Published on August 19th, 2025 by Bob Ciura

Investors in the US should not overlook Canadian stocks, many of which have high dividend yields than their U.S. counterparts.

There are many Canadian dividend stocks that have significantly higher yields and lower valuations than comparable U.S. peers.

The TSX 60 Index is a stock market index of the 60 largest companies that trade on the Toronto Stock Exchange.

Because the Canadian stock market is heavily weighted towards large financial institutions and energy companies, the TSX is a reasonable benchmark for Canadian equities performance. It is also a great place to look for investment ideas.

You can download a database of the companies within the TSX 60 (along with relevant financial metrics such as dividend yields and price-to-earnings ratios) by clicking on the link below:

The TSX 60 Stocks List available for download above contains the following information for every security within the index:

Stock Price

Dividend Yield

Market Capitalization

Price-to-Earnings Ratio

All of the financial data in the database are listed in Canadian dollars.

Note: Canada imposes a 15% dividend withholding tax on U.S. investors. In many cases, investing in Canadian stocks through a U.S. retirement account waives the dividend withholding tax from Canada, but check with your tax preparer or accountant for more on this issue.

This article will rank the top 10 Canadian dividend stocks in the Sure Analysis Research Database, ranked by their annual expected returns over the next five years.

Table of Contents

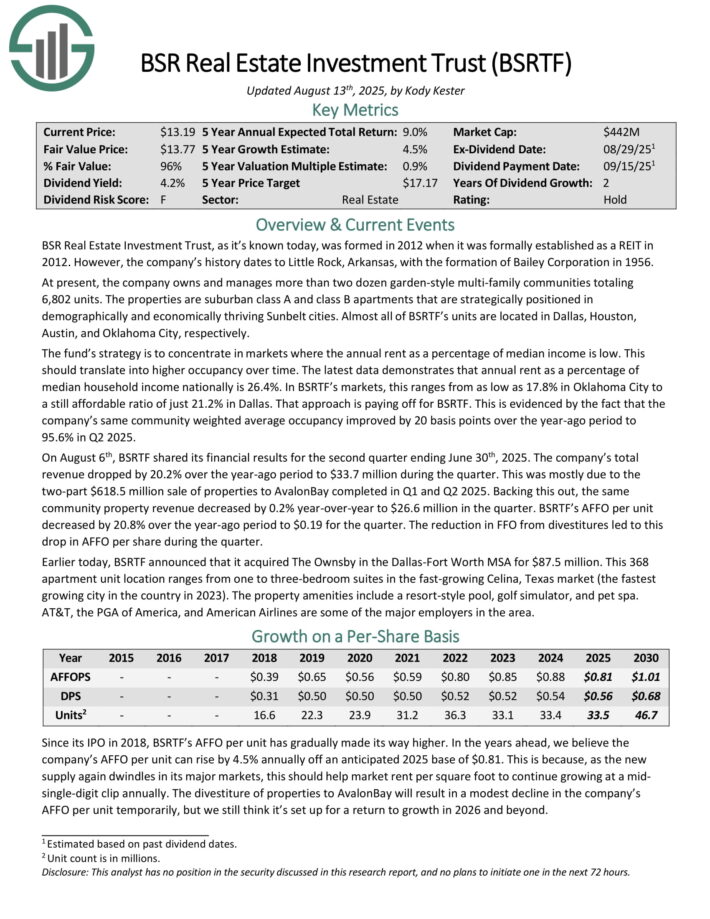

Best Canadian Dividend Stock #10: BSR Real Estate Investment Trust (BSRTF)

Annual Expected Returns: 10.6%

BSR Real Estate Investment Trust, as it’s known today, was formed in 2012 when it was formally established as a REIT in 2012. At present, the company owns and manages more than two dozen garden-style multi-family communities totaling 6,802 units.

The properties are suburban class A and class B apartments that are strategically positioned in demographically and economically thriving Sunbelt cities. Almost all of BSRTF’s units are located in Dallas, Houston, Austin, and Oklahoma City, respectively.

