Ever wondered whether an AI crypto trading bot can safely and effectively run on Coinbase Pro (now Coinbase Advanced)? I took seven different “AI crypto trading bot” platforms, hooked each up to Coinbase via API, and rigor-tested their signals, strategy flexibility, ease-of-use, and cost.

This isn’t hype—it’s real feedback so you can figure out what fits your trading style without wasting time.

Why Choose an AI Crypto Trading Bot on Coinbase?

When you’re connecting to Coinbase Advanced, you’re choosing a US-regulated, secure exchange with solid volume. An AI-driven bot here ideally offers:

Trade automation 24/7Smart strategy execution: DCA, trend, swing, signal-drivenBacktesting and adapting to live Coinbase dataEmotional discipline (bye-bye impulsive trades)Risk management and portfolio diversification

Human brain ≠ same speed as AI when markets swing, so a good bot can really help.

⬇️ See the top AI Crypto bots

What Matters Most When Opting for a Bot

I judged each on:

Core features & Coinbase compatibilityEase of setup with Coinbase APITypes of strategies availablePricing & valueReliability and customer trust

Goal: identify which tool was best for different types of traders—beginners, data-driven users, cost-aware fans, strategy builders.

Best AI Crypto Trading Bots For Coinbase

Aterna AIIntellectiaKavoutTradeSantaSignal StackCoinruleTickeron

Core Features

Trend-detectionAutomated execution via webhook or native APIAdjustable risk modules.

Use Case

Suited to those who want low-code trend-following bots directly on Coinbase.

Opinion

Setup was straightforward if they support Coinbase API. Strategy options are limited, but good if you want a bot to follow price trends automatically. Best for users wanting automation with minimal fuss.

Core Features

Uses XGBoost + neural nets to analyze sentiment, news, and technical data across crypto.Generates swing trade signals, adaptive risk sizing, multi-coin scanning.Compatible with Coinbase via webhook or manual trades.

Use Case

Ideal for swing traders looking for data-backed signals and trade timing across assets.

Opinion

Offers deep insight and adaptability. Not a plug-and-play bot, but a helpful research companion that triggers alerts you execute. Best for analytical traders wanting signal support.

Core Features

Kai ScoreSmart SignalsAI chatbot (InvestGPT)Portfolio tools spanning crypto and stocks

Use Case

If you want quick signals and asset screening before placing trades on Coinbase manually or via webhook.

Opinion

Best for users who value insight over full automation. No native execution but helpful dashboards. Signals are solid, but execution is yours to manage.

Core Features

Cloud bots for Coinbase (spot or futures)Supporting DCA, Grid strategies, templates, backtestsEasy Binance/Coinbase API setup.

Use Case

Best for newcomers wanting automated strategies running continuously without coding.

Opinion

Reliable, simple, works out-of-the-box. Not “AI‑learning” but delivers on plug-and-play automation—grid bots and DCA work well. Great usability for cost-conscious users.

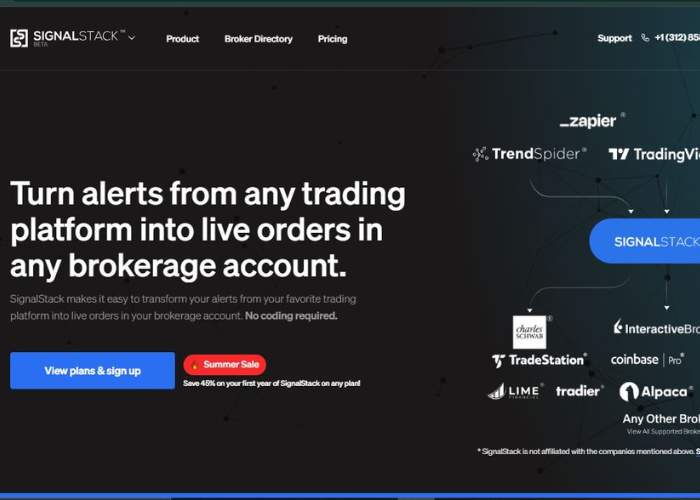

Core Features

Receives alerts (from TradingView etc.)Converts them into Coinbase trades in milliseconds

Use Case

Ideal if you build your own signals and want automation without the hassle.

