Key Takeaways:

Coinbase is registered beneath India’s Monetary Intelligence Unit (FIU).This growth paves the best way for Coinbase to supply cryptocurrency buying and selling companies in India.This aligns higher with the alternate’s second try and empower Indian entrepreneurs and builders within the blockchain area, versus its earlier effort

Following an preliminary and transient enterprise in 2022, U.S.-based cryptocurrency alternate Coinbase is making a concerted comeback to the Indian market. This can be a massive step ahead, with the corporate saying on 11 March 2025 that it has registered with India’s Monetary Intelligence Unit (FIU). This explicit regulatory hurdle is vital to a profitable return to a market with a wealth of potential, however beset with regulatory hurdles.

Coinbase Achieves FIU Registration in India: A Basis for Legit Operations

Coinbase’s profitable FIU registration is the bedrock of its revamping technique. On Thursday, Paul Grewal, Coinbase’s chief authorized officer, introduced: “Coinbase is now FIU-registered,” marking a important watershed within the firm’s ambitions in India. The registration isn’t just a mere formality; it grants Coinbase the first authorized proper to function as a digital digital asset (VDA) service supplier within the Indian jurisdiction. This instantly brings them beneath the purview of the nation’s Prevention of Cash Laundering Act (PMLA).

Compliance with PMLA is a should with stringent regulatory measures in place. This consists of, however will not be restricted to:

KYC Procedures: Know Your Buyer (KYC) procedures be sure that all customers confirm their identification.Transaction Monitoring: Intently monitoring transactions for suspicious exercise presumably indicative of cash laundering or terrorist financing.Obligatory Reporting: Reporting any suspicious exercise to each native and worldwide regulatory our bodies.Stopping Illicit Actions: A powerful framework have to be in place to stop cash laundering and terrorist financing.Audit and Scrutinisation: Operations are repeatedly audited and scrutinized by Indian authorities.

This additionally entails common audits and scrutiny of its operations by Indian authorities, additional reinforcing Coinbase’s transparency and legitimacy for its customers and stakeholders. This milestone displays Coinbase’s dedication not solely to coming into the Indian market but in addition to pursuing that entry responsibly and in accordance with India’s legal guidelines and rules. This units a powerful precedent that Coinbase is right here to remain and is constructing a long-term, reliable enterprise within the sustainable and compliant crypto ecosystem in India.

The Distinction Between this Second Comeback and the First? A Concentrate on Lengthy-Time period Ecosystem Constructing

Coinbase’s first foray into the Indian market again in April 2022 met with a fast and sudden setback, reflecting the regulatory uncertainty that characterised the Indian crypto panorama on the time. Quickly after it launched UPI (Unified Funds Interface), a widely-used real-time cost system in India, the alternate needed to shut down operations inside days. The foundation trigger was believed to be a scarcity of readability as effectively as “casual strain” from the Reserve Financial institution of India (RBI), the nation’s central financial institution. The Nationwide Funds Company of India (NPCI) — the umbrella group overseeing UPI — additionally publicly distanced itself from any crypto exchanges utilizing the cost platform. And that abrupt cease was a expensive lesson discovered, highlighting the necessity to have proactive outreach with regulators and have correct approvals in place previous to releasing a service.

This time, Coinbase takes a extra strategic strategy. Beforehand, they solely supplied a crypto buying and selling platform however realized success in India required extra. Along with offering buying and selling companies, the corporate is dedicated to making a vigorous and sustainable native blockchain ecosystem. In line with a Coinbase weblog publish, the plan is to launch preliminary retail companies later this 12 months, and this might be adopted by “further funding and merchandise in India.” This means a phased rollout, adapting to regulatory shifts.

On the core of their technique lies an enhanced deal with their developer platform and instruments, most notably by way of their Base community. Coinbase goals to equip Indian builders with tailor-made options and top-tier infrastructure. Coinbase’s emphasis on developer empowerment is tactically according to the Indian authorities’s bold “Digital India” marketing campaign, which intends to make India a digitally empowered society and data economic system. Whereas their first try confronted hesitation, Coinbase now demonstrates dedication to native legal guidelines, blockchain progress, and long-term presence.

Insider Perspective: Empowering Indian Builders

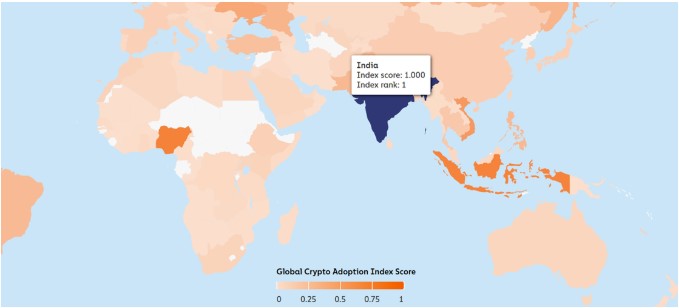

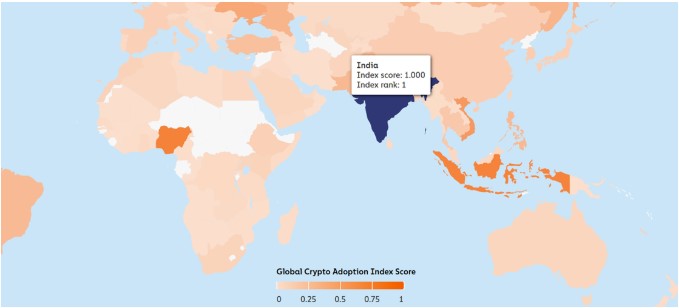

John O’Loghlen, Coinbase’s Regional Managing Director for APAC, mentioned in a ready assertion describing that imaginative and prescient: “India represents probably the most thrilling market alternatives on this planet at present, and we’re proud to deepen our funding right here in full compliance with native rules. By increasing entry to our trusted platform and instruments comparable to Base, we purpose to empower a brand new era of builders to remain house, innovate domestically, and scale globally.” In line with Chainalysis, India ranks the very best amongst CSAO nations for crypto adoption. The brand new developer platform and present compliance with rules point out a possibility to succeed the place prior to now they didn’t.

India ranks highest for crypto adoption amongst CSAO nations. Supply: Chainalysis

O’Loghlen says many Indian entrepreneurs have traditionally been drawn overseas. He believes cryptocurrency, and Coinbase’s platform particularly, can change that story, and create the circumstances for Indian expertise to flourish at house, constructing best-in-class merchandise out of India.

Extra Information: Coinbase Introduces 24/7 Bitcoin and Ethereum Futures for US Merchants