Up to date on March sixth, 2025 by Nathan Parsh

The Dividend Aristocrats encompass corporations which have raised their dividends for a minimum of 25 years in a row. Over the a long time, many of those corporations have develop into enormous multinational firms, however not all of them.

You may see the total checklist of all 69 Dividend Aristocrats right here.

We created a full checklist of all Dividend Aristocrats, together with necessary monetary metrics like price-to-earnings ratios and dividend yields. You may obtain your copy of the Dividend Aristocrats checklist by clicking on the hyperlink beneath:

Disclaimer: Certain Dividend isn’t affiliated with S&P World in any approach. S&P World owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official info.

Dover Company (DOV) has raised its dividend for 69 consecutive years, one of many longest dividend progress streaks within the inventory market.

The corporate has achieved such an distinctive dividend progress document due to its sturdy enterprise mannequin, resilience to recessions, and regular long-term progress.

There’s room for continued dividend raises every year going ahead, however then again the inventory seems to be overvalued proper now.

Enterprise Overview

Dover is a diversified world industrial producer that gives its clients tools and parts, consumable provides, aftermarket components, software program, and digital options.

It has annual revenues of almost $8 billion, with simply over half of its revenues generated within the U.S., and operates in 5 segments: Engineered Merchandise, Clear Power & Fueling, Imaging & Identification, Pumps & Course of Options, and Local weather & Sustainability Applied sciences.

On January thirtieth, 2025, Dover reported fourth-quarter and full-year outcomes. Income grew 1% for the quarter to $1.93 billion, which was $20 million lower than anticipated. Adjusted earnings-per-share of $2.20 in contrast unfavorably to $2.45 within the prior yr, however this was $0.12 forward of estimates. For the yr, income improved 1% to $7.75 billion whereas adjusted earnings-per-share of $8.29 in comparison with $8.80 in 2023.

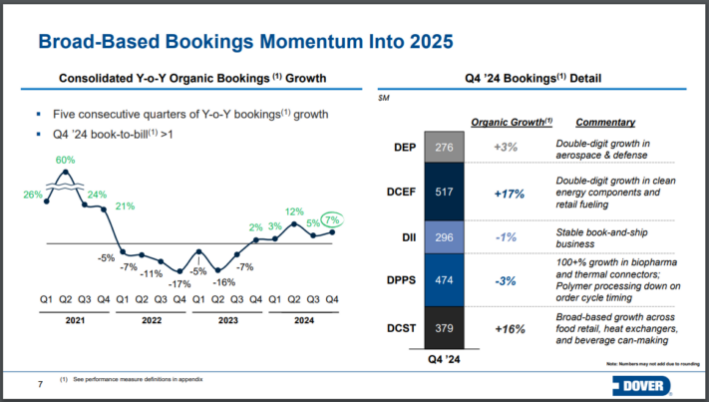

For the quarter, natural income declined 0.3% year-over-year, however bookings grew by 7%. Engineered Merchandise had natural progress of two% resulting from good points in car aftermarket and fluid allotting had been offset by cargo timings in aerospace and protection.

Clear Power & Fueling elevated 8% resulting from greater shipments and new orders in clear vitality. Quantity enhancements for aboveground retail fueling tools additionally aided outcomes.

Picture & Identification was up 1% resulting from demand for core marking and coding printers, consumables, providers, and aftermarket.

Income for Pumps and Course of Options grew 3% resulting from greater demand for thermal connectors, precision parts, and single-use biopharma parts.

Local weather & Sustainability Applied sciences was the corporate’s lone weak spot, as income fell 13%. U.S. CO2 methods reached a brand new document, however declines in European markets greater than offset this power. Bookings had been up 16% for the quarter.

General, Dover enters 2025 with sturdy momentum in its enterprise.

