Published on July 15th, 2025 by Aristofanis Papadatos

InPlay Oil (IPOOF) has two appealing investment characteristics:

#1: It is offering an above-average dividend yield of 11.1%, which is more than nine times the average dividend yield of the S&P 500.

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yields and payout ratios) by clicking on the link below:

The combination of an above-average dividend yield and a monthly dividend makes InPlay Oil an attractive option for individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about InPlay Oil.

Business Overview

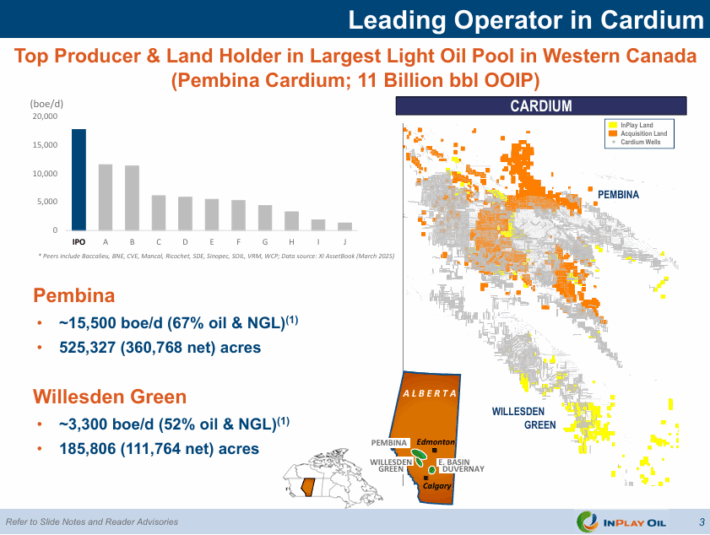

InPlay Oil is an oil and gas exploration and production company focused on developing light oil and natural gas assets in Alberta, primarily targeting the Cardium and Belly River formations.

The company combines horizontal drilling, enhanced oil recovery, and infrastructure optimization to maximize efficiency and returns.

In 2024, InPlay Oil posted average production of 8,712 barrels of oil equivalent per day, with 58% of the output attributed to crude oil and natural gas liquids (NGLs). The company is the largest Cardium oil producer and is headquartered in Calgary, Canada.

As an oil and gas producer, InPlay Oil is extremely sensitive to the boom-and-bust cycles of the oil and gas industry. It has incurred losses in 5 of the last 10 years and has exhibited a markedly volatile performance record.

In 2015, it incurred excessive losses due to a steep decrease in the prices of oil and gas. The company initiated a dividend only in late 2022.

On the other hand, InPlay Oil has some advantages compared to well-known oil producers. Most oil and gas producers have been struggling to replenish their reserves due to the natural decline of their producing wells.

Source: Investor Presentation

InPlay Oil is the greatest oil and gas producer in Cardium, which is the largest pool of light oil in Western Canada. The large scale in this highly prolific area creates economies of scale and bodes well for future production growth.

In the first quarter of this year, InPlay Oil posted an 8% decrease in its production over the prior year’s quarter. Given also the effect of a significant decrease in the average realized price of oil, the adjusted funds flow per share of the company declined 31%, from $0.13 to $0.09.

In April, InPlay Oil completed the acquisition of Pembina Cardium, which is expected to create more than $15 million in annual synergies and boost the annual free funds flow per share by 40%. Thanks to this highly accretive acquisition, we expect InPlay Oil to grow its funds flow per share from $0.34 in 2024 to $0.75 this year.

In reference to the global business landscape for oil and gas producers, OPEC provided strong support to the price of oil via deep production cuts since 2021 but this strategy approached its limits last year.

The U.S., Canada and Brazil, which do not belong to the cartel, have been growing their production and thus they have been gaining market share from OPEC.

This led many OPEC members, which rely on oil sales to fund their government budgets, to become dissatisfied with their reduced production quotas.

