Microsoft’s earnings might reveal if its AI investments can maintain dominance amid rising competitors.

Azure’s efficiency and AI prices might drive—or danger—near-term inventory momentum.

Microsoft faces a pivotal check to show Large Tech management in a fast-changing panorama.

Kick off the brand new yr with a portfolio constructed for volatility and undervalued gems – subscribe now throughout our New Yr’s Sale and stand up to 50% off on InvestingPro!

Can one of many world’s largest corporations – Microsoft (NASDAQ:), with 5 a long time of historical past and market dominance—actually concern a scrappy startup’s new app?

The very fact this query even arises says all the things concerning the transformative energy of synthetic intelligence (AI) at present. However relatively than dwell on philosophical debates about AI’s dangers and rewards, Large Tech has no time to nurse its wounds.

Simply because the mud from DeepSeek settles, Microsoft faces one other essential second: its quarterly earnings report.

A Essential Check for Microsoft

What higher manner for Microsoft to handle issues about low-cost AI opponents than to showcase its monetary energy?

On Wednesday, after the markets shut, the Redmond large will reveal its newest earnings—a second that might both calm investor nerves or gas contemporary doubts.

Microsoft’s legacy of success speaks for itself, weathering challenges just like the dot-com bubble and rising stronger each time.

The query now’s whether or not its management in AI, cloud computing, and conventional software program will proceed to drive the astronomical numbers buyers count on.

Large Tech’s Management Is within the Numbers

Microsoft has constructed its fame as a world chief in cloud computing and enterprise productiveness software program whereas driving the AI wave.

Its monetary well being is a testomony to its dominance, with a staggering 69.35% gross margin, a 36% return on fairness, and a income improve of 16% within the final quarter.

Supply: InvestingPro

Including to this stability, Microsoft has raised its dividend for 19 consecutive years, at the moment providing a 0.8% yield. Few corporations boast such a observe document, and the upcoming earnings report will reveal if it may possibly keep this momentum.

Analysts Anticipate Regular Progress

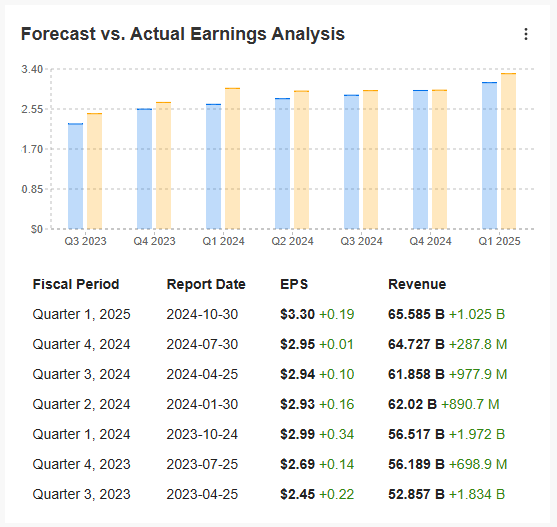

In line with analysts, Microsoft is predicted to publish earnings per share (EPS) of $3.12, up 6.5% from $2.93 a yr in the past, alongside revenues of $68.8 billion, a 4.9% improve.

Supply: InvestingPro

Given Microsoft’s observe document of outperforming expectations—beating estimates for seven straight quarters—it wouldn’t be shocking if these figures are exceeded as soon as once more.

Supply: InvestingPro

What Might Go Incorrect?

Regardless of Microsoft’s robust efficiency, the stakes are greater than ever. Markets have turn out to be unforgiving, as even slight disappointments have despatched the inventory tumbling in earlier quarters.

Supply: InvestingPro

Progress is slowing in comparison with prior durations, partly because of the huge investments in AI improvement.

Buyers are significantly centered on the efficiency of Microsoft’s cloud section. Azure’s progress slowed from 33% to 31-32% within the final quarter, sparking issues.

With capital expenditures rising to fund AI tasks, any trace of underwhelming ends in these areas might result in sharp market reactions.

A David vs. Goliath Battle

Including to the stress is DeepSeek, a low-cost AI platform from a beforehand obscure Chinese language startup.

DeepSeek has made waves by difficult OpenAI’s ChatGPT – a product closely sponsored by Microsoft – and elevating questions on whether or not Large Tech’s AI investments are sustainable.

Can Microsoft, the Goliath of tech, fend off this sudden problem? The reply received’t come in a single day, however Wednesday’s earnings might provide essential clues about how nicely the corporate is positioned to compete in a quickly evolving panorama.

All Eyes on Wednesday

Microsoft’s capacity to beat expectations whereas navigating AI-related prices and slowing cloud progress will possible outline its near-term inventory efficiency. With minimal room for error and mounting competitors, the stakes couldn’t be greater.

Keep tuned—this isn’t nearly Microsoft’s earnings; it’s about the way forward for Large Tech in an age of fast innovation and fierce competitors.

***

How are the world’s high buyers positioning their portfolios for subsequent yr?

Don’t miss out on the New Yr’s provide—your remaining probability to safe InvestingPro at a 50% low cost.

Get unique entry to elite funding methods, over 100 AI-driven inventory suggestions month-to-month, and the highly effective Professional screener that helped establish these high-potential shares.

Click on right here to find extra.

Disclaimer: This text is written for informational functions solely. It’s not meant to encourage the acquisition of property in any manner, nor does it represent a solicitation, provide, suggestion or suggestion to speculate. I want to remind you that each one property are evaluated from a number of views and are extremely dangerous, so any funding choice and the related danger belongs to the investor. We additionally don’t present any funding advisory providers.