On August 6th, BSRTF shared its financial results for the second quarter ending June 30th, 2025. The company’s total revenue dropped by 20.2% over the year-ago period to $33.7 million during the quarter. This was mostly due to the two-part $618.5 million sale of properties to AvalonBay completed in Q1 and Q2 2025.

Backing this out, the same community property revenue decreased by 0.2% year-over-year to $26.6 million in the quarter. BSRTF’s AFFO per unit decreased by 20.8% over the year-ago period to $0.19 for the quarter. The reduction in FFO from divestitures led to this drop in AFFO per share during the quarter.

Click here to download our most recent Sure Analysis report on BSRTF (preview of page 1 of 3 shown below):

Best Canadian Dividend Stock #9: Sun Life Financial (SLF)

Annual Expected Returns: 10.6%

Sun Life Financial is a financial services company that offers insurances, wealth management, group benefits and retirement services. Sun Life Financial has divisions that operate in the US, in Canada, and in Asia. Sun Life Financial was founded in 1865, is headquartered in Toronto, Canada.

Sun Life Financial reported its first quarter earnings results in May. Sun Life insurance sales between the Group and Individual franchises grew by 13% compared to one year earlier, with individual sales rising by 15% while group sales rose by 10%. Sun Life Financial’s assets under management grew by 6% compared to one year earlier.

Sun Life Financial generated underlying net profits of CAD$1.82 on a per-share basis during the first quarter, which equates to $1.33 once translated to USD. This earnings-per-share result was up by double-digits compared to the prior year’s result.

Sun Life Financial managed to generate an underlying return on equity of 18% (annualized) during the quarter, which was up slightly compared to the previous quarter. Sun Life Financial generated earnings-per-share growth of 5% in Canadian Dollars in fiscal 2024 (less in US Dollars).

Click here to download our most recent Sure Analysis report on SLF (preview of page 1 of 3 shown below):

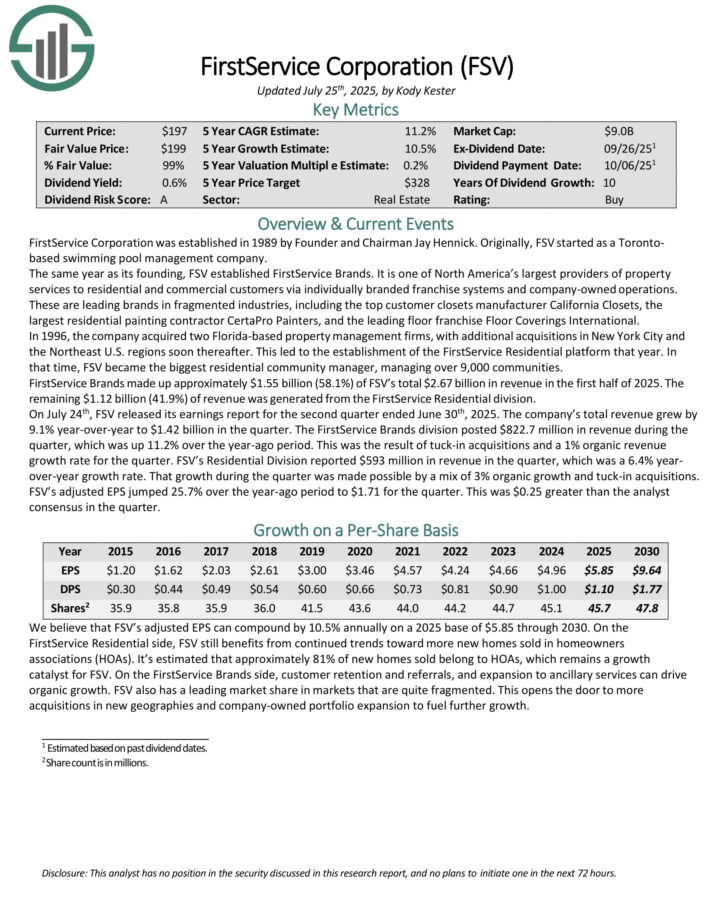

Best Canadian Dividend Stock #8: FirstService Corp. (FSV)

Annual Expected Returns: 11.1%

FirstService Corporation is one of North America’s largest providers of property services to residential and commercial customers via individually branded franchise systems and company-owned operations.

