The AO Divergence and ZeroLag MACD Foreign exchange Buying and selling Technique is a strong mixture that may considerably enhance the accuracy and effectiveness of a dealer’s decision-making course of. Within the fast-paced world of Foreign currency trading, with the ability to establish potential market reversals and momentum shifts is essential. The AO Divergence indicator highlights discrepancies between value motion and the Superior Oscillator (AO), providing merchants worthwhile perception into market traits. When paired with the ZeroLag MACD, which reduces lag present in conventional MACD alerts, merchants acquire a extra well timed and exact understanding of market actions, permitting them to behave rapidly and decisively.

The AO Divergence helps merchants spot potential reversals by analyzing divergences between value and momentum. This divergence happens when the value strikes in a single course whereas the AO strikes within the reverse, signaling that the pattern could also be shedding energy. Alternatively, the ZeroLag MACD modifies the traditional MACD by minimizing the lag, delivering quicker and extra responsive alerts. This discount in delay is especially useful within the risky Foreign exchange market, the place velocity is crucial to capitalize on short-term alternatives. Collectively, these two indicators present a extra dependable method to figuring out entry and exit factors.

When mixed, the AO Divergence and ZeroLag MACD Foreign exchange Buying and selling Technique affords merchants a complete toolset for analyzing each momentum and pattern energy. The synergy between the 2 indicators creates a extra refined buying and selling technique, enabling merchants to detect early indicators of pattern adjustments and make knowledgeable buying and selling choices with higher confidence. On this article, we’ll discover the best way to successfully use these indicators, outlining the steps to implement them in your buying and selling technique and the way they’ll improve your total market evaluation.

AO Divergence Indicator

The AO Divergence Indicator relies on the Superior Oscillator (AO), a momentum indicator that measures the market’s momentum by evaluating the present 34-period easy shifting common (SMA) to the 5-period SMA. The AO Divergence enhances the capabilities of the AO by specializing in discrepancies, or divergences, between the value motion and the AO indicator. Divergence happens when the value varieties new highs or lows, however the AO indicator doesn’t observe go well with, signaling a possible reversal available in the market.

When utilizing the AO Divergence indicator, merchants are in search of situations the place value motion and the Superior Oscillator are shifting in reverse instructions. For instance, if the value makes a better excessive, however the AO fails to substantiate this by not reaching a brand new excessive, it signifies that the shopping for momentum is weakening. This is usually a sign that the present pattern could also be shedding energy, and a reversal might be imminent. The AO Divergence is especially worthwhile for recognizing potential pattern reversals early, permitting merchants to enter or exit positions with a better degree of confidence.

The ability of the AO Divergence lies in its potential to spotlight these refined shifts in market momentum which may not be instantly apparent from value motion alone. By figuring out divergences, merchants can anticipate adjustments in market course earlier than they grow to be obvious on conventional value charts. This makes the AO Divergence a worthwhile instrument for merchants trying to seize early entries or exits in trending markets, particularly in risky environments like Foreign exchange.

ZeroLag MACD Indicator

The ZeroLag MACD Indicator is a modification of the traditional MACD (Shifting Common Convergence Divergence) indicator, designed to handle the first limitation of conventional MACD: lag. The MACD is a trend-following momentum indicator that consists of two shifting averages—often the 12-period and 26-period exponential shifting averages (EMAs)—and a sign line, which is the 9-period EMA of the MACD line itself. Whereas the MACD is broadly used for figuring out traits and momentum shifts, one among its key drawbacks is the lag between when a sign is generated and when it may be acted upon, particularly in fast-moving markets like Foreign exchange.

The ZeroLag MACD addresses this difficulty by altering the MACD system to cut back the lag time. That is achieved through the use of a distinct method to the calculation of the MACD line and sign line, which permits it to reply extra rapidly to adjustments in market circumstances. Because of this, the ZeroLag MACD gives quicker and extra correct alerts than the normal MACD, making it a perfect instrument for merchants who have to react rapidly to cost actions.

With ZeroLag MACD, merchants can obtain earlier and extra dependable alerts of pattern adjustments, bettering the timing of their entries and exits. It’s notably helpful for short-term merchants or these working in risky markets the place fast decision-making is important. The quicker response time may also help merchants spot rising traits and reversals ahead of with an everyday MACD, permitting for extra exact commerce execution. Whether or not used along side different indicators or as a standalone instrument, the ZeroLag MACD helps streamline the buying and selling course of and enhances a dealer’s potential to capitalize on market alternatives in actual time.

