Published on June 17th, 2025 by Bob Ciura

Dividends are a welcome sign for dividend investors.

And dividend growth is even more appreciated.

When a stock’s dividend per share is increased, shareholders get a boost to their passive income – without lifting a finger.

Longer streaks are preferred because they show a company can increase dividends over a wide range of economic and competitive environments. They show evidence of a durable competitive advantage.

It’s no small feat to boost a dividend year-after-year for decades at a time, through recessions, wars, and epidemics.

For this reason, we recommend investors take a closer look at quality dividend growth stocks such as the Dividend Champions, which have all increased their dividends for at least 25 consecutive years.

With this in mind, we created a downloadable list of over 130 Dividend Champions.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Investors are likely familiar with the Dividend Aristocrats, a group of 69 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

Meanwhile, investors should also familiarize themselves with the Dividend Champions, which have also raised their dividends for at least 25 years in a row.

At the same time, dividend growth plus a higher starting yield is the best combination income investors can ask for.

The following list represents the 10 Dividend Champions with the highest dividend yields.

Table of Contents

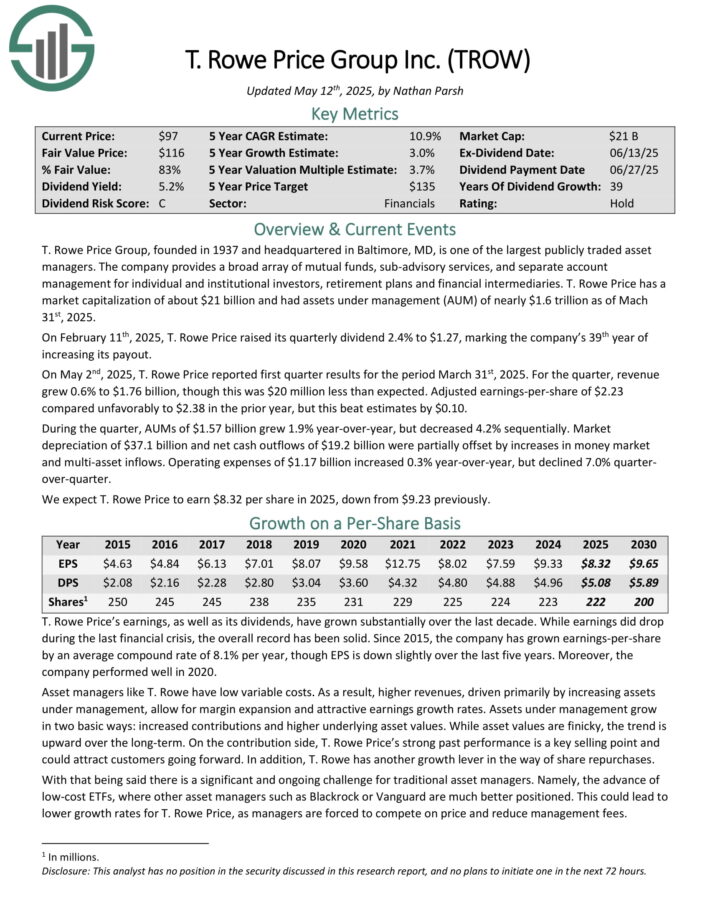

Highest Yielding Dividend Champion #10: T. Rowe Price Group (TROW)

T. Rowe Price Group, founded in 1937 and headquartered in Baltimore, MD, is one of the largest publicly traded asset managers. The company provides a broad array of mutual funds, sub-advisory services, and separate account management for individual and institutional investors, retirement plans and financial intermediaries.

T. Rowe Price had assets under management (AUM) of nearly $1.6 trillion as of March 31st, 2025.

On February 11th, 2025, T. Rowe Price raised its quarterly dividend 2.4% to $1.27, marking the company’s 39th year of increasing its payout.

On May 2nd, 2025, T. Rowe Price reported first quarter results for the period March 31st, 2025. For the quarter, revenue grew 0.6% to $1.76 billion, though this was $20 million less than expected. Adjusted earnings-per-share of $2.23 compared unfavorably to $2.38 in the prior year, but this beat estimates by $0.10.