These are leading brands in fragmented industries, including the top customer closets manufacturer California Closets, the largest residential painting contractor CertaPro Painters, and the leading floor franchise Floor Coverings International.

FirstService Brands made up approximately $1.55 billion (58.1%) of FSV’s total $2.67 billion in revenue in the first half of 2025. The remaining $1.12 billion (41.9%) of revenue was generated from the FirstService Residential division.

On July 24th, FSV released its earnings report for the second quarter ended June 30th, 2025. The company’s total revenue grew by 9.1% year-over-year to $1.42 billion in the quarter. The FirstService Brands division posted $822.7 million in revenue during the quarter, which was up 11.2% over the year-ago period.

This was the result of tuck-in acquisitions and a 1% organic revenue growth rate for the quarter. FSV’s Residential Division reported $593 million in revenue in the quarter, which was a 6.4% year-over-year growth rate.

That growth during the quarter was made possible by a mix of 3% organic growth and tuck-in acquisitions. FSV’s adjusted EPS jumped 25.7% over the year-ago period to $1.71 for the quarter.

Click here to download our most recent Sure Analysis report on FSV (preview of page 1 of 3 shown below):

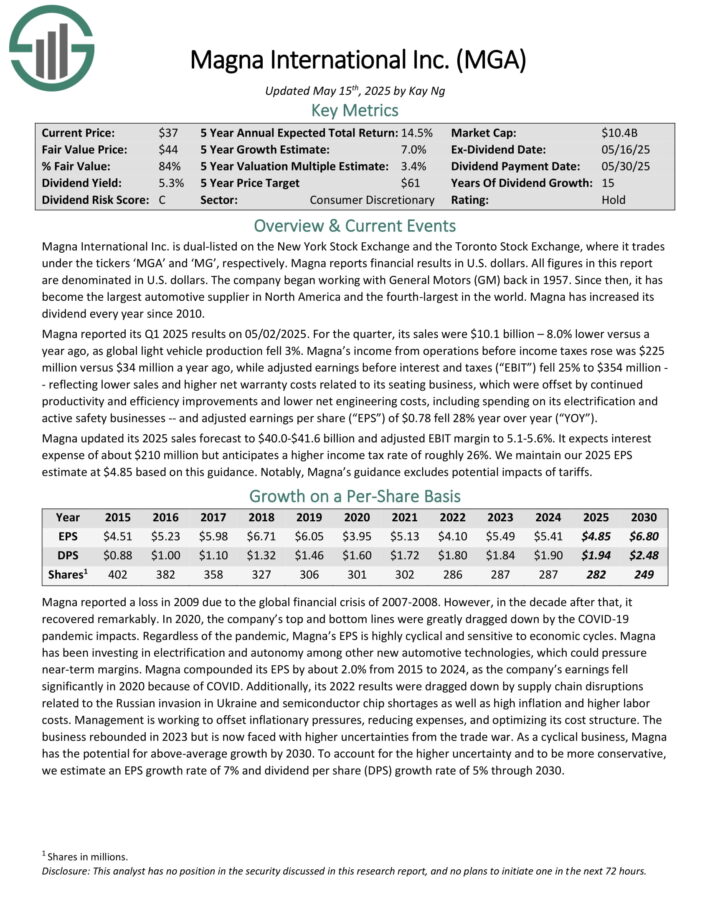

Best Canadian Dividend Stock #7: Magna International Inc. (MGA)

Annual Expected Returns: 11.5%

Magna International Inc. is dual-listed on the New York Stock Exchange and the Toronto Stock Exchange, where it trades under the tickers ‘MGA’ and ‘MG’, respectively.

