Torsten Asmus/iStock by way of Getty Photographs

Expensive Companions,

Whereas particular person shopper returns could differ based mostly on their inception dates, consolidated efficiency of all accounts for the interval ending December 31, 2024 is as follows:

This fall 2024

2024

2023

2022

2021*

White Falcon (web of charges)

5.5%

14.4%

36.0%

-9.3%

-1.5%

S&P 500 TR (CAD)

8.9%

35.2%

23.2%

-12.6%

3.3%

MSCI All Nation TR (CAD)

5.0%

26.3%

18.5%

-11.9%

1.5%

S&P TSX TR

3.8%

21.7%

11.8%

-5.8%

-0.6%

*Efficiency is from Nov 8 – Dec 31, 2021

Click on to enlarge

We had 12 months on an absolute foundation. Nonetheless, after two years of outperformance towards the favored indices we couldn’t sustain with a quick charging market. Whereas we did not expertise vital losses, we additionally did not see standout good points. As a lot as we want our shares to maneuver on a calendar foundation, we can not management market timing! We like what we personal and preserve that the portfolio is well-positioned with a big margin of security.

As we mirror on efficiency, this 12 months marks the completion of three full fiscal years for White Falcon. From the outset, we’ve persistently emphasised that we don’t handle our portfolio with the purpose of monitoring or outperforming an index. As an alternative, our focus stays steadfastly on reaching absolute returns. That mentioned, if our positions have been reversed, I might naturally need to assess whether or not the White Falcon portfolio is aggressive with broader market returns. Whereas this will appear simple, it is without doubt one of the most nuanced and difficult facets of funding administration. What constitutes “the market”? Is it the S&P 500 (SP500, SPX) , the TSX, the Russell 2000 (RTY) or some mix of those three? How do you measure the chance taken to attain these returns? And simply as importantly, how lengthy ought to one consider supervisor efficiency to differentiate between talent and luck?

Whereas there are not any ‘proper solutions’, we imagine that companions ought to examine our outcomes towards their alternative prices. Extra considerably, we preserve that not less than a decade is required to meaningfully assess whether or not a portfolio supervisor possesses true funding talent.

In fact, the long run is in the end constructed on a sequence of shorter time intervals. Under, we current our three-year return and decide to sharing rolling three-year returns going ahead.

Three Yr Cumulative*

Three Yr CAGR*

White Falcon (web of charges)

40.31%

11.95%

S&P 500 TR (CAD)

44.08%

12.95%

MSCI All Nation TR (CAD)

30.67%

9.33%

S&P TSX TR

27.85%

8.54%

Asset Allocation/Advisor Mannequin

Blackrock Core Fairness ETF (XEQT)

29.97%

9.13%

*Three years ending Dec 31, 2024

Click on to enlarge

The above exhibits that an funding of $1.0 million in White Falcon three years in the past has now grown to $1.4 million as at December 31, 2024 in spite of everything charges and bills.

We’ve got managed to do effectively however have been bested by the S&P 500 index in Canadian Greenback (CAD) phrases . Whereas this will bruise my ego, it’s necessary to take a step again and supply some context.

Currencies have performed an enormous half for Canadian traders like us investing within the U.S.! Over the previous three years, the S&P 500 has delivered a complete return of 28.6% in U.S. {Dollars} (‘USD’). Nonetheless, because of the 15.5% depreciation of the Canadian Greenback (CAD) throughout this era, its return in Canadian {Dollars} (CAD) has been considerably greater at 44.08%. The White Falcon portfolio had a median publicity of 55% to U.S. shares throughout this era resulting from which we benefited, however to a a lot lesser extent.

“The essence of funding administration is the administration of dangers, not the administration of returns” -Benjamin Graham

Importantly, the chance profile of the S&P 500 is essentially totally different from that of the White Falcon portfolio. The index has a big focus and skew towards the biggest expertise firms. Whereas this focus has been extremely advantageous for the index lately, our expertise out there has taught us that every little thing operates in cycles, and intervals of outperformance finally reverse. The precise causes could solely grow to be clear in hindsight, however historical past reminds us that timber don’t develop to the sky. The Nifty Fifty within the Nineteen Seventies, Japanese shares in Eighties, web shares in Nineteen Nineties, and rising markets/commodity shares in 2000s all function highly effective examples.

