The New Nemesis

There isn’t a doubt that the final cycles of elections worldwide, notably within the U.S., have revealed a number of “elephants within the room” full of hypocritic actions, psychological experiments subjecting the proletariat to new types of manipulation, and thru management below the guise of misinformation. The post-Chilly Warfare world moved from a superb versus evil exposé to a world void of the enemies required to feed the West’s military-industrial-political institution. In such a void, the illuminati in energy sought a brand new nemesis to make sure the continuance of their energy base, a foe that was simpler to govern. The brand new opponent turned the populus themselves.

What one might overlook is that this passage to dominate the proletariat started lengthy earlier than the Chilly Warfare ended. It grew from the seeds of the various self-serving efforts to enhance the tutorial programs of the West, from the guises to guard “non-sophisticated” traders from making their very own monetary choices which will tread on Wall-Road, and from the pretext to avoid wasting democracy, the greenback and the market system.

The False Fiat Victory

At this time, the military-industrial-political institution claims an implicit close to complete victory over the 99% constructed on a sequence of skirmishes that stretch again to the Eighties, the place the battles started in earnest. They had been the period of deregulation, Wall-Road wolves, and the rise of economic engineering that one may alternatively name the Perestroika of cash. I view the Eighties because the turning level for Western civilization. The interval seemed so good coming off the stagflation, financial and political decline, and war-torn and hostage-filled Seventies. Nevertheless, the socio-monetary battles that ensued aimed to squash Plebians spanning from dominating their technique of training, wealth creation, transport, consuming and dealing habits and ideas, amongst different areas.

Should you don’t settle for that the Eighties imposed such huge societal modifications on us, think about that it held the delivery of PEOPLExpress, the primary low-cost airline the place, we, the general public was instructed that this was the long run for aviation and journey with no extra reserved seats or meals. The last decade noticed the rise of finance because the primary space of examine chosen by the college-age era. Graduates had been taught to overlook “actual” work as the long run revolved solely round transferring cash from A to B. Our meals chains jumped over the cliff and proceed the decline nicely into the 90s and past with improvements reminiscent of “Olestra”, the fats substitute that not solely claimed to cut back your calorie consumption, however give you a facet of stomach cramping and unfastened stools as was printed on the warning label of all merchandise containing it. And, for the tree-huggers studying this, the last decade noticed the disappearance of glass bottles changed by the Tetra Pak plastic era.

Whereas I reference a glut of floor shaking actions within the Eighties, probably the most essential actions was the nuisances imposed over our instructional programs. These impositions gave delivery to long-lasting adverse penalties within the capability of people to have rational thought, specific tolerance, and present decision-making capability. Educating “shallowness” in colleges with out incomes it turned the mantra. Giving a reward for simply “making an attempt” turned 35% of your school syllabus grade. Recall that this California-created campaign reasoned that growing individuals’s shallowness may cut back crime, poverty, air pollution, international warming, and most social evils. But, they by no means talked about that it may “repair the cash” or “repair the world”. Quite than educating the lots on practicality and rationality, the lots are taught to simply pat themselves on the again. This alteration in mentality, this revision to the social and academic orders within the Eighties, I postulate, had been the triggers to the downfall of worldwide societal norms and values and subsequently monetary literacy.

“The losers are the true winners”

Over the next many years, the actions I spotlight have imposed harm to the following generations impacted monetary literacy amongst different societal norms. We now see the outcomes of those, maybe, well-intentioned, but misguided applications ensuing within the frustration now we have, as we attempt to educate not solely youth, however grown adults about Bitcoin.

I recall a phrase I heard on a TV sitcom as soon as that can go unnamed for threat of a copyright transgression: “The losers are the true winners.”

Is that this the present world we would like?

Sorry for my rant however as Shakespeare mentioned: “I rant, subsequently I’m”. Should you’re depressed at this level in my tirade, both take a tablet, a nap or develop a pair….or another fruit and plod ahead.

“Rotten” Orange…..Pilling

What’s unsuitable with traders and markets in the present day? They’re the TikTok investor era who determine that they will make funding choices and fast cash after spending 14-hours a day scrolling the app as a substitute to the mediocre high quality of college “training” in sensible finance. At this time’s traders assume they’re proof against the previous. They know all of it. Someway data discovered from historical past not issues past their 5-years of labor expertise at a Massive-4 consulting agency after acquiring a twin enterprise/fourth-century artwork historical past diploma paid from $200,000 of scholar loans.

The Wall-Road-political-media industrial advanced added to investor “dumifiction”. They did this by means of tribulations just like the manipulation of Libor, gold market collusion, and the Madoff Ponzi that gave delivery to pure distrust of all established monetary or mathematical impetus no matter its basis or its potential supply of studying. Politically motivated misinformation additional fed the hearth advocating that inflation is “good for you” and recessions don’t exist as beforehand identified. World political powers additionally added their bits telling you to be “inexperienced or die”.

“A idiot and his cash are quickly parted” was the adage. But, in the present day, the idiot earns on the expense of the rational.

