Up to date on December thirteenth, 2024 by Bob Ciura

Oil and fuel royalty trusts at the moment are providing exceptionally excessive distributions to their buyers, leading to a lot increased yields than the ~1.3% common dividend yield of the S&P 500.

We have now created a spreadsheet of excessive dividend shares with dividend yields of 5% or extra…

You possibly can obtain your free full listing of all securities with 5%+ yields (together with vital monetary metrics resembling dividend yield and payout ratio) by clicking on the hyperlink beneath:

On this article, we’ll talk about the prospects of the 5 highest-yielding royalty trusts.

Desk of Contents

You possibly can immediately soar to any particular part of the article by utilizing the hyperlinks beneath:

Excessive-Yield Royalty Belief No. 4: Permian Basin Royalty Belief (PBT)

Permian Basin Royalty Belief is an oil and fuel belief, which was based in 1980. In 2023, about 55% of output was oil and 45% was fuel, however 85% of revenues got here from oil.

PBT is a mix belief: unit holders have a 75% internet overriding royalty curiosity in Waddell Ranch Properties in Texas, which incorporates a number of oil and fuel wells; and a 95% internet overriding royalty curiosity within the Texas Royalty Properties, which incorporates varied oil wells.

The belief’s property are static in that no additional properties could be added. The belief has no operations however is merely a go by way of automobile for the royalties. PBT had royalty earnings of $54.4 million in 2022 and $29.0 million in 2023.

In mid-November, PBT reported (11/12/24) monetary outcomes for the third quarter of fiscal 2024. The typical realized value of oil considerably improved over the prior yr’s interval. Given additionally excessive working prices at Waddell Ranch properties in final yr’s quarter, distributable earnings per unit greater than doubled, from $0.07 to $0.17.

Click on right here to obtain our most up-to-date Certain Evaluation report on Permian Basin Royalty Belief (PBT) (preview of web page 1 of three proven beneath):

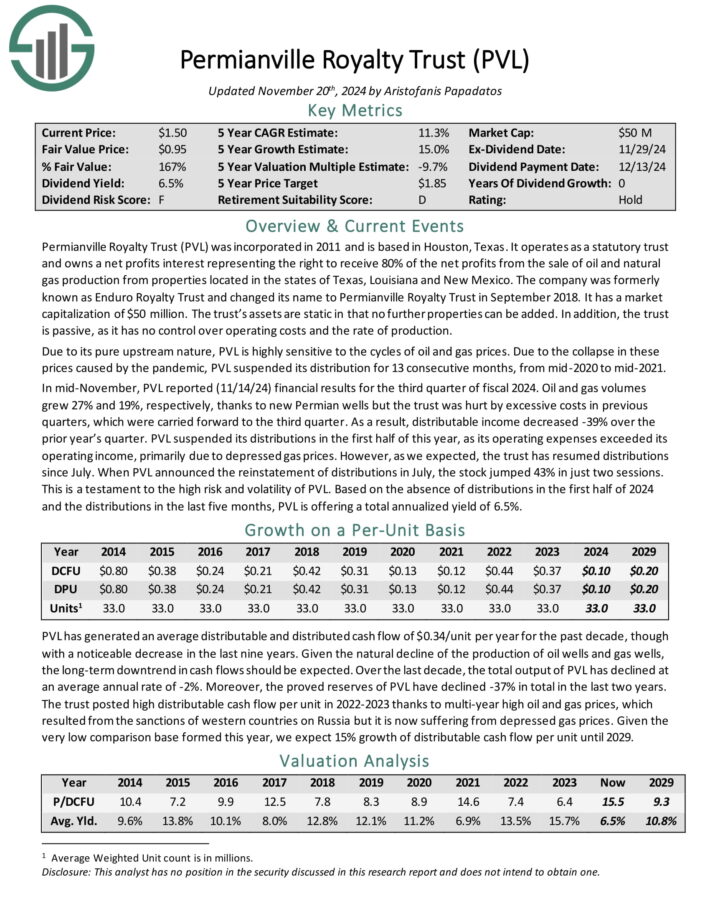

Excessive-Yield Royalty Belief No. 3: Permianville Royalty Belief (PVL)

Permianville Royalty Belief (PVL) was included in 2011 and relies in Houston, Texas. It operates as a statutory belief and owns a internet income curiosity representing the proper to obtain 80% of the online income from the sale of oil and pure fuel manufacturing from properties positioned within the states of Texas, Louisiana and New Mexico.

It has a market capitalization of $63 million. The belief’s property are static in that no additional properties could be added. As well as, the belief is passive, because it has no management over working prices and the speed of manufacturing.

In mid-November, PVL reported (11/14/24) monetary outcomes for the third quarter of fiscal 2024. Oil and fuel volumes grew 27% and 19%, respectively, due to new Permian wells however the belief was damage by extreme prices in earlier quarters, which had been carried ahead to the third quarter.