Angola exited OPEC at the beginning of last year. As a result, in April, OPEC began to unwind its production cuts, with a goal to raise its output by 2.2 million barrels per day until the end of 2026. As this strategic shift of OPEC is likely to result in a global surplus of oil, the price of oil has declined this year.

Nevertheless, it has remained above average and thus InPlay Oil is likely to remain highly profitable this year, assisted also by the aforementioned acquisition.

Growth Prospects

InPlay Oil has posted one of the highest reserve growth rates in its peer group over the last decade.

Source: Investor Presentation

Thanks to a strong record of profitable acquisitions, InPlay Oil has grown its production per share by 255% over the last decade and it has more than doubled its proved plus probable reserves over the same period.

Management has provided guidance for 15% growth of production per share and 16% growth of reserves per share in 2025. Given also the proven ability of the company to acquire profitable assets and reap great synergies from them, we expect 5% growth of funds flow per share over the next five years.

On the other hand, as an oil and gas producer, InPlay Oil is vulnerable to the wild swings of the prices of oil and gas. The company posted record earnings per share in 2021 and 2022 thanks to the recovery of global oil consumption from the pandemic and the onset of the war in Ukraine, which led the prices of oil and gas to surge to a 13-year high in 2022.

However, now that the global oil market has absorbed the impact of the Ukrainian crisis and OPEC has begun to unwind its production cuts, the price of oil has moderated.

As a result, the funds flow per share of InPlay Oil have decreased from an all-time high of $3.00 in 2021 and $2.61 in 2022 to $0.34 in 2024. We expect funds flow per share of approximately $0.75 this year.

InPlay Oil has a decent balance sheet. Its interest expense consumes 37% of its operating income while its net debt is $152 million, which is 77% of the market capitalization of the stock. Under normal business conditions, the company is not likely to have any problem servicing its debt.

On the other hand, in the event of a severe and prolonged downturn, InPlay Oil may face some financial pressure due to its somewhat leveraged balance sheet, which has resulted from the acquisitions of the company.

Dividend & Valuation Analysis

InPlay Oil is currently offering an above-average dividend yield of 11.1%, which is more than nine times the 1.2% yield of the S&P 500. The stock is an interesting candidate for income investors, but they should be aware that the dividend is far from safe due to the dramatic cycles of the prices of oil and gas.

InPlay Oil has a high payout ratio of 105%, which is unsustainable over the long run. Nevertheless, thanks to its promising growth prospects, the company is not likely to cut its dividend sharply under the prevailing oil and gas prices.

In reference to the valuation, InPlay Oil is currently trading for 9.5 times its expected funds flow per share this year. Given the high cyclicality of the company, we assume a fair price-to-funds flow ratio of 9.0, which is a typical mid-cycle valuation level for oil producers.

Therefore, the current funds flow multiple is higher than our assumed fair price-to-funds flow ratio. If the stock trades at its fair valuation level in five years, it will incur a 1.0% annualized drag in its returns.

Taking into account the 5.0% annual growth of funds flow per share, the 11.1% current dividend yield but also a 1.0% annualized headwind of valuation level, InPlay Oil could offer a 12.1% average annual total return over the next five years.

The expected return signals that the stock is a good long-term investment, even though we have passed the peak of the cycle of the oil and gas industry.

Final Thoughts

InPlay Oil has been thriving since 2021 thanks to an ideal environment of above-average oil prices. The stock is offering an above-average dividend yield of 11.1%, albeit with a high payout ratio of 105%. Given its promising growth prospects and its reasonable valuation, the stock appears attractive.

On the other hand, the company has proven highly vulnerable to the cycles of the prices of oil and gas. As a result, it is suitable only for patient investors, who can endure high stock price volatility.

Moreover, InPlay Oil is characterized by low trading volume. This means that it is hard to establish or sell a large position in this stock.

Additional Reading

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.