Published on May 27th, 2025 by Bob CiuraSpreadsheet data updated daily

Investors are likely familiar with the Dividend Aristocrats, a group of 69 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

Meanwhile, investors should also familiarize themselves with the Dividend Champions, which have also raised their dividends for at least 25 years in a row.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

However, even Dividend Champions can fall from grace. For example, Walgreens Boots Alliance (WBA) was removed from the Dividend Champions list in 2024.

The company slashed its dividend due to a pronounced business downturn in the brick-and-mortar pharmacy retail industry, amid elevated competitive threats from online pharmacies.

This was after Walgreens Boots Alliance had maintained a 40+ year streak of consecutive dividend increases.

While dividend cuts from Dividend Champions are unexpected, they have happened–and could happen again. To be clear, the following 5 Dividend Champions are not currently in jeopardy of cutting their dividends.

Their dividend payouts are supported with sufficient underlying earnings (for now). If their earnings remain stable or continue to grow, they have at least a decent change of continuing their dividend growth.

But, the 5 Dividend Champions below are facing fundamental challenges to varying degrees, which potentially threatens their dividend payouts.

This article will provide a detailed analysis on 5 Dividend Champions most in danger of a future dividend cut.

These 5 Dividend Champions have the lowest Dividend Risk Scores of ‘C’, ‘D’, or ‘F’ in the Sure Analysis Research Database, indicating weak dividend coverage.

Table of Contents

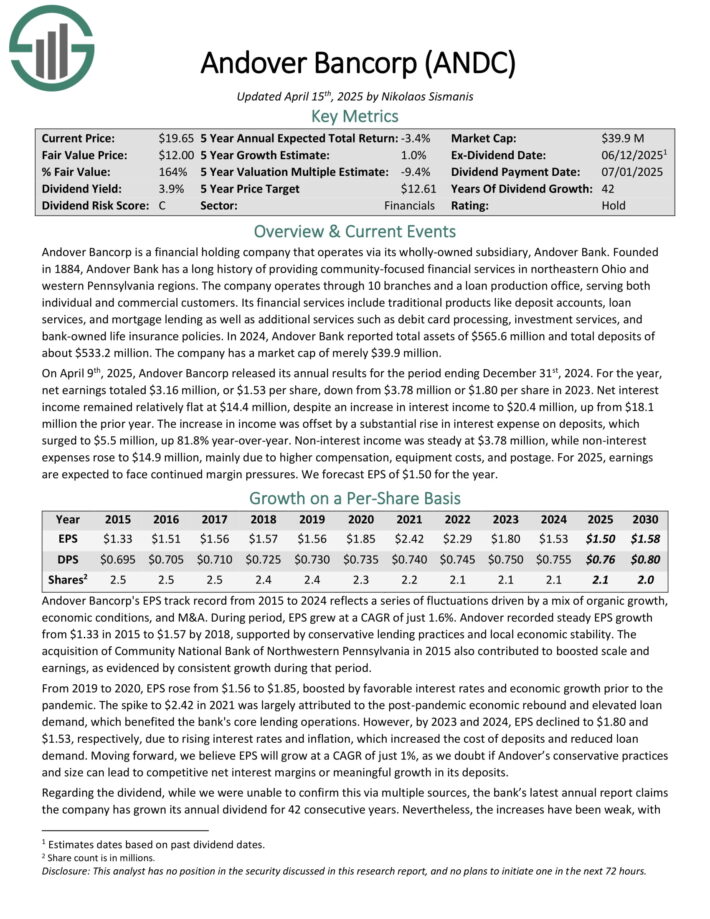

Red Flag Dividend Champion: Andover Bancorp (ANDC)

Andover Bancorp is a financial holding company that operates via its wholly-owned subsidiary, Andover Bank. Founded in 1884, Andover Bank has a long history of providing community-focused financial services in northeastern Ohio and western Pennsylvania regions.

The company operates through 10 branches and a loan production office, serving both individual and commercial customers.

Its financial services include traditional products like deposit accounts, loan services, and mortgage lending as well as additional services such as debit card processing, investment services, and bank-owned life insurance policies.

In 2024, Andover Bank reported total assets of $565.6 million and total deposits of about $533.2 million.

On April 9th, 2025, Andover Bancorp released its annual results for the period ending December 31st, 2024. For the year, net earnings totaled $3.16 million, or $1.53 per share, down from $3.78 million or $1.80 per share in 2023.

