A range of challenges loom for the future of alcohol. Alcoholic drinks are going out of fashion with young consumers, such as the sober curious Gen Zers, who are recognising how they compromise sleep, cause mortality, and overburden health services. These alcohol moderation trends are reshaping the way we view drinking, as the rise of low/no alcohol gains momentum. Climate change and a heightened focus on sustainability are further challenging traditional alcohol trends, with consumers questioning drinks that dehydrate rather than rehydrate.

Yet, alcohol has a long social and cultural history in delivering indulgence, de-stressing and enhancing conviviality. These needs are not going to disappear. In fact, they’re going to grow in a world where we find ourselves increasingly urbanised, digitised, isolated and anxious.

To stay relevant, brands must adapt to these shifting alcohol industry trends. This means brands will need to reformulate their products to match the ongoing repositioning and the broader perspective of what the future of alcohol looks like. Alcoholic drinks brands may need to become broader drinks brands instead.

Demographic and Health: Debunking Alcohol Myths

As the future of the alcohol industry unfolds, a shift in consumption trends is becoming difficult to ignore. While alcohol brands might be tempted to stick with the ‘devils they know’ and rely on familiar tactics, the latest trends reveal shifting priorities. In America, in the two decades to 2023, the number of over-55s who used alcohol grew an impressive 10 points to 59%. Yet, overall consumption fell by 10 points, signalling a growing consumer trend in alcohol moderation.

Younger generations represent the sharp end of this decline. A significant 38% of UK 16-24s had not consumed an alcoholic drink in the past year in 2021, up from 19% in 2011.

Another strategy being adopted by alcohol brands mirrors tobacco companies – focusing on cultivating emerging markets instead. However, this approach also ignores the fast that the average annual global intake of alcohol peaked over a decade ago at 6 litres per capita annually, and has since fallen to 4.9 litres in 2020.

The long-held beliefs about the health benefits of moderate alcohol consumption are evaporating fast. These include the idea that ‘daily wine’ contributes to a longer lifespan of those inhabiting the world’s ‘blue zones’, or the idea that 1-2 drinks a day reduces the risk of coronary heart disease, are increasingly being challenged.

Instead, research from the Global Burden of Disease data and studies published in The Lancet show that even the occasional alcoholic drink is harmful to health. Alcohol was responsible for causing 20% of premature deaths among 15-49-year-olds and 2.44 million deaths worldwide in 2019.

In the UK, NHS data shows that the Government spends up to £52 billion a year dealing with alcohol-related harm and that drinking alcohol was the main reason for approximately 980,000 admissions to hospital in 2019-2020.

Alcohol Industry Trends: Consumers are Rethinking their Relationship with Alcohol

We still need what alcohol offers – or at least what it used to.

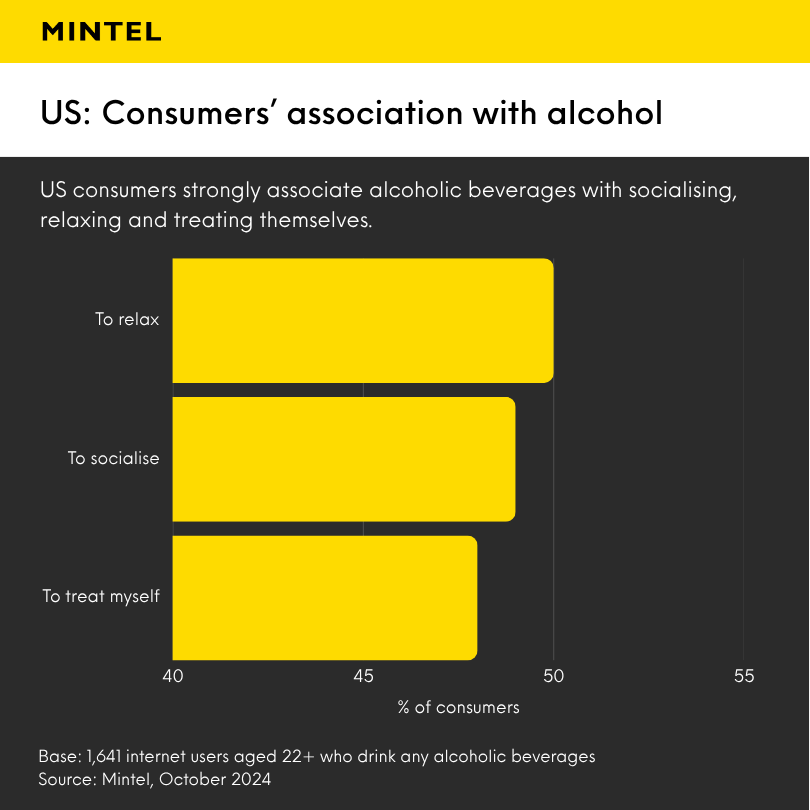

We need drinks that stimulate our senses and provide conviviality. This consumer trend is showcased by Mintel’s research, which shows that 36% of French consumers say that “share[ing] with someone” is what makes a drink an indulgent treat (client-access link only), while 60% of US-Americans prioritise a drink that is “rich/flavourful”. Additionally, we also see that 49% of US consumers continue to strongly associate alcoholic beverages with socialising, while half of US consumers associate them with relaxing.