During the quarter, AUMs of $1.57 billion grew 1.9% year-over-year, but decreased 4.2% sequentially. Market depreciation of $37.1 billion and net cash outflows of $19.2 billion were partially offset by increases in money market and multi-asset inflows.

Click here to download our most recent Sure Analysis report on TROW (preview of page 1 of 3 shown below):

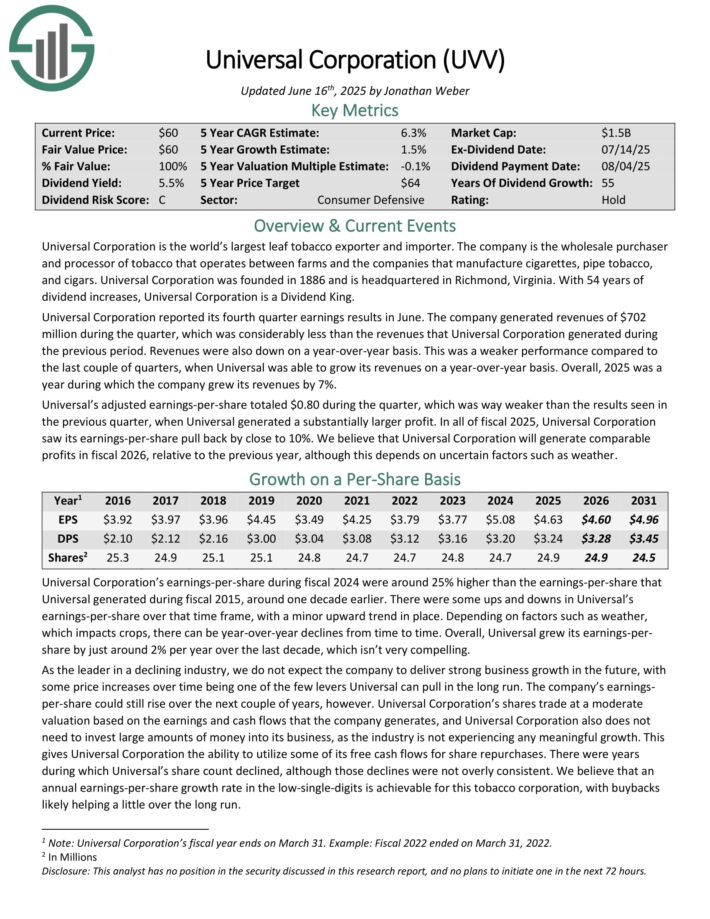

Highest Yielding Dividend Champion #9: Universal Corp. (UVV)

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates between farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. Universal Corporation was founded in 1886 and is headquartered in Richmond, Virginia.

With 54 years of dividend increases, Universal Corporation is a Dividend King.

Universal Corporation reported its fourth quarter earnings results in June. The company generated revenues of $702 million during the quarter, which was considerably less than the revenues that Universal Corporation generated during the previous period. Revenues were also down on a year-over-year basis.

This was a weaker performance compared to the last couple of quarters, when Universal was able to grow its revenues on a year-over-year basis. Overall, 2025 was a year during which the company grew its revenues by 7%.

Universal’s adjusted earnings-per-share totaled $0.80 during the quarter, which was way weaker than the results seen in the previous quarter, when Universal generated a substantially larger profit. In all of fiscal 2025, Universal Corporation saw its earnings-per-share pull back by close to 10%.

Click here to download our most recent Sure Analysis report on UVV (preview of page 1 of 3 shown below):

