It’s time to listen carefully to what the market is saying, get tactical, and prepare for better opportunities ahead.

Last week delivered a flood of market-moving events—earnings, economic data, fiscal policy moves, and political drama, but many were clouded or muted by controversy, contradiction, or doubt.

As a result, there’s a high probability of a new tone to market going forward, but to assess for “how long” and to what “magnitude”, we’ll have to look under the hood at each of the following potential market catalysts.

Corporate Earnings: The busiest week of earnings season featured key reports from (NASDAQ:), (NASDAQ:), (NASDAQ:), and (NASDAQ:). The results were debatable, but the market’s reactive message was clear.

Economic Growth: came in stronger than expected (3% vs. 2.5%), but the data remained clouded by distortions stemming from tariff policies. As noted in recent weeks, these policies have skewed trade deficit behavior to historic extremes, complicating the interpretation of top-line growth and creating doubt about underlying economic health.

Monetary Policy: The FOMC meeting included two dissenting votes for the first time since the 1990s. Still, Powell’s press conference stuck to a familiar script—signaling patience and data dependency due in part to the known and unknown impacts of tariff policies on inflation, and immigration policies changing the structure of the labor force.

The Labor Market: Friday’s report disappointed with just 73,000 jobs added versus expectations of 100,000. However, the bigger concern was the sharp downward revisions to the prior two months. Despite this, the —Powell’s stated focus—rose just 0.1% to 4.2%. Weakening labor demand vs. a stable unemployment rate in the labor market, which is undergoing a historic structural change, continues to embolden both the hawks and the doves!

The Fiscal Agenda: True to his negotiating and leadership style, President Trump “fired the messenger” (Dr. Erika McEntarfer, the commissioner of the Bureau of Labor Statistics), following Friday’s jobs data. He also moved his ceasefire agenda forward with a flexing of military muscle toward Russia by announcing nuclear submarine deployments in response to a Russian diplomat’s “provocative” comments. On trade, the administration flooded the news cycle with announcements of new tariff deals and postponements. Additionally, Fed Governor Adriana Kugler announced an early resignation, giving the President another opportunity to install a loyal appointee at the central bank.

The Market’s Message: The week began with bullish momentum but ended in technical deterioration. Chart watchers would label the week a “bearish engulfing” pattern—where the weekly decline fully swallows the prior week’s gains—indicating a potential shift in trend. Whether this marks a lasting turn or just a pause remains to be seen, but the message from price action was decisively risk-off.

Any one of the above items could have provided a normal amount of news to serve as a significant catalyst, but each one was muted by controversy, contradiction, or doubt.

Use the links below to dive into the details of each and review the Big View bullets and watch Keith’s weekly market analysis video.

This would be a good week to make sure you don’t neglect to take a few minutes to watch Keith’s weekly video, which walks you through the most important trends and insights within Big View.

Our Big View product was conceived while Keith and I were managing money at Millennium Partners as a tool for our own use to keep us ‘honest’ and focused on the trends and internal health of the market, so FOMO or greed wouldn’t get the best of us.

30 years later, it’s still guiding us and thousands of members. We hope it’ helping you too.

You’ll find the video at the bottom of the Market Outlook commentary every week.

Earnings

In last week’s Market Outlook, we suggested that despite important news on inflation, the labor market, and an FOMC meeting, earnings would be the primary driver of market action.

While the employment report had some pretty shocking data, I’d still argue that earnings data was the primary market message.

According to FactSet…“Overall, 66% of the companies in the have reported actual results for Q2 2025 to date. Of these companies, 82% have reported actual EPS above estimates, which is above the 5-year average of 78% and above the 10-year average of 75%…. In terms of revenues, 79% of S&P 500 companies have reported actual revenues above estimates, which is above the 5-year average of 70% and above the 10-year average of 64%.”

The chart below provides a breakdown by sector.

Not only are companies reporting well, but they are also revising UP.

