This week, the , , and knowledge will likely be important. This follows a robust December . The family survey was additionally strong, displaying that almost 478,000 individuals discovered jobs whereas the variety of unemployed people decreased by 235,000.

In context, there have been 7.1 million unemployed people in November, in comparison with 6.88 million in December—a considerable drop. A more in-depth look reveals that the quantity of people that misplaced jobs declined from 3.394 million in November to three.251 million in December. Moreover, new entrants to the labor pressure decreased from 2.87 million to 2.686 million, contributing to the ’s decline.

The report additionally included notable revisions. As an illustration, the July unemployment fee was adjusted from 4.3% to 4.2%, whereas March noticed an upward revision from 3.8% to three.9%. These revisions are vital as they redefine the collection’ excessive factors. Vital revisions are anticipated in January, notably for the family survey, which can make evaluating earlier experiences troublesome. Adjustments to the institution survey are additionally deliberate for January, which can complicate future knowledge interpretation.

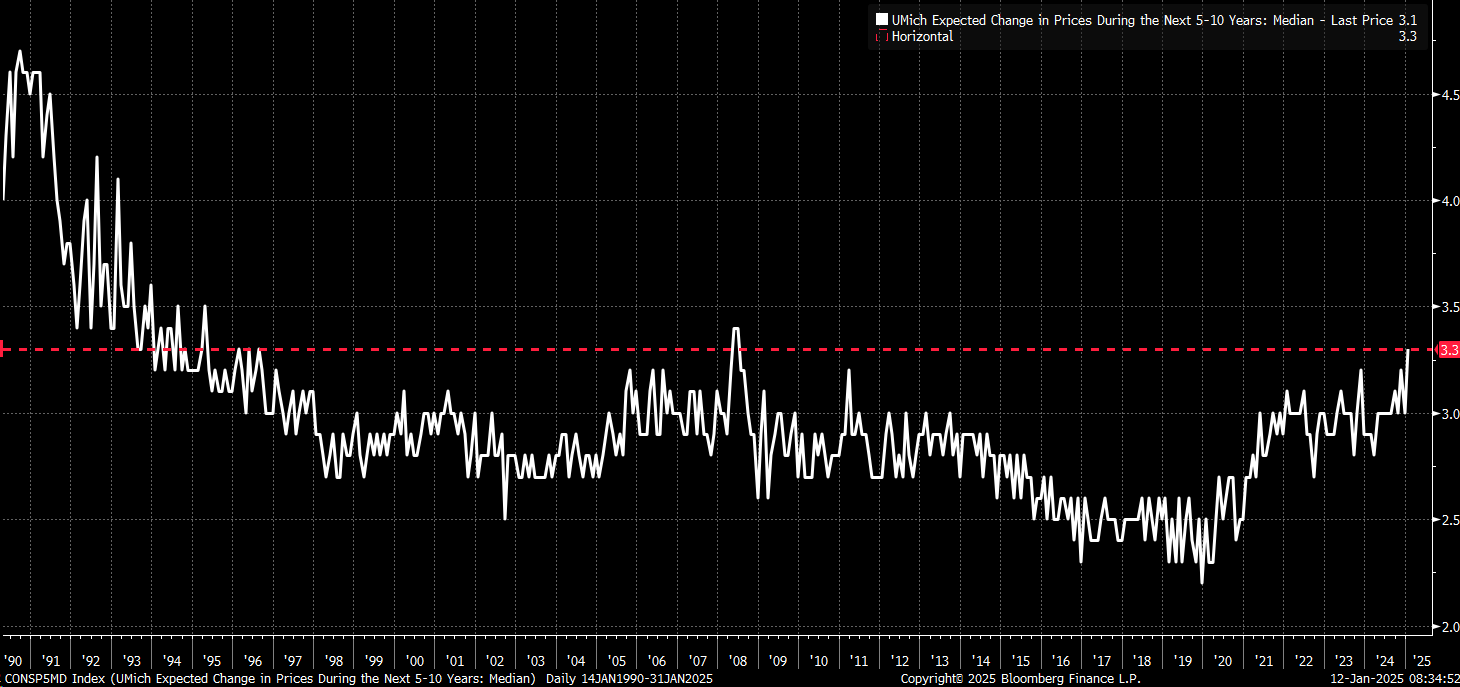

Friday’s College of Michigan inflation knowledge reveals year-ahead rose from 2.8% in November to three.3% in December, and the five-to-ten-year outlook elevated from 3.0% to three.3%—a collection excessive. That is the very best stage since 2008, signaling persistent inflation issues regardless of the Fed’s aggressive fee hikes. Preliminary knowledge may be risky, so revisions on the finish of the month will likely be essential.

