Up to date on March twelfth, 2025 by Nathan Parsh

Annually, we evaluate the entire Dividend Aristocrats. Attaining membership to this group is tough: corporations should be of a sure measurement, belong to the S&P 500 Index, and (most significantly) have a minimum of 25 consecutive years of dividend development.

There are simply 69 Dividend Aristocrats, proving the exclusivity of the listing.

You may obtain an Excel spreadsheet of all 69 Dividend Aristocrats, together with necessary monetary metrics corresponding to P/E ratios and dividend yields, by clicking the hyperlink under:

Disclaimer: Positive Dividend just isn’t affiliated with S&P World in any manner. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal evaluate, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official info.

Albemarle Company (ALB) joined this unique listing in 2020. The corporate is likely one of the most risky names among the many Dividend Aristocrats, however this makes its dividend development streak much more spectacular.

This text will evaluate Albemarle’s funding prospects.

Enterprise Overview

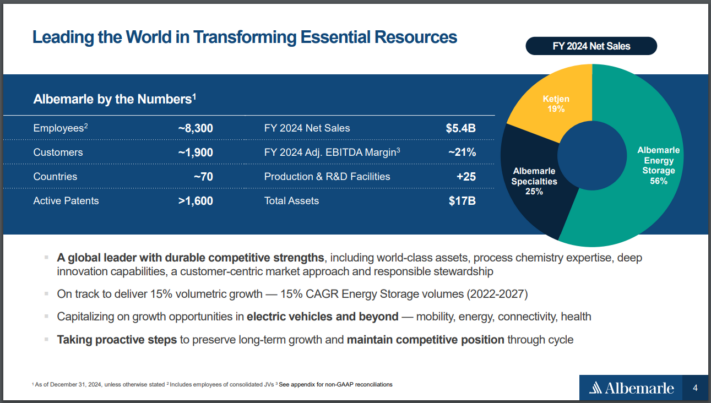

Albemarle is the most important producer of lithium and second-largest producer of bromine on the planet. The 2 merchandise account for the overwhelming majority of annual gross sales. Albemarle produces lithium from its salt brine deposits within the U.S. and Chile.

The corporate has two joint ventures in Australia that additionally produce lithium. Albemarle’s Chile property supply a really low-cost supply of lithium. The corporate operates in practically 100 nations.

Starting January 1st, 2023, the corporate reorganized into the next segments: Power Storage, Specialties, and Ketjen.

Albemarle produces annual gross sales above $5 billion.

Supply: Investor Presentation

On February twelfth, 2025, Albemarle introduced fourth-quarter and full-year 2024 outcomes. For the quarter, income declined 48% to $1.23 billion, which was $110 million lower than anticipated. Adjusted earnings-per-share of -$1.09 in contrast very unfavorably to $1.85 within the prior yr, which was $0.42 under estimates.

For the yr, income declined 44% to $5.4 billion, whereas adjusted earnings-per-share had been—$2.34 in comparison with $22.25 in 2023. It ought to be famous that the corporate had practically $10 billion in gross sales in 2023, serving to for example that extensive swings within the enterprise can happen quickly.

Decrease lithium costs as soon as once more negatively impacted outcomes. For the quarter, income for Power Storage decreased 63.2% to $616.8 million. Quantity declined 10%, whereas costs had been down 53%.

Specialties revenues had been decrease by 2.0% to $332.9 million, as a 3% enchancment in quantity was offset by a worth lower. Ketjen gross sales of $245 million had been down 17.4% from the prior yr, as a slight worth enhance was greater than offset by weakening quantity.

Albemarle offered an outlook for 2025 as nicely, with the corporate anticipating income in a spread of $4.9 billion to $5.2 billion. The corporate is predicted to supply earnings-per-share of -$0.80 in 2025. We imagine that Albemarle has earnings energy of $3.50.

Development Prospects

Outcomes are anticipated to be nicely above prior numbers, and Albemarle stands to profit from the elevated gross sales of electrical automobiles, as the corporate’s lithium is used to offer the batteries.

