Published on May 7th, 2025 by Bob Ciura

Value and income investors typically seek out dividend stocks that are trading below their intrinsic values.

There are many quality dividend stocks trading near their 52-week lows that are attractive, due to their low valuation multiples and high dividend yields.

However, dividend growth investors should not avoid quality dividend growth stocks just because their share prices have risen over the past year.

Indeed, there is good reason for investors to let their blue-chip winners run.

Blue-chip stocks are established, financially strong, and consistently profitable publicly traded companies.

This research report has the following resources to help you invest in blue chip stocks:

Many blue-chip dividend stocks are trading within near their 52-week highs, and yet, we expect them to continue performing well.

This article discusses the 10 best dividend stocks in the Sure Analysis Research Database currently trading within 10% of their 52-week highs.

These 10 dividend growth stocks have performed well in the past year, and we believe they still have room to run, due to a combination of expected earnings growth, valuation changes, and dividends.

The stocks are arranged by annual expected returns, in ascending order.

Table of Contents

The table of contents below allows for easy navigation.

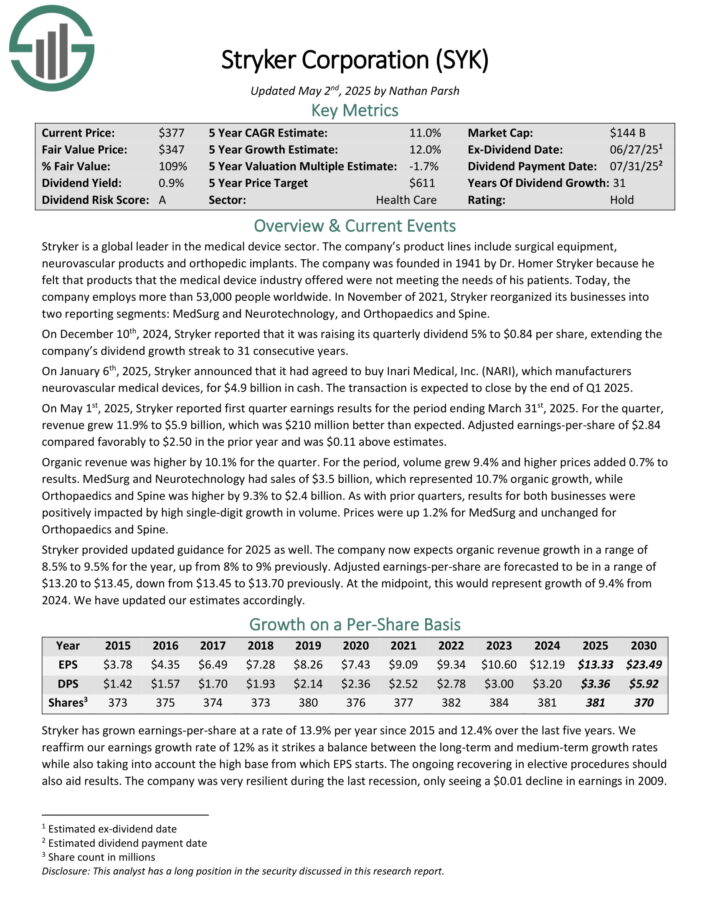

Dividend Stock Near 52-Week High #10: Stryker Corporation (SYK)

Expected Total Return: 10.9%

Stryker is a global leader in the medical device sector. The company’s product lines include surgical equipment, neurovascular products and orthopedic implants.

On December 10th, 2024, Stryker reported that it was raising its quarterly dividend 5% to $0.84 per share, extending the company’s dividend growth streak to 31 consecutive years.

On January 6th, 2025, Stryker announced that it had agreed to buy Inari Medical, Inc. (NARI), which manufacturersneurovascular medical devices, for $4.9 billion in cash. The transaction is expected to close by the end of Q1 2025.

On May 1st, 2025, Stryker reported first quarter earnings results for the period ending March 31st, 2025. For the quarter, revenue grew 11.9% to $5.9 billion, which was $210 million better than expected. Adjusted earnings-per-share of $2.84 compared favorably to $2.50 in the prior year and was $0.11 above estimates.

Organic revenue was higher by 10.1% for the quarter. For the period, volume grew 9.4% and higher prices added 0.7% to results. MedSurg and Neurotechnology had sales of $3.5 billion, which represented 10.7% organic growth, while Orthopaedics and Spine was higher by 9.3% to $2.4 billion.

Click here to download our most recent Sure Analysis report on SYK (preview of page 1 of 3 shown below):

Dividend Stock Near 52-Week High #9: Allstate Corporation (ALL)

Expected Total Return: 10.9%

Allstate Corporation is an insurance company that offers property and casualty insurance to its customers. The company also sells life, accident, and health insurance products.

Its segments include Allstate Protection, Service Businesses, Allstate Life, Allstate Benefits, Allstate Annuities, etc. Allstate’s insurance brands include Allstate, Encompass, and Esurance.

Allstate Corporation reported fourth quarter 2024 results on February 5th, 2025, for the period ending December 31st, 2024. The company reported consolidated revenues of $16.5 billion for the quarter, an 11.3% year-over-year increase, largely due to higher Property-Liability earned premium.

Property-Liability insurance premiums earned totaled $13.9 billion, up 10.6% from $12.6 billion in the same period a year ago. Adjusted net income per share of $7.67 was a 32% improvement from $5.82 a year ago.

Total policies in force increased 7.2% year-over-year, from 194.4 million to 208.3 million. The trailing twelve months adjusted net income return on common shareholder’s equity was 26.8%, 25.3 points higher than last year’s 1.5%. Book value per share rose by 22% year-over-year to $72.35.

Click here to download our most recent Sure Analysis report on ALL (preview of page 1 of 3 shown below):

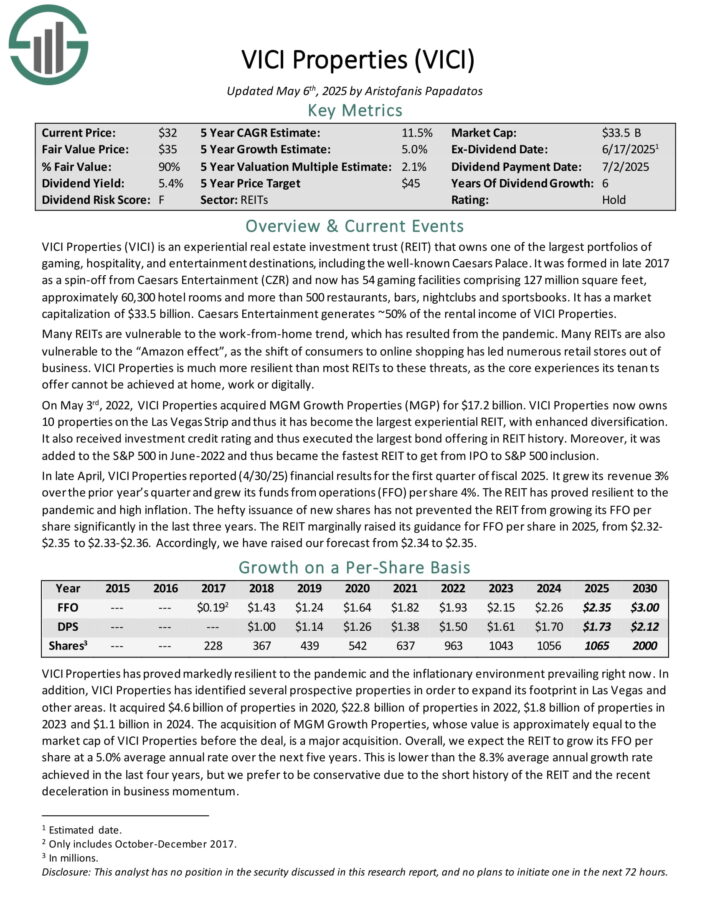

Dividend Stock Near 52-Week High #8: VICI Properties (VICI)

Expected Total Return: 11.6%

VICI Properties (VICI) is an experiential real estate investment trust (REIT) that owns one of the largest portfolios of gaming, hospitality, and entertainment destinations, including the well-known Caesars Palace.

It was formed in late 2017 as a spin-off from Caesars Entertainment (CZR) and now has 54 gaming facilities comprising 127 million square feet, approximately 60,300 hotel rooms and more than 500 restaurants, bars, nightclubs and sportsbooks.

In late April, VICI Properties reported (4/30/25) financial results for the first quarter of fiscal 2025. It grew its revenue 3% over the prior year’s quarter and grew its funds from operations (FFO) per share 4%. The REIT has proved resilient to the pandemic and high inflation.

The hefty issuance of new shares has not prevented the REIT from growing its FFO per share significantly in the last three years. The REIT marginally raised its guidance for FFO per share in 2025, from $2.32-$2.35 to $2.33-$2.36.

Click here to download our most recent Sure Analysis report on VICI (preview of page 1 of 3 shown below):

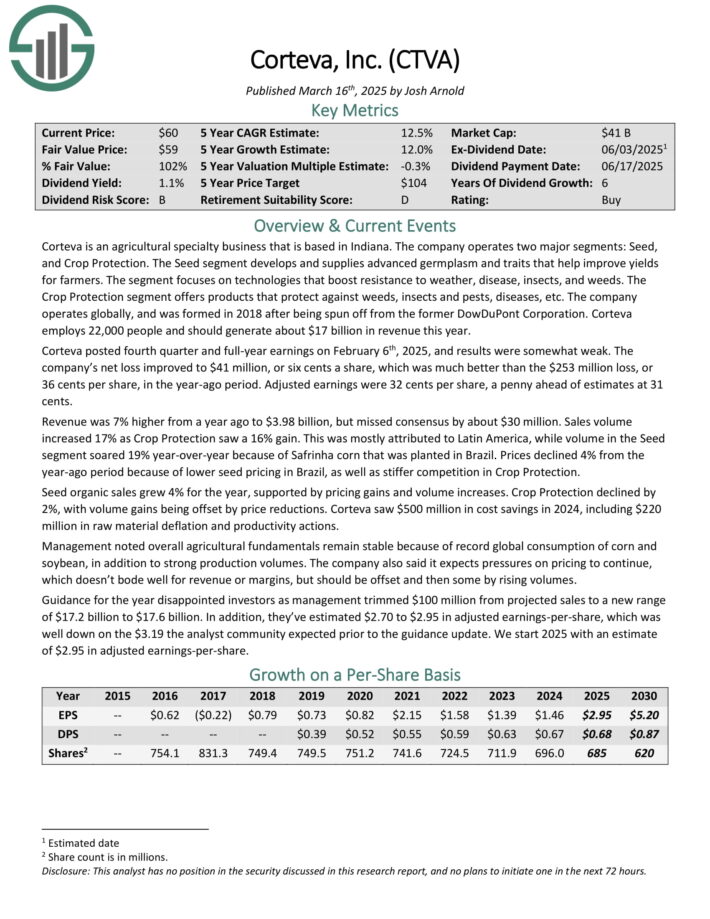

Dividend Stock Near 52-Week High #7: Corteva, Inc. (CTVA)

Expected Total Return: 11.6%

Corteva is an agricultural specialty business that is based in Indiana. The company operates two major segments: Seed, and Crop Protection.

The Seed segment develops and supplies advanced germplasm and traits that help improve yields for farmers. The segment focuses on technologies that boost resistance to weather, disease, insects, and weeds.

The Crop Protection segment offers products that protect against weeds, insects and pests, diseases, etc.

Corteva posted fourth quarter and full-year earnings on February 6th, 2025, and results were somewhat weak. The company’s net loss improved to $41 million, an improvement from the $253 million loss in the year-ago period.

Adjusted earnings were 32 cents per share, a penny ahead of estimates at 31 cents.

Revenue was 7% higher from a year ago to $3.98 billion, but missed consensus by about $30 million. Sales volume increased 17% as Crop Protection saw a 16% gain.

This was mostly attributed to Latin America, while volume in the Seed segment soared 19% year-over-year because of Safrinha corn that was planted in Brazil.

Click here to download our most recent Sure Analysis report on CTVA (preview of page 1 of 3 shown below):

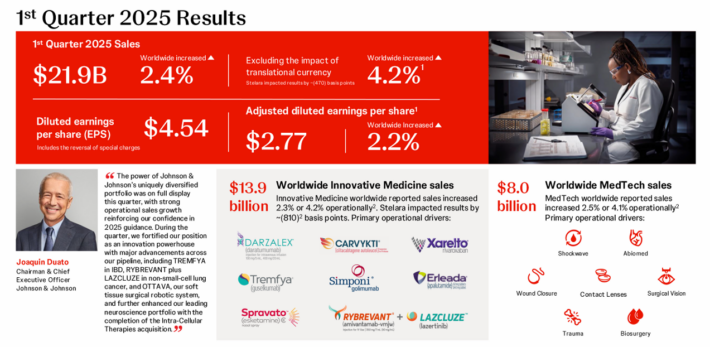

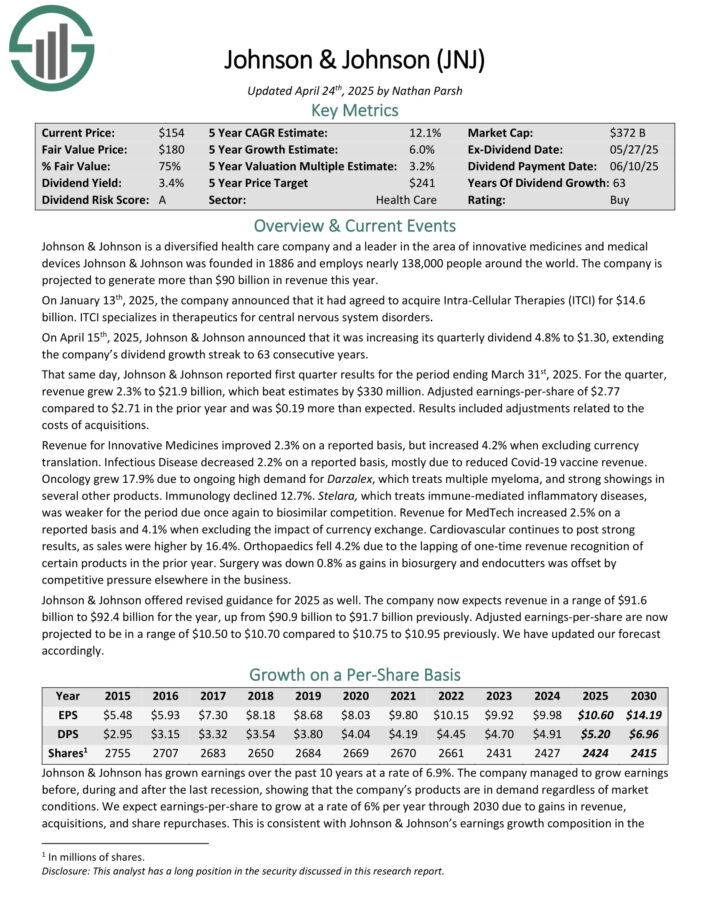

Dividend Stock Near 52-Week High #6: Johnson & Johnson (JNJ)

Expected Total Return: 11.9%

Johnson & Johnson is a diversified health care company and a leader in the area of innovative medicines and medical devices Johnson & Johnson was founded in 1886.

On April 15th, 2025, Johnson & Johnson announced that it was increasing its quarterly dividend 4.8% to $1.30, extending the company’s dividend growth streak to 63 consecutive years.

Source: Investor Presentation

That same day, Johnson & Johnson reported first quarter results for the period ending March 31st, 2025. For the quarter, revenue grew 2.3% to $21.9 billion, which beat estimates by $330 million.

Adjusted earnings-per-share of $2.77 compared to $2.71 in the prior year and was $0.19 more than expected. Results included adjustments related to the costs of acquisitions.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

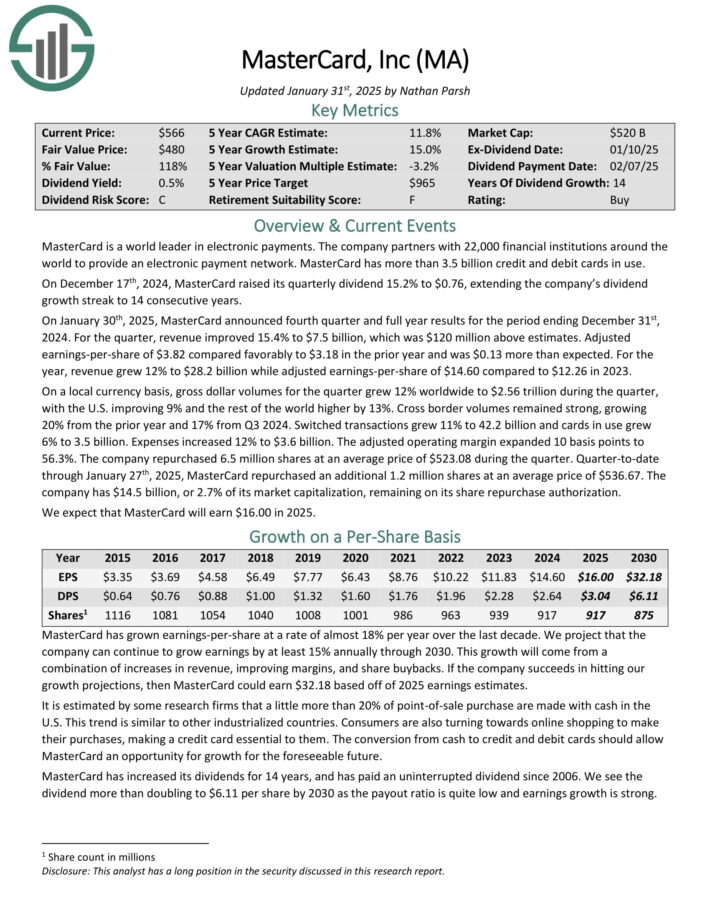

Dividend Stock Near 52-Week High #5: Mastercard Inc. (MA)

Expected Total Return: 12.0%

MasterCard is a world leader in electronic payments. The company partners with 25,000 financial institutions around the world to provide an electronic payment network. MasterCard has more than 3.1 billion credit and debit cards in use.

On January 30th, 2025, MasterCard announced fourth quarter and full year results for the period ending December 31st, 2024.

For the quarter, revenue improved 15.4% to $7.5 billion, which was $120 million above estimates. Adjusted earnings-per-share of $3.82 compared favorably to $3.18 in the prior year and was $0.13 more than expected.

For the year, revenue grew 12% to $28.2 billion while adjusted earnings-per-share of $14.60 compared to $12.26 in 2023.

On a local currency basis, gross dollar volumes for the quarter grew 12% worldwide to $2.56 trillion during the quarter, with the U.S. improving 9% and the rest of the world higher by 13%.

Cross border volumes remained strong, growing 20% from the prior year and 17% from Q3 2024.

Click here to download our most recent Sure Analysis report on Mastercard (preview of page 1 of 3 shown below):

Dividend Stock Near 52-Week High #4: Bank of New York Mellon (BK)

Expected Total Return: 12.2%

Bank of New York Mellon is present in 35 countries around the world and acts as more of an investment manager than a traditional bank.

Indeed, BNY Mellon’s stated goal is to help its customers manage their assets throughout the investment lifecycle. As such, BNY Mellon’s revenue is mostly derived from fees, not traditional interest income.

BNY Mellon posted first quarter earnings on April 11th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $1.58, which was nine cents ahead of estimates. Revenue was up 5.7% year-over-year to $4.79 billion, beating estimates by $20 million.

Fee revenue was up 3%, primarily reflecting net new business and higher market values, which was partially offset by the mix of assets under management flows. Investment and other revenue primarily reflect an asset disposal gain that was recorded.

Net interest income rose 11% year-over-year, primarily reflecting the reinvestment of maturing investment securities at higher yields, which was partially offset by changes in deposit mix. Assets under custody and administration rose 9%, reflecting inflows and higher market values.

Click here to download our most recent Sure Analysis report on BK (preview of page 1 of 3 shown below):

Dividend Stock Near 52-Week High #3: S&P Global (SPGI)

Expected Total Return: 12.5%

S&P Global is a worldwide provider of financial services and business information and revenue of over $13 billion.

Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 51 consecutive years.

S&P posted fourth quarter and full-year earnings on February 11th, 2025, and results were much better than expected on both the top and bottom lines.

Adjusted earnings-per-share came to $3.77, which was a staggering 30 cents ahead of estimates. Earnings rose from $3.13 a year ago.

Revenue was up 14% year-over-year to $3.59 billion, beating estimates by $90 million. The company posted revenue growth in all of its operating segments, in addition to strong operating margin expansion.

Operating expenses rose slightly from $2.26 billion to $2.33 billion year-over-year. That led to operating profit of $1.68 billion, sharply higher from $1.39 billion a year ago.

With dividend growth above 10%, SPGI is one of the rock solid dividend stocks.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

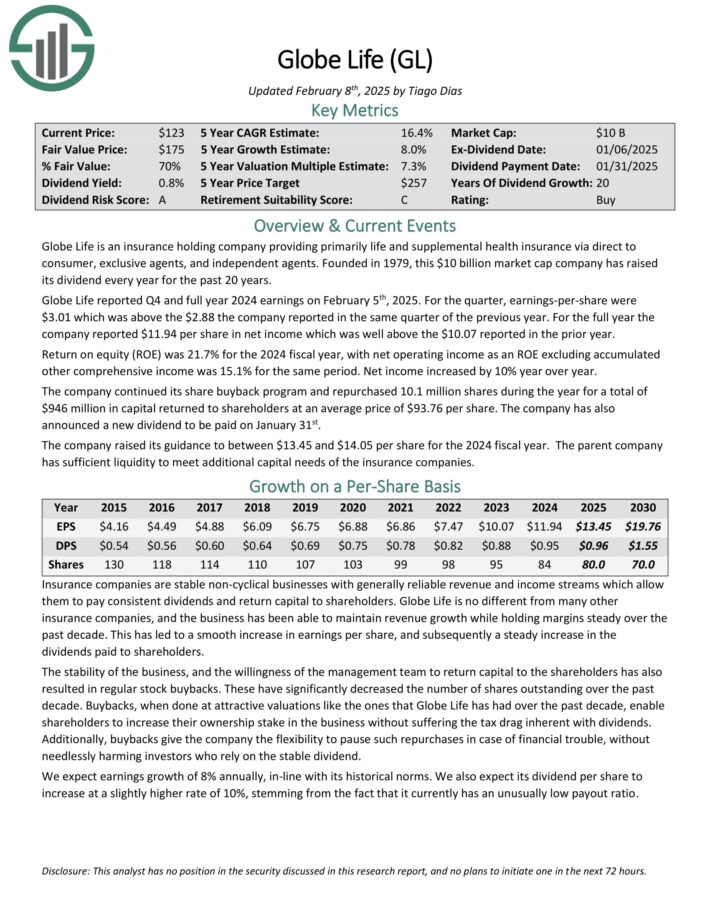

Dividend Stock Near 52-Week High #2: Globe Life (GL)

Expected Total Return: 17.0%

Globe Life is an insurance holding company providing primarily life and supplemental health insurance via direct to consumer, exclusive agents, and independent agents.

Founded in 1979, the company has raised its dividend every year for the past 20 years.

Globe Life reported Q4 and full year 2024 earnings on February 5th, 2025. For the quarter, earnings-per-share were $3.01 which was above the $2.88 the company reported in the same quarter of the previous year. For the full year the company reported $11.94 per share in net income which was well above the $10.07 reported in the prior year.

Return on equity (ROE) was 21.7% for the 2024 fiscal year, with net operating income as an ROE excluding accumulated other comprehensive income was 15.1% for the same period. Net income increased by 10% year over year.

The company continued its share buyback program and repurchased 10.1 million shares during the year for a total of $946 million in capital returned to shareholders at an average price of $93.76 per share.

Click here to download our most recent Sure Analysis report on GL (preview of page 1 of 3 shown below):

