Many new merchants battle with foreign exchange day buying and selling. Day buying and selling includes shopping for and promoting currencies inside a single day. This information will present inexperienced persons 5 key methods for foreign exchange day buying and selling.

Discover ways to begin buying and selling foreign exchange right now.

Key Takeaways

Foreign exchange day buying and selling includes shopping for and promoting foreign money pairs inside one buying and selling day to revenue from small value modifications.

Well-liked day greatest buying and selling methods for inexperienced persons embrace development buying and selling, swing buying and selling, scalping, breakout buying and selling technique, and information buying and selling methods.

New merchants ought to apply with a demo account for 3-6 months earlier than utilizing actual cash.

Profitable day merchants use strict danger administration, like setting stop-loss orders and solely risking 1-2% of their account per commerce.

Staying up to date on market information, growing emotional management, and following a stable buying and selling plan is vital to foreign exchange place day buying and selling success.

Day Buying and selling Methods for Foreign exchange Market Freshmen

Day buying and selling in foreign exchange presents fast income for expert merchants. It includes shopping for and promoting currencies inside a single buying and selling day.

What’s Foreign exchange Day Buying and selling?

Foreign exchange day buying and selling includes shopping for and promoting foreign money pairs inside a single buying and selling day. Merchants intention to revenue from small value modifications within the international change market. They open and shut positions rapidly, usually making a number of trades every day.

This fast-paced fashion requires fast selections and fixed market monitoring.

Day merchants in foreign exchange markets deal with short-term good points. They keep away from in a single day prices by closing all positions earlier than the buying and selling day ends, and excessive buying and selling quantity is vital for them.

It exhibits robust curiosity in a foreign money pair and helps discover good entry and exit factors. Profitable foreign exchange day buying and selling methods want sharp expertise and a stable grasp of market developments.

Why is Day Buying and selling Well-liked within the Foreign exchange Market?

Day buying and selling within the foreign exchange market attracts many merchants. It presents fast income and quick access. The foreign exchange market’s excessive liquidity lets merchants purchase and promote quick. This velocity is vital for day merchants opening and shutting positions inside hours.

Foreign exchange day buying and selling cuts in a single day dangers. Merchants don’t maintain positions when markets shut, defending them from sudden value modifications. Day buying and selling additionally saves on rollover charges for protecting trades open in a single day.

Subsequent, let’s discover top-day buying and selling methods for inexperienced persons.

High Day Buying and selling Methods for Freshmen

Day buying and selling in foreign exchange presents a number of methods to generate profits. Merchants can decide from strategies like development buying and selling, scalping, or information buying and selling to suit their fashion.