It has become the largest automotive supplier in North America and the fourth-largest in the world. Magna has increased its dividend every year since 2010.

Magna reported its Q1 2025 results on 05/02/2025. For the quarter, its sales were $10.1 billion – 8.0% lower versus a year ago, as global light vehicle production fell 3%. Magna’s income from operations before income taxes rose was $225 million versus $34 million a year ago.

Adjusted earnings before interest and taxes (“EBIT”) fell 25% to $354 million — reflecting lower sales and higher net warranty costs related to its seating business, which were offset by continued productivity and efficiency improvements and lower net engineering costs, including spending on its electrification and active safety businesses.

Adjusted earnings per share of $0.78 fell 28% year-over-year. Magna updated its 2025 sales forecast to $40.0-$41.6 billion and adjusted EBIT margin to 5.1-5.6%.

Click here to download our most recent Sure Analysis report on MGA (preview of page 1 of 3 shown below):

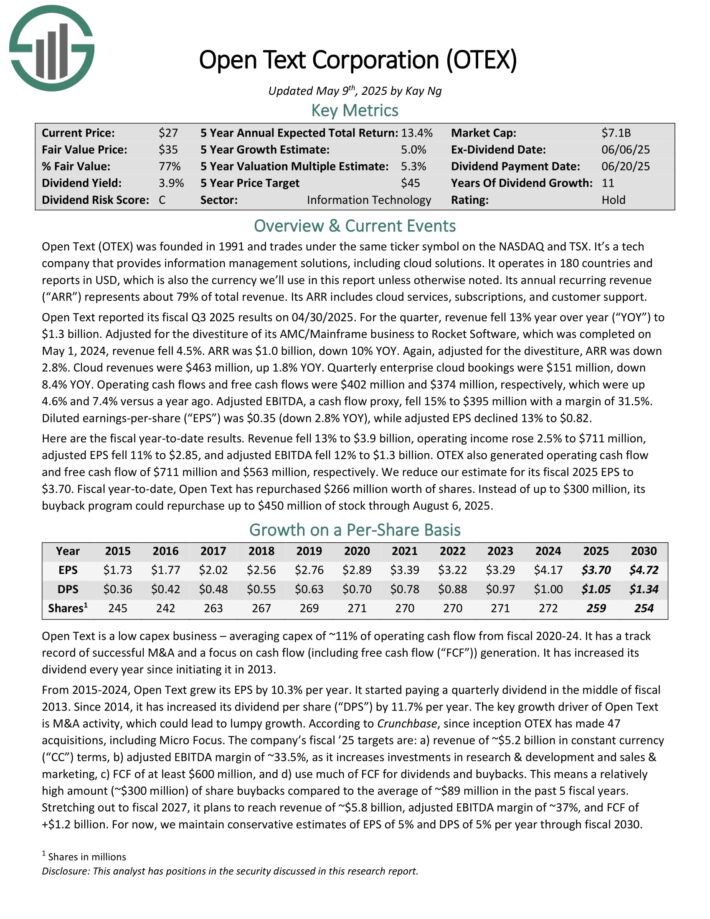

Best Canadian Dividend Stock #6: Open Text Corp. (OTEX)

Annual Expected Returns: 11.5%

Open Text was founded in 1991. It provides information management solutions, including cloud solutions. It operates in 180 countries and its annual recurring revenue (“ARR”) represents about 79% of total revenue.

Its ARR includes cloud services, subscriptions, and customer support. Open Text reported its fiscal Q3 2025 results on 04/30/2025. For the quarter, revenue fell 13% year-over-year to $1.3 billion. Adjusted for the divestiture of its AMC/Mainframe business to Rocket Software, which was completed on May 1, 2024, revenue fell 4.5%.

ARR was $1.0 billion, down 10% year-over-year. Again, adjusted for the divestiture, ARR was down 2.8%. Cloud revenues were $463 million, up 1.8% year-over-year.

