Este artículo también está disponible en español.

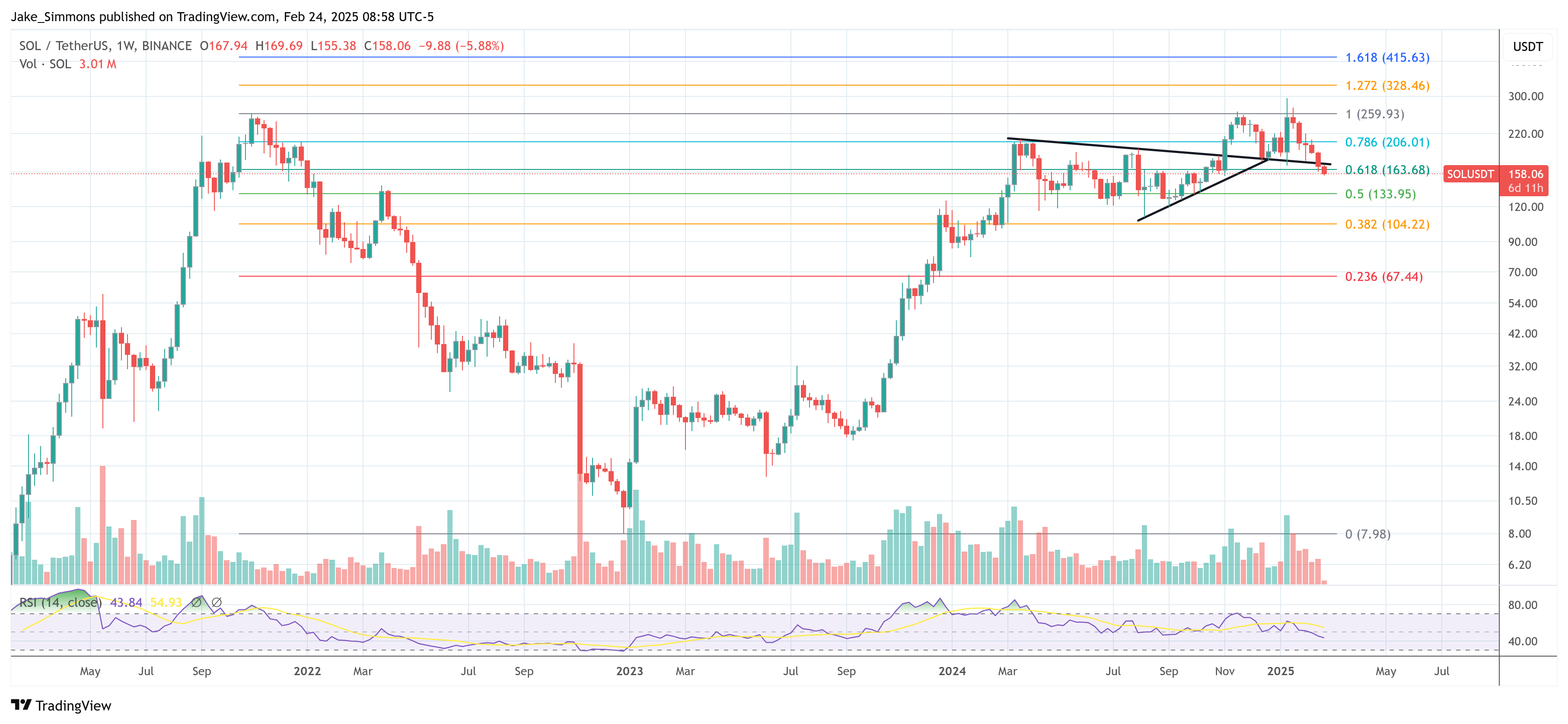

In a technical chart shared at present, crypto analyst Koroush Khaneghah, Founding father of Zero Complexity Buying and selling, underscores Solana’s ongoing downtrend, highlighting pivotal help and resistance ranges on the SOL/USDT Perpetual (Binance) day by day timeframe. In response to the chart, Solana has misplaced a number of key zones and is presently hovering close to the $157 space—what Khaneghah labels because the “final main help degree.”

