The North American information middle market is experiencing a interval of extraordinary development and tightening provide, creating each challenges and alternatives for traders. Based on JLL’s Yr-Finish 2024 North America Information Heart Report, emptiness charges have plummeted to a file low of two.6 p.c, with sturdy information middle demand throughout markets conserving the sector among the many most favored actual property asset lessons.

The shortage of provide is turning into a important concern, with only a few blocks bigger than 5 megawatts out there throughout North America. Northern Virginia, the most important international information middle market, has a mere 0.6 p.c emptiness charge. This scarcity is constraining sector development and pushing tenants to safe area as much as 24 months upfront.

READ ALSO: Goal-Constructed Life Science House Finds Wholesome Demand

Regardless of supply-chain challenges, building ranges proceed to climb. A record-setting 6.6 gigawatts of colocation capability was underneath building on the finish of 2024, with 72 precent preleased. The pipeline of deliberate tasks elevated to a powerful 22.9 GW, indicating sturdy future development potential.

Absorption charges have surged, with colocation absorption in North America totaling 4.4 GW in 2024, doubling during the last two years. Information middle occupancy has elevated at an astounding 28 p.c CAGR since 2020, pushed by insatiable demand from cloud suppliers, expertise firms and the monetary sector.

The tight market circumstances have led to vital lease development. Since 2020, rents have elevated at an 11 p.c CAGR. Landlords firmly maintain negotiating leverage, and market circumstances are unlikely to alter meaningfully within the subsequent few years.

Synthetic intelligence is rising as a key driver of development for the sector. In 2024, AI represented about 15 p.c of information middle workloads and is projected to develop to 40 p.c by 2030, turning into a major supply of demand for information middle capability.

Capital markets response

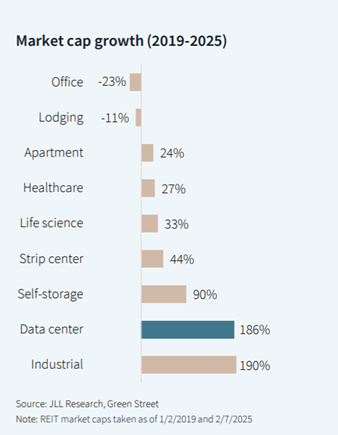

For traders, the info middle sector stays extremely enticing because of the sturdy fundamentals of insatiable tenant demand, restricted provide and rising rents. The funding panorama noticed sturdy urge for food all through 2024 throughout numerous deal profiles, from money stream patrons trying so as to add extra information facilities to their portfolios to operators searching for value-add alternatives.

Core cap charges have usually been within the 6.0 p.c to six.5 p.c vary, reflecting unstable Treasury markets. Worth-add alternatives have seen tighter cap charges, particularly if patrons can entry growth capability sooner. The hyperscale phase is anticipated to see elevated transaction exercise in 2025, as improvement tasks close to completion.

The debt marketplace for information facilities is benefiting from elevated range in lender engagement, with steadiness sheet banks and personal credit score debt funds as major gamers. Leverage will be achieved as much as 70 p.c to 75 p.c of value for long-term credit score tenant transactions (with mezz and most well-liked fairness out there to stretch to roughly 85 p.c), and the SASB and ABS markets proceed to supply liquidity for large-scale investments.

As the info middle market continues its explosive development, traders who can navigate the challenges of energy constraints and supply-chain points whereas capitalizing on the sector’s sturdy fundamentals stand to reap vital rewards on this dynamic and important actual property phase.

Carl Beardsley is a senior managing director and head of JLL’s Information Heart Capital Markets workforce.