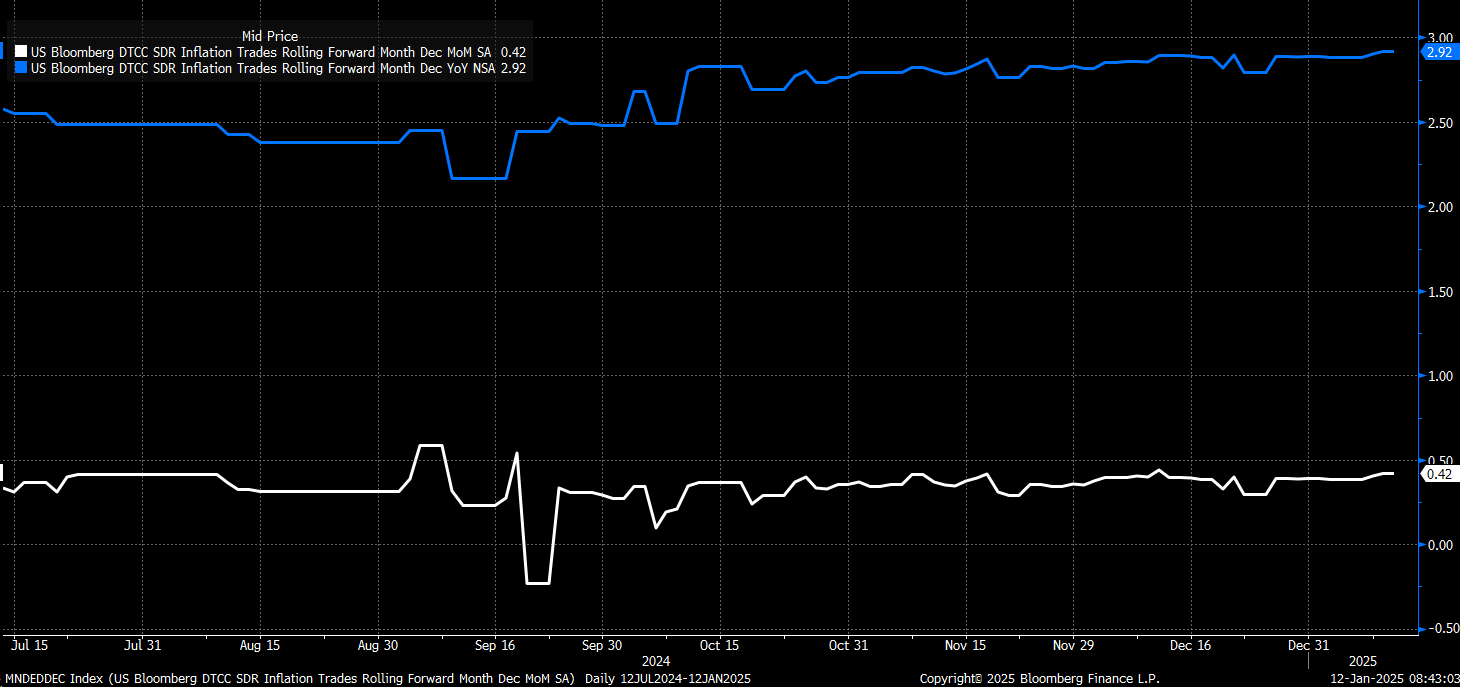

This week brings a wealth of key knowledge. On January 14th, the NFIB survey will present extra insights into inflation. On the identical day, the report is predicted to indicate a 0.4% month-over-month improve, with core PPI rising 0.3% from 0.2%. On Wednesday, is predicted to rise 0.3% month-over-month, with year-over-year projected at 2.9%, up from 2.7%. CPI swaps counsel the headline determine could are available in hotter than anticipated.

Retail gross sales are forecast to say no by 0.6% on January sixteenth, whereas the management group will stay flat at 0.4%. That day, import costs and may even be launched, adopted by housing begins knowledge on Friday.

Concerning exercise, notable audio system embody Williams on January 14th and fifteenth, Kashkari and Barkin on the fifteenth, and Goolsbee, who will communicate earlier than the Fed enters its blackout interval beginning January 18th.

After the roles report, markets are signaling fewer fee cuts in 2025, with the primary anticipated round September or October. The chances of a second-rate minimize are solely about 13%. Ahead charges counsel might rise by 15–20 foundation factors within the subsequent 12–18 months, implying a possible fee hike if financial knowledge stays robust and inflation persists.

The steepening yield curve helps this outlook, with the rising to 4.76% and the at 4.95%. The unfold between the Treasuries has widened to 40 foundation factors, whereas the 30-year minus 3-month unfold reached 61 foundation factors. An additional breakout might result in important steepening.

In foreign money markets, the (DXY) is nearing resistance at 109.60, with the potential to achieve 111.

The is holding at 1.02–1.03, however a break under 1.02 might push it underneath parity.

The stays weak; barring sudden motion from the Financial institution of Japan, the USD/JPY might run to 165.

For the , final week’s shut round 5,825 broke key help at 5,875. If draw back momentum continues, we might see the index drop to the mid-5600s. Choices market dynamics will play a major function, with the put wall at 5,800 and the unfavourable gamma flip zone at 5,930. Count on elevated implied volatility heading into the CPI report, with the potential for a volatility crush afterward.

***

Authentic Publish