Are you having hassle making constant income in foreign exchange? The market’s ups and downs can eat away at your cash. With every day trades value $7.5 trillion, the dangers are enormous. However, there’s hope! Good danger administration can defend your cash and enable you make extra in the long term.

Key Takeaways

Foreign exchange market every day buying and selling quantity: $7.5 trillion.

Advisable danger per commerce: 2% of buying and selling capital.

Leverage may be as excessive as 100:1.

Goal for a risk-to-reward ratio of at the very least 1:2.

Decrease leverage usually results in increased profitability.

Emotional management is essential for regular buying and selling.

Preserve a buying and selling journal to enhance your methods.

Understanding the Fundamentals of Foreign exchange Buying and selling

The foreign exchange market is big, with $6.6 trillion traded every day. It’s open 24/7, 5 days every week. Figuring out the fundamentals is essential for brand spanking new merchants.

The World Foreign exchange Market Construction

The foreign exchange market is just not managed by one place. This implies offers are made immediately between folks. It’s stuffed with liquidity and honest costs. Banks, firms, and merchants all play an element.

Forms of Foreign exchange Markets

There are three major kinds of foreign exchange markets:

Spot Market: Speedy change of currencies at present market charges

Ahead Market: Agreements to purchase or promote currencies at a future date

Futures Market: Standardized contracts for future foreign money transactions

Primary Foreign money Pair Mechanics

Foreign money pair buying and selling is on the coronary heart of foreign exchange. Every pair has a base and a quote foreign money. For instance, EUR/USD has EUR as the bottom and USD because the quote.

Costs transfer in pips. One pip is 0.0001 of the quoted value.

Foreign money Pair

Each day Buying and selling Quantity

Market Share

EUR/USD

$1.6 trillion

24%

USD/JPY

$1.1 trillion

17%

GBP/USD

$844 billion

13%

Studying these fundamentals is step one to buying and selling properly. It helps in making good methods and managing dangers.

Threat Administration for Lengthy-Time period Foreign exchange Merchants

Lengthy-term foreign currency trading has its personal set of challenges. Merchants face dangers throughout in a single day and weekend hours. In addition they take care of long-term financial traits and handle capital over time. It’s very important to have good danger administration strategies to succeed.

Diversification is a key technique. Buying and selling in a number of foreign money pairs can reduce the influence of unhealthy actions in a single foreign money. This spreads danger, making your portfolio extra secure.

Place sizing can be necessary. It’s sensible to danger just one% to three% of your complete account per commerce. This retains your capital protected throughout market ups and downs.

The chance-to-reward ratio is one other key issue. A 1:2 ratio is widespread, the place you danger one unit to achieve two. Some goal for a 1:3 ratio, balancing losses with larger features whenever you win.

Cease-loss orders are important for long-term merchants. They shut trades at set ranges, limiting losses. Trailing stops are nice for letting income develop whereas conserving features protected.

Leverage must be used rigorously. Decrease ratios like 10:1 or 20:1 are higher for cautious merchants. This reduces the danger of huge losses whereas conserving revenue probabilities open.

It’s necessary to repeatedly evaluate and alter your danger administration methods. Markets change, and profitable merchants adapt. This retains a steadiness between danger and reward within the ever-changing foreign exchange market.

Place Sizing and Capital Allocation

Studying about foreign exchange place sizing and capital allocation is essential to success. These strategies assist merchants handle danger and hold their capital protected over time.

Figuring out Optimum Place Sizes

Discovering the fitting place measurement is necessary in foreign currency trading. Most merchants danger not more than 2% of their capital on one commerce. For instance, with a $25,000 account, the danger per commerce is a most of $500.

The two% Rule in Foreign exchange Buying and selling

The two% rule is a well known foreign exchange place sizing technique. It limits losses and permits for regular development. If a dealer loses 10 instances in a row, risking 2% every time, they lose solely 20% of their capital.

Account Steadiness Administration

Managing your account steadiness properly is important for achievement. As your account grows, so does your place measurement. For example, in case your capital goes from $10,000 to $20,000, your danger per commerce doubles from $100 to $200.

To determine place measurement, use this system: Pips risked * pip worth * heaps traded = Greenback quantity risked. For a $10,000 account risking 1% with a 50-pip cease loss, the fitting place measurement is 2 mini heaps. This implies a $20,000 notional worth.

Through the use of these capital allocation methods, merchants can enormously scale back the danger of shedding some huge cash on one commerce. This helps them keep within the foreign exchange market for a very long time.

Leverage and Margin Administration

Foreign currency trading lets merchants management huge positions with a small deposit. The market sees over $5 trillion in every day trades. It’s a fantastic place for leveraged buying and selling. Figuring out about foreign exchange leverage dangers is essential to success.

