Driving engagement is prime of thoughts for many digital banking leaders. Forrester’s analysis reveals the immense worth – for each prospects and banks – of helpful, handy digital banking experiences. The suitable cellular banking choices, for instance, can unlock new worth for a buyer and differentiate a financial institution’s model. And our broader buyer expertise analysis – comparable to our CX Index – reveals that enhancements in expertise design strengthens a financial institution’s enterprise outcomes in three principal methods:

Retention. How possible the shopper is to stick with the model.

Enrichment. How possible the shopper is to purchase further services and products from the model (and, in banking, to show to the model with their subsequent greenback or choice).

Advocacy. How possible the shopper is to advocate the model.

As they put money into and prioritize digital experiences financial institution leaders ought to think about how prepared the shopper is to share extra information with the financial institution. This willingness varieties an necessary a part of a broader “worth flywheel.” The flywheel is particularly highly effective in banking since belief (together with associated elements like recommendation and steerage) is the muse of sustained, worthwhile development (see determine under).

In December, we requested shoppers within the US and UK in regards to the forms of firms they’re comfy sharing information with – and the elements that improve their willingness to share private and monetary information. We discovered that:

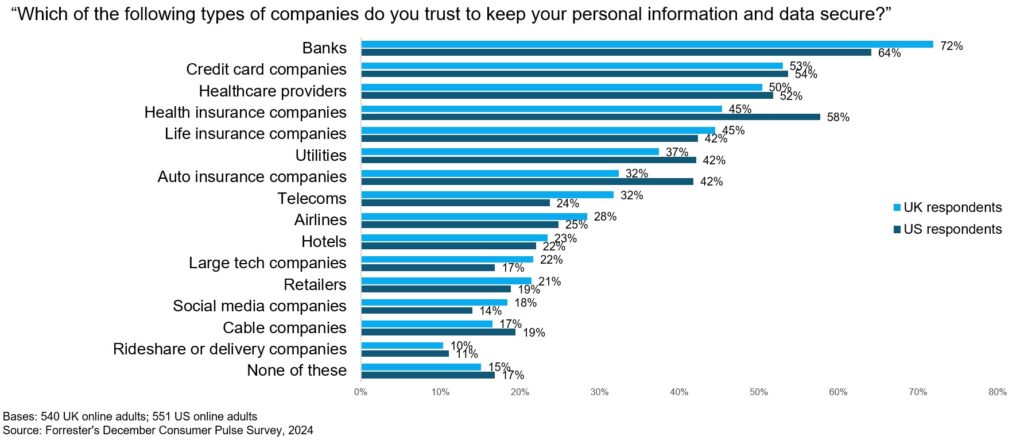

Folks are likely to belief banks to maintain their information protected. When requested which “forms of firms” respondents “belief to maintain your private data and information safe,” banks earned the highest spot: Practically three quarters (72%) of UK adults and almost two-thirds (64%) of US adults mentioned they trusted banks (see chart under). Solely bank card firms and well being suppliers garnered an identical responses in each nations.

Most prospects are prepared to share extra information in trade for worth – particularly for higher cash administration. Throughout each the US and the UK, 59% of respondents mentioned they’d be prepared to share extra of their private and monetary information with a monetary companies firm in the event that they gained some form of profit from it. The desirability of particular advantages different, however in each markets a plurality of respondents mentioned they’d share extra information in the event that they financial institution “assist[ed] me save more cash.” Different worth props included “to let me maintain higher observe of my cash” and “to present me long-term monetary recommendation.” It’s clear that banking prospects are ready to share extra information, supplied the financial institution affords them one thing in trade.

The thought of constructing a “flywheel” has been in vogue for years, so execs may be cautious of one more one. However on this case the 2 variables immediately gas each other: Elevated and expanded information sharing by financial institution prospects permits banks to supply new and higher worth to these prospects – which in flip drives deeper engagement and willingness to share ever extra information. In fact, there’s a giant “IF” in right here: This data-for-value flywheel solely works “if” the financial institution’s digital, information, and enterprise groups can harness the information prospects entrust them with. To that finish, executives ought to take advantage of Forrester’s Information, AI & Analytics service.

Executives and leaders at banks ought to try to counterpoint their prospects’ digital experiences not simply in order that they get increased engagement, consumer satisfaction, cross-sell charges, and model advocacy – however in order that they construct and strengthen a data-for-value trade that helps them create ever-better choices and acquire a sturdy aggressive benefit.

Determine 1: Illustrating The Information-For-Worth Alternate Flywheel

Determine 2: Folks Have a tendency To Belief Banks With Private And Monetary Information