Because of this, distributable earnings decreased -39% over the prior yr’s quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on PVL (preview of web page 1 of three proven beneath):

Excessive-Yield Royalty Belief No. 2: Cross Timbers Royalty Belief (CRT)

Cross Timbers Royalty Belief is an oil and fuel belief (about 50/50), arrange in 1991 by XTO Power. Its unitholders have a 90% internet revenue curiosity in producing properties in Texas, Oklahoma, and New Mexico; and a 75% internet revenue curiosity in working curiosity properties in Texas and Oklahoma.

In mid-November, CRT reported (11/13/24) outcomes for the third quarter of fiscal 2024. Fuel volumes elevated 17% over the prior yr’s quarter due to timing of receipts of Oklahoma internet revenue pursuits however oil volumes declined -23%.

As well as, the typical realized value of fuel dipped -14%. Because of this, distributable money move (DCF) per unit decreased 37%.

Click on right here to obtain our most up-to-date Certain Evaluation report on Cross Timbers Royalty Belief (CRT) (preview of web page 1 of three proven beneath):

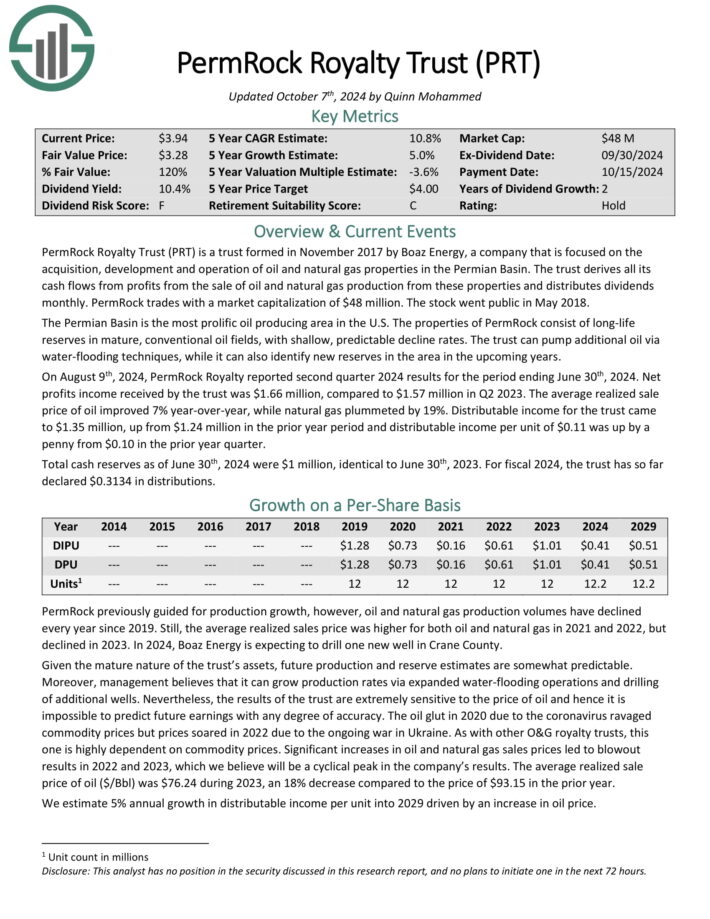

Excessive-Yield Royalty Belief No. 1: PermRock Royalty Belief (PRT)

PermRock Royalty Belief is a belief shaped in late 2017 by Boaz Power, an organization that’s centered on the acquisition, growth and operation of oil and pure fuel properties within the Permian Basin. The Belief advantages from the distinctive traits of the Permian Basin, which is probably the most prolific oil-producing space within the U.S.

On August ninth, 2024, PermRock Royalty reported second quarter 2024 outcomes for the interval ending June thirtieth, 2024. Internet income earnings acquired by the belief was $1.66 million, in comparison with $1.57 million in Q2 2023. The typical realized sale value of oil improved 7% year-over-year, whereas pure fuel plummeted by 19%.

Distributable earnings for the belief got here to $1.35 million, up from $1.24 million within the prior yr interval and distributable earnings per unit of $0.11 was up by a penny from $0.10 within the prior yr quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on PermRock Royalty Belief (PRT) (preview of web page 1 of three proven beneath):

Ultimate Ideas

On the floor, oil and fuel royalty trusts are engaging as they broadly supply increased yields than the S&P 500 common.

All of the oil and fuel trusts thrived in 2022 due to the exceptionally excessive costs of oil and fuel, which resulted from the sanctions of western international locations on Russia.

Nevertheless, oil and fuel costs are notorious for his or her dramatic swings. Oil costs have been on a downtrend for the previous a number of months.

Due to this fact, buyers needs to be ready for a lot decrease distributions from royalty trusts going ahead. They need to additionally pay attention to the extreme threat of all these trusts close to the height of their cycle.

The best time to purchase these trusts is throughout a extreme downturn of the power sector, when these shares plunge and thus grow to be deeply undervalued from a long-term perspective.

As talked about above, all of the oil and fuel trusts are extremely dangerous because of the pure decline of their manufacturing and their sensitivity to the costs of oil and fuel.

In case you are serious about discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.