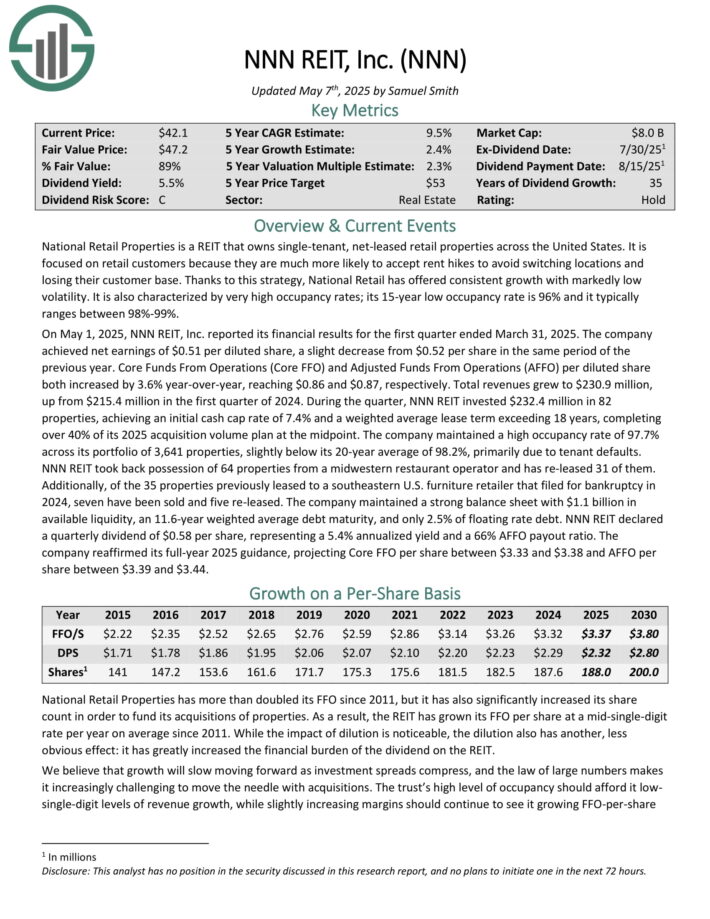

Highest Yielding Dividend Champion #8: NNN REIT Inc. (NNN)

National Retail Properties is a REIT that owns single-tenant, net-leased retail properties across the United States. It is focused on retail customers because they are much more likely to accept rent hikes to avoid switching locations and losing their customer base.

On May 1, 2025, NNN REIT, Inc. reported its financial results for the first quarter ended March 31, 2025. The company achieved net earnings of $0.51 per diluted share, a slight decrease from $0.52 per share in the same period of the previous year.

Core Funds From Operations (Core FFO) and Adjusted Funds From Operations (AFFO) per diluted share both increased by 3.6% year-over-year, reaching $0.86 and $0.87, respectively. Total revenues grew to $230.9 million, up from $215.4 million in the first quarter of 2024.

During the quarter, NNN REIT invested $232.4 million in 82 properties, achieving an initial cash cap rate of 7.4% and a weighted average lease term exceeding 18 years, completing over 40% of its 2025 acquisition volume plan at the midpoint.

The company maintained a high occupancy rate of 97.7% across its portfolio of 3,641 properties, slightly below its 20-year average of 98.2%, primarily due to tenant defaults.

Click here to download our most recent Sure Analysis report on NNN (preview of page 1 of 3 shown below):