Additionally, we take consolation in figuring out that White Falcon’s three-year money-weighted return (MWR) CAGR stands at 18.05%. This displays our shoppers’ astute timing in funding their accounts and their responsiveness to my repeated appeals so as to add capital in the course of the market downturn in 2022. Whereas this metric doesn’t instantly measure the supervisor’s talent, it does present perception into the common accomplice’s expertise and the general wealth created by White Falcon.

“The miracle of compounding returns is overwhelmed by the tyranny of compounding prices.” -John Bogle

Moreover, we’re beginning to imagine that this “alternative value” might be one thing like an asset allocation ETF, resembling Blackrock’s XEQT. A number of of our companions have joined us after beforehand working with monetary advisors. These advisors usually allocate capital in an asset allocation technique which, relying on one’s danger profile, will encompass say a 50% allocation to US shares, 30% to Canadian shares, 15% to Worldwide shares and 5% to Rising Markets. The more practical advisors maintain prices low by utilizing ETFs, whereas others depend on high-fee mutual funds or different advanced merchandise. For instance, one accomplice who joined us lately was paying a 1% advisory charge on belongings beneath administration (‘AUM’), plus mutual fund administration expense ratios (MERs) of two.5%, leading to a complete charge of three.5% of AUM! If somebody in an analogous scenario, please have them name me instantly at 416-770-6131.

Coming again to 2024, the White Falcon portfolio has 22 positions and these break down into three classes: Compounders, Worth Now and Worth Tomorrow. The precise proportion division amongst classes is to a point deliberate, however to an awesome extent, opportunistic and based mostly on valuations. As of December 30, 2024, we’re positioned as follows:

By Type

Dec 2024

Dec 2023

Compounders

25.7%

25.8%

Worth Now

41.6%

38.0%

Worth Tomorrow

26.2%

25.8%

Whole Equities

93.6%

89.5%

Click on to enlarge

ByMarket Cap

Dec 2024

Dec 2023

Massive Cap ( > $20 bn)

24.5%

33.8%

Mid-Cap ( > $1 bn < $20 bn)

53.6%

44.6%

Small-Cap ( <$1 bn)

15.5%

11.2%

Whole Equities

93.6%

89.5%

Click on to enlarge

As you see above, the portfolio has shifted much more in direction of the ‘worth at this time’ and ‘mid and small cap’ bucket. At White Falcon, we’ll all the time gravitate in direction of alternatives with low expectations and low valuations, and at this time, we’re discovering this in smaller firms which have been left behind out there rally. Nonetheless, timing is without doubt one of the most difficult facets of this technique. It’s typically troublesome to foretell how lengthy it is going to take for different traders to acknowledge and align with our view of the chance.

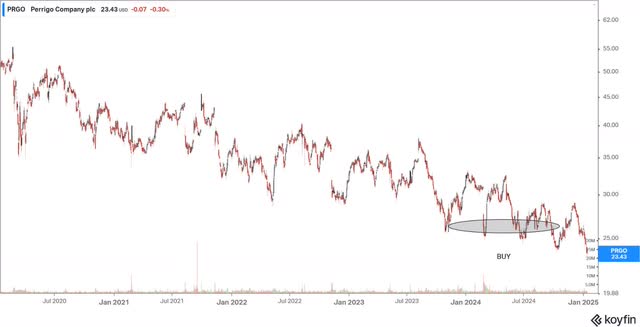

We’ve lengthy acknowledged that an actively managed portfolio wants a handful of standout performers to offset the inevitable missteps that include lively investing. In 2024, whereas our holdings in Amazon.com (AMZN), Aritzia (OTCPK:ATZAF), Nu Holdings (NU), treasured metallic royalty basket, and some others carried out effectively, the general portfolio was weighed down by the bigger allocation to firms that didn’t carry out as strongly this 12 months. A lot of our largest positions – Endava (DAVA), EPAM, Rentokil (RTO), Perrigo (PRGO), and Converge (OTCQX:CTSDF) – have been flat to barely down in comparison with our value base.

