July 2025 was an exciting month for Burning Grid, delivering strong results across all three risk levels, major technical updates, and a significant milestone with Darwinex Zero.

This report summarizes performance, strategy behavior, technical developments, and a special highlight of the month.

1️⃣ Strategy Performance

Burning Grid currently runs in three risk profiles:

Low Risk – Stability & conservative growth

Medium Risk – Balanced risk-to-reward profile

High Risk – Maximum performance under controlled risk

All accounts were traded actively in July and show the expected differences in drawdown and growth.

However, one notable event was the loss of a CHFJPY strategy on July 15, which resulted in a temporary equity drop. 💡 Remarkably, the losses were fully recovered in less than 48 hours, demonstrating the resilience and recovery logic of Burning Grid.

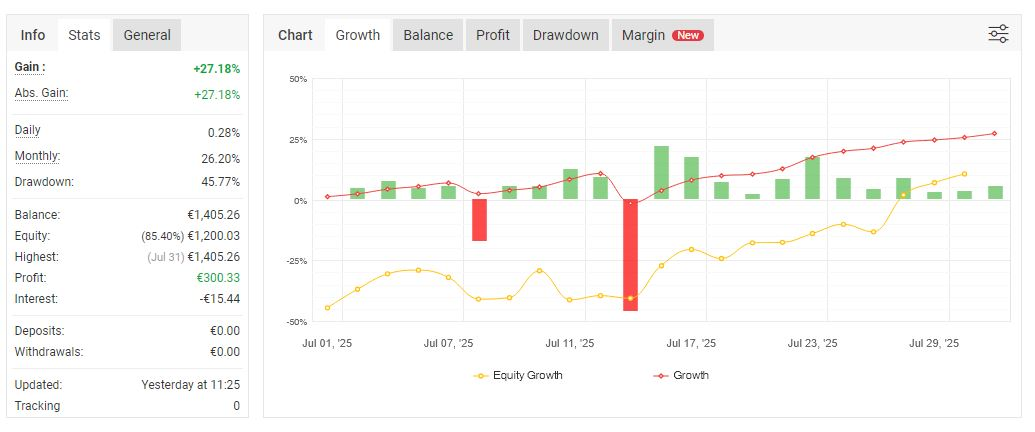

🔹 High Risk – Aggressive Growth with Discipline

The High-Risk account remains the performance flagship, although it naturally carries the highest volatility.Equity charts show drawdowns during active grid clusters, but these are contained by rule-based exits.

Despite heavier capital exposure, the strategy ended the month with over +30 % growth — a testament to logic-driven loss control.

🔸 Medium Risk – The Strategic Balance

Medium Risk once again proves to be the best balance of performance and stability.While temporary drawdowns occurred, the recovery logic ensured smooth recoveries and consistent growth.

With its high win rate and moderate capital pressure, this profile is the recommended standard choice for most traders.

🔹 Low Risk – Steady, Conservative Growth

The conservative variant continues to deliver high stability and low fluctuations.With 95 % winning trades and minimal drawdowns, Low Risk is ideal for traders who prefer long-term, low-stress grid trading.

📊 Strategy Comparison (July 2025)