How you can Commerce with AO Divergence and ZeroLag MACD Foreign exchange Buying and selling Technique

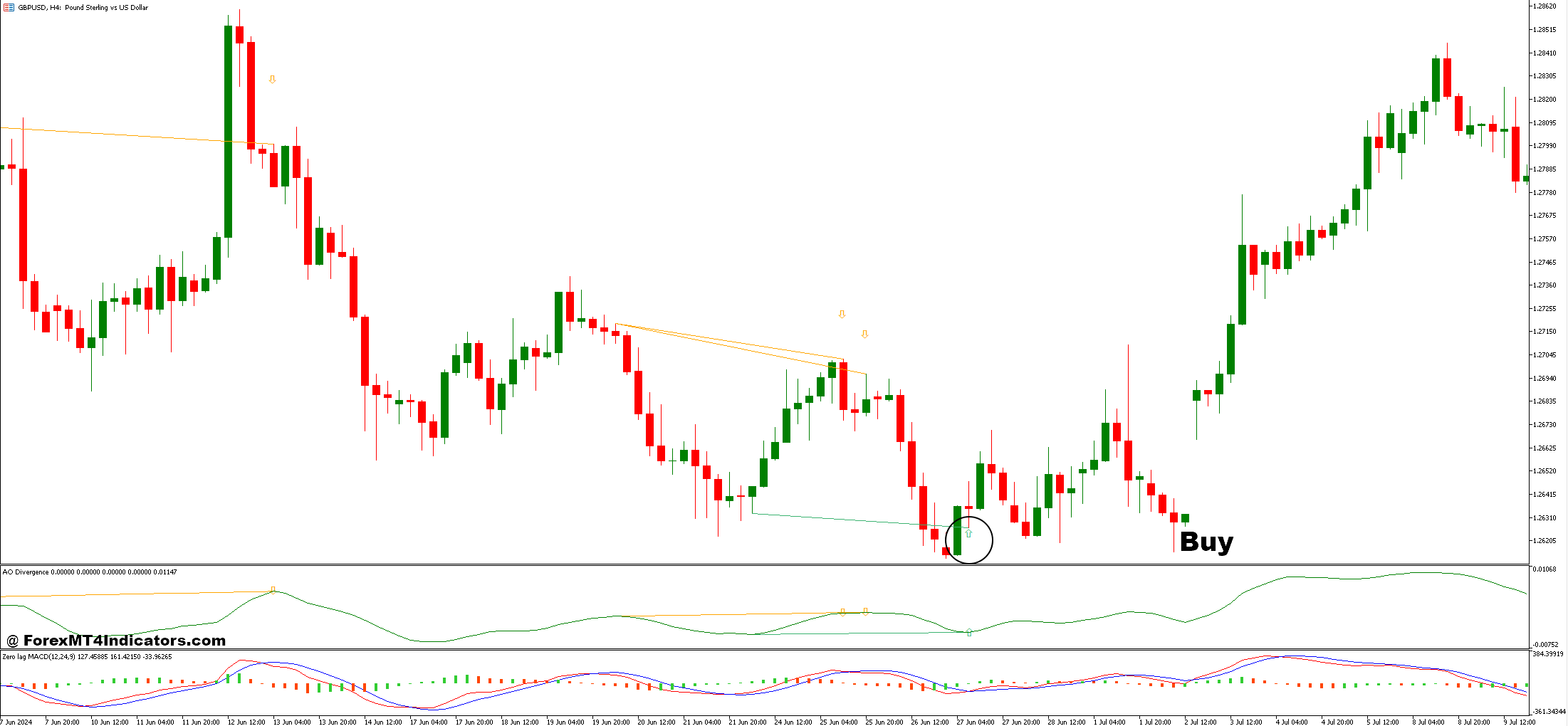

Purchase Entry

Value varieties decrease lows, however the AO varieties larger lows.

Signifies weakening bearish momentum and potential reversal to the upside.

ZeroLag MACD crosses above the sign line (MACD line crosses from under to above the sign line).

This confirms upward momentum and strengthens the purchase sign.

MACD histogram above zero (indicating growing bullish momentum).

Enter a purchase place as soon as the ZeroLag MACD crosses above the sign line and the bullish divergence on AO is confirmed.