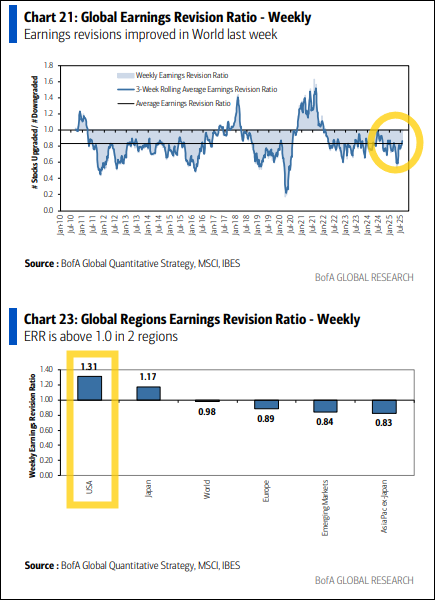

Last week, Bank of America reported that the ratio of companies revising earnings up vs. down jumped to a 43-month high (.81) globally and a 24-month high (1.31) in the U.S., as shown in the chart below.

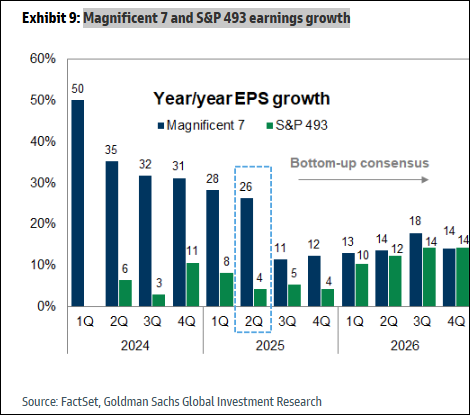

If we look at the longer-term trend in earnings and expectations in the chart below, we can see that the market has likely priced in expectations of declining growth rates from the MAG7 and the other 493 S&P 500 stocks into this quarter and next.

The expectation is then a steady rise in growth into 2026. Given this data the current rise in estimates is only consistent with generally improving expectations looking out over the next year. Good news for the longer-term prospects, but not a very significant

Economic Growth

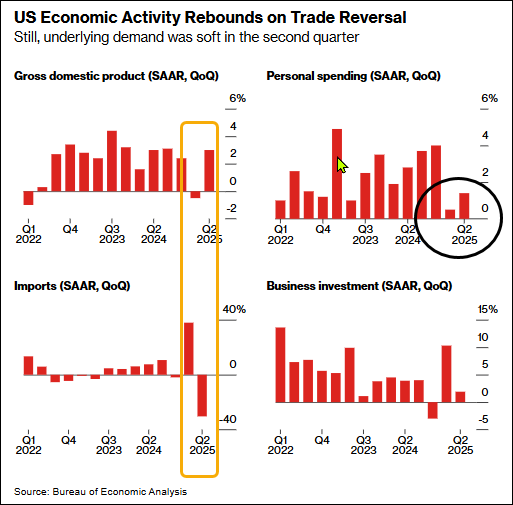

GDP came in stronger than expected (3% vs. 2.5%), but the data remained clouded by distortions stemming from tariff policies. As you can see by the yellow box in the chart below GDP data has been skewed by the volatility in imports.

One thing that is clear is the black circle around low personal spending. This is a clear softness in demand.