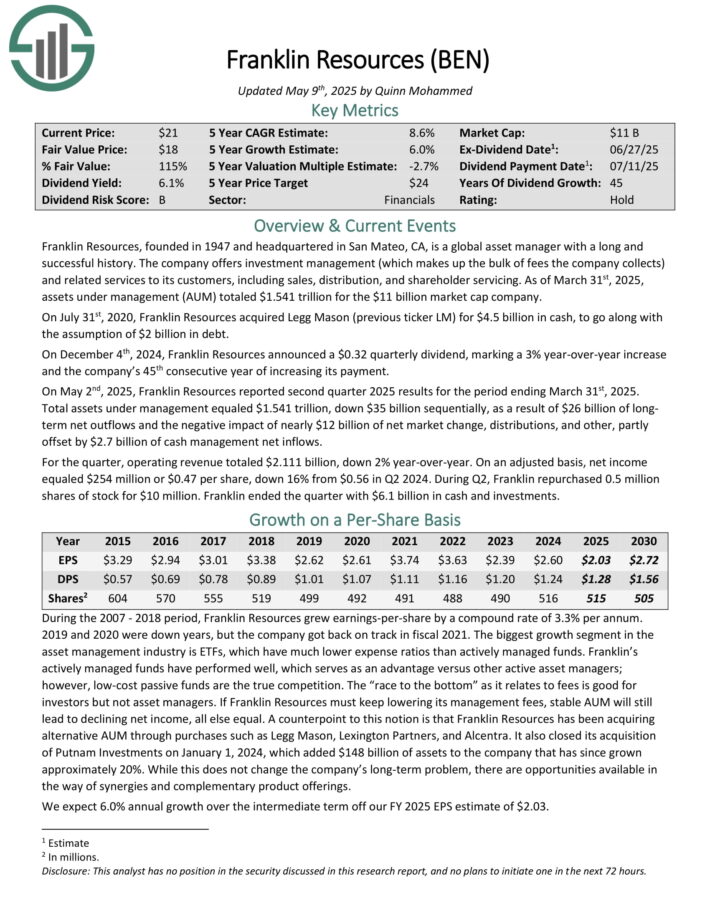

Highest Yielding Dividend Champion #7: Franklin Resources (BEN)

Franklin Resources, founded in 1947 and headquartered in San Mateo, CA, is a global asset manager with a long and successful history.

The company offers investment management (which makes up the bulk of fees the company collects) and related services to its customers, including sales, distribution, and shareholder servicing.

As of March 31st, 2025, assets under management (AUM) totaled $1.541 trillion.

On December 4th, 2024, Franklin Resources announced a $0.32 quarterly dividend, marking a 3% year-over-year increase and the company’s 45th consecutive year of increasing its payment.

On May 2nd, 2025, Franklin Resources reported second quarter 2025 results for the period ending March 31st, 2025. Total assets under management equaled $1.541 trillion, down $35 billion sequentially, as a result of $26 billion of long term net outflows and the negative impact of nearly $12 billion of net market change, distributions, and other, partly offset by $2.7 billion of cash management net inflows.

For the quarter, operating revenue totaled $2.111 billion, down 2% year-over-year. On an adjusted basis, net income equaled $254 million or $0.47 per share, down 16% from $0.56 in Q2 2024. During Q2, Franklin repurchased 0.5 million shares of stock for $10 million.

Click here to download our most recent Sure Analysis report on BEN (preview of page 1 of 3 shown below):

Highest Yielding Dividend Champion #6: Realty Income (O)

Realty Income is a retail real estate focused REIT that owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties. This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

Realty Income’s diversified portfolio comprises 15,627 commercial properties across eight countries, with 79.9% in retail, 14.4% in industrial, 3.2% in gaming, and 2.5% in other sectors. Geographically, 84.6% of annualized base rent originates from the United States, 12.6% from the United Kingdom, and 2.8% from continental Europe.

On May 5, 2025, Realty Income Corporation reported its financial results for the first quarter ended March 31, 2025. The company achieved total revenue of $1.38 billion, surpassing analyst expectations of $1.27 billion. Net income available to common stockholders was $249.8 million, or $0.28 per diluted share, compared to $129.7 million, or $0.16 per share, in the same period of the previous year.

Funds from Operations (FFO) per share increased to $1.05 from $0.94, while Adjusted Funds from Operations (AFFO) per share rose to $1.06 from $1.03, reflecting a 2.9% year-over-year growth.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