Leverage in foreign exchange may be as much as 500:1, a lot increased than 2:1 in shares. For instance, with 100:1 leverage, a $1,000 deposit can handle a $100,000 place. This implies huge wins and losses. A 1% value change on a $100,000 place could possibly be a $1,000 acquire or loss, the identical because the deposit.

Good margin administration is necessary to keep away from dangers. Margin is the cash wanted to begin and hold a leveraged commerce. For instance, a 1% margin means $1,000 is required for a $100,000 commerce. It’s necessary to look at margin ranges to keep away from margin calls, which may pressure you to promote your positions.

Margin Requirement

Leverage Ratio

Place Measurement

2%

50:1

$50,000

1%

100:1

$100,000

0.5%

200:1

$200,000

Begin with low leverage, like 1:5 or 1:10, in the event you’re new. As you get higher, you should utilize extra leverage. However keep in mind, excessive leverage can result in huge wins and losses. Sensible danger administration is crucial for achievement in foreign currency trading.

Cease Loss Methods for Lengthy-Time period Success

Foreign exchange stop-loss methods are key for long-term merchants. They defend investments and hold feelings in test within the risky foreign exchange market. Let’s have a look at some methods to maintain your buying and selling capital protected.

Forms of Cease Loss Orders

Primary cease losses are the most typical. They let merchants set a selected exit value. Assured stops guarantee execution on the set value, even with market gaps. Trailing stops in foreign exchange strikes with the market, locking in income because the commerce strikes favorably.

Calculating Cease Loss Ranges

Setting the fitting stop-loss ranges is essential. Many merchants observe the one-percent rule, risking not more than 1% of their account on a single commerce. For a $10,000 account, this implies a most lack of $100 per commerce. Cease losses must be set at the very least 1.5 instances the present high-to-low vary to keep away from untimely execution.

Trailing Cease Methods

Trailing stops are nice for long-term foreign exchange merchants. They are often primarily based on a hard and fast pip quantity or a share of the present value. Some merchants use transferring averages, such because the 20-day or 50-day, to regulate their trailing stops. This method permits income to run whereas defending features if the market reverses.

Cease Loss Kind

Description

Finest Use

Primary Cease

Fastened exit value

Quick-term trades

Assured Cease

Execution at a set value

Excessive volatility durations

Trailing Cease

Strikes with market

Lengthy-term pattern following

Efficient use of stop-loss methods can enormously enhance your long-term success in foreign currency trading. All the time take into consideration your danger tolerance and market circumstances when utilizing these strategies.

Threat-to-Reward Ratios in Foreign exchange Buying and selling

Foreign exchange risk-reward ratio is essential for long-term success. It’s about balancing revenue and loss in trades. Good merchants search for ratios the place revenue is greater than loss.

Setting Optimum Threat-Reward Targets

A very good foreign exchange risk-reward ratio is 1:2 or increased. This implies you need to make twice as a lot as you danger. For example, risking $100, goal to make at the very least $200.

Dealer

Threat-Reward Ratio

Success Fee

Dealer X

1:3

40%

Dealer Y

1:5

30%

Dealer Z

1:2

60%

Merchants can succeed with completely different ratios. Dealer Z’s success charge is excessive, even with a decrease ratio. Dealer Y’s excessive ratio helps with a decrease win charge.

A number of Time Body Evaluation

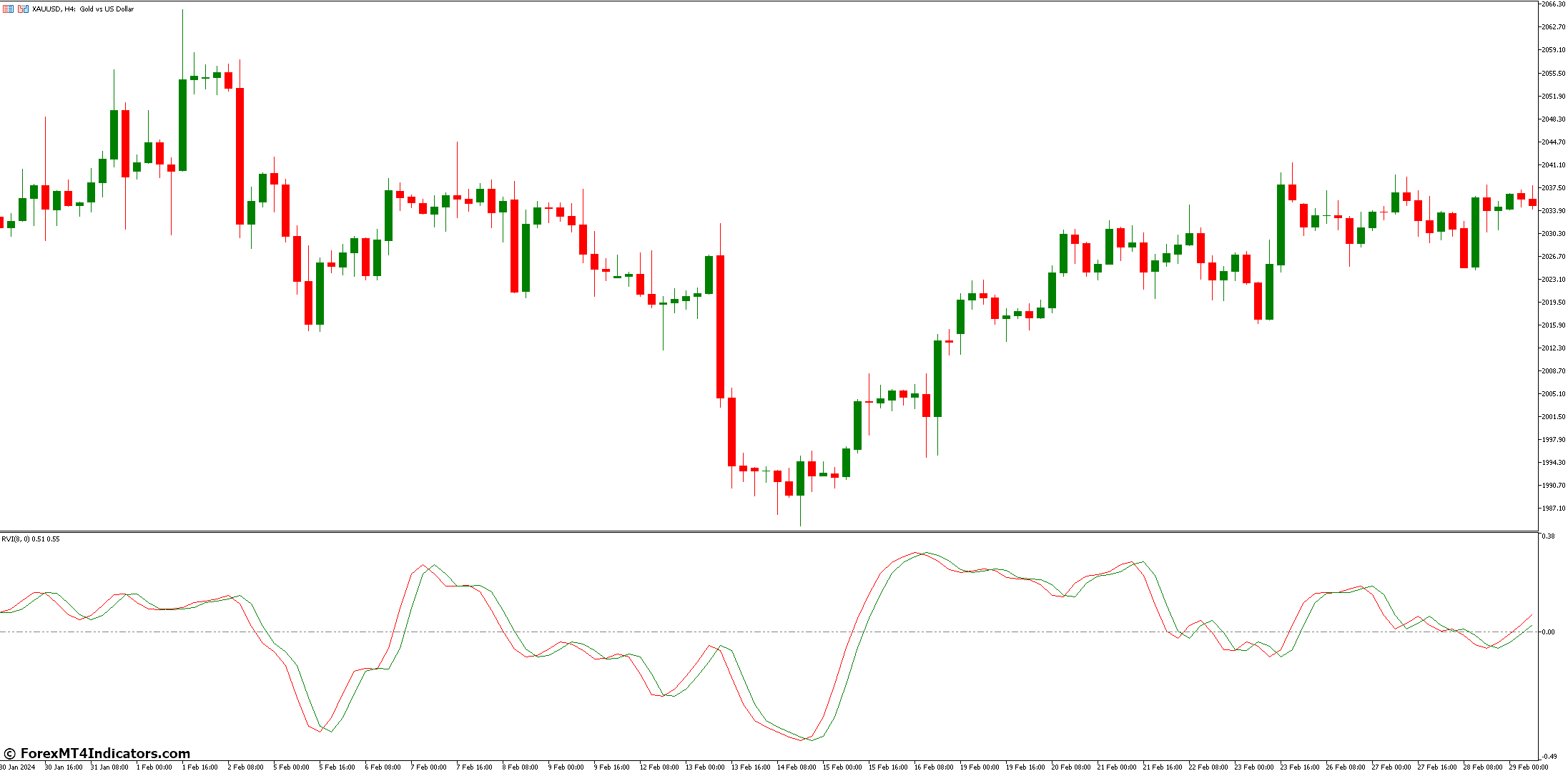

Timeframe evaluation helps discover good commerce setups. charts in several time frames exhibits traits and entry factors. This matches properly with danger administration.

Lengthy-term charts: Determine total market course

Medium-term charts: Spot potential commerce setups

Quick-term charts: Fantastic-tune entry and exit factors

The very best ratio adjustments along with your buying and selling model and market. All the time evaluate and alter your risk-reward technique for long-term success in foreign exchange.

Managing Market Volatility

Foreign exchange volatility administration is essential to long-term buying and selling success. The foreign exchange market’s ups and downs can have an effect on merchants’ positions and emotions. It’s necessary to know and use good methods for managing volatility to remain worthwhile.

Utilizing instruments just like the Common True Vary (ATR) indicator is an effective strategy to handle volatility. It helps merchants see how risky the market is and alter their plans. For instance, when the market may be very risky, merchants would possibly take smaller positions to keep away from huge losses.

Diversifying throughout completely different foreign money pairs is one other long-term technique. This may scale back dangers from sudden market adjustments in a single pair. Research present that diversifying can result in extra secure returns over time.

Retaining calm can be very important in managing market volatility. The foreign exchange market may be unpredictable, and staying calm is necessary. Merchants who observe their plans, not making fast selections primarily based on short-term adjustments, normally do higher in the long term.

Setting stop-loss orders can be necessary. These orders shut positions when costs hit sure ranges, serving to to regulate losses throughout risky instances. Specialists say it’s greatest to danger not more than 1-2% of your buying and selling capital on one commerce to remain sustainable in the long run.

Psychological Features of Threat Administration

Foreign currency trading psychology is essential for managing danger. Emotional management is essential to success. It helps merchants generate income in the long term.

Emotional Management in Buying and selling

Emotions like concern and greed can have an effect on buying and selling decisions. A research confirmed that mindfulness helps merchants make higher selections. Retaining feelings in test is important for achievement.

Coping with Buying and selling Losses

Merchants will face losses. Profitable ones danger solely 1-2% of their capital per commerce. This limits huge losses and retains feelings secure. Seeing losses as probabilities to be taught is necessary.

Constructing Buying and selling Self-discipline

Having a buying and selling routine helps keep disciplined. Retaining a buying and selling journal is essential. It helps observe feelings and enhance methods.

Emotional Issue

Influence on Buying and selling

Administration Technique

Worry

Untimely promoting missed alternatives

Set clear stop-loss and take-profit ranges

Greed

Overtrading, holding positions too lengthy

Stick with predetermined exit methods

Overconfidence

Extreme risk-taking

Common efficiency critiques

By specializing in the psychological elements of danger administration, merchants can succeed within the foreign exchange market. Keep in mind, earning money long-term wants a great technique and emotional management.

Commerce Documentation and Evaluation

Retaining good information and analyzing trades is essential to success in foreign currency trading. A buying and selling journal and common checks on efficiency assist merchants perceive their methods higher. This results in higher decision-making.

Sustaining a Buying and selling Journal

A buying and selling journal is a should for monitoring your trades. It exhibits your progress, patterns, and classes from wins and losses. Right here’s what to incorporate in your journal:

Entry and exit factors

Place measurement and leverage used

Threat-reward ratio

Emotional state throughout trades

Market circumstances and information occasions

Efficiency Metrics Monitoring

Checking your efficiency repeatedly is necessary. It exhibits how properly your technique works. Take a look at these key metrics:

Win charge: Share of worthwhile trades

Common win/loss: Comparability of common worthwhile trades to shedding ones

Threat-adjusted return: Profitability relative to the danger taken

Most drawdown: Largest peak-to-trough decline in account steadiness

By taking a look at these metrics, you may see what’s working and what’s not. For instance, in case your win charge is low however your wins are huge, take into consideration altering your place measurement or stop-loss methods. This might assist your total efficiency.

Market Liquidity Issues

Foreign exchange market liquidity is essential to buying and selling success. Excessive liquidity makes it simpler to purchase and promote foreign money pairs. The foreign exchange market may be very liquid, with over $5 billion traded every day for main pairs.

This excessive liquidity results in tight spreads, normally 1-3 pips for common pairs.

Liquidity danger administration is about understanding market depth. Throughout busy instances, spreads are slender (0.1-0.2%) and costs get well shortly (1-2 minutes). However throughout quiet instances, spreads widen (2-5%) and restoration takes longer (5-10 minutes).

To deal with liquidity dangers, concentrate on main pairs and keep away from off-peak hours. Watch every day buying and selling volumes too. Volumes beneath 75% of the 30-day common would possibly sign liquidity issues. For extra on danger administration in foreign currency trading, take a look at specialised instruments and indicators.

Liquidity Indicator

Excessive Liquidity

Low Liquidity

Common Each day Buying and selling Quantity

>1M shares

Bid-Ask Unfold

0.1-0.2%

2-5%

Value Restoration Time

1-2 minutes

5-10 minutes

Each day Value Vary

1-2%

5-10%

By conserving these factors in thoughts, merchants can higher perceive the foreign exchange market’s liquidity. This helps make smarter buying and selling decisions.

Financial Calendar and Information Influence

The foreign exchange financial calendar is essential for making buying and selling selections. It lists upcoming financial occasions that may change market traits. Figuring out how information impacts buying and selling is important for long-term success in foreign exchange.

Excessive-Influence Financial Occasions

Large occasions like central financial institution charge adjustments and job reviews can shake the market. These occasions may cause huge value swings in foreign money pairs. Merchants should watch these occasions to maintain their positions protected.

Occasion Kind

Instance

Potential Influence

Curiosity Fee Resolution

Federal Reserve Assembly

Excessive

Employment Report

Non-Farm Payroll (NFP)

Excessive

Inflation Information

Client Value Index (CPI)

Average to Excessive

Information Buying and selling Threat Administration

It’s key to handle danger throughout huge information. Merchants can alter stop-loss ranges and scale back commerce sizes to chop losses. Avoiding an excessive amount of publicity throughout risky instances can be necessary.

Use wider stop-loss orders throughout high-impact occasions

Cut back commerce measurement to restrict potential losses

Think about staying out of the market throughout extraordinarily risky durations

Through the use of the foreign exchange financial calendar and understanding information influence, merchants could make smarter decisions. This helps them handle danger higher over time.

Conclusion

Threat administration is essential to success in long-term foreign currency trading. The foreign exchange market is big, with trillions traded every day. It wants a wise plan to handle dangers.

Merchants have to be cautious on this huge market. It’s crammed with banks and massive establishments. They should defend their cash.

Good danger administration is important for earning money over time. New merchants ought to observe the two% rule. This implies risking not more than 2% of their account on every commerce.

Utilizing a 1:2 risk-reward ratio can be sensible. This implies a 20-pip stop-loss is matched with a 40-pip revenue. These steps assist hold losses small and income huge.

Lengthy-term success in foreign exchange depends upon being versatile. Merchants must learn about financial information, political adjustments, and market ups and downs. By at all times checking and altering their plans, they’ll deal with the market’s challenges.

Threat is a part of each commerce. However with the fitting strategy, merchants can attain their objectives within the foreign exchange market.