Operating cash flows and free cash flows were $402 million and $374 million, respectively, which were up 4.6% and 7.4% versus a year ago. Adjusted EBITDA, a cash flow proxy, fell 15% to $395 million with a margin of 31.5%.

OTEX also generated operating cash flow and free cash flow of $711 million and $563 million, respectively.

Click here to download our most recent Sure Analysis report on OTEX (preview of page 1 of 3 shown below):

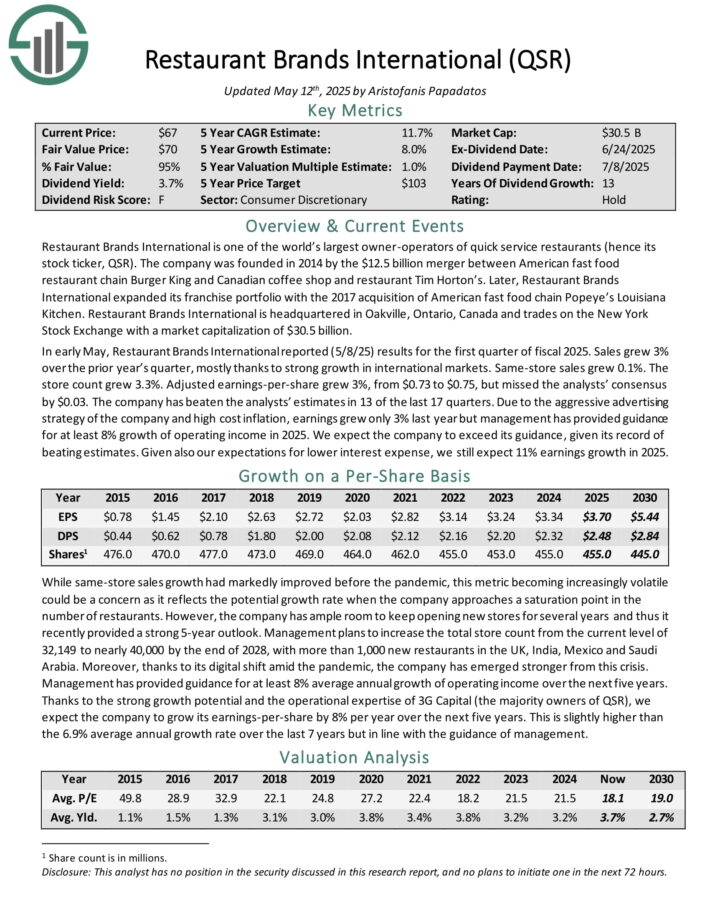

Best Canadian Dividend Stock #5: Restaurant Brands International (QSR)

Annual Expected Returns: 12.1%

Restaurant Brands International is one of the world’s largest owner-operators of quick service restaurants. The company was founded in 2014 by the $12.5 billion merger between American fast food restaurant chain Burger King and Canadian coffee shop and restaurant Tim Horton’s.

Later, Restaurant Brands International expanded its franchise portfolio with the 2017 acquisition of American fast food chain Popeye’s Louisiana Kitchen.

In early May, Restaurant Brands International reported (5/8/25) results for the first quarter of fiscal 2025. Sales grew 3% over the prior year’s quarter, mostly thanks to strong growth in international markets. Same-store sales grew 0.1%.

The store count grew 3.3%. Adjusted earnings-per-share grew 3%, from $0.73 to $0.75, but missed the analysts’ consensus by $0.03. The company has beaten the analysts’ estimates in 13 of the last 17 quarters.

Due to the aggressive advertising strategy of the company and high cost inflation, earnings grew only 3% last year but management has provided guidance for at least 8% growth of operating income in 2025.