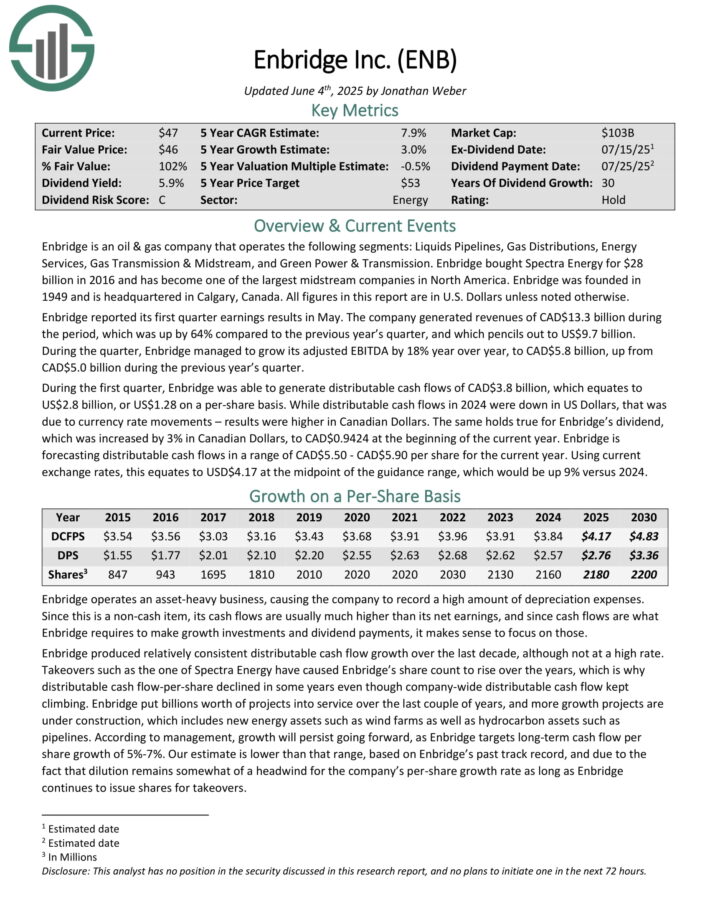

Highest Yielding Dividend Champion #5: Enbridge Inc. (ENB)

Enbridge is an oil & gas company that operates the following segments: Liquids Pipelines, Gas Distributions, Energy Services, Gas Transmission & Midstream, and Green Power & Transmission. Enbridge bought Spectra Energy for $28 billion in 2016 and has become one of the largest midstream companies in North America.

Enbridge was founded in 1949 and is headquartered in Calgary, Canada. All figures in this report are in U.S. Dollars unless noted otherwise.

Enbridge reported its first quarter earnings results in May. The company generated revenues of CAD$13.3 billion during the period, which was up by 64% compared to the previous year’s quarter, and which pencils out to US$9.7 billion.

During the quarter, Enbridge managed to grow its adjusted EBITDA by 18% year over year, to CAD$5.8 billion, up from CAD$5.0 billion during the previous year’s quarter. During the first quarter, Enbridge was able to generate distributable cash flows of CAD$3.8 billion, which equates to US$2.8 billion, or US$1.28 on a per-share basis.

Enbridge is forecasting distributable cash flows in a range of CAD$5.50 – CAD$5.90 per share for the current year.

Using current exchange rates, this equates to USD$4.17 at the midpoint of the guidance range, which would be up 9% versus 2024.

Click here to download our most recent Sure Analysis report on ENB (preview of page 1 of 3 shown below):

