Although coworking and flex office space continue to see increased demand from both tenants and landlords, they haven’t yet achieved the scale and consistency of more mature asset classes. As traditional landlords increasingly embrace inclusion of flex space in their portfolios, there’s a growing need for a more seamless experience, where integrated technology, operational efficiency and standardization all play key roles.

“The coworking industry can learn a lot from the standardized data model in the multifamily and hotel industries,” observed Will Sandford, Yardi’s director of coworking. “We’re actively building this, as it will benefit user experience, increase the size of the market and facilitate a better broker experience.”

Does the sector’s next chapter depend on treating it as a whole, instead of patches of local space? In this interview with Commercial Property Executive, Sandford shares his take on how improved booking infrastructure, enterprise tools and a smarter approach to space aggregation can shape the future of coworking.

WATCH: What Office Workers Want the Most

What are the top three trends you’re seeing now in the evolution of coworking and flex office?

Sandford: Traditional office landlords are seeking to offer a variety of flexible solutions. These range from coworking and tenant amenities (most liquid) to spec suites for short-term lease or license (moderate flexibility) to traditional leases (inflexible). They are seeking engaging technology to ensure tenants utilize available facilities and engage with operators for their needs across space and at all stages in the growth cycle. Operators are focused on offering a full-service experience at this stage in the cycle.

Coworking operators who are seeing the most success are doing two things: building a strong relationship with their landlord and delivering an offering that supports the needs of the building, tenants and local community on top of their direct member base. Supporting their members with non-space offerings, including mail, phone and virtual services, is also part of the offerings.

Coworking operators know that corporate users spend two to three times more per user, both a function of the duration of their stay and their willingness to pay. For this reason, multi-site coworking operators are gearing their marketing efforts around the platforms, brokers and channels that connect them with this customer.

Technology is certainly a huge part of the flex office model. How has it shaped the industry’s evolution so far and what new roles do you expect it to play in the future?

Sandford: Technology in the traditional tenant-landlord relationship was perfunctory: How do I pay my rent and how do I raise a service ticket?

As commercial landlords start to adopt some of the best practices from coworking, technology that’s commonplace in coworking is being delivered to the traditional tenant audience. The ability to manage and use credit pools across multiple spaces and buildings with simple distribution of charges, real-time availability across owned and partner locations, tenant utilization data across leased and on-demand space to gain a full picture of employee engagement is part of the new model.

As more enterprise clients choose flexible offerings and landlords right-size their portfolios to include such spaces in their offerings, what software capabilities are most critical to meeting their expectations and needs?

Sandford: There are two critical technology components to engage enterprises with flex: platforms and enterprise workplace tools. Firstly, offering access to the highest-quality spaces in a region, but ideally globally. The platform needs to be able to surface, book and confirm space via a simple and intuitive user experience.

Secondly, companies have highly structured workplace and workforce plans that drive collaboration, culture and productivity. The platforms and coworking operators need to be able to deliver this experience in a way that feels like an extension of each company’s owned and leased workplace. This involves capabilities like workforce management (who can book where based on employee role), consolidated billing across space providers, suggestion engines (based on my team location and intent, where they should work) and experience (how are they greeted in a new space).

READ ALSO: Coworking’s the New Satellite Office

Are there any technological gaps that still need to be addressed in the coworking and flex space?

Sandford: Several critical gaps need to be addressed to create a seamless, tenant-driven, flexible workplace experience. Yardi is actively working on all three of these hurdles: Standardized backend for inventory availability and booking across coworking and traditional space offerings; Getting into a building is still a snowflake experience and unifying building access systems, mobile credentials and user interfaces will significantly increase the adoption of on-demand use of space; The more space platforms can work as an extension of the enterprise workplace experience, the more adoption will occur.

Can you touch on the importance of market visibility for coworking operators and the role that aggregators and listing platforms play in improving occupancy rates?

Sandford: Many coworking operators have limited marketing budgets and focus on local demand, as this is who will fill their offices. Beyond that, coworking platforms play an important role as they generate awareness to a broader customer base, provide access to the enterprise on-demand customers and create an opportunity for negative cost of customer acquisition leads, as paying on-demand customers convert to longer-term members. For most coworking operators, space platforms are an essential complement to, not a replacement for, organic marketing in addition to lead generation efforts.

In what ways has the Yardi and WeWork partnership shaped your strategy around brand positioning and market presence in an increasingly competitive flex landscape?

Sandford: WeWork was and continues to be the brand name in coworking. Over the volatility of the last few years, no one has questioned the quality or need for their product. We see this as an important indicator of the importance of flex offerings in the office ecosystem. With Yardi taking a controlling position with WeWork, we’re focused on supporting their mission with our core competencies: delivering best in class technology for both the operators and members, providing opportunities to expand their network with other coworking operators by leveraging Yardi’s existing technology relationships and helping them operate as efficiently as possible to position WeWork as the obvious flex provider for landlords.

What role do brokers play in this ecosystem? How has/is their role changed/changing?

Sandford: Brokers are and will continue to be a critical part of the flex ecosystem. This is because the largest group of employees who need but can’t access flex are large enterprises with corporate real estate teams and seasoned brokers. Ensuring that flexible solutions are an important complement to corporate workplace strategy, rather than a competitor, is essential. Guaranteeing that brokers have access to the inventory, tools and data they need to ensure this happens is a key focus for Yardi as a technology provider and platform.

How are brokers and coworking operators collaborating to adapt to the growing presence of flex offerings in the market?