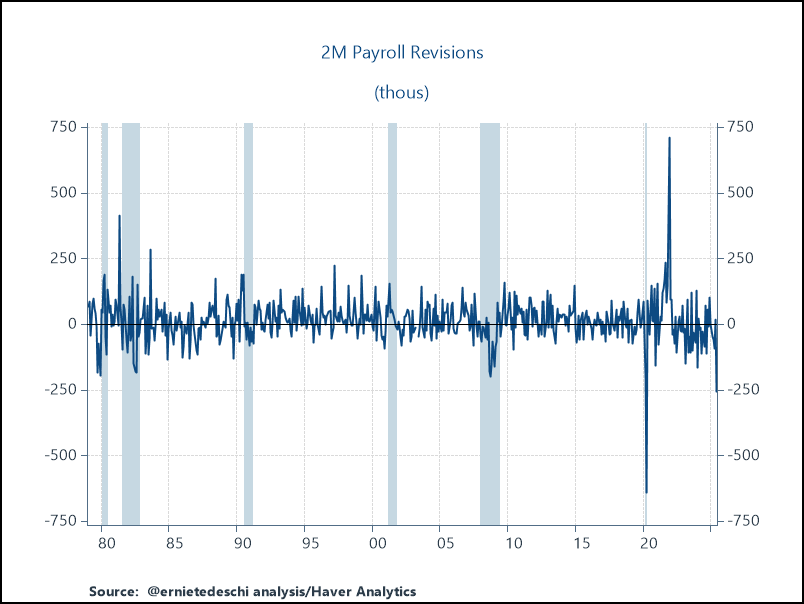

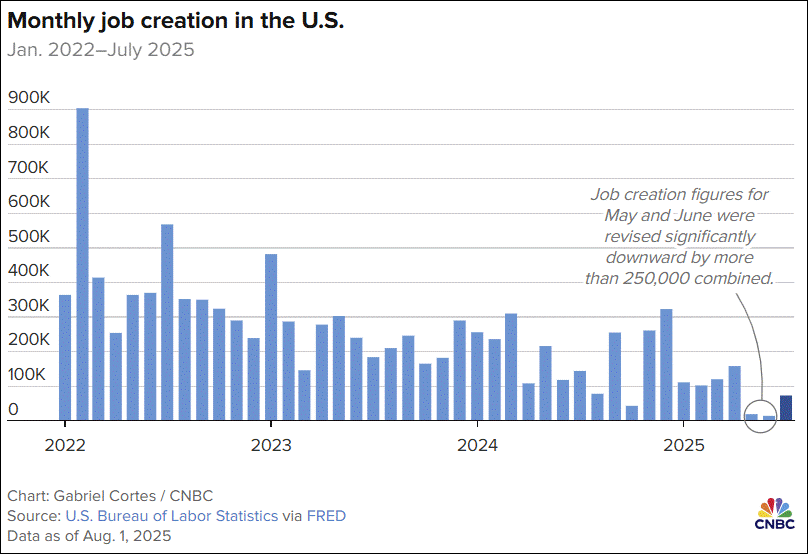

The Labor Market: Friday’s nonfarm payrolls report disappointed with just 73,000 jobs added versus expectations of 100,000. However, the bigger concern was the sharp downward revisions to the prior two months.

As you can see by the chart below this 2-month (2M) revision represents the largest on record back to 1979 with the exception of the pandemic.

The resulting payroll trend now looks as follows:

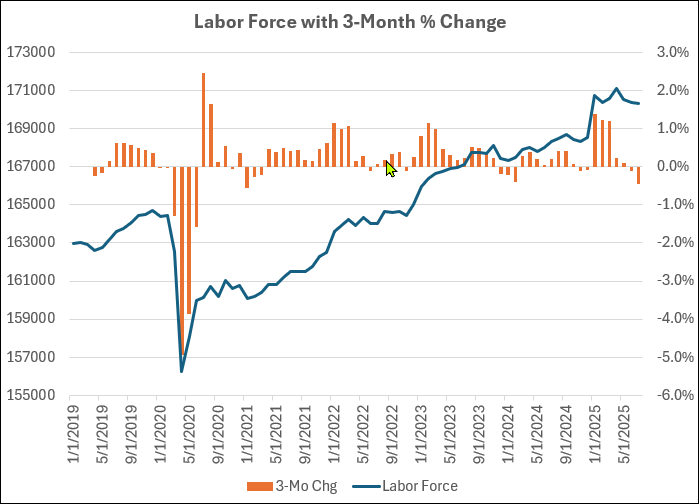

At the center of the debate between Chair Powell and advocates for is the balance between the supply of jobs (payroll creation) and the demand for jobs (size of the labor force). The combination of these two factors results in the , which Powell has said he’s focused on.

As you can see in the chart below, the change in the labor force since April (3-month change) in orange has dropped -0.5% which is one of the largest since the pandemic.

