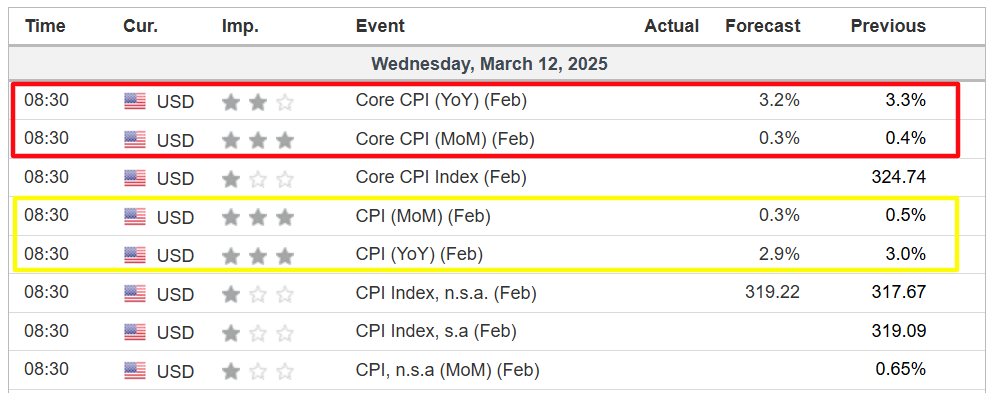

Headline annual inflation is seen rising by 2.9% and core CPI is forecast to extend by 3.2%.

Buyers ought to brace for volatility amid the continued market correction and mounting commerce tensions.

In search of extra actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to ProPicks AI winners.

Because the U.S. inventory market navigates by means of uneven waters, traders are bracing for a essential report that might both calm markets or pour gasoline on an already burning hearth.

The February CPI report arrives at a essential juncture, with the benchmark and tech-heavy now each formally in correction territory after falling 10% from their current file highs.

Supply: Investing.com

Supply: Investing.com

What to Count on

Scheduled for launch at 8:30 AM ET on Wednesday, the February CPI knowledge is predicted to make clear the inflation panorama throughout a interval marked by escalating commerce tensions and financial uncertainty.

Analysts predict a 0.3% rise in headline inflation, moderating from a rise of 0.5% in January. Yr-over-year, CPI is predicted to chill to 2.9%, following a 3.0% rise within the previous month.

In the meantime, , which excludes meals and power costs, is forecast to extend by 0.3% month-over-month, with an acquire of three.2%, barely down from the three.3% noticed in January.

Supply: Investing.com

This knowledge is especially vital because it precedes the Federal Reserve’s on March 18-19. Current financial knowledge has painted a blended image, with some indicators suggesting a slowdown in financial progress. This has led markets to anticipate extra price cuts this yr to assist the financial system.

The percentages for price cuts have certainly elevated, as per the Investing.com Fed Monitor Device, with markets now pricing in round three cuts of 25 foundation factors (bps) every by the top of 2025, with the primary probably coming in June.

Nonetheless, the narrative may shortly change if the CPI report reveals that inflation remains to be operating sizzling. A excessive CPI studying may sprint hopes for imminent price cuts, as it will oblige the U.S. central financial institution to take care of a good financial coverage to fight sticky inflation.

What to Do Amid the Tech Selloff and Market Correction

The backdrop of President Donald Trump’s proposed tariffs on imported items from Canada, Mexico, the European Union, and China has added layers of complexity to the financial outlook. Amid these uncertainties, the Cboe Volatility Index has spiked to the very best stage since late 2024, reflecting rising market unease.

Supply: Investing.com

The continuing market correction, coupled with the tech selloff, has left traders looking for secure havens and strategic funding alternatives.

Whereas the present market correction and tech selloff could instill concern, historical past has proven that such corrections may current helpful shopping for alternatives for affected person and strategic traders. It is important to stay vigilant, knowledgeable, and ready to grab these alternatives whereas managing danger successfully.

Listed below are some key concerns and potential funding methods:

1. Figuring out Resilient Tech Shares

Regardless of the broader selloff, some tech corporations with strong fundamentals and strategic positioning stay engaging. For example, analysts have highlighted names like Meta (NASDAQ:), Amazon (NASDAQ:), Nvidia (NASDAQ:), and Broadcom (NASDAQ:) as potential buy-the-dip candidates.

These corporations are thought of well-positioned to capitalize on long-term progress developments, making them compelling choices throughout market downturns.

2. Diversifying with Worth Shares

Amidst the volatility, shifting focus in the direction of ‘boring’ value-oriented sectors can present stability. Investments in client staples, utilities, and healthcare sectors usually function defensive performs throughout market corrections.

Firms like Johnson & Johnson (NYSE:), Procter & Gamble (NYSE:), Merck (NSE:), Coca-Cola (NYSE:), and Altria (NYSE:) have traditionally demonstrated resilience in turbulent markets, providing traders a buffer towards heightened volatility.

3. Leveraging Alternate-Traded Funds (ETFs)

ETFs that observe worth indices or particular sectors can supply diversified publicity with decreased danger.

For instance, the Vanguard Worth ETF (NYSE:) supplies entry to a broad vary of worth shares, whereas the Utilities Choose Sector SPDR® Fund (NYSE:) focuses on the utilities sector, each of that are historically thought of defensive throughout market downturns.

Conclusion

The upcoming February CPI report stands as a pivotal indicator for traders, providing insights into inflation developments that might affect financial coverage and market actions.

Amidst the present market correction and tech sector selloff, adopting a balanced funding strategy that features resilient tech corporations, worth shares, and diversified ETFs could assist mitigate dangers and capitalize on rising alternatives.

As all the time, aligning funding methods with particular person monetary targets and danger tolerance stays paramount. Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with confirmed observe file.

InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for one of the best shares based mostly on lots of of chosen filters, and standards.

High Concepts: See what shares billionaire traders corresponding to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 through the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I frequently rebalance my portfolio of particular person shares and ETFs based mostly on ongoing danger evaluation of each the macroeconomic surroundings and corporations’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.