Click here to download our most recent Sure Analysis report on QSR (preview of page 1 of 3 shown below):

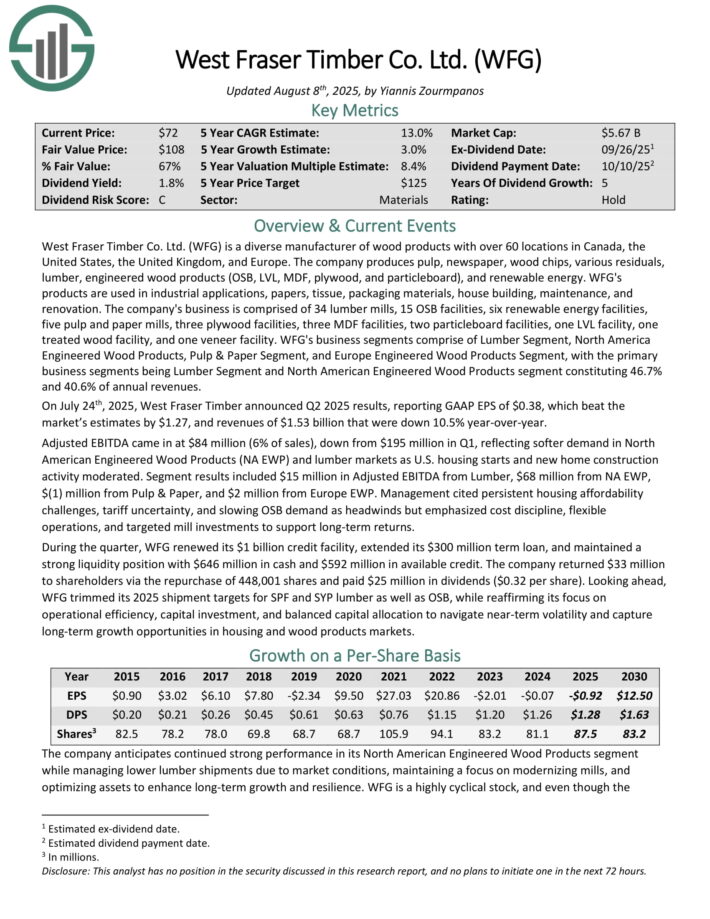

Best Canadian Dividend Stock #4: West Fraser Timber Co. (WFG)

Annual Expected Returns: 12.5%

West Fraser Timber is a diverse manufacturer of wood products with over 60 locations in Canada, the United States, the United Kingdom, and Europe. The company produces pulp, newspaper, wood chips, various residuals, lumber, engineered wood products (OSB, LVL, MDF, plywood, and particleboard), and renewable energy.

WFG’s products are used in industrial applications, papers, tissue, packaging materials, house building, maintenance, and renovation.

WFG’s business segments comprise of Lumber Segment, North America Engineered Wood Products, Pulp & Paper Segment, and Europe Engineered Wood Products Segment, with the primary business segments being Lumber Segment and North American Engineered Wood Products segment constituting 46.7% and 40.6% of annual revenues.

On July 24th, 2025, West Fraser Timber announced Q2 2025 results, reporting GAAP EPS of $0.38, which beat the market’s estimates by $1.27, and revenues of $1.53 billion that were down 10.5% year-over-year.

Adjusted EBITDA came in at $84 million (6% of sales), down from $195 million in Q1, reflecting softer demand in North American Engineered Wood Products (NA EWP) and lumber markets as U.S. housing starts and new home construction activity moderated.

Click here to download our most recent Sure Analysis report on WFG (preview of page 1 of 3 shown below):

Best Canadian Dividend Stock #3: TFI International Inc. (TFII)

Annual Expected Returns: 14.9%

TFI International Inc. is a leading North American transportation and logistics company. The Canada-based company’s 95-plus operating companies and over 26,000 employees provide a variety of transportation and logistics services to customers.

TFII’s customers operate mostly in the retail, manufactured goods, automotive, building materials, food and beverage, metals and mining, and services industries.

Approximately two-thirds of the company’s revenue is generated in the U.S., with the remaining third of revenue being derived in Canada.

