Ethereum is holding steady above the $4,400 mark after a weekend surge that briefly carried it to fresh all-time highs. The rally, fueled by strong institutional demand and broader market optimism, has been tempered over the past two days as the price retraced to test lower levels. Despite the pullback, ETH remains one of the most closely watched assets in the market, with bulls and bears both eyeing the next decisive move.

Analysts are divided. Some argue that ETH’s ability to maintain support above $4,400 signals resilience and a potential setup for another rally toward $5,000. Others, however, see warning signs of buying exhaustion and raise concerns of a deeper correction if market sentiment shifts.

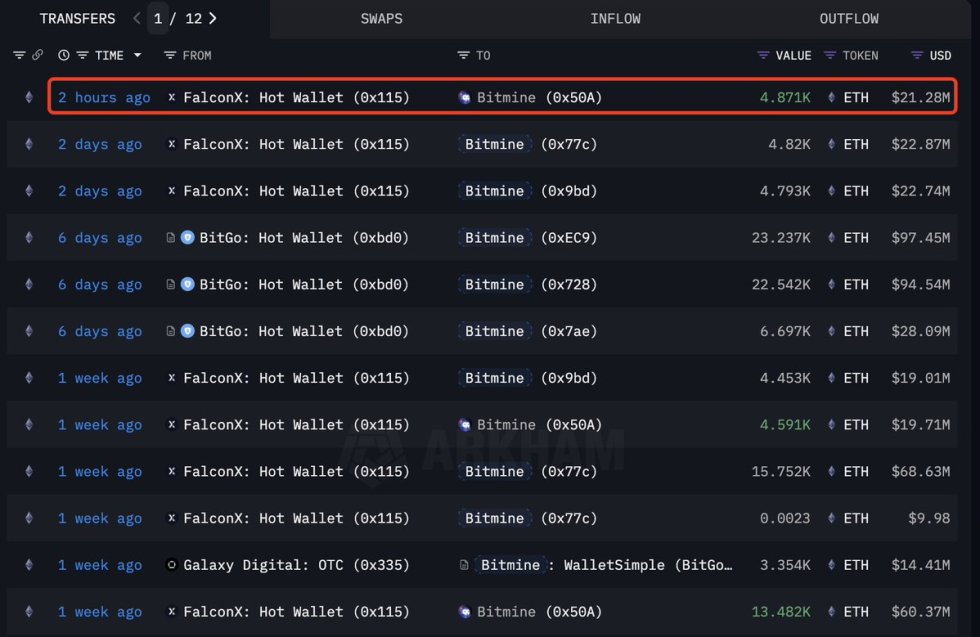

Adding to the intrigue, blockchain analytics firm Lookonchain revealed that Bitmine, Ethereum’s largest corporate holder, bought another 4,871 ETH worth $21.28M just 12 hours ago. This brings Bitmine’s total holdings to staggering levels, reaffirming the narrative of large-scale institutional accumulation.

The combination of strong whale activity, heightened institutional demand, and volatile short-term price swings underscores the pivotal moment Ethereum faces. Whether ETH breaks higher into uncharted territory or succumbs to correction pressures will be a defining factor for the broader altcoin market.

Ethereum Whale Accumulation Strengthens Bullish Outlook

According to Lookonchain, Bitmine currently holds 1,718,770 ETH valued at $7.65 billion, making it one of the largest corporate holders of Ethereum. This accumulation trend has become a defining feature of the current market cycle, with other companies such as Sharplink Gaming and Bit Digital also expanding their ETH positions. Such large-scale institutional buying reinforces the bullish continuation narrative and sets Ethereum apart as the leading altcoin for long-term growth.

Beyond accumulation, macro conditions and legal clarity in the US are playing a vital role in Ethereum’s outlook. The clearer regulatory environment is attracting more institutions, which now see ETH not only as a key player in decentralized finance but also as an asset with growing legitimacy. This shift in sentiment is fueling expectations for Ethereum to outperform in the coming months.

At the same time, liquidity dynamics are tightening. Exchanges are reporting declining ETH balances, while OTC desks such as Wintermute highlight a fast-paced decline in reserves. This suggests that supply is increasingly being absorbed by institutions and long-term holders, leaving fewer coins available on the open market.

The combination of institutional demand, regulatory clarity, and shrinking supply creates a powerful backdrop for Ethereum. While short-term volatility may persist, the underlying fundamentals point to a market primed for continuation toward new milestones.

Weekly Chart Signals Strength

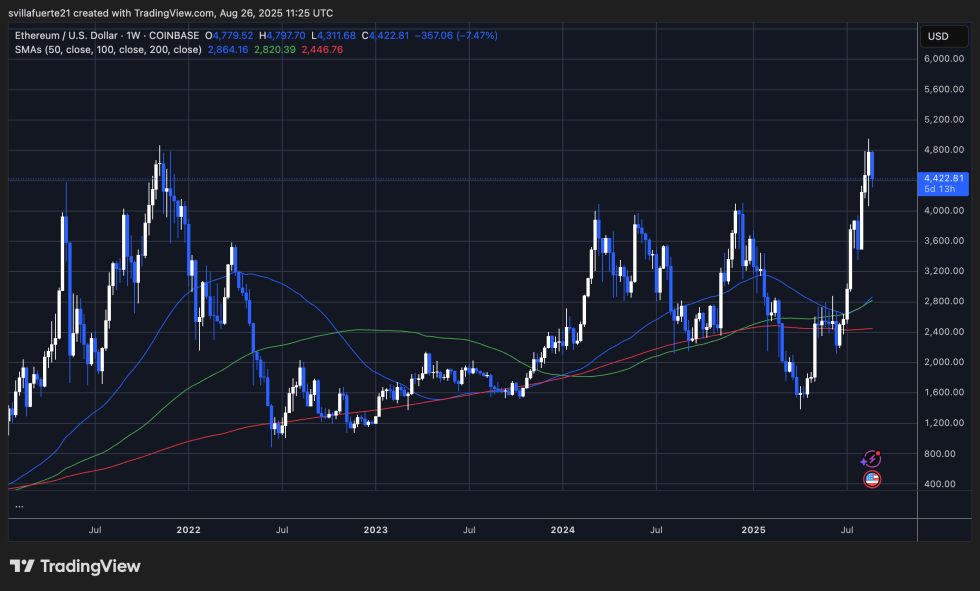

Ethereum’s weekly chart shows that the asset is in the middle of a significant test after its surge to new highs above $4,800. Following that rally, ETH retraced sharply, now trading around $4,422, reflecting a volatile but healthy correction after weeks of steep gains. Despite this drop, the chart still shows ETH maintaining its broader bullish structure.

The 50-week moving average (blue line) is curving upwards, signaling renewed momentum after months of consolidation earlier this year. Meanwhile, the 100-week (green) and 200-week (red) moving averages remain well below the current price, reinforcing that ETH is still in a strong macro uptrend. The retracement seems to be finding support around the breakout zone of $4,200–$4,400, which could act as a new base if bulls defend it.

The most notable takeaway is how ETH has broken free from its long consolidation between 2022 and early 2025, where the price struggled under $3,000. That multi-year resistance zone has now flipped into strong support, suggesting the potential for Ethereum to sustain higher levels in the months ahead.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.