“Within the brief time period market is a voting machine, in the long run it is a weighing balance” -Benjamin Graham

One key flaw in our execution this 12 months is that we purchased after which added to our positions too quickly. We should always have positioned higher emphasis on shopping for or including to positions as companies started to indicate optimistic inflection factors or the primary indicators of restoration from short-term challenges. The draw back, in fact, is that when a enterprise reaches an inflection level, the market typically re-rates the inventory sharply, making it considerably tougher to ascertain a place at a beautiful value. Nonetheless, shifting ahead, we’ll try to refine our strategy by utilizing place sizing extra successfully and prioritizing averaging up moderately than averaging down.

The highest 5 positions within the portfolio have been: Treasured Metals royalty basket, Endava, EPAM, Amazon.com, and AMD.

Throughout the 12 months, we offered half of our stakes in AMD and Nu Holdings as they reached their intrinsic values. Nonetheless, the decline in these shares towards the top of the 12 months supplied us with a possibility so as to add to our positions.

In AMD’s case, the market has been disenchanted by the corporate’s potential shortfall in AI chip revenues, which have been beforehand forecasted to succeed in $10 billion in 2025. Nonetheless, the components required to justify the funding when the inventory is priced at $220 per share are vastly totally different from these wanted when the inventory is at $120 per share. Sure, AMD’s AI chips and related software program will not be aggressive with Nvidia (NVDA) however that is now identified and within the valuation. We imagine this hyperfocus on AI ignores AMD’s different companies the place they proceed to reap the benefits of Intel’s missteps. Importantly, AMD retains the potential to seize a small share of the AI chip market, which, given the market’s huge dimension, might be extremely impactful for the corporate.

Nu has lately corrected resulting from Brazil’s macroeconomic struggles. Nu stories its earnings in U.S. {dollars} however generates income in Brazilian reais, Mexican pesos, and Colombian pesos. The sharp depreciation of those rising market currencies, coupled with ongoing macroeconomic uncertainty, is making traders uncomfortable. Our due diligence means that Nu stays unaffected. Importantly, we proceed to imagine that Nu is a uncommon enterprise with a mix of a big market alternative, a powerful moat pushed by its superior value construction, and a superb administration group.

Whereas this uncertainty in Brazil has prompted many traders to dump Brazilian shares, we’ve taken benefit of this setting to ascertain a place in VALE. Vale is among the many world’s largest and lowest-cost iron ore producers and boasts a rising portfolio of high-demand copper and nickel belongings. It’s at present buying and selling at a P/E of 5.3x with a 8% dividend yield.

We’ve got additionally considerably elevated our place in NFI Group (OTCPK:NFYEF), a enterprise that confronted provide chain challenges throughout COVID however has emerged as certainly one of solely two bus producers in North America. NFI now boasts a powerful backlog and, with efficient execution, is well-positioned to capitalize on this chance.

Our IT providers holdings, Endava and EPAM, are exhibiting optimistic inflections in key metrics. We imagine these firms are coming into a powerful development cycle, pushed by the growing want for companies to modernize their core expertise stacks to be able to successfully implement AI options. Each holdings have considerably strengthened their operations by means of counter-cyclical acquisitions. In reality, EPAM made 4 acquisitions over the previous 18 months, which, because the market cycle shifts, will considerably improve their earnings potential.

Within the appendix to this letter, we current the funding thesis on Perrigo Firm plc- a shopper well being firm which, we imagine, is near an inflection level!

General, we imagine that a good portion of our portfolio firms are well-positioned for substantial earnings development in 2025. This earnings development, we hope, will catalyze the “pent-up” efficiency that we imagine is inherent throughout the portfolio.

“Its deja vu once more” -Yogi Berra

A key problem in managing cash within the present setting is the more and more speculative nature within the markets. Whereas we preserve that the “market of shares” stays pretty valued, the general “inventory market” is at present priced within the greater quartile in comparison with its historic averages. Simply as generals would possibly ship inexperienced troopers to the frontlines as a result of they’re keen and unafraid, some younger traders have been drawn to speculative investments or high-risk alternatives, believing they simply have to “purchase the dip”. Whereas we imagine our holdings are fairly valued, low-cost can all the time grow to be cheaper, and a broader market correction to wring out these speculative excesses might nonetheless result in a short-term decline in our portfolio.