Opinion

Not a strategy bot—but best for power users who script alerts and need fast execution. Solid, lean, and cheap for what it does.

Core Features

If‑this‑then‑that rule engineStrategy marketplaceBacktestingAny‑coin scannerDirect Coinbase Pro integration

Use Case

Beginners and pros who want no-code rule automation with connectors for Coinbase Advanced.

Opinion

Great usability and Coinbase-ready out-of-the-box. Offers both templates and custom rule building. Best for users who want flexible automation with minimal code.

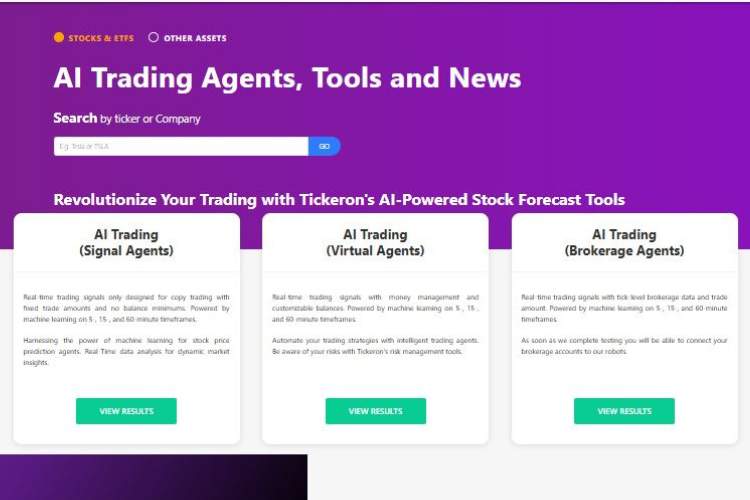

Core Features

Pattern recognitionSingle-ticker AI robotsCandlestick-based strategy bots

Use Case

Focused traders dialing in one coin (e.g. BTC/USDC) using AI‑pattern signals.

Opinion

Easiest for hands-off pattern-based play, though customization limited. Best for beginners wanting ready signals on specific coins.

Comparison Table

BotBest ForStrategy StyleAutomation LevelCoinbase Connect MethodAterna AITrend-followersTrend-detecting botsFully automatedNative API or webhookIntellectiaSwing/data-driven tradersMarket sentiment/swingAlerts (manual or webhook)API integration optionalKavoutInsight-seekers, manual controlSignal scoringSignal onlyManual or webhookTradeSantaEasy automation, beginnersGrid, DCA, futuresFully automatedCoinbase APISignalStackCustom alerts → auto executionAlert-based strategiesWebhook executionAPI integration for executionCoinruleRule‑based automation, no codeIFTTT logic rulesFully automatedCoinbase Pro APITickeronPattern-based single-coin signalsCandlestick AI botsFull via platformAPI execution if supported

Conclusion & Top 3 Recommendations

After testing, here’s what stands out:

Coinrule – Most flexible no-code rule engine, Coinbase‑Pro-native, great for both newbies and intermediate traders.TradeSanta – Best plug‑and‑play automation platform; grid, DCA and futures bots run reliably on Coinbase.Signal Stack – Perfect for users building their own TradingView signals and needing seamless Coinbase execution.

Runner‑ups:

Intellectia for signal accuracy in swing trading;Tickeron for single-coin simplicity;Kavout when you need AI insight over automated trade;Aterna AI if its Coinbase integration is confirmed and trends execution is preferred.

So if you want to set it and forget it on Coinbase, go with TradeSanta or Coinrule. If you’re more hands-on and build your own signals, Signal Stack delivers smooth execution.

Each tool has its sweet spot—pick based on how much control versus automation you need.