sankai/iStock by way of Getty Photographs

Standardized efficiency (%) as of September 30, 2024

Quarter

YTD

1 12 months

3 Years

5 Years

10 Years

Since inception

Class A (MUTF:MLPAX) shares inception: 03/31/10

NAV

4.01

27.13

31.83

25.84

14.34

2.69

6.07

Max. Load 5.5%

-1.67

20.19

24.49

23.46

13.07

2.11

5.65

Class R6 shares inception: 06/28/13

NAV

4.07

27.49

32.25

26.31

14.73

3.03

4.54

Class Y shares inception: 03/31/10

NAV

4.13

27.56

32.18

26.17

14.62

2.95

6.33

Alerian MLP Index-GR

0.72

18.56

24.46

25.47

13.50

1.82

–

Complete return rating vs. Morningstar Vitality Restricted Partnership class (Class A shares at NAV)

–

–

44%

(41 of 95)

16%

(17 of 94)

33%

(33 of 92)

34%

(20 of 60)

–

Click on to enlarge

Calendar yr complete returns (%)

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Class A shares at NAV

6.81

-31.59

25.75

-7.46

-14.85

6.96

-28.61

39.39

29.07

20.44

Class R6 shares at NAV

7.24

-31.37

26.28

-7.27

-14.55

7.37

-28.36

39.70

29.61

20.76

Class Y shares at NAV

7.07

-31.40

26.06

-7.30

-14.60

7.24

-28.38

39.76

29.45

20.45

Alerian MLP Index-GR

4.80

-32.59

18.31

-6.52

-12.42

6.56

-28.69

40.17

30.92

26.56

Click on to enlarge

Expense ratios per the present prospectus: Class A: Web: 3.11%, Complete: 3.11%; Class R6: Web: 2.76%, Complete: 2.76%; Class Y: Web: 2.86%, Complete: 2.86%.

The fund is structured as a C company and could also be topic to sure tax bills which can be mirrored within the expense ratio. Please seek advice from the present prospectus for extra data.

Efficiency quoted is previous efficiency and can’t assure comparable future outcomes; present efficiency could also be decrease or larger. Go to Nation Splash for the latest month-end efficiency. Efficiency figures mirror reinvested distributions and modifications in web asset worth (NAV). Funding return and principal worth will range so that you just

could have a achieve or a loss once you promote shares. Returns lower than one yr are cumulative; all others are annualized. As the results of a reorganization on Might 24, 2019, the returns of the fund for durations on or previous to Might 24, 2019 mirror efficiency of the Oppenheimer predecessor fund. Share class returns will differ from the predecessor fund on account of a change in bills and gross sales costs. Index supply: RIMES Applied sciences Corp. Had charges not been waived and/or bills reimbursed up to now, returns would have been decrease. Efficiency proven at NAV doesn’t embrace the relevant front-end gross sales cost, which might have lowered the efficiency.

Class Y and R6 shares don’t have any gross sales cost; subsequently efficiency is at NAV. Class Y shares can be found solely to sure buyers. Class R6 shares are closed to most buyers. Please see the prospectus for extra particulars.

For extra data, together with prospectus and factsheet, please go to Invesco.com/MLPAX

Not a Deposit Not FDIC Insured Not Assured by the Financial institution Might Lose Worth Not Insured by any Federal Authorities Company

Click on to enlarge

Supervisor perspective and outlook

West Texas Intermediate (‘WTI’) crude oil priced on the Cushing hub ended the quarter at $68.17 per barrel, down 16% from the tip of the second quarter and 25% decrease than one yr in the past. The unfold between Brent crude, a proxy for worldwide crude costs, and WTI ended the quarter at $3.60 per barrel, tightening in the course of the quarter.

Henry Hub pure gasoline costs ended the quarter at $2.92 per million British thermal items (MMbtu), up 12% from the tip of the second quarter and flat in comparison with one yr in the past. Gasoline pricing within the Permian Basin ended the quarter decrease than the tip of the second quarter and skilled weak spot (even buying and selling at damaging costs) in the course of the interval, as pipeline upkeep continued to stress already-constrained takeaway capability.

Pure gasoline liquids (NGLs) priced at Mont Belvieu ended the quarter at $24.86 per barrel, down 16% from the tip of the second quarter and 17% decrease than one yr in the past. Costs for the NGL purity merchandise had been combined at quarter finish, with butane and ethane buying and selling larger whereas propane, isobutane and pure gasoline traded decrease. Frac spreads, a measure of pure gasoline processing economics, settled at $0.37 per gallon, down 25% from the tip of the second quarter and 24% decrease than one yr in the past.

Portfolio positioning

Prime fairness issuers (% of complete web property)

Fund

Index

MPLX LP (MPLX)

13.50

10.24

Vitality Switch LP (ET)

13.30

10.00

Targa Sources Corp (TRGP)

11.32

0.00

Western Midstream Companions LP (WES)

10.42

9.82

Enterprise Merchandise Companions LP (EPD)

8.70

9.87

ONEOK Inc (OKE)

6.77

0.00

Plains All American Pipeline LP (PAA)

6.21

9.95

Sunoco LP (SUN)

4.74

10.04

Williams Cos Inc/The (WMB)

4.42

0.00

Cheniere Vitality Inc (LNG)

3.11

0.00

As of 09/30/24. Holdings are topic to vary and should not purchase/promote suggestions.

Click on to enlarge

For the third quarter of 2024, grasp restricted partnerships (MLPs), as measured by the Alerian MLP Index (AMZ), had been down 1.05% on a worth foundation and up 0.72% when together with distributions. For the quarter, the S&P 500 Index (SP500, SPX) gained 5.53% on a worth foundation and returned 5.89% together with distributions.