Pattern Buying and selling

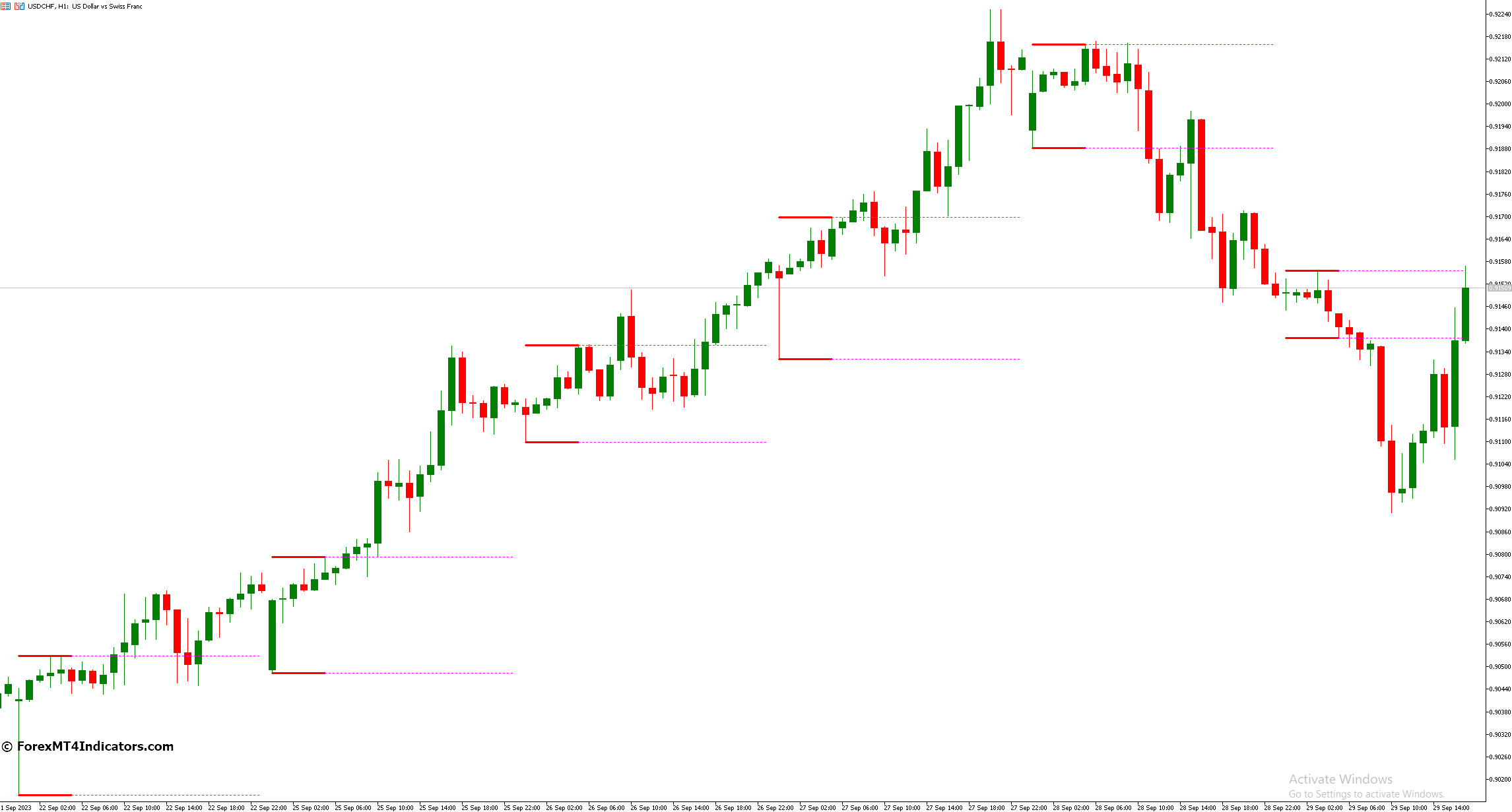

Pattern buying and selling follows market momentum. Merchants purchase property in uptrends and promote in downtrends. This technique works effectively within the monetary market on account of long-lasting foreign money developments. Merchants use instruments like shifting averages to identify developments.

They intention to revenue from large value strikes over days or perhaps weeks.

Success in development buying and selling requires persistence and self-discipline. Merchants should anticipate clear developments to emerge. In addition they have to set stop-loss orders to restrict dangers. Pattern merchants usually use technical evaluation to make selections.

Well-liked Buying and selling indicators embrace MACD and Bollinger Bands.

Swing Buying and selling

Swing buying and selling is a well-liked greatest foreign exchange technique. Merchants maintain positions for days or perhaps weeks. They intention to catch greater value strikes than day merchants. This technique fits those that can’t watch markets all day.

Swing merchants use charts to identify developments. They search for help and resistance ranges. These assist them resolve when to enter and exit trades. Swing greatest buying and selling balances danger and reward effectively.

It presents extra possibilities to revenue than long-term investing.

Scalping

Scalping is a fast-paced greatest foreign currency trading technique technique. Merchants intention to make small income from tiny value modifications. They open and shut many trades in a single day. This technique wants fast considering and sharp focus.

Scalpers use tight stop-loss orders to restrict dangers. They usually exit trades earlier than the day ends to keep away from additional charges. Success in scalping requires a stable plan and strict guidelines. Merchants should act quick on value shifts to seize small good points.

Breakout Buying and selling

Transferring from scalping to breakout buying and selling session alternatives, merchants shift focus to bigger value actions. Breakout buying and selling spots key ranges the place costs may bounce or drop quick. It goals to catch large strikes early.

Merchants look ahead to costs to interrupt previous help or resistance ranges. They enter trades when costs push via these limitations. This technique works effectively in trending markets. It might result in large good points if a powerful development follows the breakout.

Information Buying and selling

Information buying and selling makes use of financial studies to make fast trades. Merchants watch for large information that may transfer foreign money costs quick. They purchase or promote primarily based on how the information impacts the market.

This technique wants quick motion and good timing. Merchants should know which information issues most. In addition they want to grasp the way it impacts completely different currencies. Success depends upon fast selections and cautious danger administration.

Begin Day Buying and selling within the Foreign exchange Market

Beginning day kind of buying and selling within the foreign exchange market may be thrilling. Merchants want a stable plan and the suitable instruments to start their journey.

Select Your Buying and selling Model

Merchants should decide a mode that matches their targets and character. Foreign exchange presents a number of choices. Scalping includes fast trades lasting minutes. A swing buying and selling account retains positions open for days.

