With the broader crypto market’s renewed bullish condition, Ethereum is beginning to demonstrate robust upward movements as it hovers near the pivotal $1,900 level. Following the recent bullish performance, investors and traders are choosing to hold onto their coins, as indicated by a sharp drop in ETH’s exchange reserves.

Exchanges Ethereum Reserves Drop Sharply

Ethereum’s price has picked up its pace once again, reclaiming above $1,800 amidst favorable market conditions. During the positive period, investors appear to have been withdrawing ETH from major exchanges, especially Binance, the largest crypto exchange.

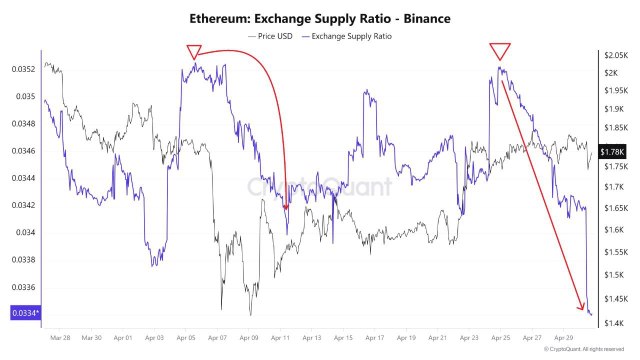

Kyle Doops, the host of the Crypto Banter show, revealed the shift in investor sentiment toward ETH after investigating the Ethereum Exchange Supply Ratio metric on the Binance exchange.

This drop in exchange reserves indicates that investors are increasingly putting ETH into long-term or cold storage, lowering the quantity that is easily accessible for trading. It also reflects investors’ strong conviction in the altcoin‘s long-term prospects as the bull market progresses.

Data shared by Kyle Doops in the X post shows that Ethereum is quietly tightening on exchanges, with its available supply plummeting sharply to the lowest levels in weeks. Over time, these supply reductions have often come before price increases, fueled by the dynamics of growing demand and scarcity.

According to the expert, ETH leaves crypto exchanges, causing selling pressure to drop and tightening supply when this happens, which leads to price squeezes in the near term. As Ethereum’s exchange supply reduces, Kyle Doops claims that the Binance platform is the liquidity hub.

ETH’s Uptrend Unable to Halt Bearish Streak

Since the development often signals potential upward surges, this implies that Ethereum’s price might be gearing up for bullish responses, suggesting a continuation of its current uptrend. However, despite the ongoing upside movements, the altcoin has finished another month in a bearish style.

Technical expert and investor, Venturefounder delved into the monthly price action, highlighting 5 consecutive months of unhinged selling pressure and bearish performance. He also highlighted that the altcoin has flipped into a bullish outlook as May begins, hinting at a possible end to the negative streak.

The chart shows that April’s bearish close marked the second-largest streak of consecutive red months since 2018, where ETH witnessed 7 straight red months between May and November. By the time the streak ended, Ethereum’s price had dropped significantly to the $91 level.

In the meantime, Crypto Bullet, a market expert, is confident that this mid-term correction has reached its end, mapping out a giant reversal candle from the August to October 2023 lows. While the bottom is in, the analyst anticipates a good bounce in the mid-term.

Crypto Bullet stated that the expected move might be a rally to a new all-time high or a dead cat bounce. However, the expert is leaning toward the dead cat bounce scenario based on ETH’s weakness this cycle and that the cycle is just 7 months away from concluding.

Featured image from Getty Images, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.