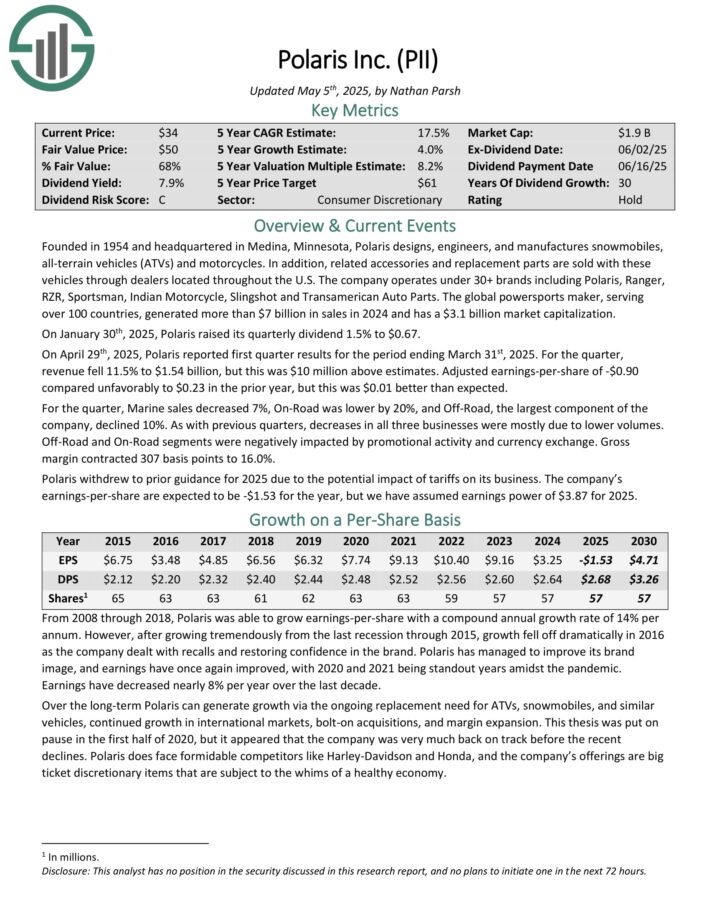

Highest Yielding Dividend Champion #4: Polaris Inc. (PII)

Polaris designs, engineers, and manufactures snowmobiles, all-terrain vehicles (ATVs) and motorcycles. In addition, related accessories and replacement parts are sold with these vehicles through dealers located throughout the U.S.

The company operates under 30+ brands including Polaris, Ranger, RZR, Sportsman, Indian Motorcycle, Slingshot and Transamerican Auto Parts. The global powersports maker, serving over 100 countries, generated more than $7 billion in sales in 2024.

On April 29th, 2025, Polaris reported first quarter results for the period ending March 31st, 2025. For the quarter, revenue fell 11.5% to $1.54 billion, but this was $10 million above estimates.

Adjusted earnings-per-share of -$0.90 compared unfavorably to $0.23 in the prior year, but this was $0.01 better than expected.

For the quarter, Marine sales decreased 7%, On-Road was lower by 20%, and Off-Road, the largest component of the company, declined 10%. As with previous quarters, decreases in all three businesses were mostly due to lower volumes.

Click here to download our most recent Sure Analysis report on PII (preview of page 1 of 3 shown below):

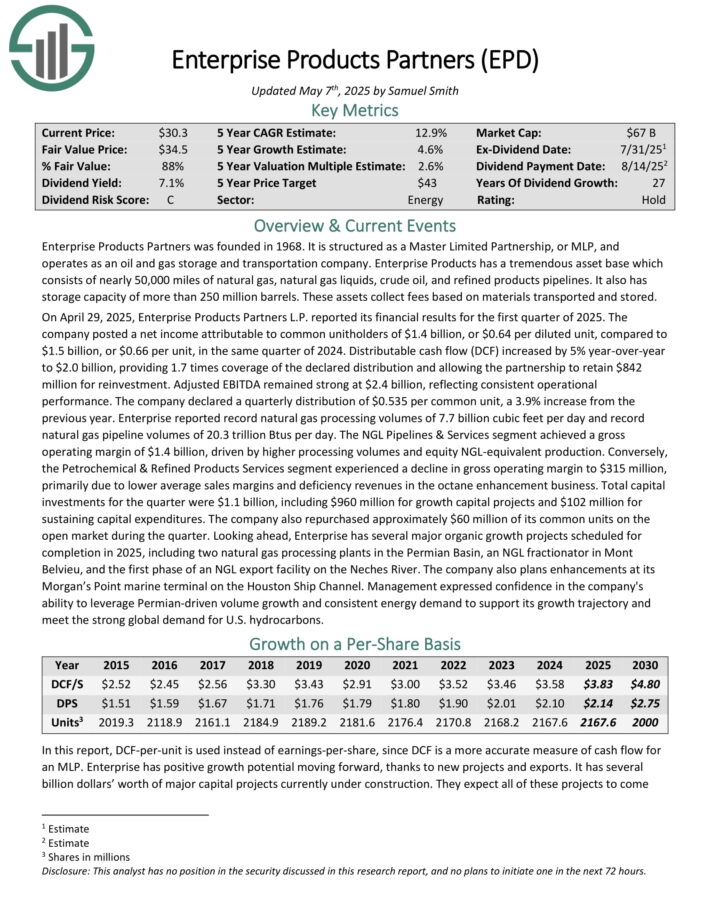

Highest Yielding Dividend Champion #3: Enterprise Products Partners LP (EPD)

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

On April 29, 2025, Enterprise Products Partners L.P. reported its financial results for the first quarter of 2025. The company posted a net income attributable to common unitholders of $1.4 billion, or $0.64 per diluted unit, compared to $1.5 billion, or $0.66 per unit, in the same quarter of 2024.

