With so many stock picking services and financial research platforms available today, it can be hard to separate the noise from the value. One name that has gained traction in recent years is Moby Premium, a subscription-based investment research platform focused on delivering model portfolios, expert analysis, and actionable stock picks. But in a world with options like Motley Fool Stock Advisor, Seeking Alpha Premium, and other financial services, a fair question arises: Is Moby Premium worth it?

In this deep-dive review, we’ll look at Moby Premium’s features, track record, investment research methodology, pricing structure, and why 89% of trustpilot reviews rate Moby at 5 stars. We’ll also explore how it compares to other premium services, and whether it’s a good fit for beginner, intermediate, or experienced investors looking to build or refine their investment strategy.

What Is Moby Premium?

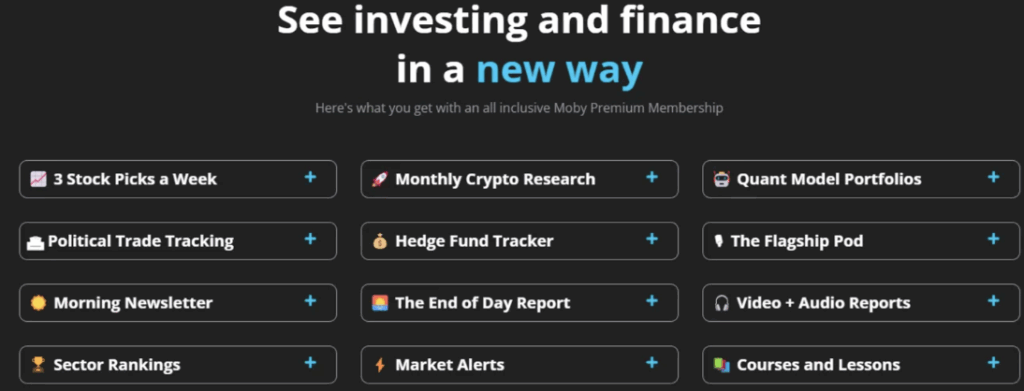

Moby Premium is the paid version of the Moby app, a financial education and stock market research tool designed to help investors make informed investment decisions. The service offers a variety of premium content types including:

Curated stock recommendations with supporting analysis

Model portfolios based on themes such as growth, technology, or market volatility

Daily financial news and market summaries

Exclusive research reports and insights

Real-time alerts and portfolio tracking tools

Moby is currently offering a free stock pick here and offering 50% off for new subscribers.With the WallStreetSurvivor Exclusive offer on this page, enter your email, and then you can save 50% 1 year for only $99.Don’t miss out on their next pick and remember they have 30 day money back guarantee.

The Moby team, made up of former hedge fund analysts and Wall Street veterans, builds its recommendations using quantitative models, fundamental analysis, and a mix of proprietary metrics that aim to uncover undervalued technology companies and emerging trends.

Key Features of a Moby Premium Subscription

Subscribers to Moby Premium gain access to a wide range of tools and reports designed to support long-term wealth building. Let’s break down what you get:

Stock Picks and Analysis

Every week, Moby Premium delivers detailed stock picks, complete with price targets, supporting data, and technical analysis. These picks are backed by the Moby investment team’s research and often feature opportunities in growth businesses and high-performing sectors.

Model Portfolios

Moby Premium includes several model portfolios based on different investment strategies, such as dividend growth, tech leaders, and inflation-resistant assets. These are built using both proprietary algorithms and human oversight to match various risk tolerance levels.

Moby is currently offering a free stock pick here and offering 50% off for new subscribers.With the WallStreetSurvivor Exclusive offer on this page, enter your email, and then you can save 50% 1 year for only $99.Don’t miss out on their next pick and remember they have 30 day money back guarantee.

Research Reports and Alerts

In addition to stock picks, Premium members get access to in-depth research reports, daily market updates, and real-time alerts when new opportunities are identified. The Moby app provides push notifications for key insights, making it easy to stay up to date.

Educational Resources

The service offers a robust library of educational content aimed at helping investors understand core concepts, trends, and tools. From decoding inflation reports to understanding asset lookup tools and reading the economic calendar, the resources are geared toward helping users build confidence.

Portfolio Tracking and In-App Tools

Users can connect their existing investment portfolios and track performance against Moby’s model portfolios. The in-app trading tools allow for easier management and comparison, making the experience seamless and intuitive.

The Team Behind the Picks: Moby’s Analysts and Methodology

The strength of any stock picking service comes down to the quality of its analysis. Moby Premium is built around a team with backgrounds in hedge funds, institutional research, and algorithmic modeling. Their approach blends quantitative tools with human insight.

Many of Moby’s recommendations have focused on undervalued technology companies, clean energy stocks, and mid-cap growth firms, reflecting a bias toward innovation and long-term investment goals. Reports often include comparisons to broader market conditions, analysis of company fundamentals, and historical track records.