Supply: Investor Presentation

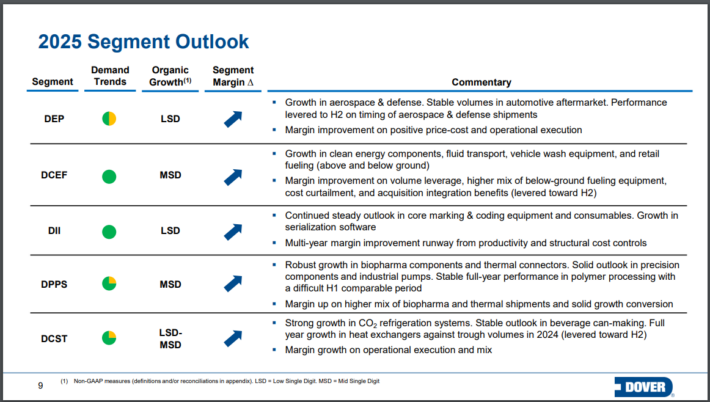

Dover expects adjusted earnings-per-share in a variety of $9.30 to $9.50 for 2025. On the midpoint, this may symbolize 13.4% progress from 2024. Natural income progress is projected to be in a variety of three% to five%.

Progress Prospects

Dover has pursued progress by increasing its buyer base and thru bolt-on acquisitions. To reshape its portfolio and maximize its long-term progress, Dover routinely executes a collection of bolt-on acquisitions and occasional divestments.

The administration crew is consistently targeted on delivering essentially the most worth to shareholders by means of portfolio transformation, which has usually been profitable. The corporate’s prospects for 2025 additionally look sturdy in each side of its enterprise.

Supply: Investor Presentation

In the present day, the corporate is a extremely diversified industrial firm with a sexy progress profile. As well as, Dover can be more likely to improve its earnings per share by way of opportunistic share repurchases.

We see 8% long-term earnings-per-share progress within the years to come back, pushed primarily by income will increase, with a lift from share repurchases decreasing the float.

Aggressive Benefits & Recession Efficiency

Dover is a producer of business tools. The corporate gives extremely engineered merchandise which are important to its clients. Switching to a different provider can be uneconomic for its clients as a result of the danger of decrease efficiency is materials.

Subsequently, Dover primarily operates in area of interest markets, which provide the corporate a big aggressive benefit. This aggressive benefit helps clarify Dover’s constant long-term progress trajectory.

However, Dover is susceptible to recessions resulting from its reliance on industrial clients. Within the Nice Recession, its earnings per share had been as follows:

2007 earnings-per-share of $3.22

2008 earnings-per-share of $3.67 (14% improve)

2009 earnings-per-share of $2.00 (45% decline)

2010 earnings-per-share of $3.48 (74% improve)

Dover acquired by means of the Nice Recession with only one yr of decline in its earnings per share, and the corporate nearly totally recovered from the recession in 2010.

Given its sensitivity to financial cycles, it’s spectacular that Dover has grown its dividend for 69 consecutive years.

One more reason is administration’s conservative dividend coverage, which targets a payout ratio of round 30%. This coverage offers a large margin of security throughout tough financial durations. The anticipated payout ratio for 2025 is simply 22%.

General, Dover will undoubtedly proceed to boost its dividend for a lot of extra years due to its low payout ratio, first rate recessions resilience, and wholesome stability sheet.

Valuation & Anticipated Returns

Dover is predicted to generate earnings-per-share of $9.40 for 2025. Which means the inventory trades at 19.8 occasions this yr’s earnings, which is greater than our estimate of truthful worth at 18 occasions earnings.

That means a ~1.9% annual headwind to complete returns from valuation compression over the following 5 years.

Together with 8% anticipated annual earnings-per-share progress, the 1.1% present dividend yield, and a 1.9% annualized compression of the price-to-earnings ratio, we count on Dover to supply 6.9% common annual return over the following 5 years.

This places Dover inventory into the territory of a maintain score.

Last Ideas

Dover has a formidable dividend progress document, with almost seven a long time of dividend raises. That is a formidable achievement, notably given the corporate’s dependence on industrial clients, who are likely to wrestle throughout recessions.

Dover has persistently grown its earnings per share over time, which has translated into annual dividend will increase.

This technique offers the corporate ample room to proceed rising for a lot of extra years. The inventory is barely overpriced, which means it earns a maintain score.

Moreover, the next Certain Dividend databases include essentially the most dependable dividend growers in our funding universe:

In the event you’re on the lookout for shares with distinctive dividend traits, take into account the next Certain Dividend databases:

The most important home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.