Net interest income remained relatively flat at $14.4 million, despite an increase in interest income to $20.4 million, up from $18.1 million the prior year.

The increase in income was offset by a substantial rise in interest expense on deposits, which surged to $5.5 million, up 81.8% year-over-year.

Click here to download our most recent Sure Analysis report on ANDC (preview of page 1 of 3 shown below):

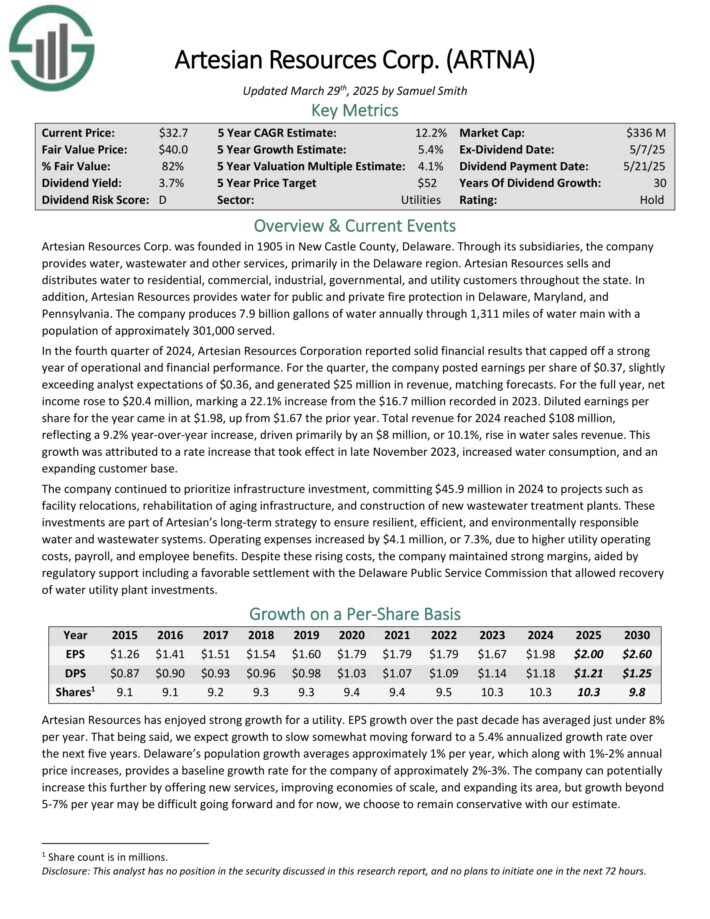

Red Flag Dividend Champion: Artesian Resources (ARTNA)

Artesian Resources Corp. was founded in 1905 in New Castle County, Delaware. Through its subsidiaries, the company provides water, wastewater and other services, primarily in the Delaware region.

Artesian Resources sells and distributes water to residential, commercial, industrial, governmental, and utility customers throughout the state.

In addition, Artesian Resources provides water for public and private fire protection in Delaware, Maryland, and Pennsylvania. The company produces 7.9 billion gallons of water annually through 1,311 miles of water main with a population of approximately 301,000 served.

In the fourth quarter of 2024, Artesian Resources Corporation reported earnings per share of $0.37, slightly exceeding analyst expectations of $0.36, and generated $25 million in revenue, matching forecasts.

Click here to download our most recent Sure Analysis report on ARTNA (preview of page 1 of 3 shown below):

