Published on August 21st, 2025 by Bob Ciura

Monthly dividend stocks have instant appeal for many income investors. Stocks that pay their dividends each month offer more frequent payouts than traditional quarterly or semi-annual dividend payers.

For this reason, we created a full list of over 80 monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yields and payout ratios) by clicking on the link below:

Healthpeak Properties (DOC) switched to a monthly dividend payout schedule in April 2025. This potentially makes the stock more attractive for income investors looking for more frequent dividend payouts.

This article will analyze Healthpeak Properties in greater detail.

Business Overview

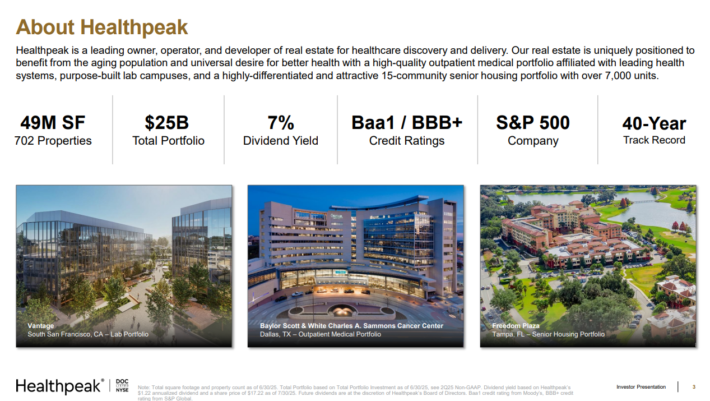

Healthpeak Properties is the largest healthcare REIT in the U.S., with 774 properties. It was the first healthcare REIT that was included in the S&P 500. The 37-year old REIT invests in life science facilities, senior houses, and medical offices, with 97% of its portfolio based on private-pay sources. It has a market capitalization of $12 billion.

Healthpeak Properties posted declining FFO for six consecutive years, until 2022. However, Healthpeak Properties has sold several assets and has used the proceeds to reduce its debt. As a result, the REIT has received credit rating upgrades from S&P and Fitch (to BBB+) as well as Moody’s (to Baa1).

Source: Investor Presentation

On July 24th 2025, the REIT reported second-quarter financial results. Quarterly revenue of $694.35 million was in-line with analyst estimates, and represented a year-over-year decline of 0.2%. Adjusted funds-from-operation (FFO) was $0.46 per share, up 2.2% from the same quarter last year. Adjusted FFO-per-share was also in-line with estimates. Same-store cash net operating income growth was 3.5% for the second quarter.

Investment activity for the quarter included two new development agreements with a combined projected cost of $148 million to support Northside Hospital’s continued outpatient expansion in the Atlanta market. Healthpeak Properties also sold one outpatient medical land parcel in June 2025 and two outpatient medical buildings in July 2025 for combined proceeds of approximately $35 million.

For 2025, Healthpeak Properties confirmed its forecast for adjusted diluted FFO-per-share to be in a range of $1.81 to $1.87. In addition, same-store cash (Adjusted) NOI growth is expected to be 3.0% to 4.0% for the full year.

Growth Prospects

Healthpeak Properties benefits from favorable secular trends. As the baby boomer generation ages and the average life expectancy is on the rise, the senior population of the U.S. is expected to grow significantly in the upcoming years. The 80+ age group is expected to grow by about 5% per year on average until 2030.

In addition, this age group has immense spending power. Thanks to these trends, healthcare spending in the U.S. is expected to grow by about 5% per year on average until 2030.

Although Healthpeak Properties posted declining FFO for six consecutive years, until 2022, and the restructuring process will keep burdening the REIT in the near future, most of the damage has already been done. We also expect the trust to enter a sustainable growth trajectory.

Nevertheless, due to the hefty issuance of new shares for the above merger and high interest expense amid high interest rates, we expect 3% annual growth of FFO per share over the next five years.

Dividend & Valuation Analysis

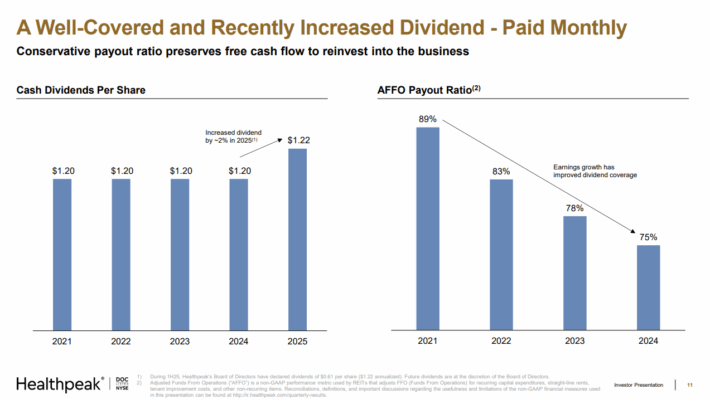

The performance of Healthpeak Properties has been poor in the last nine years and the REIT cut its dividend by -19% in 2021, due to the impacts of the coronavirus pandemic. As this was the second dividend cut in the last decade, it is evident that the REIT is vulnerable to downturns.

In addition, interest expense has increased 85% since 2021 due to high interest rates and the merger.

On the other hand, we note that the payout ratio is standing at a nearly 10-year low while the REIT does not have any debt maturities this year.

Source: Investor Presentation

DOC has a 2025 expected dividend payout ratio of 66%, based on the midpoint of the REIT’s adjusted FFO-per-share guidance for 2025. This indicates a sustainable dividend payout backed by sufficient FFO.

We also view the REIT as undervalued. Based on expected adjusted FFO-per-share of $1.84 for 2025, shares of DOC currently trade for a price-to-FFO ratio of 9.3. This is significantly below the 10-year average P/FFO ratio of 15.1, which we view as fair value.

If the valuation multiple were to expand to 15.1, it would boost annual shareholder returns by 10.2% per year over the next five years. This indicates the stock is significantly undervalued.

Adding in 3% expected FFO-per-share growth per year, as well as the 7.1% current dividend yield, total returns could exceed 20% per year for DOC.

Final Thoughts

Healthpeak Properties is a relatively new monthly dividend stock, having started paying its dividend on a monthly basis in April 2025.

The REIT has recovered from the various challenges faced during the pandemic, and could offer high average annual returns over the next five years, thanks to growth of FFO per share, its 7.1% dividend yield, and a significant expansion of the valuation multiple. Normally, we would rate such a high level of expected returns as a buy.

Nevertheless, due to the volatile performance record and the high debt load of the REIT, we rate it as a hold for patient, risk-tolerant investors who can endure extended periods of stock price pressure.

Additional Reading

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.