Fundamental Info

This EA consists of 270 distinctive methods for 29 totally different buying and selling pairs.The optimization of methods was carried out from 01.01.2020 to roughly 01.02.2025 (over the previous 5+ years), using essentially the most granular and detailed modeling mode “Each Tick”, on historic knowledge from the dealer “IC Markets”.

Obtain a Settings File Navigator right here:PrizmaL_270_in_1_Ver_1-00_Package_1000.zip(up to date on: Feb 07, 2025)

Selecting a Technique

The Technique Filtering panel permits to simply handle and discover buying and selling methods primarily based on particular buying and selling pairs or to show all obtainable methods. It’s designed to streamline the choice course of and supplies the next options:

① Exhibits the entire variety of methods.② Present methods for a particular buying and selling pair or listing all obtainable methods.

Overview of Outcomes

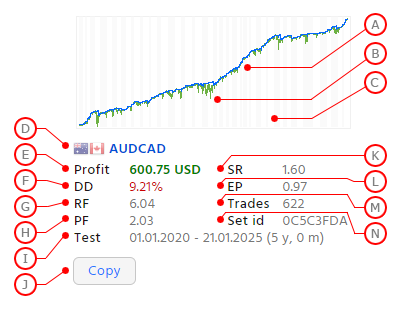

The technique panel shows an in depth revenue and drawdown chart, examined utilizing “Each Tick” modeling, offering a transparent visualization of the buying and selling technique’s efficiency over time. Important efficiency metrics, similar to Whole Revenue, Most Drawdown, Restoration Issue, Revenue Issue, Sharpe Ratio, Anticipated Payoff, and Variety of Trades, are systematically organized in separate sections for environment friendly evaluation. A “Copy” button permits customers to rapidly copy the technique’s configuration tackle for seamless integration with MetaTrader 5.

Ⓐ The blue line on the graph represents the account stability.Ⓑ The inexperienced line on the graph represents the account fairness.Ⓒ The white and grey vertical traces denote particular person months of buying and selling exercise.Ⓓ The buying and selling pair for which the technique is designed.Ⓔ Income in US {dollars}.Ⓕ Most drawdown as a share.Ⓖ Restoration issue.Ⓗ Revenue issue.Ⓘ Check interval.Ⓙ The [Copy] button lets you copy the trail of the settings file to the clipboard, simplifying its use in MetaTrader 5.Ⓚ Sharpe ratio.Ⓛ Anticipated payoff.Ⓜ Variety of trades.Ⓝ Setting ID.

An Excel (CSV) file can also be offered for viewing and filtering methods within the desk.

Technique Testing

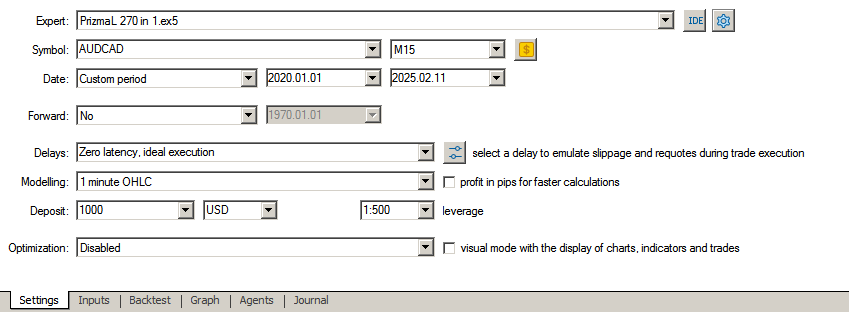

To start testing the technique, configure the Technique Tester in MetaTrader 5 and replicate the settings proven within the screenshot beneath. For preliminary and faster testing, use the “1 minute OHLC” modeling kind. For extra in-depth testing, use the “Each tick” modeling kind. Ensure to pick out the suitable buying and selling pair (Image) title for every technique. To load the technique settings, click on the [Copy] button situated beneath every chart within the desk. Then, go to Technique Tester and navigate to the “Inputs” tab to load the settings.

Make sure that the ‘Data Panel’ is about to false throughout testing, as it might decelerate the method.

(If you have not used the Technique Tester earlier than, be at liberty to contact me straight, and I am going to offer you the required data and an in depth information on how one can check within the MetaTrader 5 Technique Tester.)

Deposit and Dangers

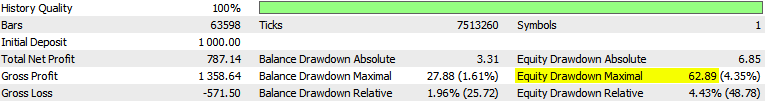

To find out the minimal deposit for every technique, we have to conduct check with out utilizing cash administration mode. After testing your chosen settings test the ‘Fairness Drawdown Most’ quantity. This worth signifies the very best drawdown quantity noticed through the testing interval.

If we look at the instance beneath, you will discover that the utmost drawdown reached $63 {dollars}. Which means that if we begin utilizing this technique with an account stability of $126 {dollars}, the utmost drawdown might be 50%.

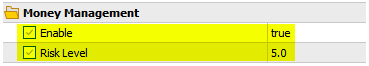

After that, you’ll be able to set this stability quantity within the technique tester, allow the cash administration mode, and modify the chance degree by rising or reducing it by 1 or 0.5 factors.

Be at liberty so as to add me as a buddy to remain up to date with my newest information and updates!