Many sector contributors continued to purchase again inventory as enticing valuations endured. Buyback disclosures traditionally usually accompany earnings reviews, which path the quarter finish by a number of weeks (roughly $1.3 billion of buybacks had been disclosed with second quarter earnings reviews).

We estimate MLP-focused funding automobiles, together with closed-end funds, open-end funds and index-linked merchandise, skilled roughly $313 million of web inflows in the course of the quarter.

MLP capital funding included an estimated $5.0 to $6.0 billion of natural capital spending. As producer progress plans have remained average, midstream capital spending necessities have lessened, growing the free money obtainable to sector contributors for debt retirement, unit repurchases and distribution will increase in present and future durations. Company mergers and acquisitions (M&A) remained wholesome, with a number of transactions introduced in the course of the quarter.

The ten-year US Treasury (US10Y) yield was 3.78% at quarter finish, down 0.62% from the tip of the second quarter. The MLP yield unfold, as measured by the implied yield of the AMZ Index relative to the 10-year Treasury yield, widened by 0.72%, ending the quarter at 3.38%. The long-term common for the MLP yield unfold (2000 by means of the third quarter of 2024) is 4.39%. At quarter finish, the AMZ Index’s yield was 7.16%.

We consider that regardless of a number of years of outperforming the S&P 500 Index, midstream equities are effectively positioned to offer buyers with a sexy yield and complete return expertise over the approaching years. Valuations have remained in our view enticing and fundamentals assist expectations for money movement progress for many sector contributors, significantly these with enterprise segments targeted on key producing basins and people who assist actions to export crude oil, refined merchandise, liquified petroleum gases (LPGs) and/or liquified pure gasoline (‘LNG’).

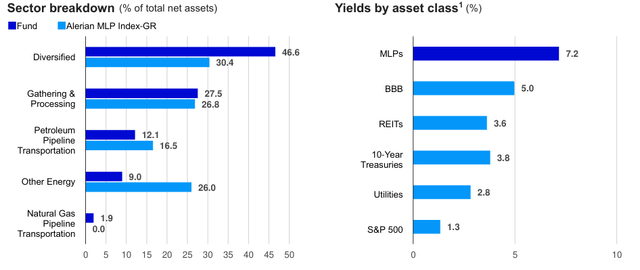

1Source: Bloomberg. Information as of September 30, 2024 and is calculated utilizing the latest annualized distribution. MLPs are represented by the Alerian MLP Index (AMZ). Actual Property Funding Trusts (REITs) are represented by the FTSE NAREIT Fairness REIT Index. BBB Bonds (BBB) are represented by the U.S. Company Bond BBB yields. Utilities are represented by the Dow Jones Utilities Index. 10-12 months Treasuries are represented by the U.S. Treasury Bond 10-year yield. S&P 500 Index is an unmanaged capitalization-weighted index of 500 shares listed on numerous exchanges. Index efficiency is proven for illustrative functions and doesn’t predict or depict efficiency of the Fund. The indexes are unmanaged and can’t be bought instantly by buyers. Previous efficiency doesn’t assure future outcomes.

Click on to enlarge

Efficiency highlights

The pure gasoline pipelines sub-sector and the petroleum pipelines sub-sector offered the very best relative efficiency in the course of the quarter. The pure gasoline pipeline group seemingly benefited from an outlook for rising pure gasoline demand pushed by LNG exports and knowledge facilities. The propane and marine sub-sectors had the bottom common returns in the course of the quarter. Every sub-sector was hampered by idiosyncratic elements affecting sure sub- sector contributors.

Contributors to efficiency

Targa Sources Corp. (TRGP)

TRGP outperformed after reporting better- than-expected monetary and working outcomes and elevating 2024 money movement steering. The corporate is collaborating within the Blackcomb Pipeline three way partnership, taking a direct fairness stake within the subsequent pure gasoline egress resolution out of the Permian Basin, which is predicted to be in service within the second half of 2026.

ONEOK Inc. (OKE)

OKE outperformed after reporting monetary and working outcomes that had been above consensus expectations. Throughout the quarter, OKE introduced it would purchase each Medallion Midstream, a non-public crude gathering and transportation system, and International Infrastructure Companions’ fairness curiosity in EnLink Midstream (ENLC).

Williams Corporations Inc. (WMB)

WMB outperformed in the course of the quarter after reporting better-than-expected monetary and working outcomes. The corporate additionally introduced the second part of its Regional Vitality Entry pure gasoline system on-line sooner than anticipated, constructing on its respected observe report of strong execution.

Detractors from efficiency

Western Midstream Companions LP (WES)

WES items underperformed in the course of the quarter after its sponsor, Occidental Petroleum (OXY), offered a block of shares at a reduction to the latest buying and selling worth. The partnership reported monetary and working outcomes that had been in step with expectations and signed a number of new long-term contracts with prospects. WES is a crude and pure gasoline gathering and processing midstream firm targeted on the Denver-Julesberg and Permian basins.

Sunoco LP (SUN)

SUN items underperformed in the course of the quarter regardless of continued energy in gas margins supporting robust quarterly outcomes and market contributors showing to typically assist its latest NuStar acquisition. SUN’s numerous geographic footprint, wholesome stability sheet and deal with the wholesale gas distribution enterprise is predicted to offer regular long-term operational outcomes.

Vitality Switch LP (ET)

ET underperformed in the course of the quarter regardless of reporting quarterly earnings that had been in step with expectations and growing its 2024 EBITDA steering to account for the $2.3 billion WTG Midstream acquisition that closed in July. ET is, in our view, effectively positioned with one of many largest and most diversified portfolios of midstream property within the US, with a strategic footprint in all the foremost home manufacturing basins.