Because the November Client Value Index () report approaches, its launch on Wednesday is poised to be a pivotal second for markets, because it may considerably impression the Federal Reserve’s outlook for financial coverage.

With the Fed’s assembly developing on December 17-18, this knowledge will play a vital position in figuring out whether or not the central financial institution continues easing within the months forward or adopts a extra cautious stance.

Whereas markets at present an 88% likelihood of a fee lower subsequent week, hotter-than-expected inflation knowledge may revive fears of extended financial tightening.

What’s Anticipated

Economists forecast headline CPI to speed up to 2.7% year-over-year, up from 2.6% in October. In the meantime, , which excludes meals and vitality costs, is predicted to extend by 0.3% , with an annual acquire of three.3%.

Supply: Investing.com

This may mark the fourth consecutive month of a 3.3% core studying, signaling ongoing challenges for the Fed, which is targeted on the ‘final mile’ of its journey to carry inflation again all the way down to 2%.

Any surprises—greater or decrease—may sway the Fed’s present stance on financial coverage. A softer CPI print might bolster the case for a fee lower, whereas hotter-than-expected knowledge would possibly immediate the Fed to keep up its present vary of 4.50%-4.75%, and even ship a “hawkish lower” that tempers expectations for 2025.

Market Implications

Inflation stays central to monetary markets, significantly amid file highs for the and the tech-heavy , that are each on observe for a banner 12 months in 2024. Supply: Investing.com

Supply: Investing.com

The interaction between inflation tendencies, Fed coverage, and the financial system’s resilience will form market dynamics as we transfer into 2025. As such, this report is not only a mirrored image of inflation but in addition a key determinant of how the Fed would possibly steadiness development and value stability within the coming months.

What To Do Now

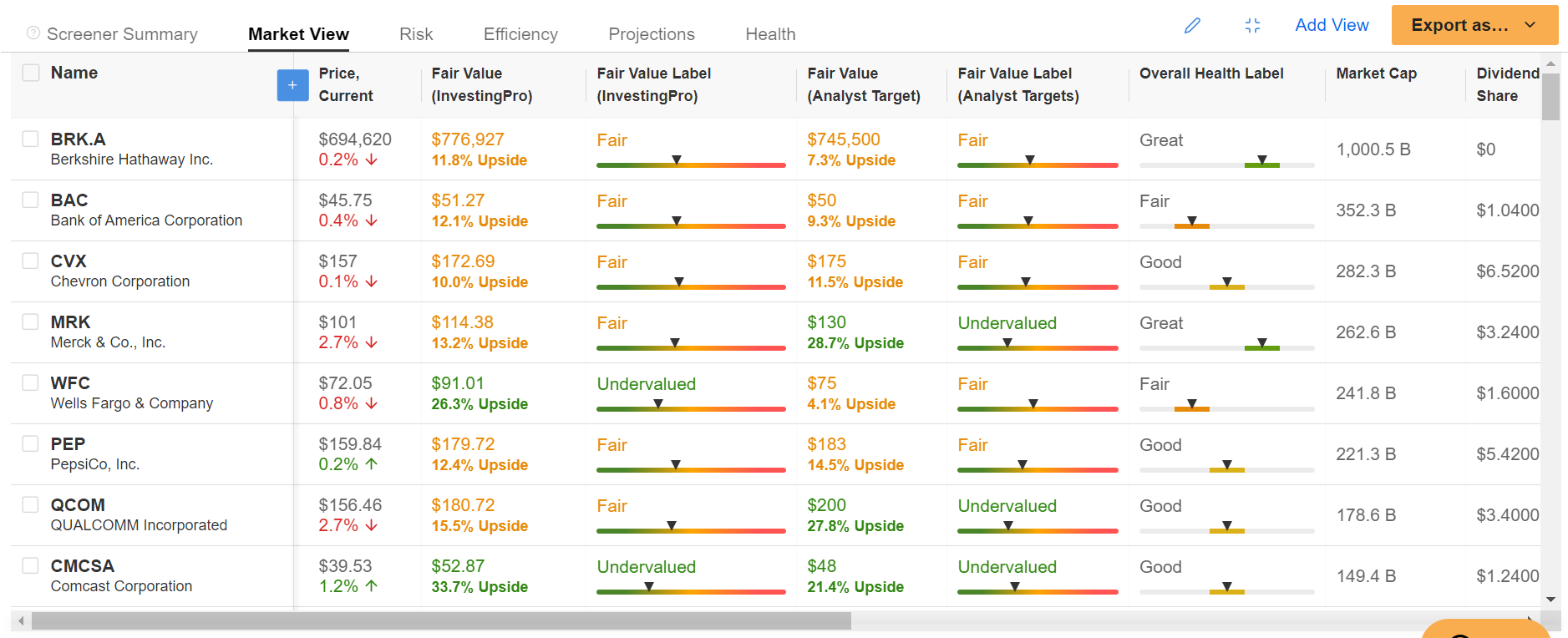

Utilizing instruments just like the InvestingPro Inventory Screener will help simply determine high-quality corporations which can be price proudly owning amid the present local weather. As inflation dynamics evolve, sure sectors stand out for his or her potential to climate inflationary pressures.

Vitality Shares: Rising prices usually profit vitality producers. Contemplate corporations like Exxon Mobil (NYSE:), Chevron (NYSE:), and Schlumberger (NYSE:), which thrive in inflationary environments.

Client Staples: Corporations like Pepsico (NASDAQ:), Coca-Cola (NYSE:), Nike (NYSE:), and Procter & Gamble (NYSE:) preserve pricing energy and regular demand, making them defensive performs.

Financials: Banks equivalent to Financial institution of America (NYSE:), Wells Fargo (NYSE:), JPMorgan Chase (NYSE:), in addition to Berkshire Hathaway (NYSE:) profit from greater rate of interest environments.

Actual Belongings: Investments in REITs like American Tower (NYSE:) and commodity-focused corporations equivalent to Barrick Gold (NYSE:) present inflation safety.

Supply: InvestingPro

Supply: InvestingPro

These belongings are well-positioned to supply resilience and development potential as inflationary tendencies develop, giving traders alternatives to capitalize on shifting macroeconomic circumstances.

Keep tuned for the CPI report and the ensuing implications for the Fed’s coverage path. The stakes are excessive, and the outcomes may form the funding panorama for months to return.

Make sure you try InvestingPro to remain in sync with the market development and what it means in your buying and selling. Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now to get 55% off all Professional plans and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with confirmed observe file.

InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for one of the best shares primarily based on a whole bunch of chosen filters, and standards.

Prime Concepts: See what shares billionaire traders equivalent to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR® S&P 500 ETF, and the Invesco QQQ Belief ETF. I’m additionally lengthy on the Expertise Choose Sector SPDR ETF (NYSE:).

I usually rebalance my portfolio of particular person shares and ETFs primarily based on ongoing threat evaluation of each the macroeconomic atmosphere and corporations’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.