Do you battle to guess the place costs will go in foreign currency trading? Many merchants do. The ups and downs of forex pairs can result in missed possibilities and large losses. However, there’s a option to know extra: assist and resistance ranges.

These key spots available in the market give us clues about when costs may change or hold going. By studying about assist and resistance, merchants can discover the most effective instances to purchase or promote. They will additionally handle dangers higher and make smarter decisions. Let’s discover how these ideas can change your buying and selling sport.

Key Takeaways

Assist and resistance ranges are elementary to foreign exchange technical evaluation

These ranges point out potential shopping for and promoting possibilities

Value motion close to these ranges can present when tendencies may change or hold going

Assist can flip into resistance and vice versa after a breakout

Realizing these ranges helps in planning when to enter or exit trades

Utilizing completely different time frames makes assist and resistance extra dependable

Assist and Resistance Ranges in Foreign exchange

Assist and resistance ranges are key in foreign currency trading. They assist us perceive worth actions and make sensible buying and selling decisions. Let’s dive into what these vital ideas are all about.

Definition and Fundamental Ideas

Assist ranges act as a ground, stopping costs from dropping too low. Resistance ranges, however, act as a ceiling, making it onerous for costs to go up. These ranges are important in technical evaluation, with over 70% of merchants utilizing them to plan their strikes.

Function in Technical Evaluation

In technical evaluation, assist and resistance ranges predict future worth actions. Main ranges are adopted by the market 60-80% of the time. Minor ranges are revered 40-50% of the time. Sturdy assist ranges, examined greater than thrice, are seen as extra dependable.

Market Psychology Behind Value Ranges

Buying and selling psychology is vital in forming assist and resistance ranges. Worry, greed, and herd conduct form market actions. Psychological ranges, usually at rounded numbers, are key areas of assist and resistance due to dealer conduct. Realizing these emotional components can improve buying and selling methods and enhance worth prediction.

Stage Kind

Market Respect Charge

Psychological Affect

Main Assist/Resistance

60-80%

Excessive

Minor Assist/Resistance

40-50%

Reasonable

Psychological Ranges

Varies

Very Excessive

What Makes Assist Ranges in Buying and selling

Assist ranges in buying and selling are like worth flooring. They occur when extra individuals need to purchase at decrease costs. From 2019 to 2022, the bottom worth was 6375, displaying how these ranges final.

Merchants discover assist ranges in numerous methods. They take a look at previous costs to see the place demand was sturdy. These ranges usually match spherical numbers, like $50 or $100, which have an effect on the market.

The energy of a assist stage is dependent upon how usually it’s hit. A stage touched 4 instances is seen as sturdy. Trendlines, needing at the least three touches, additionally present assist zones. These pattern reversals might be seen in lots of time frames, from day by day to five-minute charts.

Realizing about assist ranges helps predict market strikes. Merchants use them to make sensible decisions. This exercise exhibits sturdy beliefs in an asset’s worth, hinting at future worth adjustments and possibilities to commerce.

Understanding Resistance Zones and Their Formation

Resistance zones are key in foreign currency trading. They’re worth ceilings that cease costs from going up. Realizing how they kind may help merchants succeed.

How Resistance Ranges Kind

Resistance ranges kind when costs cease going up after which go down. This occurs when sellers suppose the value is just too excessive. Numbers like 1.5000 for EUR/USD usually act as boundaries.

Key Traits of Sturdy Resistance

Sturdy resistance zones have a couple of vital traits. They kind after costs have been examined at the least thrice. This exhibits sturdy vendor sentiment.

Value reversals prior to now can even point out future resistance. The extra a worth stage is examined, the extra it impacts the market.

Psychology Behind Resistance Zones

The psychology of resistance zones is fascinating. Greed in rising markets helps create resistance. When costs close to historic resistance, about 65% of merchants suppose a reversal will occur.