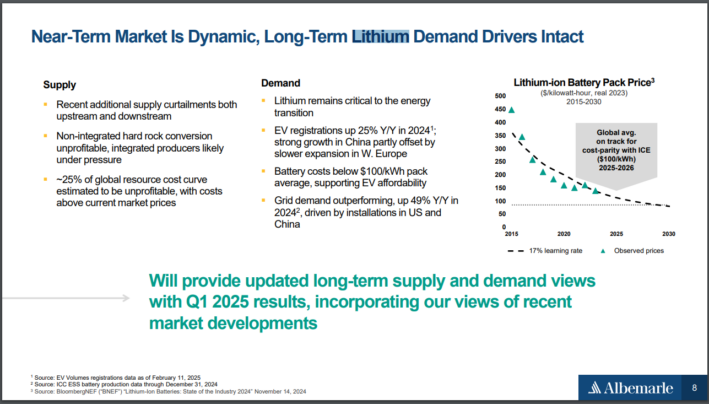

Lithium is predicted to be a development phase over the subsequent 5 years resulting from growing demand for a variety of functions, together with electrical automobiles and shopper electronics.

Supply: Investor Presentation

Demand for vitality storage tends to fluctuate, however the future seems to be promising for electrical automobiles as extra shoppers contemplate making that buy. By 2035, electrical automobiles are projected to account for 26% of all automobiles on the street within the U.S. Battery measurement can be anticipated to develop.

With this development will come a major enhance in demand for lithium.

As a consequence of its management positions in lithium and bromine, we imagine the corporate can develop earnings per share at a charge of seven.5% yearly for the subsequent 5 years.

Aggressive Benefits & Recession Efficiency

Regardless of being amongst world leaders in a number of companies, Albemarle isn’t content material to relaxation on its earlier success. The corporate has been energetic in buying companies that strengthen its market share.

Albemarle just isn’t a recession-proof firm. Listed under are the corporate’s earnings-per-share throughout and after the final recession:

2007 earnings-per-share of $2.41

2008 earnings-per-share of $2.40 (0.4% lower)

2009 earnings-per-share of $1.94 (19% enhance)

2010 earnings-per-share of $3.51 (45% enhance)

The specialty chemical enterprise is closely reliant on buyer demand. Decrease demand leads to decrease pricing, which negatively impacts Albemarle’s efficiency. The corporate is more likely to face the same kind of slowdown throughout the subsequent recession.

That stated, the corporate has sturdy aggressive benefits. A key aggressive benefit is that it ranks as the most important producer of lithium on the planet. The metallic is utilized in batteries for electrical automobiles, prescription drugs, airplanes, mining, and different functions.

Albemarle can be a high producer of Bromine, which is used within the electronics, building, and automotive industries. The corporate possesses a measurement and scale that others can’t match.

Buyers excited about investing in Albemarle ought to perceive that possession of the inventory comes with dangers because of the nature of its business.

Valuation & Anticipated Returns

Utilizing our anticipated earnings energy determine of $3.50 for the yr, ALB shares have a price-to-earnings ratio of 20.9. During the last decade, Albemarle has traded with a mean price-to-earnings ratio of 21.3.

Our a number of goal is 18x earnings, which we really feel takes under consideration the demand for the corporate’s supplies and the excessive volatility of lithium costs. If the inventory had been to commerce with this goal by 2030, then valuation can be a 2.9% headwind to annual returns over this time interval.

As well as, the dividend yield of two.2% will add to shareholder returns. The dividend payout is well-covered, because the projected payout ratio for the yr is simply 46% of our earnings energy estimate.

Given the character of its enterprise, the corporate has been profitable at prudently managing its dividend. Albemarle has raised its dividend for 29 consecutive years.

Subsequently, we challenge that Albemarle will present a complete annual return of 6.6% over the subsequent 5 years, stemming from 7.5% earnings development and a beginning yield of two.2% which can be offset by a low single-digit headwind from a number of contraction.

Remaining Ideas

Reaching Dividend Aristocrat standing isn’t any small feat. Albemarle is the dominant participant within the lithium business. The corporate advantages from low-cost mines and its management place in a number of classes.

Albemarle is way from recession-proof and has skilled some vital earnings declines over the past decade, however this makes the corporate’s dividend development monitor document much more spectacular.

Whereas the corporate’s enterprise could be unpredictable, we charge Albemarle’s shares as a maintain.

Moreover, the next Positive Dividend databases comprise probably the most dependable dividend growers in our funding universe:

In the event you’re searching for shares with distinctive dividend traits, contemplate the next Positive Dividend databases:

The most important home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.