Tesla Inc (NASDAQ:) shares have sharply declined in current weeks. Neither technical nor basic evaluation appears to supply hope for a reversal. The one risk is that the ever-ingenious Elon Musk will pull off certainly one of his traditional surprises.

Early Tensions After the First 2024 Earnings Report

Following the post-election rally, the EV maker’s inventory confronted challenges on January 29 when it lower-than-expected figures for the fourth quarter of 2024. The earnings per share stood at $0.73, falling in need of the expected $0.76, and revenues reached $25.71 billion, under analysts’ expectations of $27.23 billion.

Regardless of this, Tesla maintained its document of practically 2 million deliveries in a yr and decreased manufacturing prices to beneath $35,000 per car, showcasing enhancements in operational effectivity.

Tesla’s newest quarterly studies – Supply: InvestingPro

Musk’s Political Victory Bolsters the Inventory

Regardless of uncertainties, the inventory benefited from Musk’s political success, climbing again above $400 per share in response to the monetary outcomes. Nevertheless, since early February, the pattern has reversed, and by the eleventh of the month, the inventory had fallen to ranges seen in early December 2024.

Thomas Monteiro, a senior analyst at Investing.com, remarked shortly after the corporate’s earnings announcement that “the success of Musk’s political endeavor introduced Tesla’s buyers probably the most precious asset proper now: time. And, frankly, it is in all probability the one factor stopping a serious collapse given the numbers offered tonight.”

Since January 31, although, the street has been slippery for Tesla, with the inventory dropping greater than 13 % in simply a few weeks.

Musk Faces Challenges Amid Declining Tesla Gross sales and OpenAI Rejection

The yr 2025 has already offered a number of hurdles for Tesla. The corporate has been immediately impacted by a drop in gross sales beginning in January, with vital declines in traditionally robust markets resembling Germany (-60%), France (-63%), the UK (-8%), and China (-11.5%), notably in Beijing, a vital marketplace for Tesla.

Including to those challenges are the dangers related to dependency on its founder. Markets may need responded positively to the prospect of integrating OpenAI’s newest synthetic intelligence fashions into future autos. Nevertheless, Sam Altman, CEO of OpenAI, wittily rejected Musk’s $97.4 billion supply for the creator of ChatGPT, suggesting, “No thanks, however if you’d like, we are able to purchase Twitter for $9.74 billion.” This rejection not solely dashed Musk’s plans but additionally underscored the potential downsides of the political and media consideration surrounding the world’s wealthiest particular person, which may negatively influence the businesses linked to him. This provides one other layer of uncertainty to Tesla’s future.

Lack of Innovation

The challenges do not cease there. In his January evaluation, Monteiro identified “weak demand for electrical autos” and a “waning enthusiasm round Tesla,” largely due to a “lack of eye-catching improvements in recent times,” which is contributing to the model’s devaluation.

In essence, “Musk & Co haven’t discovered tips on how to improve car manufacturing with out severely compressing margins. Whereas we maintain out hope for future developments to boost Tesla’s choices, time is passing, and the corporate continues to point out sluggish development quarter after quarter,” Monteiro concluded.

Basic View: Tesla is overvalued

What Do Tesla’s Fundamentals Counsel for the Future?

Regardless of the current decline, Tesla’s inventory stays removed from low-cost, nonetheless buying and selling at a hefty 158 instances earnings.

Moreover, analysts have considerably lowered their earnings expectations for this quarter. Over the previous 12 months, estimates for Q1 2025 EPS have dropped from $1.01 per share to $0.52 per share, with 13 downward revisions occurring in simply the previous three months.

Supply: InvestingPro

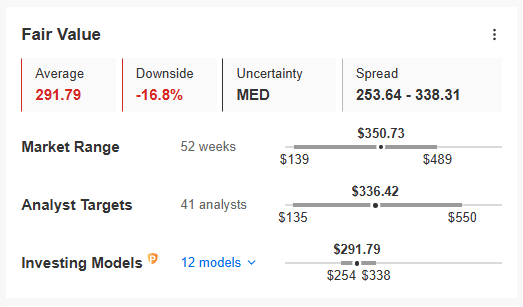

Even when contemplating Honest Worth, which InvestingPro calculates utilizing 12 acknowledged monetary fashions tailor-made to Tesla’s traits, the inventory seems overvalued. It exhibits a possible draw back of 16.8 % from the $350.73 per share recorded on the shut on February 10.

Supply: InvestingPro

Supply: InvestingPro

In the meantime, analysts are divided on Tesla’s working plan. Amongst them, 19 suggest shopping for, 15 recommend holding, and 12 advise promoting. Analysts have set a goal worth of $336.42 for Tesla over the following yr, representing a decline of about 4 % from present ranges.

Supply: Investing.com

Supply: Investing.com

Musk wants extra time and innovation to return Tesla to development

Can the South African-born tycoon leverage his political affect and entrepreneurial ability to spice up the inventory, which, it’s price noting, has gained about 86 % over the previous yr? Or are his ambitions too unwieldy, doubtlessly leaving Tesla within the already crowded house of “I want I might however I am unable to”?

Solely time can present the solutions. Though Musk might appear to have loads of it, time stays relentless, and its judgment will in the end rely on delivering profitable improvements, whether or not they contain OpenAI or not.

***

Searching for a instrument that will help you select the most effective shares to purchase and promote amid rising volatility? Attempt InvestingPro. With superior inventory screeners, Honest Worth assessments, and AI-driven methods like Propicks IA, InvestingPro is designed that will help you outperform the market.

Give it a attempt now—CLICK HERE and begin investing like a PRO!

DISCLAIMER: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or advice to speculate as such it isn’t meant to incentivize the acquisition of property in any approach. As a reminder, any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding determination and the related threat stays with the investor