Extra capital might be injected into the industrial actual property market this yr as pricing is predicted to be favorable for buyers, in keeping with a brand new survey from CBRE.

The Investor Intentions Survey confirmed that rate of interest shifts will current challenges, however not sufficient to hassle in any other case optimistic sentiments.

This yr, 70 p.c of respondents plan to accumulate extra belongings than a yr in the past and 75 p.c stated they’re much more constructive about their very own plans. Greater than half stated they’re experiencing restoration inside their portfolios.

“We at the moment are roughly three years faraway from the height pricing seen in 2022, and property valuations have adjusted to align with the upper rate of interest surroundings,” Kevin Aussef, Americas president of funding properties for CBRE, advised Business Property Government.

READ ALSO: A New Daybreak for CRE Investing?

“There’s a rising consensus that the market has largely stabilized and averted a major downturn. On the basics facet, the resilience of the US financial system is obvious in robust leasing exercise throughout most property sectors. Simply 18 months in the past, there was widespread concern about declining demand and oversupply in lots of markets, however these fears have largely subsided.”

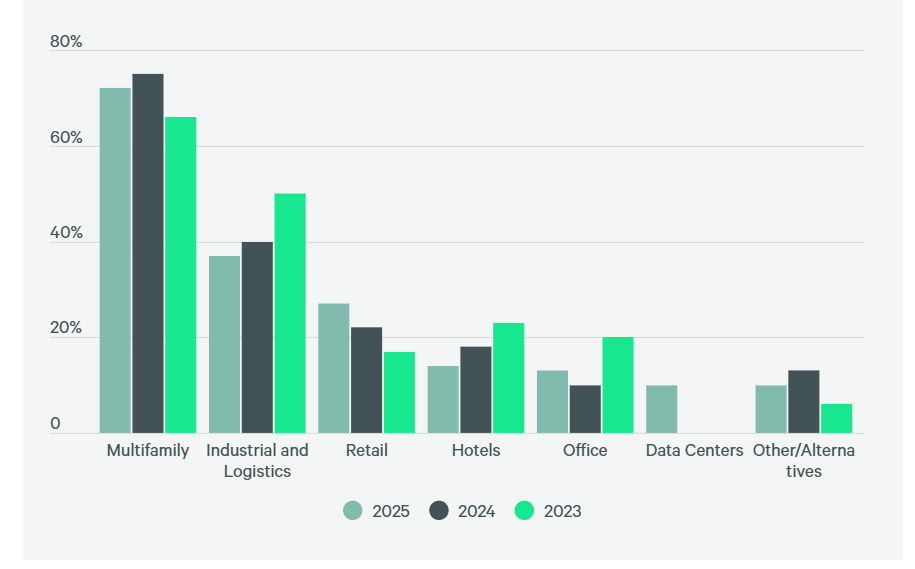

Three-quarters of CBRE respondents stated that multifamily stays their high goal, adopted by industrial and logistics belongings at 37 p.c, retail at third and workplace at fourth.

Overseeing CBRE Funding Administration are newly appointed co-CEOs Andrew Glanzman and Adam Gallistel.

Solar Belt sees consolidation

Multifamily patrons in Solar Belt markets consolidated right into a barbell-like distribution on the danger curve because the fee hikes in 2022, in keeping with Adam Nourafchan, a managing companion at Lunada Rose Companions.

“Core patrons jumped in regardless of substantial unfavorable leverage with the thesis that both rents would develop or cap charges would drop, whereas opportunistic patrons had been anticipating a wave of misery stemming from aggressive COVID-era bridge mortgage maturities,” Nourafchan advised CPE.

“After practically three years, cap charges haven’t dropped, and there was minimal misery, inflicting disillusioned buyers from each methods to shift towards a medium-risk strategy the place they’ll enhance worth via a hands-on capital enchancment technique fairly than counting on market elements which are out of their management.”

John Felker, Co-CIO of T2 Capital Administration, advised CPE his agency has seen elevated curiosity in retail properties.

“With increased cap charges on retail properties, the asset class has been extra resilient to the run-up in rates of interest,” Felker stated.

Prime funding markets

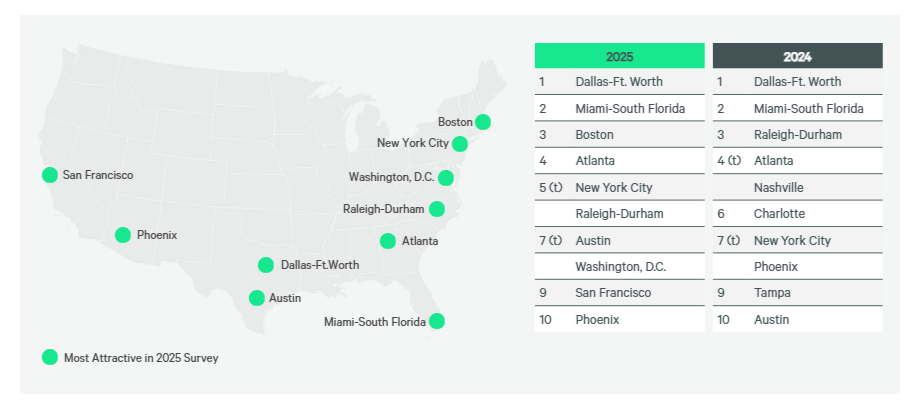

CBRE stated buyers are specializing in gateway and high-growth Solar Belt markets, with Dallas taking the highest spot, adopted by Miami. Boston, Washington, D.C., San Francisco, Atlanta, Raleigh-Durham, Austin and Phoenix are additionally extremely rated.

“Solar Belt markets have been the go-to markets for builders for years now,” Felker stated.

“Whereas curiosity in these markets stays excessive, issues about new provide getting absorbed in these progress markets are a major concern within the close to time period. As a result of run-up in rates of interest and building prices, the brand new provide needs to be down considerably in 2026.”

Boston stands out as a extremely interesting marketplace for buyers, supported by its robust supply-demand fundamentals and sustained lease progress potential, in keeping with Matt Ranalli, Co-Founder and chief funding officer of Jones Road Funding Companions.

The Northeast/Mid-Atlantic areas have demonstrated exceptional stability over the previous 25 years, with a mean annual lease progress of roughly 3.2 p.c, similar to faster-growing markets just like the Southeast and Southwest however with much less volatility and financial sensitivity, he stated.

“Persistent housing undersupply in these markets, exacerbated by regulatory burdens, excessive land and labor prices and NIMBYism, (and) creates a compelling case for multifamily funding, specifically,” Ranalli advised CPE.

Millennials and Gen Z are utilizing social media to study passive earnings and sensible investing, Benjamin Gordon, managing director at Continental Ventures, advised CPE. “They’re investing in tangible actual property as a method for them to put money into their futures whereas child boomers are cashing out,” he advised CPE.

“Actual property will at all times be a basic want, and whether or not one rents or owns, spending cash on a snug house will at all times be essential. At the same time as an thrilling wave of investments grows in AI and crypto-currency, folks will at all times want someplace to reside, work, and play.”

Prime investor challenges

An unsure path for rates of interest, elevated and risky long-term rates of interest, and better working prices are the three high challenges for buyers, CBRE confirmed.

Recession and a wider hole in purchaser and vendor expectations are much less of a fear, CBRE stated.

“In mid-2024, there was growing optimism concerning a drop in rates of interest and a ensuing enhance in transaction quantity,” Felker stated, “however the transfer increased within the lengthy finish of the yield curve on the finish of the yr has considerably dampened these expectations.”