scotia (BNS)

5-year anticipated annual returns: 10.9%

Financial institution of Nova Scotia (typically known as Scotiabank) is the fourth-largest monetary establishment in Canada behind the Royal Financial institution of Canada, the Toronto-Dominion Financial institution and Financial institution of Montreal.

Scotiabank experiences in 4 core enterprise segments – Canadian Banking, Worldwide Banking, International Wealth Administration, and International Banking & Markets.

Scotiabank reported fiscal This autumn and full-year 2024 outcomes on 12/03/24. For the quarter, income rose 3.1% to C$8.5 billion, whereas non-interest bills fell 4.2% to C$5.3 billion. Provision for credit score losses (“PCL”) declined by 18% 12 months over 12 months (“YOY”) to C$1.0 billion, weighing much less on earnings in comparison with a 12 months in the past.

Because of this, web earnings rose 25% to C$1.7 billion and diluted earnings per share (“EPS”) rose 23% to C$1.22. The financial institution’s PCL as a proportion of common web loans & acceptances was 0.54%, down from 0.65% a 12 months in the past, whereas the PCL on impaired loans as a proportion of common web loans & acceptances was 0.55%, up from 0.42% a 12 months in the past.

The fiscal 12 months noticed income rising 4.5% to C$33.7 billion. Non-interest bills elevated by 3.0% to C$19.7 billion, whereas PCL rose 18% to C$4.1 billion.

The PCL as a proportion of common web loans & acceptances was 0.53%, up from 0.44% a 12 months in the past, whereas the PCL on impaired loans as a proportion of common web loans & acceptances was 0.46%, up from 0.32% a 12 months in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on BNS (preview of web page 1 of three proven beneath):

Canadian Financial institution Inventory #1: Toronto-Dominion Financial institution (TD)

5-year anticipated annual returns: 12.2%

Toronto-Dominion Financial institution traces its lineage again to 1855 when the Financial institution of Toronto was based. It’s now a serious financial institution with C$1.9 trillion in property. The financial institution produces about C$14 billion in annual web earnings every year.

TD reported fiscal This autumn and full-year 2024 earnings outcomes on December fifth, 2024. For the quarter, TD reported income development of 18% year-over-year to C$15.5 billion. Provision for credit score losses (“PCL”) rose 26% to C$1.1 billion.

Nevertheless, web earnings nonetheless climbed 27% to C$3.6 billion. The adjusted metrics probably present a greater image of TD’s regular earnings energy.

The adjusted income climbed 12% to C$14.9 billion, and the adjusted web earnings fell 8% to C$3.2 billion, resulting in adjusted diluted earnings per share (“EPS”) of C$1.72, down 5.5% 12 months over 12 months. Its PCL ratio as a proportion of common web loans and acceptances was 0.47%, up 8 foundation factors from a 12 months in the past.

The adjusted return on fairness (“ROE”) was 13.4%, up from 10.5% a 12 months in the past. The financial institution’s capital place remained stable with a typical fairness tier 1 ratio of 13.1%, down from 14.4% a 12 months in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on TD (preview of web page 1 of three proven beneath):

Last Ideas

Canadian financial institution shares don’t get almost as a lot protection as the key U.S. banks. Nevertheless, earnings and worth buyers ought to take note of the massive 5 Canadian financial institution shares.

Royal Financial institution of Canada, TD Financial institution, Financial institution of Nova Scotia, Financial institution of Montreal, and Canadian Imperial Financial institution of Commerce are all extremely worthwhile banks.

And, all 5 have cheap valuations with dividend yields which can be effectively above the U.S. financial institution shares.

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.