Distributable cash flow (DCF) increased by 5% year-over-year to $2.0 billion, providing 1.7 times coverage of the declared distribution and allowing the partnership to retain $842 million for reinvestment.

Adjusted EBITDA remained strong at $2.4 billion, reflecting consistent operational performance. The company declared a quarterly distribution of $0.535 per common unit, a 3.9% increase from the previous year.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

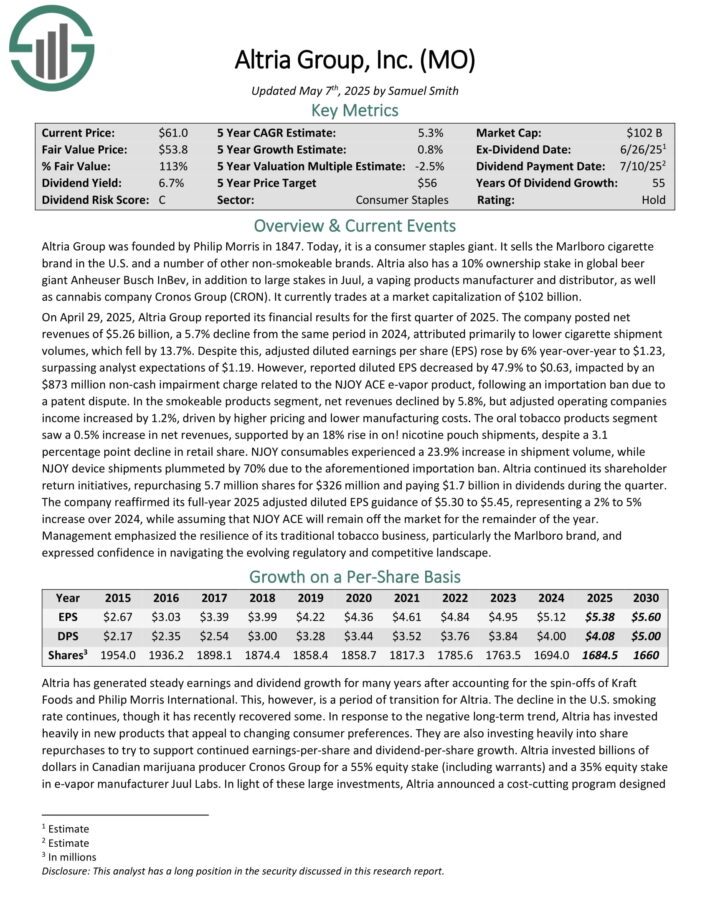

Highest Yielding Dividend Champion #2: Altria Group (MO)

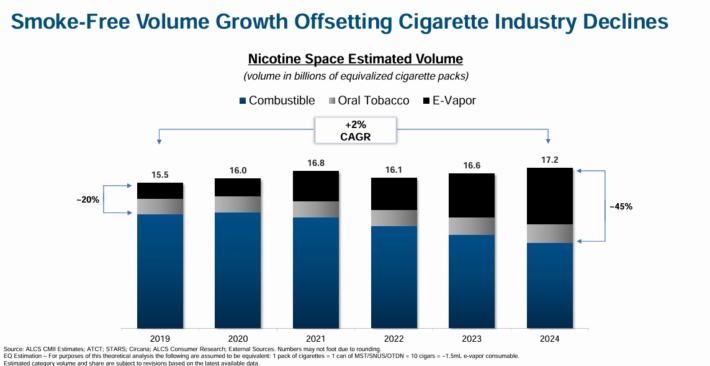

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

This is a period of transition for Altria. The decline in the U.S. smoking rate continues. In response, Altria has invested heavily in new products that appeal to changing consumer preferences, as the smoke-free category continues to grow.

Source: Investor Presentation

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the Canadian cannabis producer Cronos Group (CRON).

On April 29, 2025, Altria Group reported its financial results for the first quarter of 2025. The company posted net revenues of $5.26 billion, a 5.7% decline from the same period in 2024, attributed primarily to lower cigarette shipment volumes, which fell by 13.7%.