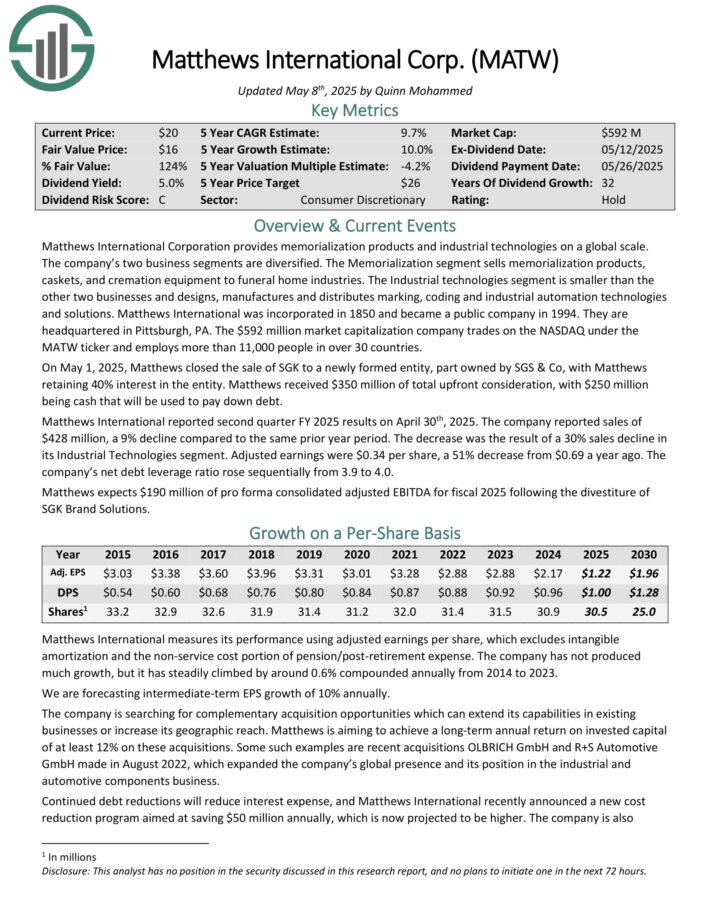

Red Flag Dividend Champion: Matthews International (MATW)

Matthews International Corporation provides brand solutions, memorialization products and industrial technologies on a global scale. The company’s three business segments are diversified.

The SGK Brand Solutions provides brand development services, printing equipment, creative design services, and embossing tools to the consumer-packaged goods and packaging industries.

The Memorialization segment sells memorialization products, caskets, and cremation equipment to funeral home industries.

The Industrial technologies segment is smaller than the other two businesses and designs, manufactures and distributes marking, coding and industrial automation technologies and solutions.

Matthews International reported second quarter FY 2025 results on April 30th, 2025. The company reported sales of $428 million, a 9% decline compared to the same prior year period. The decrease was the result of a 30% sales decline in its Industrial Technologies segment.

Adjusted earnings were $0.34 per share, a 51% decrease from $0.69 a year ago. The company’s net debt leverage ratio rose sequentially from 3.9 to 4.0.

Click here to download our most recent Sure Analysis report on MATW (preview of page 1 of 3 shown below):

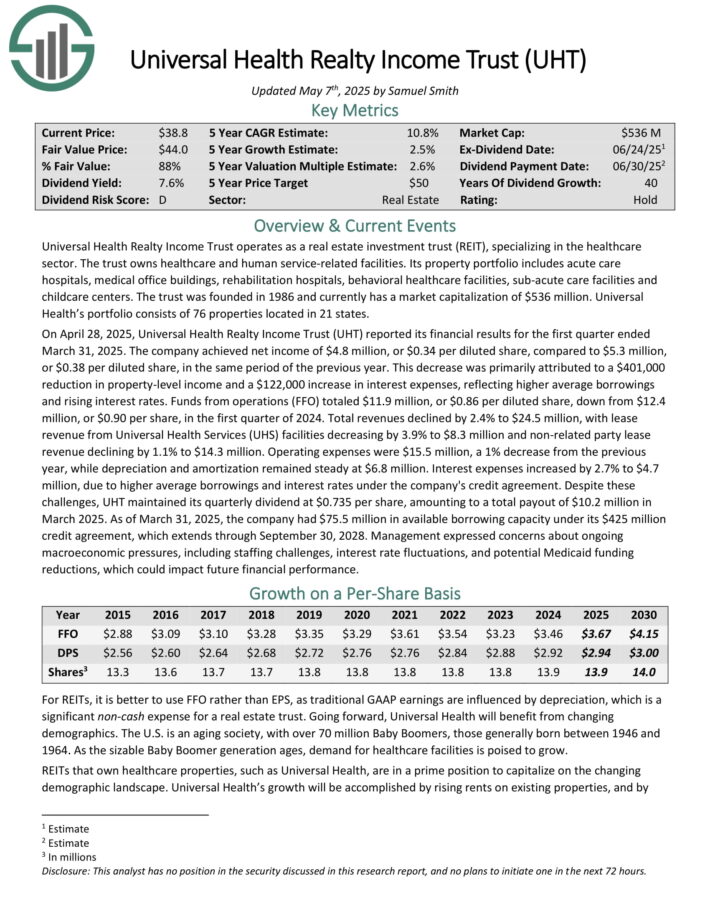

Red Flag Dividend Champion: Universal Health Realty Income Trust (UHT)

Universal Health Realty Income Trust operates as a real estate investment trust (REIT), specializing in the healthcare sector. The trust owns healthcare and human service-related facilities.

Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers.

Universal Health’s portfolio consists of 76 properties located in 21 states.

On April 28, 2025, Universal Health Realty Income Trust (UHT) reported its financial results for the first quarter ended March 31, 2025. The company achieved net income of $4.8 million, or $0.34 per diluted share, compared to $5.3 million, or $0.38 per diluted share, in the same period of the previous year.

This decrease was primarily attributed to a $401,000 reduction in property-level income and a $122,000 increase in interest expenses, reflecting higher average borrowings and rising interest rates.

Funds from operations (FFO) totaled $11.9 million, or $0.86 per diluted share, down from $12.4 million, or $0.90 per share, in the first quarter of 2024. Total revenues declined by 2.4%.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

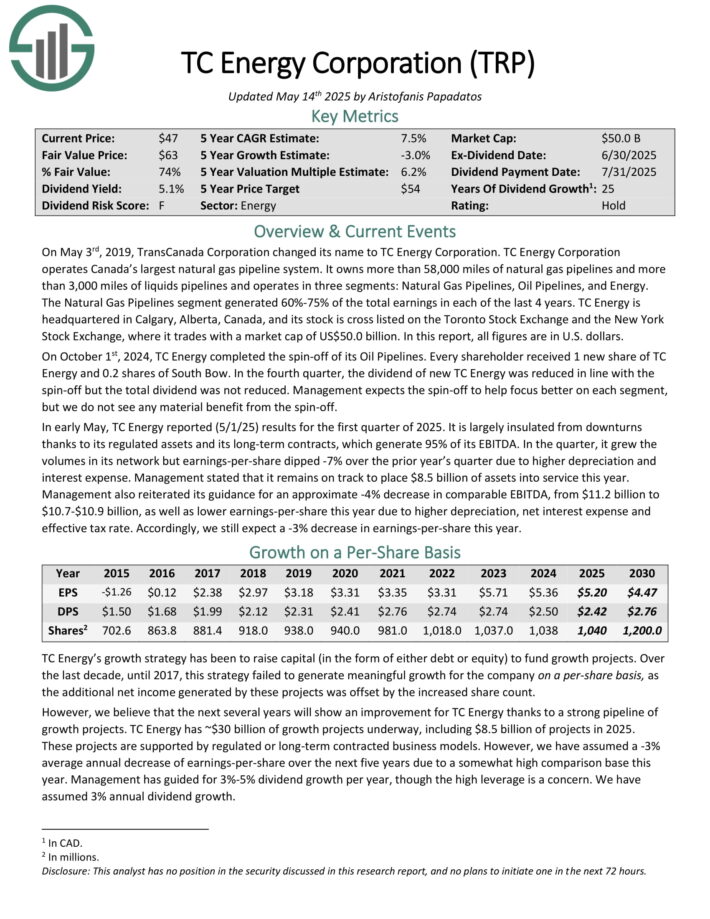

Red Flag Dividend Champion: TC Energy Corp. (TRP)

TC Energy Corporation operates Canada’s largest natural gas pipeline system. It owns more than 58,000 miles of natural gas pipelines and more than 3,000 miles of liquids pipelines and operates in three segments: Natural Gas Pipelines, Oil Pipelines, and Energy.

The Natural Gas Pipelines segment generated 60%-75% of the total earnings in each of the last 4 years. TC Energy is headquartered in Calgary, Alberta, Canada. In this report, all figures are in U.S. dollars.

In early May, TC Energy reported (5/1/25) results for the first quarter of 2025. It is largely insulated from downturns thanks to its regulated assets and its long-term contracts, which generate 95% of its EBITDA.

In the quarter, it grew the volumes in its network but earnings-per-share dipped -7% over the prior year’s quarter due to higher depreciation and interest expense.

Click here to download our most recent Sure Analysis report on TRP (preview of page 1 of 3 shown below):

Final Thoughts

The Dividend Champions have increased their dividends for at least 25 consecutive years.

And while most Dividend Champions will continue to raise their dividends each year, there could be some that end up cutting their payouts.

While it is rare, investors have seen multiple Dividend Champions cut their dividends over the past several years, including Walgreens Boots Alliance, 3M Company (MMM), V.F. Corp. (VFC), and AT&T Inc. (T).

For this reason, income investors should view the 5 red flag Dividend Champions in this article cautiously going forward.

Additional Reading

The following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.