Alcohol alternative brands could argue that reformulation can deliver all of the above. With innovations like Sentia Black, a £32 premium bottle featuring a “unique blend of functional botanicals that stimulate the release of Gaba”, a neurotransmitter that slows down the brain – gently mimicking the convivial feeling of alcohol without the subsequent side effects. This gives consumers a glimpse of what the future of drinking could look like.

Celebrity-backed, non-alcoholic brands like Louis Hamilton’s blue agave spirit Almave and actor Tom Hollands’ non-alcoholic beer brand BERO strive to repeat and replicate alcohol’s traditional aspirational imagery and positioning.

However, consumers might be ready to move even further from low/no alcohol categories for their social fix. For example, 74% of Canadians agree that coffee shops are a good place to meet friends to socialise. Meanwhile, in the US, 46% of consumers purchase tea as a substitute for alcohol, compared to 14% for non-alcoholic beer. Alcohol brands can take learnings from how tea and tea soda brands are encroaching on the mocktail space. Meanwhile, US brands like Collider, Psychedelic Water and Hiyo are embracing adaptogens and nootropics to promise qualities such as relaxation, sociability and buzz.

How to Meet Consumers’ Needs for Relaxation and Coolness in the Alcohol Industry

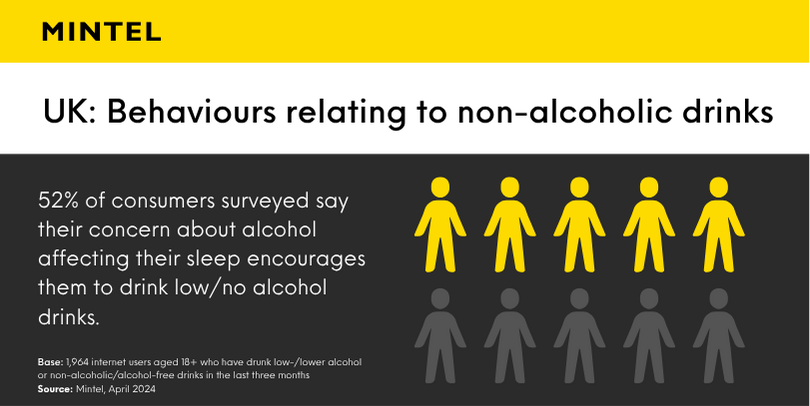

The demand for products that help us relax and sleep is on the rise. This shift is influencing trends in the alcohol industry, as alcohol and caffeine can be seen as problematic. In fact, 52% of UK low/no-alcohol drinkers cite concerns about alcohol affecting sleep as a key reason for choosing low/no-alcohol drinks.

Research from Philips reveals that 50% identify sleep as having the greatest impact on overall health and wellbeing, compared to diet (41%) and exercise (40%). These two need states have already carved out enormous FMCG markets in their own right, and the drinks industry is now following suit. Across all Mintel’s surveyed markets, exercise is used as a stress reliever by twice as many people as those turning to alcohol. This highlights the growing importance of wellness-focused alternatives in reshaping alcohol consumption trends.

Sustainability, health concerns and global challenges don’t necessarily have to signal a decline in alcohol sales. Historically, two of Britain’s iconic contributions to drinks culture – India Pale Ale and the Gin and Tonic – emerged from functional needs tied to global travel and health challenges. Hops served as preservatives for IPA, allowing it to travel long distances, while quinine in tonic water helped combat malaria, made palatable by gin. Today, innovation continues to define the alcohol industry. For example, Jopen has developed a Summer Session IPA that is brewed with seawater, showcasing how the industry can prioritise sustainability by innovating to conserve freshwater and achieve brand differentiation in the process.

However, even under the most optimistic 1.5 °C rise in temperature scenario, extreme heat events are expected to become 4.1 times more likely to occur globally. This creates a growing consumer focus on hydration, not dehydration. The rise of water filter jugs and cold brew coffees is an example of broader cooling trends in the drinks industry.

What’s Next? Diversify to Meet Evolving Alcohol Trends

Alcoholic drinks can survive the turbulence in the short term by satisfying the established preferences of baby boomers or the evolving tastes of emerging markets.

In the longer term, though, it’s clear that alcoholic consumption levels and habits are steadily declining. However, the underlying needs which gave rise to alcohol culture, such as indulgence, relaxation, taste, experience and sociability, are certainly not. Drinks across all categories will increasingly innovate to meet consumers to fulfill these timeless desires.

Alcohol is unlikely to disappear entirely, either as a vice or a responsibly consumed indulgence. However, there are plenty of examples where established brands have successfully adapted in industries that have been fundamentally reshaped by changing consumer consumption trends and behaviours. Alcohol brands can adopt a similarly forward-thinking approach to navigate and thrive in this evolving landscape.

Navigate Shifting Priorities with Mintel Consulting

If you’re looking to understand how these changes in consumption affect your own brand, your customers, and your innovation strategy, then get in touch with Mintel Consulting to learn more about how we can use our methods to help drive your growth strategies.

We can help you identify what’s already happening in your sector, predict what’s coming next, and understand what it means for your business’s strategy.

Book a Consultant Strategy Session