Despite this, adjusted diluted earnings per share (EPS) rose by 6% year-over-year to $1.23, surpassing analyst expectations of $1.19.

In the smokeable products segment, net revenues declined by 5.8%, but adjusted operating companies income increased by 1.2%, driven by higher pricing and lower manufacturing costs.

The oral tobacco products segment saw a 0.5% increase in net revenues, supported by an 18% rise in nicotine pouch shipments.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

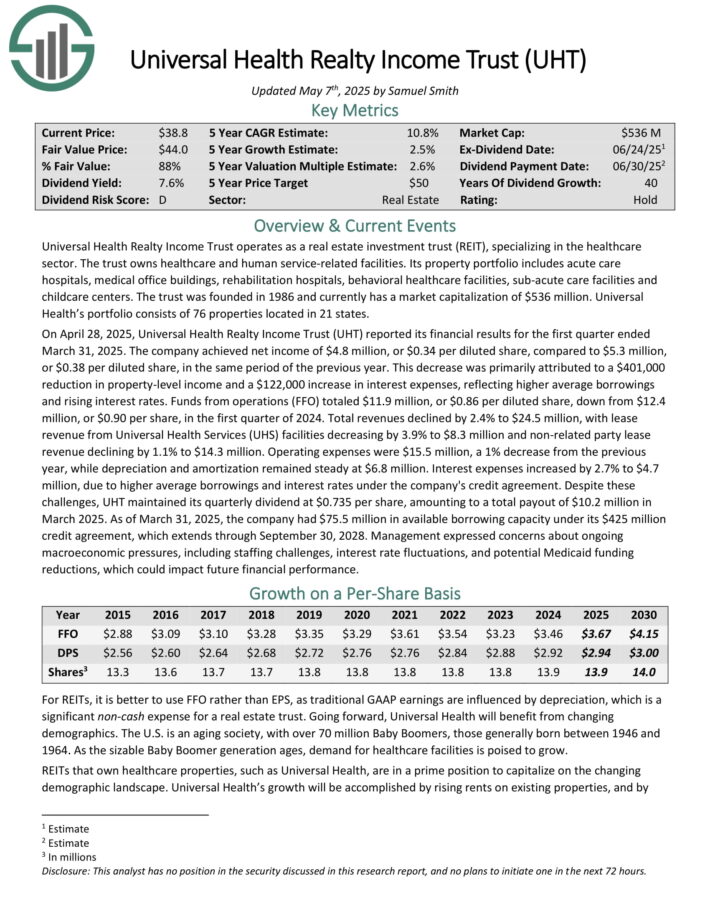

Highest Yielding Dividend Champion #1: Universal Health Realty Income Trust (UHT)

Universal Health Realty Income Trust operates as a real estate investment trust (REIT), specializing in the healthcare sector. The trust owns healthcare and human service-related facilities.

Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers.

Universal Health’s portfolio consists of 76 properties located in 21 states.

On April 28, 2025, Universal Health Realty Income Trust (UHT) reported its financial results for the first quarter ended March 31, 2025. The company achieved net income of $4.8 million, or $0.34 per diluted share, compared to $5.3 million, or $0.38 per diluted share, in the same period of the previous year.

This decrease was primarily attributed to a $401,000 reduction in property-level income and a $122,000 increase in interest expenses, reflecting higher average borrowings and rising interest rates.

Funds from operations (FFO) totaled $11.9 million, or $0.86 per diluted share, down from $12.4 million, or $0.90 per share, in the first quarter of 2024. Total revenues declined by 2.4%.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

Final Thoughts

High dividend stocks are naturally appealing to income investors, especially when the S&P 500 Index is only yielding roughly 1.3% on average.

Even better, these 10 Dividend Champions have also increased their dividends each year, for at least 25 consecutive years. In this way, they could provide strong income through the combination of dividend yield, and regular dividend increases.

Investors should continue to monitor each stock to make sure their fundamentals and growth remain on track, particularly among stocks with extremely high dividend yields.

Additional Reading

If you are interested in finding other high-yield securities, the following Sure Dividend resources may be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.