We’re thrilled to share an thrilling organizational replace! Please be a part of us in welcoming Siddhant Kapur to the White Falcon group. Siddhant is an accounting and finance main on the College of Waterloo. He will probably be working with us in the course of the winter semester, including recent views and precious assist to our analysis efforts.

We sit up for his contributions as we proceed to pursue our mission of delivering distinctive outcomes for our companions.

In closing, I’m really grateful for the partnership we share. Please be at liberty to get in contact with me at any time for any questions, considerations, or suggestions you’ll have.

With gratitude,

Balkar Sivia, CFA

Founder and Portfolio Supervisor | White Falcon Capital Administration Ltd.

Perrigo Firm PLC

“Virtually all good companies interact in ‘ache at this time’, ‘acquire tomorrow’ actions”-Charlie Munger

Perrigo Firm plc, generally often known as Perrigo, is an American-Irish producer famend for its personal label over-the-counter prescription drugs. The corporate’s roots hint again to 1887 when it was based by Luther Perrigo in Allegan, Michigan. In 1887, Luther Perrigo, who owned a normal retailer and an apple-drying enterprise, conceived the thought of packaging and distributing patented medicines and home goods to nation shops. To spice up buyer loyalty, Luther launched the “personal label” idea, providing to print the shop’s title on labels of merchandise like Epsom salts, candy oil, bay rum, and lots of different moist and dry items at no further value. Perrigo established its first manufacturing facility in Allegan, Michigan, in 1921 and secured its first main private-label buyer within the mid-Nineteen Thirties. This milestone marked the corporate’s transition from a re-packager of house treatments to a producer of inexpensive healthcare merchandise.

By the Eighties, the corporate had established itself as a key participant within the personal label over-the-counter (OTC) pharmaceutical market. In 1988, Perrigo went public, itemizing its shares on the NASDAQ inventory trade. The Nineteen Nineties noticed Perrigo prolong its attain internationally, establishing operations in varied nations and buying a number of firms to broaden its product portfolio and market presence.

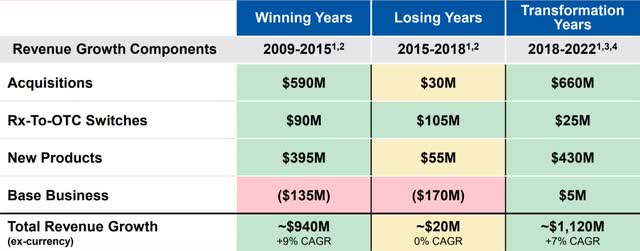

Perrigo’s development was additional propelled by the appearance of prescription-to-over-the-counter (Rx-to-OTC) switches, which allowed prescription merchandise to grow to be accessible over-the-counter. This shift considerably expanded the marketplace for OTC merchandise, offering Perrigo with new alternatives for development and innovation within the healthcare sector.

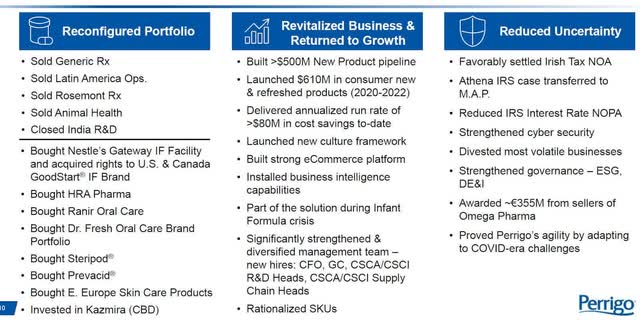

Perrigo’s long-term technique was to grow to be a number one world supplier of self-care merchandise. The corporate sought to leverage its strengths within the shopper well being sector moderately than the extra aggressive and lower-margin generic drug market. The corporate made a big transfer in 2013 by buying the Elan Company, which not solely relocated its company domicile to Eire but in addition positioned it as a world pharmaceutical business participant. The redomiciling of Perrigo to Eire allowed the corporate to learn from Eire’s decrease company tax charges in comparison with the usAnother notable acquisition was in 2015 when Perrigo purchased Omega Pharma, a number one European OTC healthcare firm, additional solidifying its market place.