TFII is organized into the following three operating segments. The Less-Than-Truckload segment provides over-the-road and asset-light intermodal LTL services. Through the first half of 2025, LTL accounted for the plurality (~41%) of the company’s $3.5 billion in total revenue before fuel surcharges.

The Truckload segment offers flatbed, tank, and container services to customers. The segment also carries full loads from the customer to the destination using a closed van or specialized equipment.

Lastly, the Logistics segment provides asset-light logistics services, such as freight forwarding, transportation management, and small package parcel delivery.

On July 28th, TFII shared its earnings report for the second quarter ended June 30th, 2025. The company’s total revenue decreased by 10% over the year-ago period to $2.04 billion in the quarter. This was due to reduced volumes stemming from weaker end-market demand during the quarter.

TFII’s adjusted diluted EPS dropped by 21.6% year-over-year to $1.34 for the quarter. That beat the analyst consensus by $0.11 per share.

Click here to download our most recent Sure Analysis report on TFII (preview of page 1 of 3 shown below):

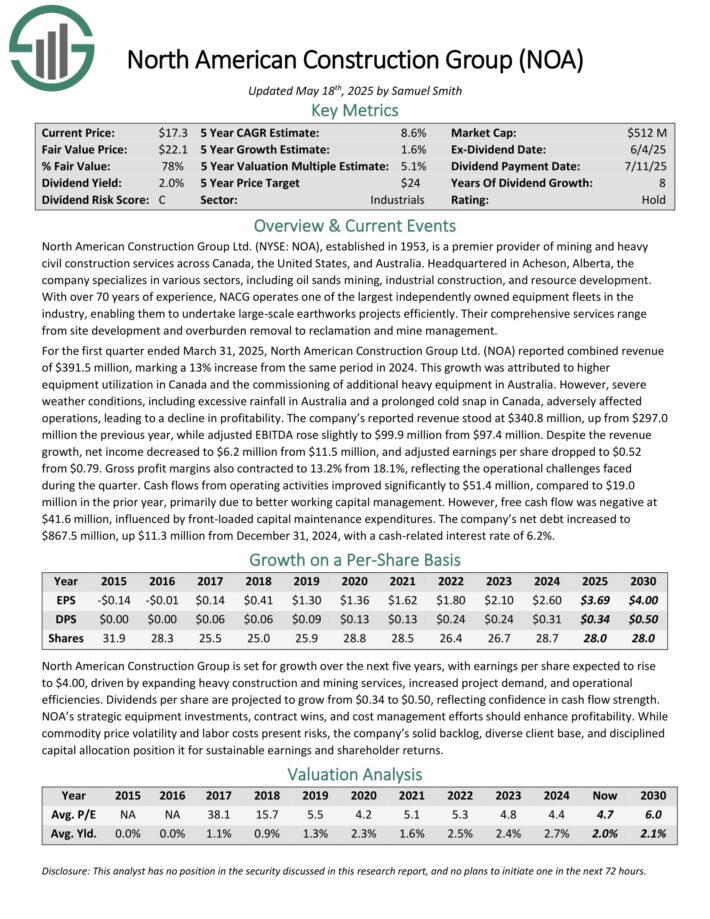

Best Canadian Dividend Stock #2: North American Construction Group (NOA)

Annual Expected Returns: 15.8%

North American Construction Group, established in 1953, is a premier provider of mining and heavy civil construction services across Canada, the United States, and Australia. Headquartered in Acheson, Alberta, the company specializes in various sectors, including oil sands mining, industrial construction, and resource development.

For the first quarter ended March 31, 2025, North American Construction Group reported combined revenue of $391.5 million, marking a 13% increase from the same period in 2024. This growth was attributed to higher equipment utilization in Canada and the commissioning of additional heavy equipment in Australia.

The company’s reported revenue stood at $340.8 million, up from $297.0 million the previous year, while adjusted EBITDA rose slightly to $99.9 million from $97.4 million. Despite the revenue growth, net income decreased to $6.2 million from $11.5 million, and adjusted earnings per share dropped to $0.52 from $0.79.