This collective considering makes the resistance zone stronger. Breakout alternatives come up when market sentiment adjustments. This may result in greater buying and selling volumes and costs going past resistance.

Understanding these dynamics helps merchants make higher decisions. They will revenue from worth rejections at resistance or put together for breakouts.

Main vs Minor Assist and Resistance Ranges

In foreign currency trading, figuring out key worth ranges is vital. It helps in understanding the market construction and buying and selling ranges. Assist and resistance ranges are main and minor. They each form worth actions and dealer choices.

Main ranges are massive boundaries available in the market. They will cease and even reverse tendencies. For instance, a significant assist stage as soon as led to a +9489 level surge in a short while. These ranges usually match psychological worth factors or long-term pattern traces.

Minor ranges, however, trigger brief pauses in worth motion. They could briefly decelerate rising or falling costs in a pattern. Merchants use these ranges for fast trades or to regulate their entries and exits.

Variety of instances examined

The amount of trades at these factors

The timeframe they seem on

Main ranges present up on longer time frames and have been examined many instances. Minor ranges are extra frequent in shorter time frames. They might solely be examined a couple of instances earlier than breaking.

Realizing the distinction between main and minor ranges helps merchants. Main ranges supply massive worth strikes and pattern reversals. Minor ranges present fast, short-term trades throughout the market construction.

How Assist Transforms into Resistance and Vice Versa

The foreign exchange market exhibits fascinating function reversals. Assist ranges can flip into resistance and vice versa. This modification exhibits how the market is at all times shifting and offers merchants useful insights.

Value Stage Flip Phenomenon

Assist and resistance ranges are usually not mounted. They will swap roles, opening up new possibilities for merchants. For instance, the DJIA fell 5% after breaking its assist on Could 17, 2006. This assist then turned a brand new resistance stage.

Buying and selling the Stage Transformation

Merchants can take advantage of these adjustments by looking forward to key worth motion indicators. ExxonMobil’s inventory is an effective instance. Its resistance stage of $65 was examined twice in 2005-2006 earlier than turning into assist in mid-July 2006. This modification introduced new buying and selling possibilities.

Figuring out Legitimate Stage Adjustments

It’s vital to identify real-level adjustments for profitable buying and selling. Walmart’s inventory worth round $51 exhibits this. This stage was supported in 2004, then turned to resistance in early 2005. Such adjustments occur in about 60% of circumstances when a stage is damaged.

Inventory

Stage

Preliminary Function

Remodeled Function

Transformation Interval

DJIA

Unspecified

Assist

Resistance

Could 17, 2006

ExxonMobil

$65

Resistance

Assist

Mid-July 2006

Walmart

$51

Assist

Resistance

Early 2005

Buying and selling Methods Utilizing Assist and Resistance

Assist and resistance ranges are key in foreign currency trading. They assist merchants discover when to purchase and promote. In addition they assist handle dangers. Let’s take a look at some good methods to make use of them.

Shopping for when costs bounce off assist and promoting once they hit resistance is a well-liked tactic. For example, if a forex pair usually finds assist at 6375, a dealer may purchase when it will get near that stage.

Breakout buying and selling is one other methodology. When costs break by way of a resistance stage, it’d imply they’re going up. A drop under assist may imply they’re taking place. Merchants usually enter trades simply after these ranges to catch the transfer.

It’s vital to handle dangers when buying and selling assist and resistance. Merchants set stop-loss orders under assist for lengthy positions and above resistance for brief positions. This limits losses if the value goes towards the commerce.

Technique

Entry Level

Exit Technique

Danger Administration

Bounce Buying and selling

At assist or resistance

Goal reverse stage

Cease-loss past stage

Breakout Buying and selling

Past stage break

Trailing cease or goal

Cease-loss at damaged stage

Retest Technique

On stage retest

Set revenue goal

Tight stop-loss

Keep in mind, assist and resistance ranges change. A damaged assist can turn into resistance, and vice versa. Merchants want to look at the market carefully and regulate their plans as wanted.