In 2016, Perrigo acquired PBM Merchandise for $800 million, an toddler formulation enterprise, which manufactured formulation for main retailers like Walmart and Kroger, in addition to different personal label toddler formulation.

In April 2015, Mylan, identified for its generics and specialty medication, made an preliminary provide to accumulate Perrigo at $26 billion or $205 per share. Administration at Perrigo rejected this provide and the inventory has accomplished nothing however go down since! A fowl in hand….

In 2016, Starboard Worth grew to become certainly one of Perrigo’s largest shareholders, advocating for adjustments to enhance the corporate’s efficiency and worth. Starboard needed Perrigo to concentrate on its core shopper self-care enterprise together with on operational enhancements and divest non-core belongings, resembling its generic drug enterprise. It will finally try this, however it could take for much longer than anybody anticipated.

In 2020, Perrigo reached a settlement with the Irish tax authorities. As a part of the decision, Perrigo agreed to a fee of $1.9 billion to settle the tax dispute which was a considerable hit to the financials. In 2021, Perrigo issued a voluntary recall of sure a lot of child formulation resulting from potential contamination considerations after which in 2023, it confronted additional points in its newly acquired toddler formulation facility from Nestle.

These challenges have contributed to the creation of quite a few worth traders who developed promising funding theses, solely to see their efforts persistently thwarted by ongoing points. In lots of cases, even when the funding setup begins to enhance, former traders could also be reluctant to re-evaluate the scenario resulting from their prior unfavourable experiences with the inventory. The repeated setbacks can result in a reluctance to rethink the funding, regardless of evolving circumstances.

That is the place the psychological flexibility of famend traders like Warren Buffett turns into notably notable. Regardless of having a notably poor expertise with investments within the airline business, Buffett made one other funding within the sector as soon as he noticed enhancements within the business’s construction. His skill to reassess and make investments based mostly on evolving situations, moderately than being anchored by previous disappointments, highlights a vital facet of profitable investing: the willingness to replace one’s views and methods in response to altering market dynamics.

Lastly, in February 2021, Perrigo introduced the sale of its generic drug enterprise, which was a part of its Rx phase, to a non-public fairness agency, TPG Capital for $1.55 billion. Perrigo is now a pure OTC enterprise targeted on its core shopper self-care enterprise, which incorporates over-the-counter (OTC) well being and wellness merchandise. By divesting the generic drug enterprise, Perrigo aimed to streamline its operations and focus sources on areas with stronger development potential and better margins.

The corporate now stories two segments: Shopper Self-Care Americas (‘CSCA’) Shopper Self-Care Worldwide (‘CSCI’). Each divisions develop, manufacture, and market over-the-counter (OTC) retailer model merchandise, primarily within the cough, chilly, allergy, analgesics, gastrointestinal, smoking cessation, toddler formulation, and oral care. Nonetheless, the CSCI division in Europe and ROW truly markets beneath its personal model names incomes a lot greater gross margins (50-55%) than the US division (30-32%).

Non-public manufacturers are a win-win-win as retailers provide personal label merchandise at aggressive costs, typically decrease than nationwide manufacturers, which attracts cost-conscious customers whereas offering greater revenue margins resulting from diminished advertising and marketing and distribution prices. Nonetheless, as customers could initially understand personal label merchandise as decrease high quality, establishing a powerful personal label model calls for constant high quality and efficient advertising and marketing efforts. Because of this, retailers are all the time cautious with their partnerships and concentrate on high quality and scale moderately than simply value.

Aggressive benefits

“I feel Perrigo has benefits, their dimension and the quantity of issues they’re in a position to produce. They undoubtedly have a aggressive benefit in that house. Something a particular retailer needed, they obtained” -Former govt at Perrigo (Alphasense transcript)

Scale and scope:

In a pharmacy, the intensive vary of merchandise is essential for gaining nationwide distribution with main retailers like Walmart (WMT), CVS, and Walgreens (WBA). Retailers want to work with firms that supply a broad portfolio of merchandise as a result of it simplifies the procurement course of and permits them to inventory a number of objects from the identical provider. If an organization solely sells a restricted variety of merchandise, it turns into difficult to persuade these main retailers to hold their objects, because the retailers would possibly want suppliers who can provide a wider choice and meet varied shopper wants.

