The brand new US Securities and Change Fee (SEC) administration makes a grand transfer to situation a joint movement with Binance to remain the case for 60 days.

Previous to this, SEC was reported to have reassigned one of many prime officers of its crypto models to a different division, hinting at its newest plan to take a smooth method towards the trade.

In a earlier replace, we reported that the US Securities and Change Fee (SEC) has sued Binance and all affiliated corporations on 13 fees. In keeping with that report, the Company accused the crypto alternate of failing to stick to fundamental Know-Your-Buyer (KYC) guidelines and permitting US residents to create accounts with out buying the required licenses.

At the moment, it was alleged that Binance-linked tokens – BNB and BUSD stablecoin had been securities and had been unlawfully issued to prospects. As detailed in our earlier information piece, 10 cryptos that had been listed within the unique lawsuit as securities had been later revised in an amended grievance.

We allege that Zhao and Binance entities engaged in an in depth internet of deception, conflicts of curiosity, lack of disclosure, and calculated evasion of the legislation. The general public ought to watch out for investing any of their hard-earned belongings with or on these illegal platforms.

Nevertheless, the case started to take a unique flip following the stepdown of Gary Gensler and the appointment of Mark Uyeda as an appearing Chairman of the Fee.

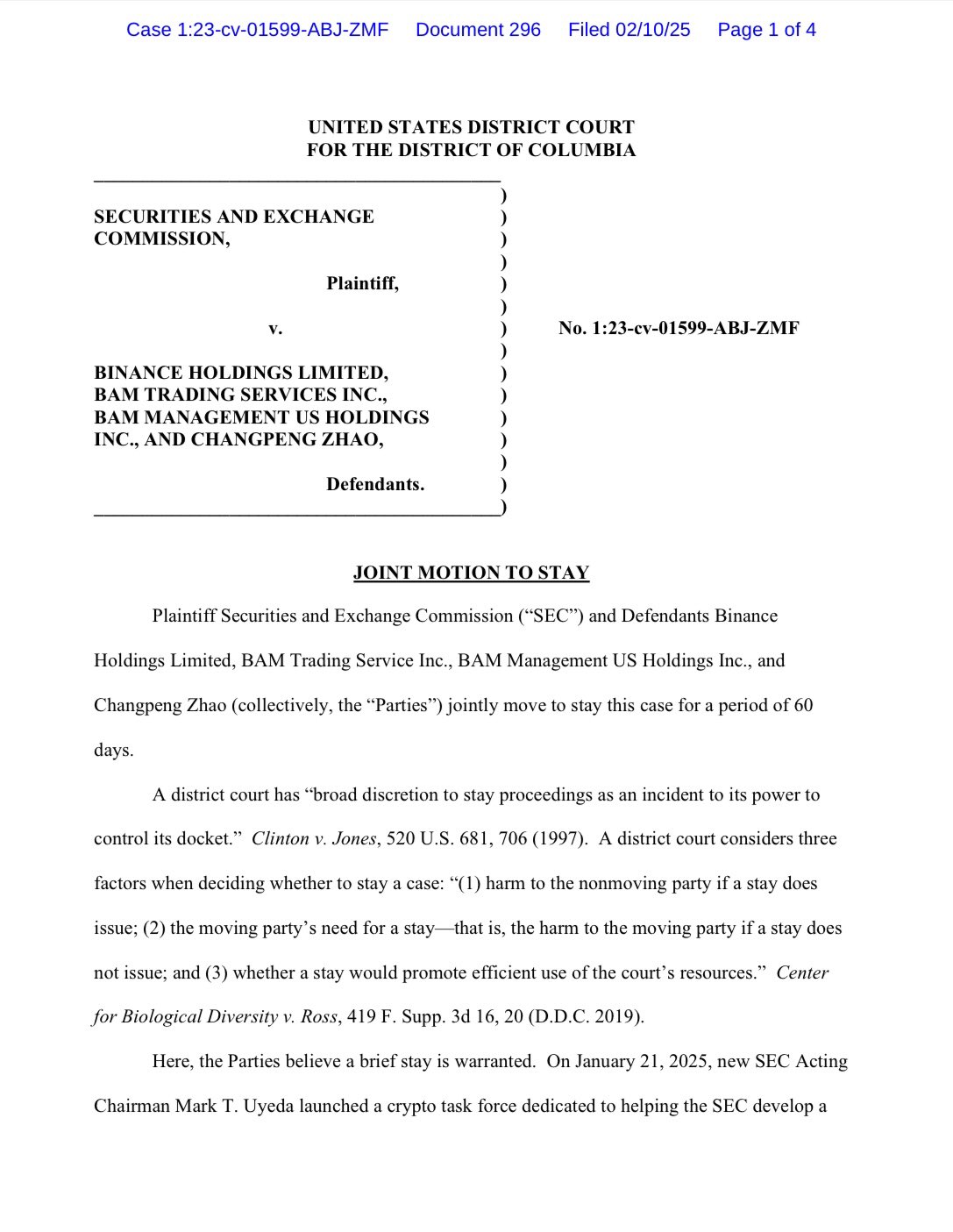

Primarily based on the newest report at our disposal, Binance and SEC have filed a joint movement to remain the case for 60 days. In keeping with a doc shared by Fox Enterprise journalist Eleanor Terrett, the brand new SEC crypto taskforce was cited to be “having a potential bearing on the case.”

After 60 days, the case is anticipated to take a brand new twist as each events may “situation a joint standing report” to watch whether or not the case could possibly be continued. In the meantime, this growth has additionally been hinted to not finish with Binance as Ripple, Coinbase, Kraken, and different non-fraud instances may have related destiny.

SEC vs. Ripple Replace

The SEC can be reported to be taking a smooth stance towards Ripple within the multi-year lawsuit because the Company reassigns one of many prime officers within the crypto unit, Jorge Tenreiro, to a different division. In keeping with the supply, Tenreiro performed an enormous function within the lawsuit towards the blockchain firm, and this determination may suggest that the case is nearing a optimistic decision.

Echoing the same trace, crypto knowledgeable Del Crypto has additionally disclosed that the reshuffle of the SEC official may result in a optimistic final result. Equally, Ripple Chief Authorized Officer Stuart Alderoty has highlighted that the transition of management could possibly be a approach of fixing the prevailing views of the Fee on the trade.

For a very long time, Alderoty has maintained that the lawsuits from the SEC are a declaration of battle on crypto. In the meantime, the Fee lately did not oppose Coinbase’s movement for an interlocutory enchantment, hinting at a potential change in place.

Following the current growth within the Binance case, the broad crypto market has made an considerable transfer with a 2.3% surge within the complete market cap. XRP, which stands to learn enormously from such information, has additionally recorded a 4% surge within the final 24 hours to commerce at $2.5. In keeping with our current evaluation, this asset may hit $8 within the close to time period.

Beneficial for you: