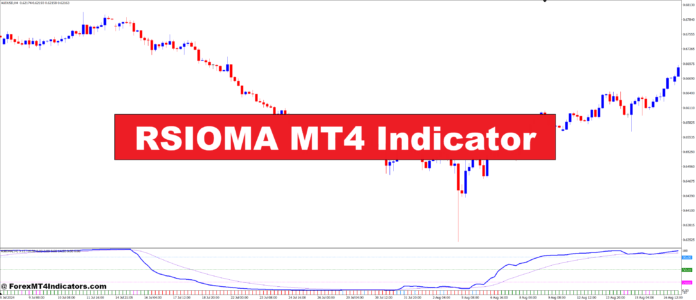

The RSIOMA MT4 Indicator is a powerful tool designed for traders using the MetaTrader 4 (MT4) platform. It combines the Relative Strength Index (RSI) with the Oscillator of Moving Average (OMA) to give traders a comprehensive understanding of market conditions. The RSI helps to identify whether an asset is overbought or oversold, while the OMA smooths out price data, revealing underlying trends more clearly. By merging these two indicators, the RSIOMA creates a more accurate and reliable tool for tracking price momentum. This combination allows traders to make more informed decisions when entering or exiting trades.

How the RSIOMA Indicator Helps Traders

One of the main challenges traders face is dealing with conflicting signals from various indicators. Traditional indicators often produce unclear or unreliable data, making it difficult to identify the right moments to act. The RSIOMA MT4 Indicator addresses this issue by filtering out noise and providing a much clearer signal. Since it combines the strength of the RSI and OMA, it helps eliminate false signals, allowing traders to focus on trends that matter. This makes the RSIOMA a more reliable tool for spotting entry and exit points in real time, which is crucial for improving trading outcomes.

Versatility of the RSIOMA MT4 Indicator

The RSIOMA MT4 Indicator is versatile and adaptable to different trading styles. Whether you’re a short-term day trader or a long-term investor, this indicator can work with various strategies. For short-term traders, the RSIOMA can highlight quick trend shifts, allowing them to act on short-term price movements. Meanwhile, long-term traders can use the indicator to identify larger, more significant market trends. This adaptability makes the RSIOMA useful for traders of all experience levels, from beginners to professionals. By offering insights into both short-term and long-term market conditions, it can serve as a valuable addition to any trader’s toolkit.

Maximizing the Potential of the RSIOMA Indicator

While the RSIOMA MT4 Indicator is powerful on its own, it’s most effective when used alongside other technical analysis tools. For example, combining it with trend lines, support and resistance levels, or moving averages can help confirm signals and improve the accuracy of trading decisions. By using the RSIOMA in combination with other indicators, traders can ensure that they are not relying on just one source of information. This multi-tool approach increases the chances of making successful trades and minimizes the risk of relying on faulty signals.

How to Trade with RSIOMA MT4 Indicator

Buy Entry

RSI Below 30: The market is oversold, suggesting a potential reversal to the upside.

OMA Uptrend Confirmation: The OMA line should be moving upwards, confirming an overall bullish trend.

RSIOMA Combined Signal: Look for both the RSI below 30 (oversold) and OMA indicating an upward trend to confirm a strong buy signal.

Price Action: Ensure price action shows signs of reversal or consolidation before entering a buy trade.

Sell Entry

RSI Above 70: The market is overbought, suggesting a potential reversal to the downside.

OMA Downtrend Confirmation: The OMA line should be moving downward, confirming an overall bearish trend.

RSIOMA Combined Signal: Look for both the RSI above 70 (overbought) and OMA indicating a downward trend to confirm a strong sell signal.

Price Action: Ensure price action shows signs of reversal or consolidation before entering a sell trade.

Conclusion

The RSIOMA MT4 Indicator is an invaluable tool for traders looking to make smarter, more informed decisions in the forex market. By combining the benefits of the RSI and OMA, it offers a clearer understanding of market conditions, helping traders spot overbought and oversold conditions with greater ease. Whether you’re new to trading or an experienced professional, incorporating this indicator into your strategy could significantly improve your trading results. By reducing uncertainty and enhancing your ability to track market trends, the RSIOMA can play a key role in boosting your trading success.

Recommended MT4/MT5 Broker

XM Broker

Free $50 To Start Trading Instantly! (Withdraw-able Profit)

Deposit Bonus up to $5,000

Unlimited Loyalty Program

Award Winning Forex Broker

Additional Exclusive Bonuses Throughout The Year

Exclusive 50% Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 50% Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

(Free MT4 Indicators Download)