Sandford: Many of the tools that corporate real estate leaders need from flex platforms are the same as those requested by brokers: real-time availability and access to pricing, space performance details, ability to shortlist and contact operators’ sales contacts, self-service access to operators’ licensing heads of terms. The goal is to make lower-value transactions, as flex inherently should be, lower-touch.

On top of this, giving brokers visibility when a transaction closes and managing commissions is an additional focus. With enterprise as a key focus to increase market size, brokers’ tools continue to remain important.

Tell us more about how coworking operators and CRE brokers can work more collaboratively to align incentives and improve the customer journey in the flex market.

Sandford: One of the biggest blockers to meaningful broker engagement in flex is the disproportionate return to time spent on a deal. With most flex transactions being both small and short-term commissions, brokers don’t want to spend the same time on a flex transaction as they do a lease, and neither should they.

There are two key technological elements to fix this. Firstly, the broker tools discussed earlier. Secondly, marketplace standardization such that broker and occupier have confidence in what an ‘office’ or ‘desk’ at different coworking operators encompasses from a space, performance and services perspective.

Lastly, where do you see the biggest opportunities for operational efficiency in flexible office and coworking going forward?

Sandford: Simply put, front-to-back data and workflow management. More mature real estate segments, specifically high-volume segments like multifamily and hospitality, have technology to support operations and customer journey from lead to accounting, with minimal data loss and significant automation.

The coworking industry still relies on disparate solutions, many of which have not been built for an industry as nuanced as coworking. A single stack solution with the ability to integrate with best-in-class niche technologies is what will differentiate those designed to efficiently scale from those who overinvest in infrastructure maintenance.

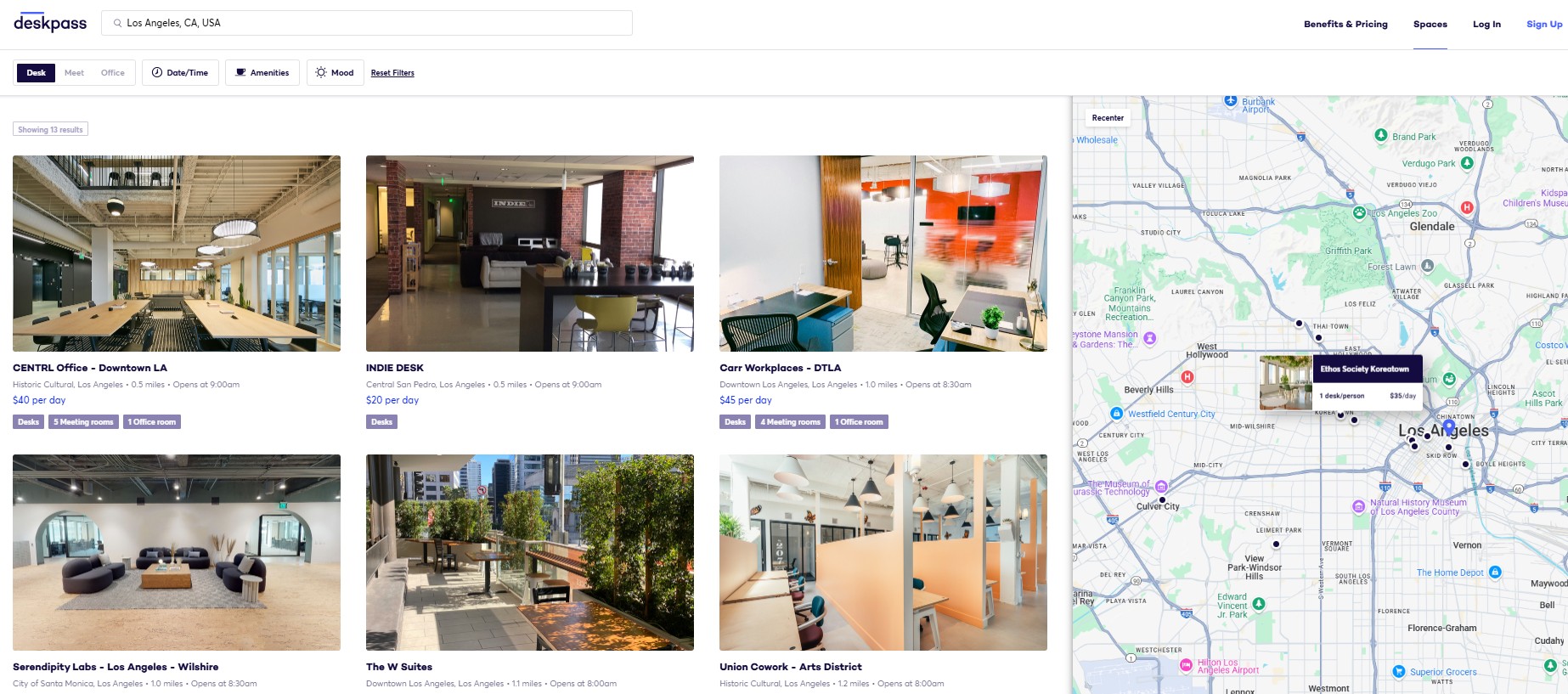

That is why we are tripling down on coworking technology at Yardi. Between the launch of Yardi Kube version 20 this summer, increased integrations with Yardi Voyager accounting suite and marketplace investments with Deskpass and Hubble, we’re seeking to provide coworking operators a single partner to grow every part of their businesses.

Note: Yardi Systems is the parent company of Commercial Property Executive.