The Moby team also releases occasional reports on themes like emerging markets, political trade tracking, and machine learning trends in finance. These insights help diversify users’ exposure beyond traditional sectors.

Comparing Moby Premium to Other Services

It’s important to compare your options when paying for a premium investing service. We take care of that and compare Moby to some of the top options on the market.

Moby vs. Motley Fool Stock Advisor

Motley Fool is perhaps the best-known stock advisor platform in the United States, with a long history of performance data and brand recognition. It focuses on high-conviction long-term stock picks, generally offering two selections per month. While Motley Fool excels in brand legacy, it does not offer in-app trading, portfolio tracking, or daily financial news like Moby does.

Moby vs. Seeking Alpha Premium

Seeking Alpha Premium offers deep analyst coverage and tools like quant ratings, valuation grades, and dividend analysis. However, its interface and articles often cater to intermediate investors and can be dense. Moby Premium’s advantage lies in its jargon-free, mobile-first interface and streamlined alerts.

Moby vs. Traditional Financial Advisors

For those comparing Moby to human financial advisors, it’s worth noting that Moby Premium is a research service, not a personalized financial planner. It offers general insights, not bespoke investment portfolio allocations tailored to individual needs or full financial planning.

Pricing: What Does Moby Premium Cost in 2025?

As of May 2025, Moby Premium is priced at $29.95 per month or $199.95 per year ($100 for new users that use our code). New users are protected by a 30-day money-back guarantee, which allows for full access to the platform and all content.

Moby is currently offering a free stock pick here and offering 50% off for new subscribers.With the WallStreetSurvivor Exclusive offer on this page, enter your email, and then you can save 50% 1 year for only $99.Don’t miss out on their next pick and remember they have 30 day money back guarantee.

This pricing puts it squarely in competition with other investment services and premium subscriptions, though Moby frequently runs promotional offers that bring the price down through seasonal discounts or first-year savings.

Who Is Moby Premium For?

Beginner Investors: The platform’s clean interface, educational materials, and thematic portfolios make it a strong starting point for those just beginning to build a stock market strategy.

Intermediate Investors: For users who already understand the basics but want help finding investment ideas or building a more structured investment portfolio, Moby provides a blend of guidance and autonomy.

Experienced Investors: Those with a firm grasp on their own research may still benefit from Moby’s model portfolios, alternative data tools, and additional coverage of sectors or stocks they may not be tracking.

Does Moby Guarantee Results?

Like all platforms in this space, Moby is careful to state that past performance does not guarantee future results. While the Moby team has a solid track record, no tool or analyst can fully predict future market behavior. All investors are advised to conduct their own due diligence and understand their risk tolerance before acting on third-party recommendations.

That said, Moby’s transparency, clarity in investment analysis, and the availability of a money-back guarantee do offer peace of mind.

Pros and Cons of Moby Premium

Pros:

Clear and accessible financial research

Mobile-friendly experience through the Moby app

Weekly stock picks and real-time updates

Model portfolios suited for a variety of goals and risk levels

Educational content for all experience levels

30-day money-back guarantee

Cons:

No personalized financial advice or one-on-one planning

Limited international stock coverage

Focused more on U.S. equities and technology sectors

Final Verdict: Is Moby Premium Worth It?

After reviewing the content, tools, and performance history, the answer depends on your needs. For investors who want a stock picking service with expert-backed insights, a clean mobile interface, and an affordable subscription, Moby Premium represents a solid option.

Its blend of research reports, model portfolios, and educational content positions it as a strong player in a growing field of accessible investment tools. If you’re trying to cut through the noise and find a structured way to analyze the markets, Moby Premium delivers good value, especially at its current pricing.

While it won’t replace a human financial advisor or offer guarantees, its balance of affordability, usability, and performance tracking makes it worth considering for many investors.

If you are looking for the best Moby Promo codes available, check out our Best Moby App Promo & Discount Codes article.

FAQ

A Moby Premium subscription includes weekly stock picks, model portfolios, research reports, market updates, educational content, and in-app tools for tracking your portfolio.

Yes. Moby Premium comes with a 30-day money-back guarantee, allowing new users to try the platform risk-free.

Moby typically provides new stock picks on a weekly basis, often supported by expert analysis and market context.

Yes. The Moby app is available for both iOS and Android devices, and the platform is optimized for mobile use.

Yes. While it is beginner-friendly, Moby also provides enough depth and data to benefit experienced investors seeking new ideas or alternative research angles.

Moby offers a more mobile-centric experience with real-time alerts, model portfolios, and more frequent updates, while Motley Fool Stock Advisor is more focused on long-term stock picks and educational articles.

No. Like any investment platform, Moby does not guarantee results. All stock picks are subject to market risk and users should evaluate picks in line with their own risk tolerance.