Rules:

The enterprise of over-the-counter prescription drugs is advanced because of the varied FDA approvals required. The FDA’s approval course of for OTC prescription drugs entails a number of levels and varieties of approvals. Every stage requires thorough documentation, testing, and compliance with particular pointers. This course of might be time-consuming and requires cautious planning and execution.

Who’s the buyer?

Shoppers are more and more savvy about over-the-counter prescription drugs, notably by way of value and high quality. Not like within the Eighties and Nineteen Nineties, when branded merchandise dominated and retailer manufacturers have been much less trusted, at this time’s market has seen vital development in retailer manufacturers and generic choices. Shoppers at this time – whether or not excessive revenue or low revenue – are extra knowledgeable in regards to the equivalency of merchandise. They acknowledge that, as an illustration, each Advil and Costco’s (COST) Kirkland ibuprofen are FDA-approved and primarily the identical, so that they go for the extra inexpensive possibility to save cash.

Income Development

Perrigo revenues ought to develop with the class which, in combination, is rising at low single digits.

Perrigo is the the third largest OTC firm within the US and the eighth largest OTC firm in Europe.

Traditionally it has enhanced its development with M&A and new product launches.

“Would I say that Perrigo is without doubt one of the most, for example, innovation-savvy firms? Possibly not. In terms of innovation and creating new merchandise based mostly on shopper demand or market scenario, I feel possibly there’s firms who’re doing it higher. Alternatively, if you consider the acquisition and coming into new classes by means of acquisitions or coming into new classes by means of using the footprint out there due to the presence in a number of classes, I feel undoubtedly that is one of many issues Perrigo can do significantly better than lots of its opponents” -Former govt at Perrigo (Alphasense transcript)

Earnings development

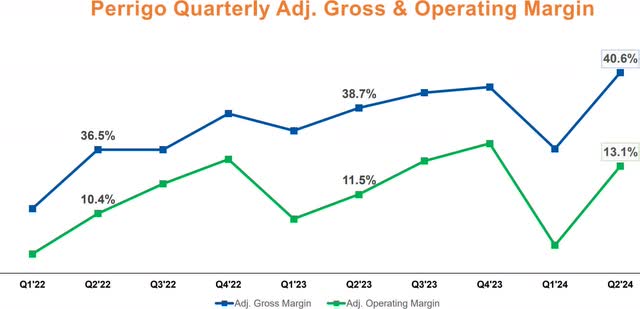

The corporate goals to extend its adjusted gross margin to not less than 40% over the subsequent three years. To attain this goal, Perrigo is using a number of methods:

International Provide Chain Reinvention Program: This initiative is predicted to ship annualized run-rate financial savings of $200 million to $300 million by the top of 2028. These financial savings will come from optimizing manufacturing processes and enhancing efficiencies throughout the provision chain. Integration of Acquisitions: Perrigo plans to combine latest acquisitions, resembling HRA Pharma and Gateway, that are anticipated to be margin accretive. For instance, theintegration of HRA is projected to attain €50 million in synergies by the top of 2024 by shifting distribution from third events to Perrigo’s in-house infrastructure. Pricing Actions: The corporate anticipates advantages from the annualization of inflation-justified pricing actions taken in 2023/2024. You will need to notice that Perrigo was behind branded gamers when it got here to pricing and is simply now catching up.

“Once more, I feel there have been numerous silos and numerous duplication throughout the group. Due to the acquisition of HRA Pharma who had Opill after which Compeed and plenty of manufacturers in Europe, I feel the European group, branded-wise, implausible. They’re persevering with to actually make progress, however I feel there’s duplication throughout the board, and there is some issues that must be centralized like digital and branded advertising and marketing and channel administration or business technique and implementation.” -Former govt at Perrigo (Alphasense transcript)

“Undertaking Energize. Equally, there was an funding value to this, however you’ll be able to see the $140 million to $170 million in financial savings by the top of 2026. General funding, $40 million to $60 million. However as soon as once more, this can be a five-year ROI of over 80%. We’re an amalgamation of a number of transactions, however it’s important that we streamline this firm to 1 working mannequin, which we confer with as One Perrigo” -CFO at Oppenheimer convention 2024

Perrigo achieved this standing early in 2024 and the advantages from restructuring are nonetheless ongoing resulting from which, that is in all probability a minimal expectation!