Pattern buying and selling follows long-term market strikes. Breakout buying and selling catches large value jumps. Every fashion wants completely different expertise and time commitments.

New merchants usually begin with development or swing buying and selling. These kinds enable extra time to research markets and make selections. In addition they have decrease stress ranges than fast-paced day buying and selling alternatives.

CFDs let merchants strive completely different kinds with small accounts. Apply helps discover the very best foreign exchange match.

Create a Stable Buying and selling Plan

A stable buying and selling for inexperienced persons plan guides foreign exchange day merchants to success. It units clear targets and guidelines for trades. The plan outlines place buying and selling sizes, danger limits, and techniques. It additionally defines the dealer’s consolation with market swings.

A superb plan makes use of information to make decisions. This could embrace financial information or chart patterns.

Merchants should stick with their plan it doesn’t matter what. Feelings can result in unhealthy decisions in quick markets. A robust plan helps keep away from this lure. It offers a roadmap for every commerce from begin to end.

This construction boosts confidence and cuts stress within the foreign exchange pair market.

Study Threat Administration Methods

Threat administration is vital in foreign exchange day buying and selling. Merchants should set stop-loss orders to restrict potential losses on every commerce. They need to additionally use place sizing to manage danger publicity.

This implies solely risking a small share of account capital per commerce, usually 1-2%. Correct danger administration helps shield a dealer’s account from giant drawdowns that might finish their buying and selling profession.

Instruments like trailing stops and take-profit orders additionally assist handle danger. Trailing stops lock-in income as a commerce strikes favorably. Take-profit orders shut successful trades at predetermined value ranges.

Utilizing these danger administration methods offers merchants extra management over outcomes. It permits them to commerce with self-discipline and shield their capital within the unstable foreign exchange market.

Open and Monitor Your First Commerce

Opening a foreign exchange commerce begins with choosing a foreign money market pair. Merchants select a pair and resolve to purchase or promote primarily based on their evaluation. They decide the commerce measurement and any stop-loss or take-profit orders.

As soon as the commerce is lively, steady monitoring is crucial. Market situations change quickly, so merchants want to watch value actions intently.

Efficient merchants keep detailed information of their trades. They doc entry and exit factors, causes for the commerce currencies, and outcomes. This apply helps them study from each successes and setbacks.

Common evaluate of those information can improve buying and selling platform expertise over time. Merchants must be conscious that day buying and selling seldom offers constant earnings, significantly for newcomers.

Ideas for Success in Foreign exchange Day Buying and selling

Foreign exchange day-trading success hinges on sensible strikes and sharp expertise. Merchants should keep alert, apply usually, and preserve cool underneath stress. Wish to study extra? Learn on for key tricks to increase your foreign exchange sport.

Keep Up to date on Market Information

Foreign exchange merchants should keep on high of market information. This implies checking monetary studies, financial calendars, and international occasions every day. Good merchants use information apps and observe trusted monetary sources on social media.

They watch for large bulletins that might shake up foreign money values.

Staying knowledgeable helps merchants spot good possibilities to purchase or promote. It additionally helps them keep away from dangerous trades throughout unstable instances. Merchants ought to deal with information about rates of interest, GDP, and employment information.

These components usually trigger large strikes in foreign money pairs.

Apply with a Demo Account

Demo accounts let new merchants apply foreign exchange with out danger. These platforms mimic actual markets however use faux cash. Freshmen can check methods, study platform instruments, and construct confidence.

Many brokers supply free demo accounts with $10,000 to $100,000 in digital money. Customers ought to deal with demo buying and selling like actual buying and selling to achieve helpful expertise.

Merchants can use demo accounts to strive completely different foreign money pairs and timeframes. They’ll find out how information occasions affect costs and the right way to handle positions. Demo buying and selling helps develop self-discipline and emotional management.

It’s a protected technique to spot strengths and weaknesses earlier than utilizing actual funds. Specialists recommend practising for 3-6 months earlier than stay buying and selling.

Deal with Self-discipline and Emotional Management

Merchants want iron-clad self-discipline and emotional management. Foreign exchange markets transfer quick. Rash decisions can result in large losses. Good merchants stick with their plans it doesn’t matter what. They don’t let worry or greed sway them.

Good merchants know their limits. They set clear guidelines for entries, exits, and danger. Then they observe these guidelines each time. This helps them keep cool underneath stress. It additionally retains them from making pricey errors when markets get wild.

Conclusion

Day buying and selling foreign exchange takes ability and apply. New merchants ought to begin small and study the ropes. Utilizing demo accounts helps construct confidence with out danger. Stable methods and danger administration are key to success.

With effort and time, inexperienced persons can grow to be expert foreign exchange day merchants.