Technical Instruments for Figuring out Assist and Resistance

Merchants use many instruments to search out assist and resistance in foreign exchange markets. These instruments assist them see the place costs may change course. This offers them a bonus in making buying and selling decisions.

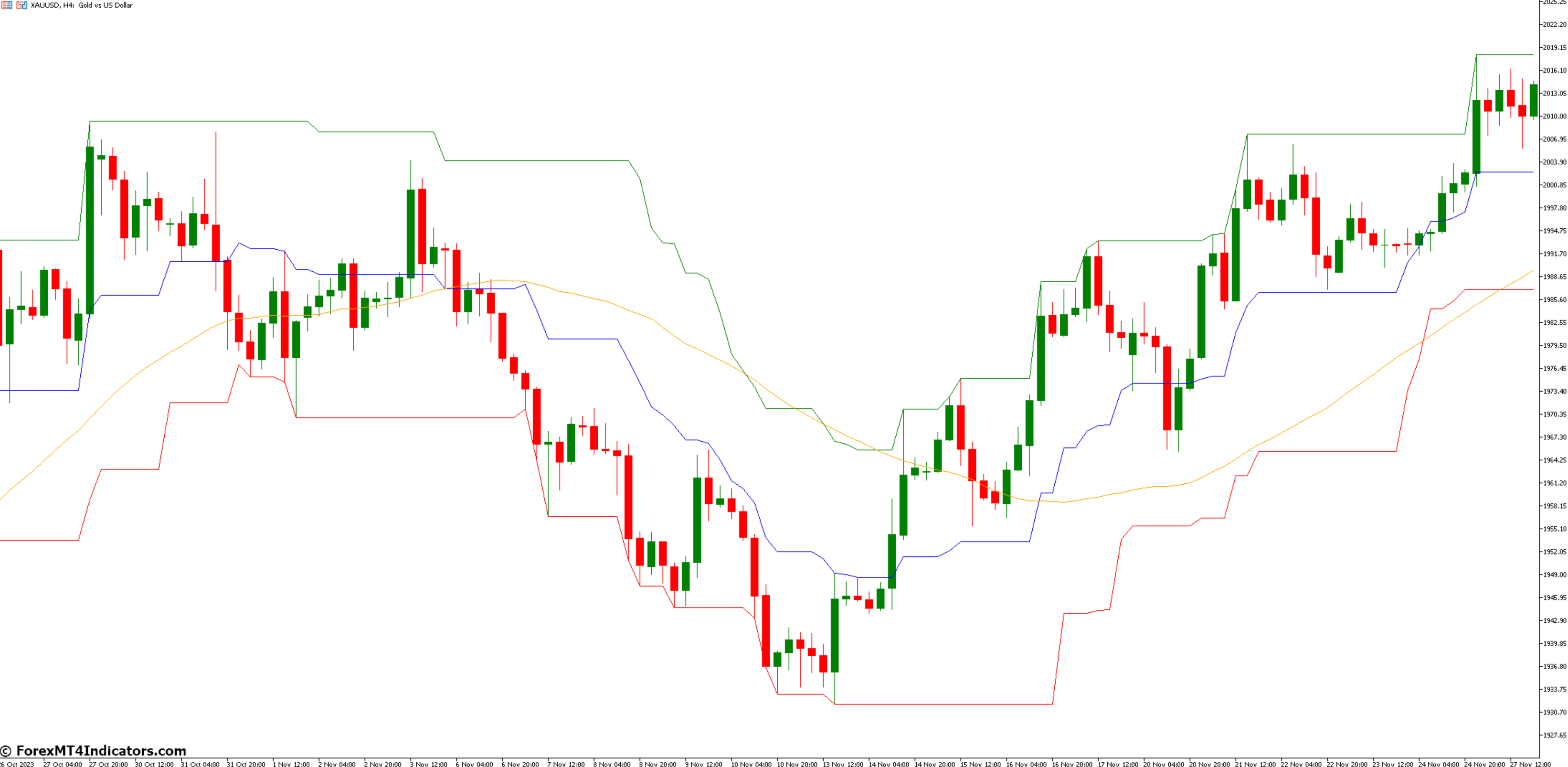

Transferring Averages as Dynamic Ranges

Transferring averages are key for recognizing assist and resistance. The 25-day, 50-day, and 200-day averages are favorites. When the value hits a shifting common, it usually bounces again, displaying assist. Alternatively, when the value meets a shifting common going up, it will probably present resistance.