To this ratatouille of the miss-guided and ill-informed present investor era, international central financial institution cash printing presses for the reason that Eighties added their drug by means of the creation of a glut of liquidity. Arm the TikTok investor with liquidity and within the phrases of Alan Greenspan “irrational exuberance” outcomes. Buyers imagine falsely that they’re specialists in portfolio idea, threat administration, and investing. The liquidity glut has run rampant by means of the TikTok era quicker than a Fauci/Gates impressed virus.

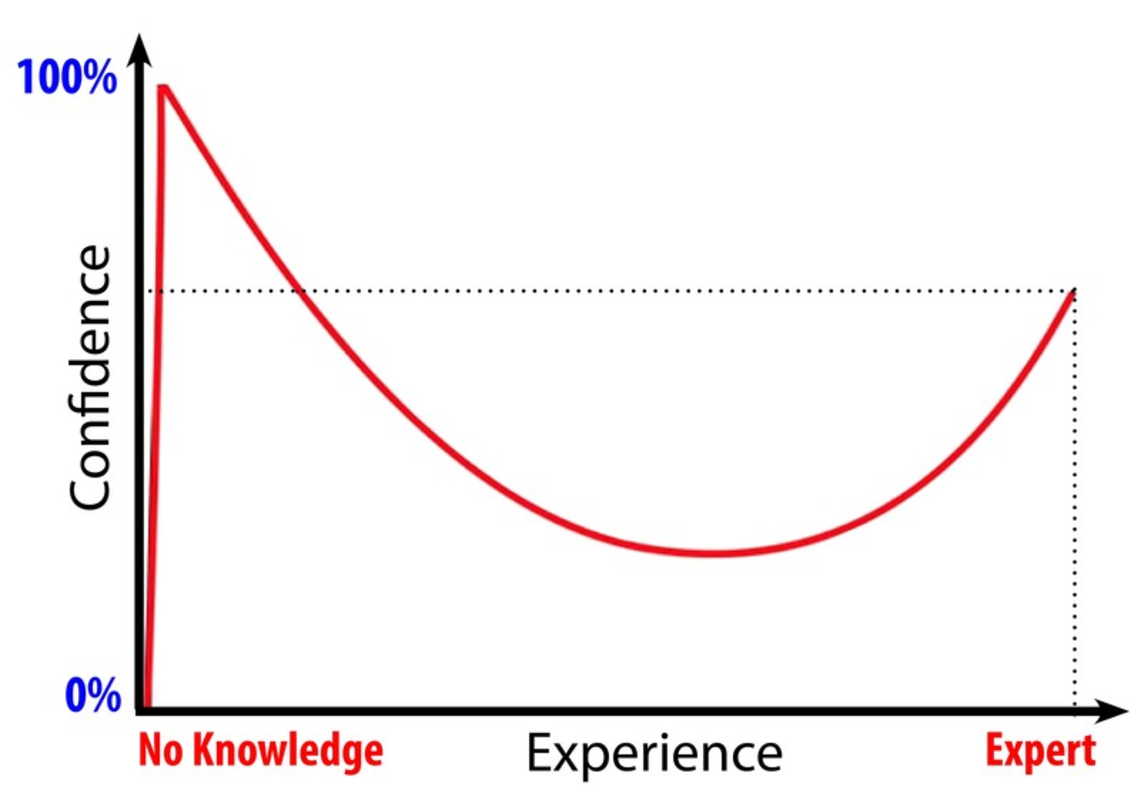

In different phrases, these Rotten Oranges during the last many years have created in the present day’s irrational cash administration mentality. The Dunning–Kruger impact has incentivized throwing cash at “Shitcoins” reasonably than Bitcoins.

Moneyzine.com reported that the proportion of US adults with poor monetary literacy stood at 25% in 2023, that Gen Z and Gen Y have the bottom monetary literacy charges amongst US generations, at 38% and 45% respectively, and that 48% of teenagers say they find out about private finance on social media.

Aleksandr Solzhenitsyn mentioned that: “Human beings are born with completely different capacities. If they’re free, they aren’t equal. And if they’re equal, they aren’t free.”

However can a price proposition, a financial revolution overcome such a dilemma?

Would Aleksandr Solzhenitsyn ever have hypothesized that his phrases could possibly be utilized to our want to interrupt freed from Fiat hegemony?

Can Bitcoin supply human beings a fantastic equalizer and private freedom on the identical time?

From Rotten Oranges to Orange Blossoms

Educating the brand new era not solely on Bitcoin but in addition re-educating the lots on monetary widespread sense must be a precedence. Practicality should once more prevail versus likes earned on Instagram. The Robinhood’s of in the present day must cease studying finance on TikTok and examine historic context. Concerning Bitcoin the intrepid Greg Foss mentioned it’s “simply math”.

The “gentle spoken” Max Keiser additionally mentioned: “We should proceed to coach the lots and encourage financial savings in Bitcoin to actually drain the kleptocratic swamp ruling our monetary system.”

Even “God’s Banker” couldn’t escape being the wrath of the non-common-sensical Fiat world together with his demise below only one bridge too far.

With out monetary widespread sense as written by Benjamin Franklin in “The Approach to Wealth”,

“We’re taxed twice as a lot by our idleness, thrice as a lot by our pleasure, and 4 occasions as a lot by our folly”

Are you able to re-awaken to the wanted actuality or be taxed 4 occasions?

It is a visitor publish by Enza Coin. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.