Turnaround of Toddler Method

Perrigo obtained a warning letter from the FDA on August 30, 2023, concerning their toddler formulation manufacturing facility in Eau Claire, Wisconsin. The letter outlined vital violations of FDA rules pertaining to good manufacturing practices, high quality management procedures, and extra. These violations have been found throughout an inspection performed from March 6 to April 26, 2023. Particular points included insufficient course of controls to forestall contamination and the presence of Cronobacter spp. in a number of batches of their toddler formulation merchandise. Regardless of these warnings, the FDA has reassured the general public that it doesn’t at present advise dad and mom and caregivers to keep away from buying any particular toddler formulation merchandise from Perrigo.

“We’ve got made excellent progress. The big-scale plant reset at three vegetation that went by means of vital remediation that’s now behind us, was accomplished some months in the past. We’ve got seen vital enhancements in high quality management, manufacturing, packaging and launch attainment. To place some numbers round that, we have seen a 10-fold enchancment in our environmental stability, which is excellent” -CFO at Oppenheimer convention 2024

Perrigo took speedy steps to deal with the problems. This included halting manufacturing and conducting thorough cleansing and sanitation of their manufacturing tools and services. Extra importantly, Perrigo spent capital in upgrading services in order that this situation is solved as soon as in for all. Till this improve was accomplished Perrigo couldn’t manufacture or promote toddler formulation! This was a daring step as this may take away the income and earnings contribution from their toddler formulation enterprise and Perrigo must miss steering. Buyers, who had had a sequence of setbacks in Perrigo have been additional disenchanted by ‘one other’ guide-down. We imagine this was the ultimate capitulation the place many worth traders gave up on the inventory.

“Keep in mind, once we talked about our earnings steering, we anticipated a $0.65 influence associated to toddler formulation into our outcomes for 2024. We’re effectively on observe to recapturing $140 million of annual adjusted working revenue in 2025, capturing all of that plus in 2026.,The important thing factor that we’re contemplating is constructing some stock inventory that is going to be necessary to guarantee that we will handle any shocks in provide in order that demand will not be impacted by that. So, we count on a good portion of that $0.65 to get better.” -CFO throughout earnings name

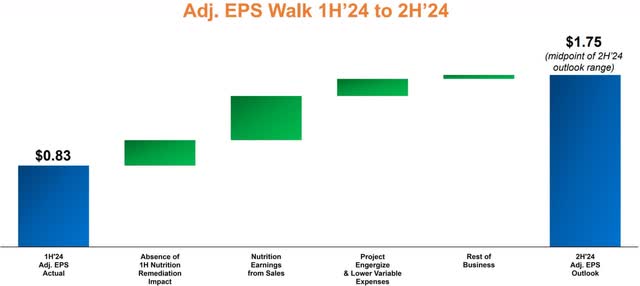

Nonetheless, in its simply reported earnings, Perrigo preponed the timeline the place it ought to see the restoration of a few of its toddler formulation enterprise in 2H 2024.

Which means that they need to do round $2.58 in EPS in 2024 and the inventory is at present buying and selling for 10x this EPS estimate.

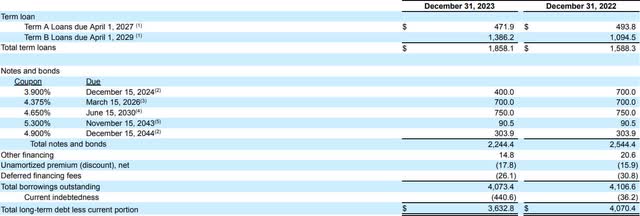

Perrigo’s steadiness sheet has been leveraged however the maturities are unfold out and coupon charges are comparatively low:

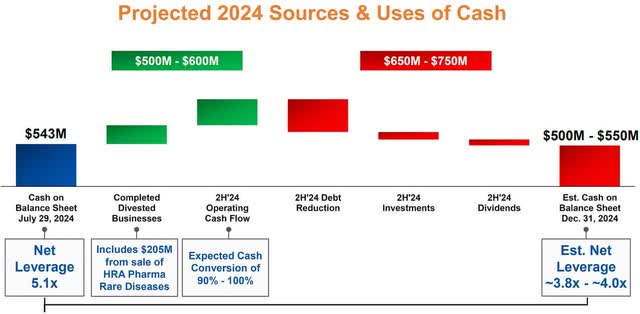

Importantly, Perrigo is a really money generative enterprise and has plans to aggressively pay down debt over the subsequent few years:

Free possibility – Opill

Perrigo launched Opill which is a progestin-only oral contraceptive capsule, which, not like mixture contraception capsules, incorporates solely progestin and is appropriate for a broader vary of ladies. In 2023, Opill obtained FDA approval as the primary over-the-counter (OTC) contraception capsule in the USA. This makes contraception extra accessible with no prescription. Opill enhances entry to contraception for a lot of ladies, together with younger ladies, these with out medical health insurance, and people in areas with restricted healthcare providers.

Launching an OTC contraception capsule requires vital instructional and advertising and marketing efforts to make sure correct use and integration into broader healthcare conversations. Because of this, Opill is at present dilutive to earnings however administration expects it to start out contributing to earnings in 2025-26. We imagine that there’s a vital market alternative for a capsule like Opill and this could contribute meaningfully to Perrigo’s leads to the close to future.

Going ahead, one can count on:

Natural web gross sales development within the low to mid-single digits Earnings will develop sooner resulting from working leverage and value slicing packages. As well as, the complete pressure of toddler formulation and a few contribution from Opill implies that EPS can hit $3.25-3.50 in 2025/26. After that, a HSD proportion development in adjusted working revenue and the next low-teens development in EPS resulting from debt paydown and decrease curiosity expense

Because of all this, we imagine that Perrigo must be buying and selling at a 14-15x a number of of this $3.50 in earnings in 2025/2026 resulting in a projected share value of $50 which is near a double in comparison with the share value at this time.

Administration

Murray S. Kessler was appointed the CEO in 2019 and performed an enormous half in main the corporate by means of varied strategic initiatives. Kessler was the Chairman and CEO of Lorillard, Inc., a serious tobacco firm.

Patrick Lockwood-Taylor took on the roles of President, Chief Govt Officer, and Board Member of Perrigo beginning June 30, 2023 and has been instrumental in its turnaround. Previous to becoming a member of Perrigo, he was the Regional President of Shopper Well being North America at Bayer AG, the place he additionally held the place of President of Bayer U.S. His profession consists of over twenty years at Procter & Gamble, the place he held varied model franchise and normal administration roles.

“Now, the excellent news is I feel Patrick Lockwood, who grew to become CEO proper as I used to be leaving, comes from a branded background and comes from P&G. I’ve watched the executives that they’ve employed, and I am like, “Possibly they’re turning the nook as a result of these are executives who perceive the branded recreation and perceive the place the funding must go.” -Former govt at Perrigo (Alphasense transcript)

Perrigo is an execution heavy enterprise (that no ham sandwich can run) and has chewed by means of CEO’s up to now. We imagine Patrick is doing the precise factor and comes from the precise background for this chance. The choice making at Perrigo has been a lot improved the place they’re making the precise choices for the corporate on a long run foundation because the appointment of Patrick. We imagine he’ll see this by means of and improve the standard of the enterprise over the very long run.

Conclusion

Perrigo stands out as a high-quality enterprise resulting from a number of key attributes that contribute to its sturdy market place. Perrigo has a diversified portfolio targeted on shopper self-care merchandise, together with over-the-counter medicines, dietary merchandise, and toddler formulation. This diversification helps mitigate dangers related to dependence on any single product class. Furthermore, Perrigo’s scale and scope in addition to its expertise with varied regulatory our bodies and intensive manufacturing and distribution community helps construct a moat which is troublesome for opponents to match. We’re at an inflection level the place Perrigo’s earnings ought to quickly improve and this, together with an appreciation of its enterprise mannequin, ought to assist re-rate the inventory. Lastly, Perrigo has proven resilience – even with all of the disappointments – with constant income and profitability. Its skill to generate sturdy money flows helps dividend funds to shareholders and will assist de-lever the steadiness sheet in a speedy method.