Gross profit margins also contracted to 13.2% from 18.1%, reflecting the operational challenges faced during the quarter. Cash flows from operating activities improved significantly to $51.4 million, compared to $19.0 million in the prior year, primarily due to better working capital management.

Click here to download our most recent Sure Analysis report on NOA (preview of page 1 of 3 shown below):

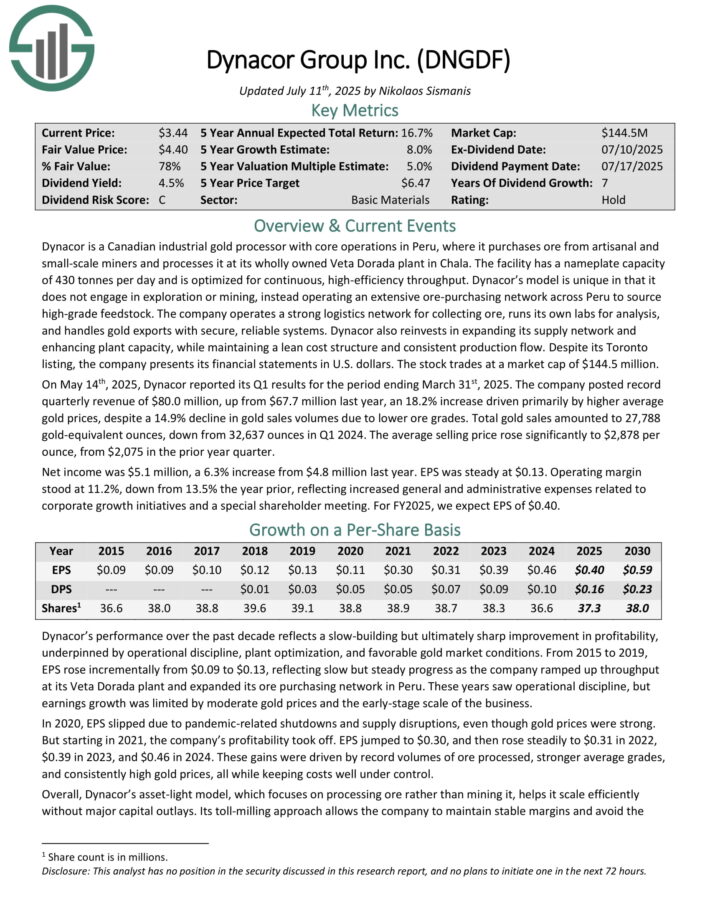

Best Canadian Dividend Stock #1: Dynacor Group Inc. (DNGDF)

Annual Expected Returns: 16.6%

Dynacor is a Canadian industrial gold processor with core operations in Peru, where it purchases ore from artisanal and small-scale miners and processes it at its wholly owned Veta Dorada plant in Chala.

The facility has a nameplate capacity of 430 tonnes per day and is optimized for continuous, high-efficiency throughput.

Dynacor’s model is unique in that it does not engage in exploration or mining, instead operating an extensive ore purchasing network across Peru to source high-grade feedstock.

The company operates a strong logistics network for collecting ore, runs its own labs for analysis, and handles gold exports with secure, reliable systems.

Dynacor also reinvests in expanding its supply network and enhancing plant capacity, while maintaining a lean cost structure and consistent production flow. Despite its Toronto listing, the company presents its financial statements in U.S. dollars.

On May 14th, 2025, Dynacor reported its Q1 results for the period ending March 31st, 2025. The company posted record quarterly revenue of $80.0 million, up from $67.7 million last year, an 18.2% increase driven primarily by higher average gold prices, despite a 14.9% decline in gold sales volumes due to lower ore grades.

Total gold sales amounted to 27,788 gold-equivalent ounces, down from 32,637 ounces in Q1 2024. The average selling price rose significantly to $2,878 per ounce, from $2,075 in the prior year quarter.

Click here to download our most recent Sure Analysis report on DNGDF (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

Canadian Dividend Stocks

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.