The Bearish Argument For Solana

“The downtrend continues as SOL will get rejected by one other S/R flip and crashes right down to the $150 degree. Sentiment at an all-time low. Assume continuation till confirmed in any other case,” Khaneghah writes by way of X.

A outstanding function of the evaluation is a help/resistance (S/R) flip round $180.58. Earlier in February, Solana tried to reclaim this degree however was met with sturdy promoting stress. The failure to safe a day by day shut above $180.58—now appearing as resistance—signaled renewed draw back momentum.

Following the drop, Solana has settled simply above $157, marked on the chart because the “Final main help degree.” Costs have briefly dipped beneath this zone, suggesting fragility out there’s present stance. A failure to carry $157 on day by day closes will increase the potential of additional decline towards the subsequent vital horizontal line round $127.05—seen on the decrease finish of the chart.

Associated Studying

Koroush’s annotations additionally point out that crossing again above $180.58 would shift the market bias from bearish to “impartial.” Till that occurs, the analyst cautions that sellers seem like in management, with adverse sentiment round meme cash reinforcing the continued downtrend.

The Bullish Argument For SOL

In the meantime, crypto analyst RunnerXBT (@RunnerXBT) has shared a orderflow evaluation of the Solana (SOL) futures chart (2-hour timeframe on Binance) at present. The chart underscores notable value factors, liquidations, and modifications in positioning forward of the upcoming March 1 unlock—when 11.2 million SOL (valued at roughly $1.77 billion) are scheduled for launch.

Within the annotated chart, the value peaked in mid-January, reaching $295, earlier than starting a gradual descent that has most not too long ago seen SOL hovering within the mid-$150 vary. The chart reveals that from early to late January, there was a big drop in open curiosity (OI) alongside a slide within the value, with Cumulative Quantity Delta (CVD) suggesting it was pushed primarily by lengthy positions closing. RunnerXBT’s notes attribute this to SOL weak spot shifting largely in tandem (1:1) with Bitcoin.

By late January, after a extra pronounced downward transfer, the value and OI each settled at decrease ranges. OI briefly rebounded in early February, although the chart signifies that preliminary lengthy positioning was quickly adopted by brief protecting as merchants pivoted to profit-taking or closed shedding brief positions. Regardless of this exercise, SOL’s value was unable to mount a sustained uptrend, reinforcing a broader sense of hesitancy amongst merchants.

Associated Studying

Round mid-February (February 16–18) and once more on February 24, the chart highlights phases of “aggressive shorting and spot promoting,” which contributed to persistent downward stress on the value. Although there have been situations of brief protecting (notably round February 21, the place CVD ticked up barely), the general momentum has remained subdued, with few indicators of latest lengthy accumulation.

On the best aspect of the chart, RunnerXBT has positioned a vertical purple line marking March 1 because the date of what he calls the “largest SOL unlock recognized to mankind.” Many market individuals seem like “front-running” the occasion by promoting in anticipation of a flood of latest tokens hitting the market. This has the potential to drive heightened volatility.

But, in his submit, RunnerXBT warns towards shorting SOL at present ranges, explaining that he initially began monitoring this case when the token traded just below $200 and is now in search of a scalp lengthy after the unlock has occurred. He factors out that makes an attempt to catch each 5–10% day by day drop are harmful and that merchants who achieve this danger frequent stop-outs or liquidations.

“I dont assume its a clever “new” brief right here of SOL. I began posting in regards to the state of affairs at jus underneath $200 per SOL. I’m on the lookout for a scalp lengthy AFTER the unlock, folks “frontrunning” it are getting stopped out or liquidated. You aren’t a hero catching -5% to -10% day by day falling knives. […] TLDR: On the lookout for longs (not 5 days earlier than unlock). NOT shorts. if folks can’t learn, i can’t enable you to,” he writes by way of X.

At press time, SOL traded at $158.

Featured picture from Shutterstock, chart from TradingView.com