As a result, the lower job creation has had less of an impact on the rate.

In short, deporting our labor force and discouraging immigration may have unintended consequences on the labor market and monetary policy.

Monetary Policy

The FOMC meeting included two dissenting votes for the first time since the 1990s. Still, Powell’s press conference stuck to a familiar script—signaling patience and data dependency due in part to the known and unknown impacts of tariff policies on inflation, and immigration policies changing the structure of the labor force.

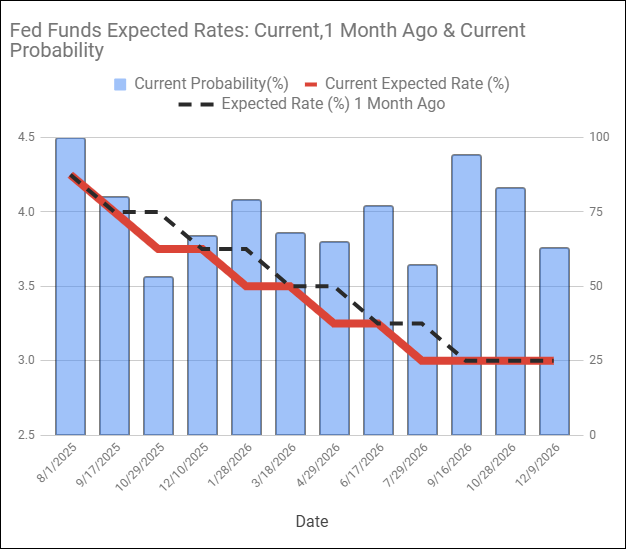

Chair Powell’s message that he wants more persuasive data on inflation and the unemployment rate, but the market expectations by the end of the week pointed to ahead, with or without him.

As you can see from the blue column in the chart below, the market now has the odds that he’ll cut in September at over 75%, and equally high odds that we’ll see 3 cuts (3.5% Fed Funds) by the January meeting.

The shift down in the red line from the black dashed line represents the change in the expected rates over the next year.

Looking at the ETF that tracks the 1-3 year bonds () below, you will see lines showing the compression and last week’s move above the July high and a big horizontal resistance level. Higher bond prices mean lower rates.