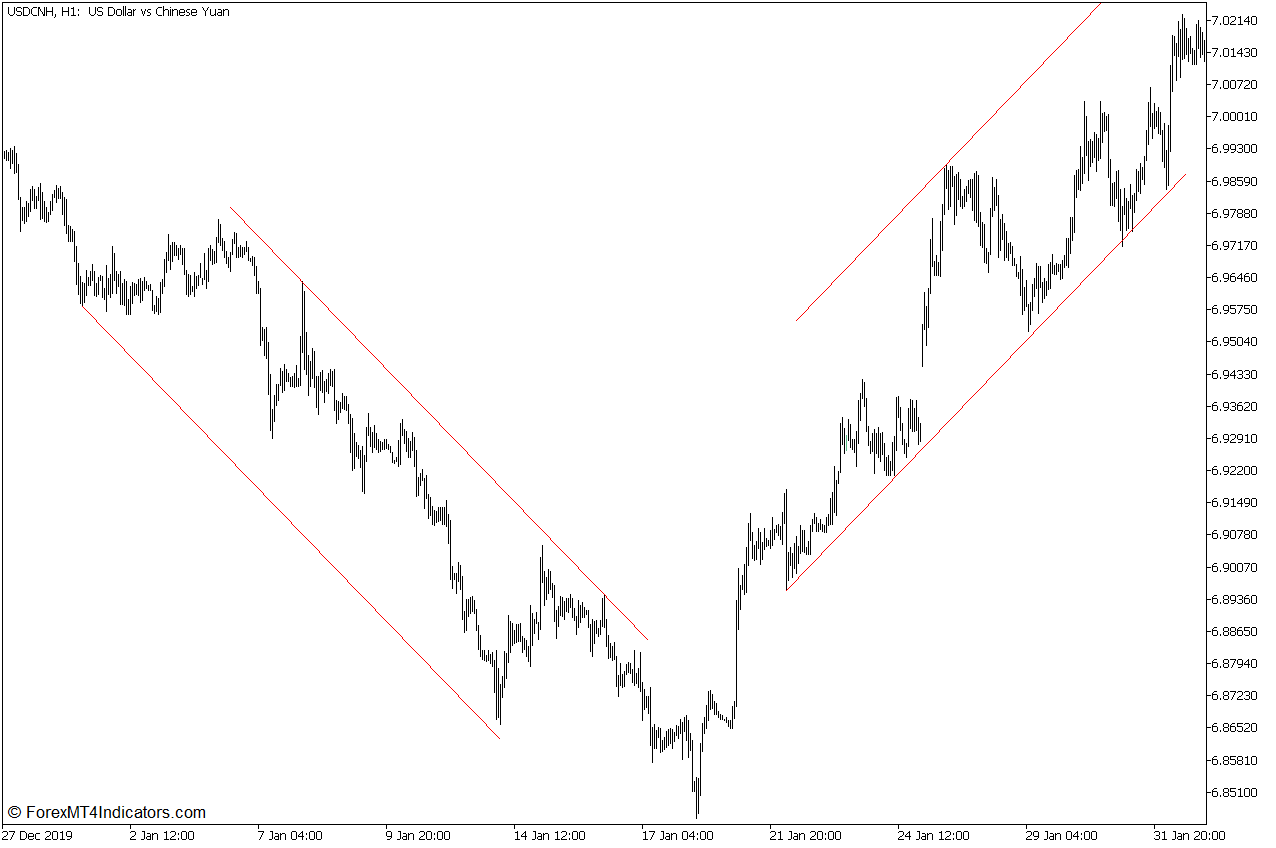

Pattern Traces and Their Utility

Pattern traces are very important for locating assist and resistance. To make a very good pattern line, join at the least two worth factors. The extra instances the value touches a pattern line, the stronger it’s as assist or resistance. Merchants search for breakouts or bounce off these traces.

Spherical Numbers in Stage Evaluation

Spherical numbers are vital in foreign currency trading. Numbers like 1.3000 in EUR/USD usually act as assist or resistance. Merchants usually place orders at these ranges, making pure boundaries. Look ahead to worth motion round these numbers to search out potential reversals or breakouts.

Instrument

Utility

Key Characteristic

Transferring Averages

Dynamic S/R

Adapts to cost adjustments

Pattern Traces

Static S/R

Connects worth factors

Spherical Numbers

Psychological S/R

Complete quantity ranges

Through the use of these technical instruments collectively, merchants can discover sturdy assist and resistance ranges. This helps them make higher buying and selling decisions within the foreign exchange market.

Widespread Errors in Buying and selling Assist and Resistance

Buying and selling assist and resistance ranges might be difficult. Many merchants fall into frequent traps that harm their efficiency. Let’s take a look at a few of these errors and how you can keep away from them.

False breakouts are a giant drawback. Merchants usually bounce in too rapidly when the value strikes previous a stage. This may result in losses if the breakout isn’t actual. It’s higher to attend for affirmation earlier than coming into a commerce.

Overtrading is one other situation. Some merchants attempt to catch each transfer at assist or resistance. This may eat into earnings and enhance danger. It’s smarter to be selective and solely commerce the most effective setups.

