Bitwise CIO Matt Hougan predicts a Bitcoin boom in 2026, breaking the four-year cycle. Regulatory clarity in the U.S. and institutional demand to drive prices.

Matt Hougan, Chief Investment Officer of Bitwise Asset Management, predicts a crypto boom in 2026. In 2025, crypto prices peaked in January before correcting. BTC ▲0.92% slumped to $75,000, driving some of the top Solana meme coins like TRUMP crypto lower.

Explore: Best High-Risk, High-Reward Crypto to Buy in July 2025

Will 2026 Be an “Up Year” for Bitcoin?

The sell-off was the washout the market needed to flush out speculative 100X leveraged traders across multiple crypto exchanges.

After the dip, prices rose, breaching $110,000, before extending gains to $123,000. As of July 28, 2025, prices are at near all-time highs, but bulls need to break above $120,000 and July highs for the uptrend to continue.

Hougan believes this bull run is inevitable, not in 2025 but in 2026. In an interview, the CIO expressed confidence in a major price recovery, stating that 2026 will be an “up year,” with a “sustained, steady boom” for Bitcoin. Unlike the volatile peaks and troughs of past cycles, he predicts Bitcoin will march steadily, printing “god candles” to new all-time highs.

DID I HEAR SUPER CYCLE???

The four-year cycle is dead and adoption killed it.@Matt_Hougan says we're going higher in 2026.

Early profit takers will be left behind!!!

Full break down with @JSeyff and @Matt_Hougan in comments

pic.twitter.com/Ffn9penapN

— Kyle Chassé / DD

(@kyle_chasse) July 25, 2025

If Bitcoin breaks $123,000 and reaches, say, $150,000 or $500,000 in 2026, it would break the four-year cycle historically associated with the coin. Bitcoin prices, and thus, some of the best cryptos to buy, have loosely followed a four-year cycle driven by halving events for over a decade.

The Bitcoin network halves miner rewards approximately every four years, making the coin deflationary. The last halving was on April 20, 2024, reducing block rewards to 3.125 BTC.

The bitcoin halving will cut incoming supply by 50%.

You don't have to overthink it.

If demand is 10-20x more than supply, Economics 101 taught you that price has to go up to accommodate everyone.

Here is my segment with @cvpayne on Fox Business today. pic.twitter.com/qNvAO5Uk9E

— Anthony Pompliano

(@APompliano) March 11, 2024

This supply shock often drives prices upward, as seen in 2013, 2017, and 2021. Hougan believes this cycle is now obsolete due to structural shifts shaping Bitcoin prices.

Regulatory Clarity and Interest Rates to Drive Prices

Macroeconomic and regulatory developments are key drivers.

After Donald Trump’s election, he declared the United States the home of crypto and Bitcoin.

POMPLIANO: "The U.S. government will announce at some point that they are buying Bitcoin."

Bitcoin strategic reserve is imminent

pic.twitter.com/pzGvpMGkhB

— Bitcoin Archive (@BTC_Archive) July 28, 2025

The establishment of a Bitcoin reserve and the passing of the GENIUS Act, which provides a legal framework for stablecoins, signal regulatory clarity.

While not directly tied to Bitcoin, this benefits smart contract platforms like Ethereum and Solana and reduces the risk of crackdowns seen during Gary Gensler’s tenure.

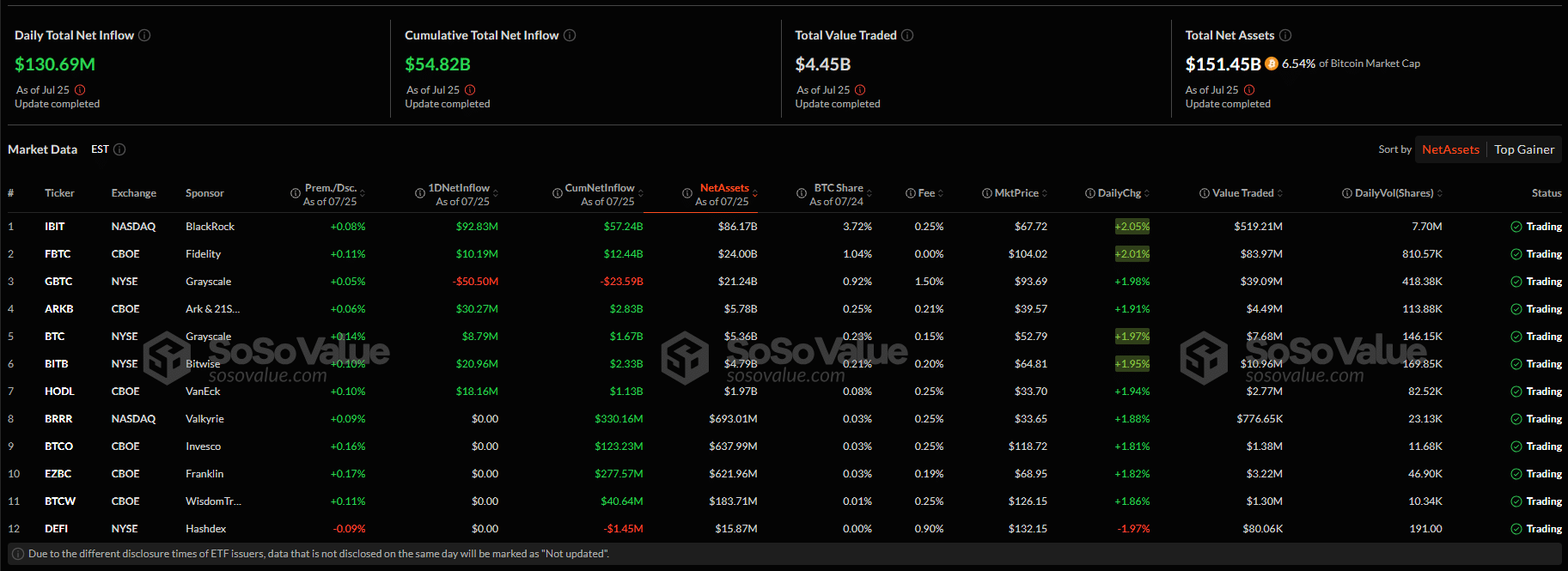

Due to regulatory clarity, institutions have invested over $151 billion in spot Bitcoin ETFs, with $130 million in BTC-backed ETF shares purchased on July 25, 2025.

(Source: SosoValue)

Additionally, President Trump is pushing for lower interest rates. Since April, Hougan notes, Trump has pressured Jerome Powell to cut rates, which could drive capital to Bitcoin and gold.

A low-interest-rate environment is typically “positive for crypto,” as seen in the 2020–2021 bull run when the Federal Reserve slashed rates to near zero to stimulate the economy. If rates are cut on July 30, 2025, Bitcoin prices could soar.

DISCOVER: 18 Next Crypto to Explode in 2025: Expert Cryptocurrency Predictions & Analysis

Bitwise CIO Matt Hougan Predicts a New Era for Bitcoin

Matt Hougan predicts a crypto and Bitcoin boom in 2026

Will Bitcoin break its four-year cycle?

Regulatory clarity boosts investor confidence

Federal Reserve likely to slash rates in July

The post Bitwise CIO Matt Hougan Predicts a New Era for Bitcoin, Forecasts 2026 Rally appeared first on 99Bitcoins.