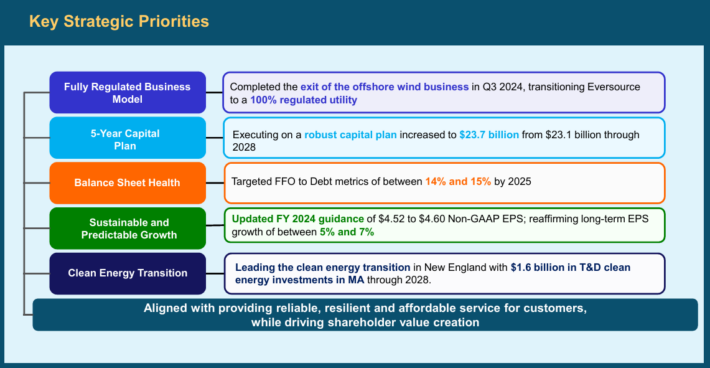

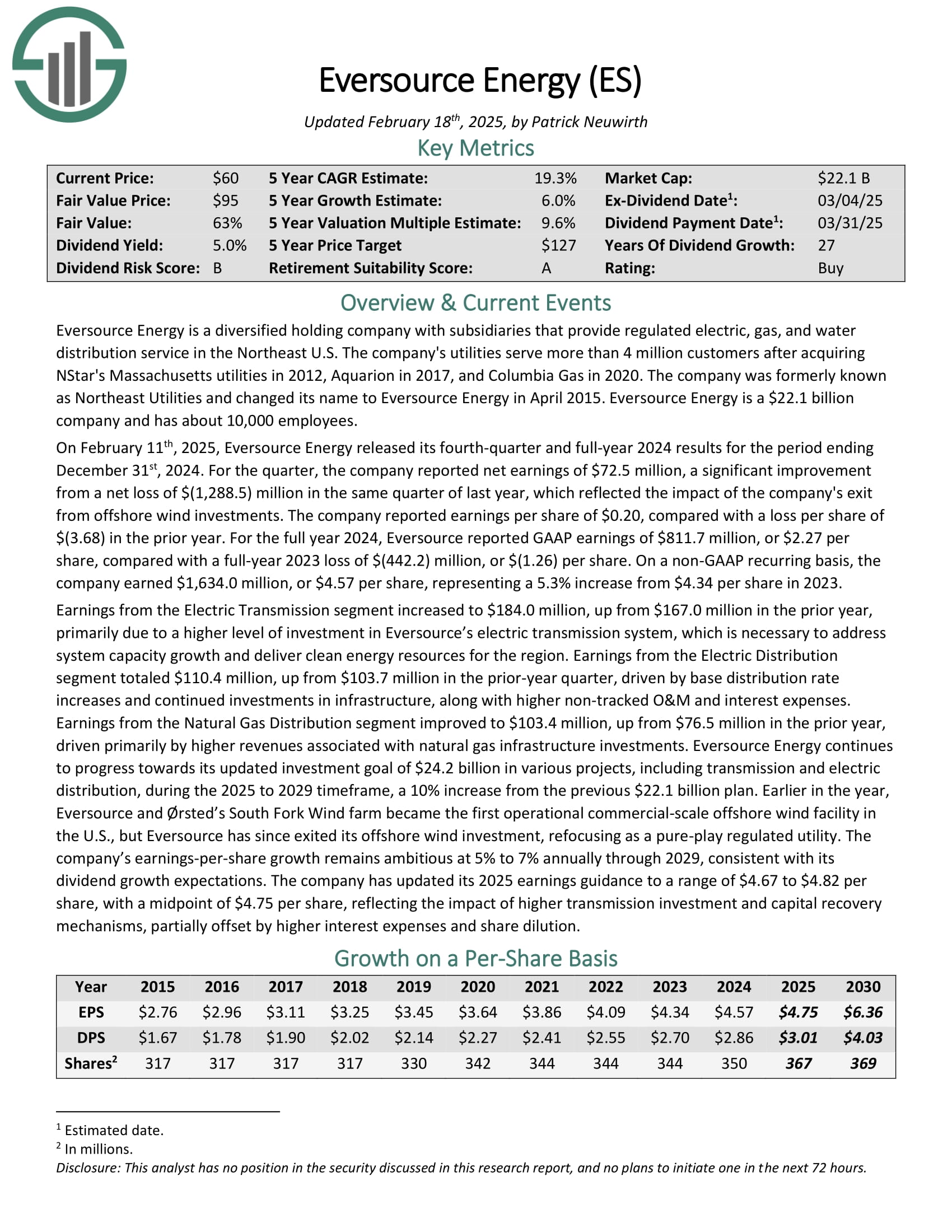

Dividend Stock Near 52-Week High #1: Eversource Energy (ES)

Expected Total Return: 19.6%

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S.

FactSet, Erie Indemnity, and Eversource Energy are the three new Dividend Aristocrats for 2025.

The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

Eversource has delivered steady growth to shareholders for many years.

Source: Investor Presentation

On February 11th, 2025, Eversource Energy released its fourth-quarter and full-year 2024 results. For the quarter, the company reported net earnings of $72.5 million, a significant improvement from a net loss of $(1,288.5) million in the same quarter of last year, which reflected the impact of the company’s exit from offshore wind investments.

The company reported earnings per share of $0.20, compared with a loss per share of $(3.68) in the prior year. For the full year 2024, Eversource reported GAAP earnings of $811.7 million, or $2.27 per share, compared with a full-year 2023 loss of $(442.2) million, or $(1.26) per share.

On a non-GAAP recurring basis, the company earned $1,634.0 million, or $4.57 per share, representing a 5.3% increase from 2023.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

Other Blue Chip Stock Resources

The resources below will give you a better understanding of dividend growth investing:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.