Danger administration errors might be pricey. Inserting cease losses too near assist or resistance usually results in pointless losses. Utilizing the Common True Vary (ATR) may help set higher cease losses. For instance, with a 20-period ATR of 60 pips, you may set your cease loss on the recognized excessive plus this buffer.

Many merchants mark too many ranges on their charts. This creates confusion and makes evaluation tougher. Concentrate on only one or two key ranges, particularly on greater timeframes like day by day or weekly charts. This retains issues clear and helps spot vital worth motion.

Widespread Mistake

Affect

Answer

False breakouts

Pointless losses

Watch for affirmation

Overtrading

Lowered earnings, elevated danger

Be selective with trades

Poor stop-loss placement

Getting stopped out too usually

Use ATR for stop-loss setting

Marking too many ranges

Complicated evaluation

Concentrate on key ranges solely

By avoiding these errors, merchants can enhance their success price and make higher choices within the foreign exchange market.

Value Motion Round Assist and Resistance Zones

Understanding worth motion close to assist and resistance zones is vital to buying and selling success. These areas usually result in massive market strikes. They’re vital for merchants to control.

Breakout Patterns

Breakout patterns occur when the value goes by way of a assist or resistance stage. They present a potential pattern change or continuation. Merchants use quantity to verify if it’s an actual breakout.

An enormous enhance in buying and selling quantity means a robust breakout. This exhibits the market’s sturdy emotions.

Rejection Indicators

Rejection indicators occur when the value checks a stage however can’t break by way of. Patterns like pin bars or doji candles present these rejections. They imply the extent is robust and may result in a worth flip.

False Breakouts

False breakouts happen when the value briefly crosses a stage however then rapidly goes again. They will trick merchants into appearing too quickly. To identify false breakouts, search for low quantity and quick worth adjustments.

Realizing the market’s temper helps inform actual from pretend breakouts.