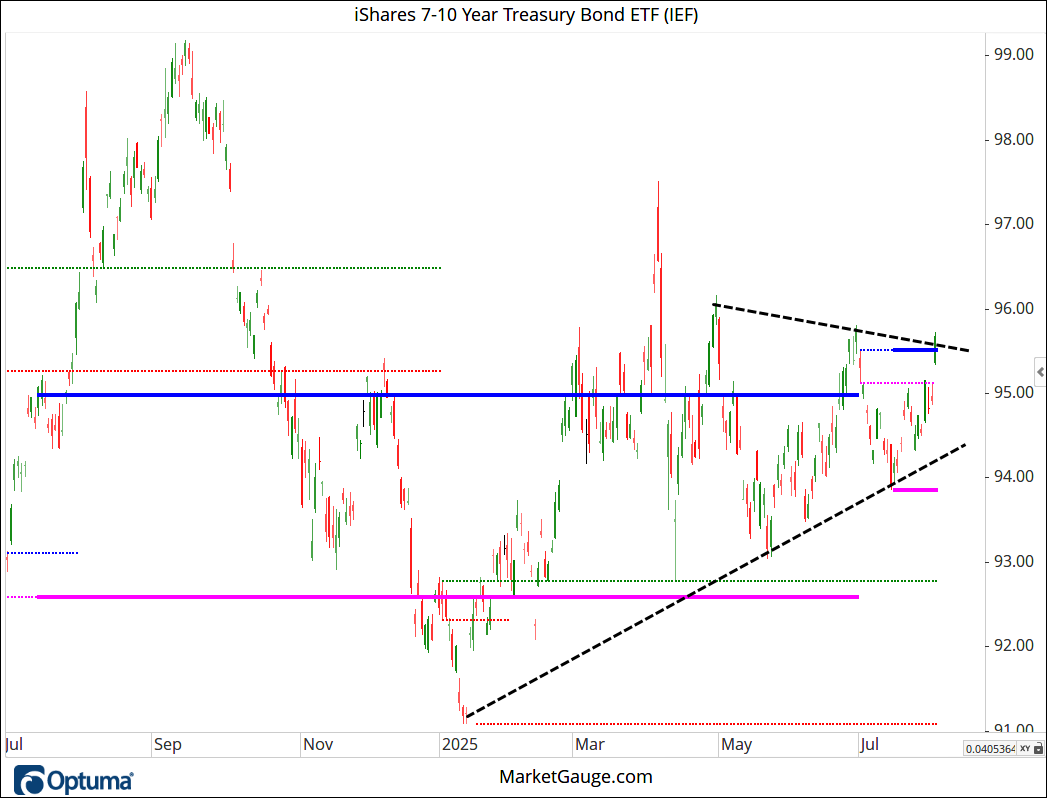

The 7-10 year bonds ETF () also looks like there is potential for a bullish breakout of a compression pattern and a key horizontal level (below).

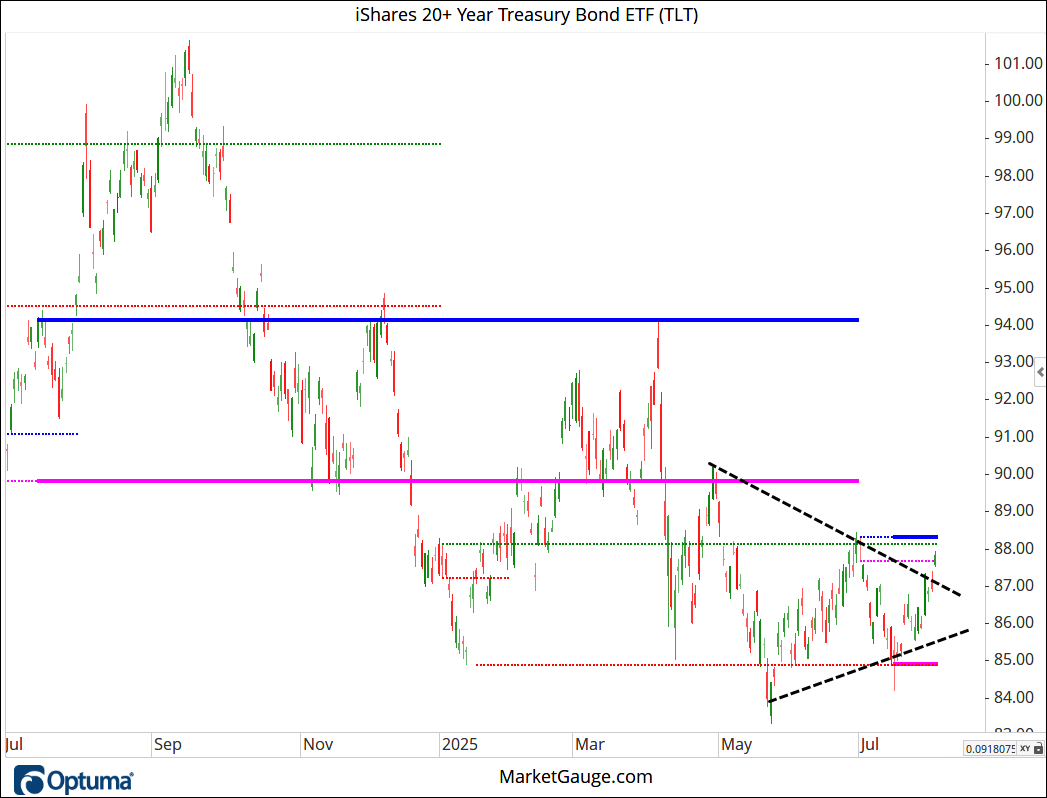

As we move out to the riskiest part of the yield curve, the 20+ year bonds ETF (), the breakout of the compression is beginning, but the trend has not yet turned higher relative to the July high (blue line)

Summary

There are reasons in the GDP data and the labor market data to be concerned about a slowing of the economy. The interest rate market suggests it sees this too.