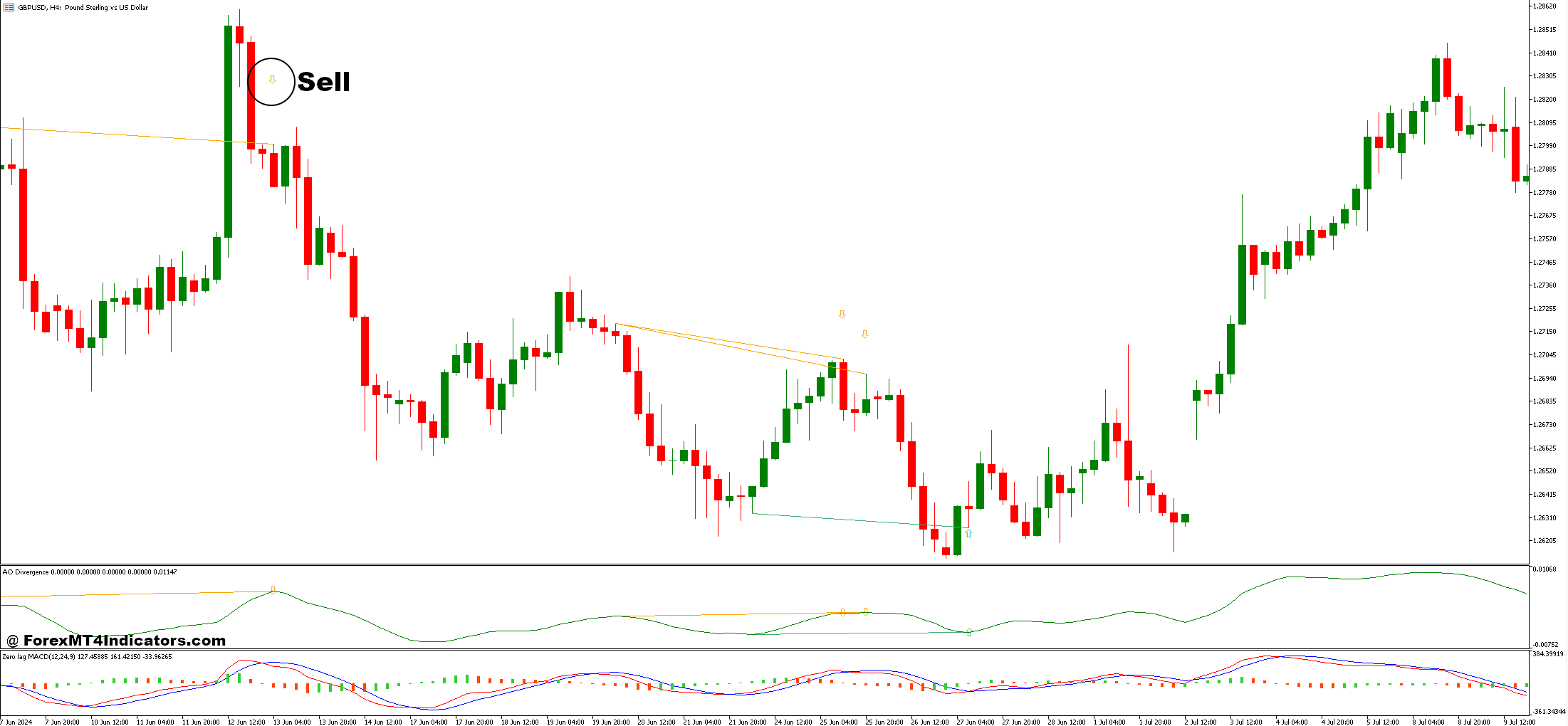

Promote Entry

Value varieties larger highs, however the AO varieties decrease highs.

Signifies weakening bullish momentum and potential reversal to the draw back.

ZeroLag MACD crosses under the sign line (MACD line crosses from above to under the sign line).

This confirms downward momentum and strengthens the promote sign.

MACD histogram under zero (indicating growing bearish momentum).

Enter a promote place as soon as the ZeroLag MACD crosses under the sign line and the bearish divergence on AO is confirmed.

Conclusion

The AO Divergence and ZeroLag MACD Foreign exchange Buying and selling Technique is a sturdy and dependable methodology for figuring out potential pattern reversals and momentum shifts in Forex. By leveraging the ability of the AO Divergence indicator to identify discrepancies between value motion and momentum, and confirming these alerts with the ZeroLag MACD for quicker and extra correct entries, merchants can improve their potential to make well timed and knowledgeable buying and selling choices.

Really useful MT4 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Profitable Foreign exchange Dealer

Extra Unique Bonuses All through The Yr

Unique 50% Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here under to obtain:

Get Obtain Entry