Sample

Traits

Buying and selling Implications

Breakout

Sturdy worth transfer, excessive quantity

Potential pattern change or continuation

Rejection

Pin bars, doji candles

Attainable worth reversal

False Breakout

Weak quantity, fast reversal

Keep away from untimely entries

By studying these worth motion patterns and utilizing candlestick evaluation, merchants could make sensible decisions close to assist and resistance zones. Keep in mind, profitable buying and selling wants persistence and apply in studying these market indicators.

Utilizing A number of Timeframes for Stage Evaluation

Foreign exchange merchants use many timeframes to grasp market tendencies higher. This methodology helps verify tendencies and makes buying and selling extra constant. By trying on the identical forex pair in numerous time frames, merchants could make higher decisions.

Good timeframe evaluation consists of three durations. The medium-term is the typical commerce size. Brief-term frames are 25% of the medium-term. Lengthy-term frames are at the least 400% larger. This timeframe correlation boosts the probabilities of profitable trades.

Lengthy-term charts present sluggish adjustments and elementary influences. They result in lasting tendencies however supply much less short-term revenue. Medium-term trades can earn more money due to larger worth swings and fewer noise. Brief-term trades reap the benefits of quick market adjustments however value extra to do.

Timeframe

Traits

Advantages

Lengthy-term

Basic influences, sluggish adjustments

Sustained tendencies, much less frequent buying and selling

Medium-term

Bigger worth actions, much less noise

Greater revenue, balanced method

Brief-term

Fast fluctuations, greater volatility

Frequent adjustments want lively administration

Utilizing completely different timeframes helps make higher choices and analyze charts. Swing merchants usually use weekly charts with day by day or 4-hour charts. Intraday merchants may pair day by day charts with 30-minute or 15-minute charts. This methodology improves the reward-to-risk ratio and finds key assist and resistance ranges.

Danger Administration at Assist and Resistance Ranges

Buying and selling foreign exchange wants a very good grasp of danger administration. This ability is much more vital when utilizing assist and resistance ranges. Let’s take a look at how you can handle danger properly in these conditions.

Cease Loss Placement

Setting cease losses is a giant a part of managing trades. For lengthy positions, put cease losses 1-2% under assist ranges. For brief positions, place them 1-2% above resistance ranges. This helps hold your cash protected if the market goes towards you.

Place Sizing Issues

Getting the suitable place measurement is vital to retaining your capital protected. Don’t danger greater than 1-2% of your account on one commerce. This manner, you possibly can deal with a number of losses with out dropping all of your buying and selling cash.

Managing Breakout Trades

Breakout trades might be each worthwhile and dangerous. Enter lengthy positions when costs break above resistance, displaying a robust uptrend. Use a trailing cease to safe earnings as the value strikes your means. This boosts your risk-reward ratio.

Keep in mind, assist and resistance ranges change with market circumstances. Keep watch over these ranges and regulate your plans as wanted. Through the use of these danger administration ideas and cautious evaluation, you possibly can enhance your buying and selling success by 15-25%.

Conclusion

Assist and resistance ranges are key in foreign currency trading abilities. They’re the place demand and provide meet, shaping the market. At assist ranges, shopping for stops worth drops. At resistance, promoting stops the value rises.

Realizing these ranges is crucial for good market evaluation.

About 70% of merchants use assist and resistance of their plans. This exhibits how vital they’re. When a stage is damaged, it usually adjustments roles. This occurs about 80% of the time, displaying how markets change.

Studying by no means stops in foreign exchange. Whereas 90% of latest merchants simply take a look at worth ranges, winners do extra. They take a look at provide and demand, use technical and elementary evaluation, and shifting averages to identify tendencies. Spherical numbers are sturdy boundaries, good for coming into or leaving the market.

In brief, mastering assist and resistance takes effort and time. By enhancing these abilities and at all times studying, merchants can higher analyze the market. Keep in mind, within the fast-changing world of foreign exchange, figuring out rather a lot may be very highly effective.