The Fed sees the weakness but also feels the need to consider the inflationary risks of lowering rates, given all the uncertainty surrounding the tariffs and the labor force.

In the not-too-distant past, we would have been talking about the market liking fiscal gridlock. Under the current administration, the gridlock certainly isn’t on the fiscal side, and all the moving parts are creating a level of uncertainty that the market has had to adapt to.

There is, however, gridlock between the administration and the Fed, and I think the market is just fine with it.

The market sold into Google’s (NASDAQ:) good earnings report last week, and then did the same with MSFT and META before the weak labor report. AMZN didn’t deliver surprisingly good numbers, and it got punished.

A healthy market needs good corrections, and these often start just like last week. Profit taking makes sense when investors doubt the good news can continue at the same pace.

Last week, the market sold into good earnings news, and at the same time, there was elevated doubt about what the economic data implied for economic growth, and there was a lack of new buyers to continue to support higher prices despite better-than-expected earnings.

This is an environment where quant models and savvy active investors can thrive by managing downside risk. Make sure you take a few minutes to watch Keith’s weekly video (below), which walks you through the most important trends and technical insights that are driving this correction.

Summary: Markets flipped decisively to risk-off this week, with major indexes breaking down from all-time highs with a confirmed bearish engulfing pattern, volume and internals turning negative, and nearly all sectors—including key economic bellwethers like transports and retail moving into a distribution phase.

Risk On

Value versus growth, while it deteriorated slightly, is still showing risk-on with value breaking under its 50-Day Moving Average while growth is still in a bull phase. (+)

Seasonally, August remains a month with positive expected returns (except for small caps), though significantly weaker than earlier summer months. A modest risk-on reading. (+)

Neutral

Foreign equities giving a mixed signal with emerging markets still in a bull phase, while more established foreign equities broke down into a warning phase. Leadership versus U.S. equities has been surrendered. (=)

Soft commodities remain under pressure, and broke down hard this week, closing at the lower end of its trading range and in a bear phase. came off hard ( -20%)over changes in Tariff policies.This rapid shift could happen to any market at any time based on shifting geopolitical pressures. (=)

is right in the middle of its trading range for the last several months and back into a bullish phase. Until it breaks out of this trading range, we are looking at this as overall neutral. (=)

broke down, closing under several weeks of compression at the highs, but still in a bull phase overall. It needs to hold the $110k level, which it has been respecting for quite some time. (=)

A Fed governor is retiring, giving President Trump more opportunity to appoint more dovish members and push rates lower faster. A drop seems to be in the cards with rates now trading above key moving averages across the entire yield curve. (=)

Risk Off

Markets were down between -2.2% and -4.2% on the week with a confirmed breakdown of a bearish engulfing pattern which occurred at all-time highs in both the S&P and . This was one of the first risk-off patterns we have seen in the indexes in months. (-)

Volume patterns were weakening and flipped into negative territory this week. (-)

With the exception of Utilities, all sectors were down on the week, led by along with , which moved into a distribution phase and now down year-to-date. Indicating a slowing economy. (-)

Looking at the global macro picture, volatility and short instruments on foreign equities surged on the week. (-)

As we have been highlighting the last several weeks, the weakness in market internals collapsed this week and is starting to reach moderately oversold conditions. (-)

The new high new low ratio flipped negative across the board from moderately overbought levels. (-)

With this week’s action, market internals as measured by our color charts (moving average of stocks above key moving averages) has decisively flipped negative with the exception of longer-term reading on the 200-Day Moving Average which is now neutral. Net, the overall picture is still risk-off on the short-to-intermediate term picture. (-)

The Risk gauge swung to fully risk-off with the strength in utilities and treasuries. (-)

As covered in last week’s video, volatility had reached oversold conditions and flipped this week with a massive confirmation on Friday. (-)

The modern family broke down hard with regional banks breaking down below its 50 and 200-Day Moving Average, with transports breaking down even harder. (-)