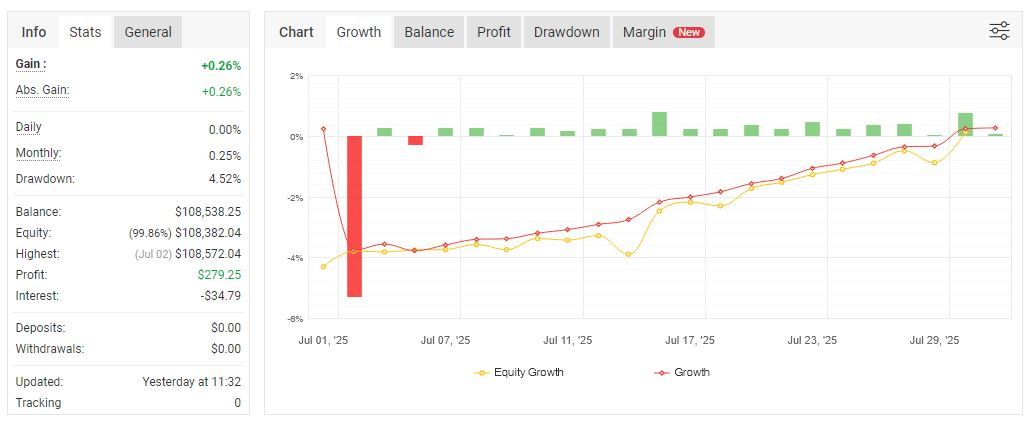

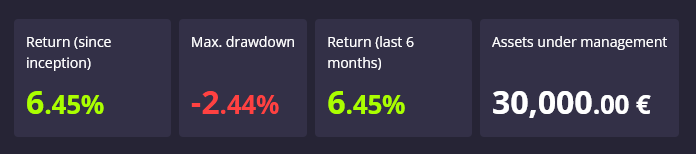

2️⃣ ⭐ Special Highlight: Darwinex Zero – First Allocation Achieved

A key milestone in July: Burning Grid, combined with Burning London and a preview version of Burning Aurum, achieved its first capital allocation via Darwinex Zero.

📅 Timeline

July 2, 2025:All open positions were intentionally closed to start with a clean slate for the Darwinex account.⚠ This resulted in a realized loss of nearly 4 %.

Immediately after:The account was relaunched with a Darwinex-optimized setup featuring the High-Risk Level setup plus blocking running symbols.

Despite the initial -4 % realized loss, the account instantly qualified for the first allocation, highlighting the robustness of the combined system.

💡 Takeaway:Achieving the allocation despite a realized 4 % loss demonstrates that Burning Grid and its companion strategies can meet strict, capital-market-like requirements while maintaining investor-friendly drawdowns.

Unfortunately Darwinex Zero is using demo accounts, so its not possible to run a signal on Metatrader.

3️⃣ 🔧 Technical Updates – July 2025

Burning Grid received three major updates in July, improving usability and professional deployment:

1️⃣ Symbol & Currency Blocker

Optional blocker at symbol or currency level

Prevents multiple strategies from trading the same symbol or correlated currencies simultaneously

Use case: Enabled for Darwinex Zero to avoid overlapping risk

2️⃣ Prop Firm & Small Account Modes

New selectable modes in the EA interface

Optimized for prop-firm accounts and small-cap trading

Simplified setup — no manual setfile adjustments required

3️⃣ Auto-Mode for Small Accounts

Fully automates small account management

Automatically switches to Regular Mode once account equity exceeds $10,000

Completely removes the need for separate small-account setfiles

💡 Advantage: These updates make Burning Grid more flexible, safer, and future-proof, especially for prop firm evaluations and account scaling.

4️⃣ 🙌 Community & Outlook

Burning Grid’s evolution is driven by its community.Key features like the Symbol Blocker and Auto-Mode were implemented directly from user feedback.

💬 Join the discussion and influence future development here:Community Thread

The main focus for August 2025 will be on the finalization of Burning Aurum – our first dedicated gold trading bot.

Burning Aurum is designed to complement the existing Burning Grid and Burning London strategies by focusing exclusively on XAUUSD (Gold), leveraging:

Precise volatility-based entry logic

Adaptive grid control tailored to gold’s unique behavior

Integrated risk & news management for high-impact economic events

💡 Our goal is to make Burning Aurum a shining centerpiece in our lineup, delivering robust performance on one of the world’s most dynamic trading instruments.

If development and final testing proceed as planned, we expect to present this golden gem to our community by the end of August.

📌 Conclusion

July 2025 proves that Burning Grid is profitable, robust, and ready for professional use.

Three risk profiles – something for every trader

Technical improvements for prop firm & small account deployment

Successful Darwinex Zero allocation despite a start-loss

For real-world trading, we recommend starting capital of at least €10,000 per setup to fully utilize the EA’s built-in safety and scaling potential.

Small Accounts can start with starting capital of $500. Take care to choose either Auto Mode or Small Account Mode + correct Setup Files!

🔗 Resources & References

🛒 Burning Grid on MQL5 Marketplace – 📖 Read the Full Blog Article – 💬 Join the Community & Support Group –

🛒 Burning London on MQL5 Marketplace –