Up to date on January fifteenth, 2025 by Bob Ciura

Kevin O’Leary is Chairman of O’Shares Funding Advisors, however you in all probability know him as “Mr. Fantastic”.

He will be seen on CNBC in addition to the tv present Shark Tank. Buyers who’ve seen him on TV have possible heard him focus on his funding philosophy.

Mr. Fantastic seems for shares that exhibit three most important traits:

First, they have to be high quality firms with sturdy monetary efficiency and strong stability sheets.

Second, he believes a portfolio needs to be diversified throughout totally different market sectors.

Third, and maybe most necessary, he calls for revenue—he insists the shares he invests in pay dividends to shareholders.

You possibly can obtain the entire listing of all of O’Shares Funding Advisors inventory holdings by clicking the hyperlink beneath:

OUSA owns shares that show a mixture of all three qualities. They’re market leaders with sturdy income, diversified enterprise fashions, they usually pay dividends to shareholders.

The listing of OUSA portfolio holdings is an fascinating supply of high quality dividend development shares.

This text analyzes the fund’s largest holdings intimately.

Desk of Contents

The highest 10 holdings from the O’Shares FTSE U.S. High quality Dividend ETF are listed so as of their weighting within the fund, from lowest to highest.

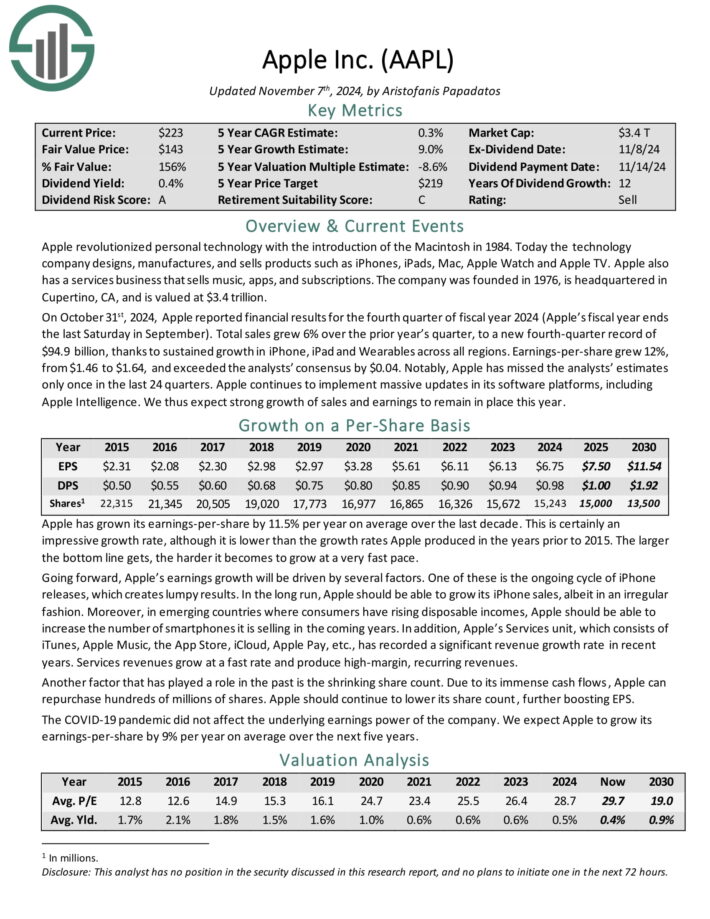

No. 10: Comcast Company (CMCSA)

Dividend Yield: 3.4%

Proportion of Portfolio: 3.26%

Comcast is a media, leisure and communications firm. Its enterprise items embody Cable Communications (Excessive–Pace Web, Video, Enterprise Companies, Voice, Promoting, Wi-fi), NBCUniversal (Cable Networks, Theme Parks, Broadcast TV, Filmed Leisure), and Sky, a number one leisure firm in Europe.

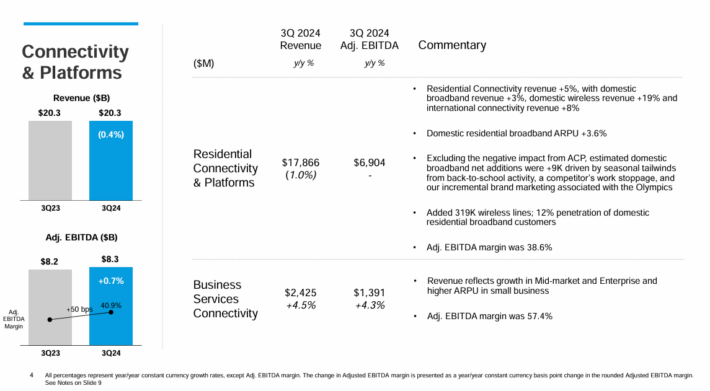

Comcast reported its Q3 2024 outcomes on Oct. thirty first, 2024. For the quarter, the corporate’s income rose 6.5% to $32.1 billion 12 months over 12 months. Adjusted EBITDA (a money circulate proxy) was down 2.3% to $9.7 billion.

Supply: Investor Presentation

Nonetheless, it was capable of enhance adjusted earnings-per-share (EPS) by 3.3% to $1.12. And Comcast generated free money circulate (FCF) of $3.4 billion. The Connectivity & Platforms section’s revenues had been down 0.4% to $20.3 billion.

The section skilled adjusted EBITDA rising marginally by 0.7% to $8.3 billion, helped by margins enlargement of 0.5% to 40.9%. The Content material & Experiences section noticed income develop 19% to $12.6 billion, whereas its adjusted EBITDA fell 8.7% to $1.8 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on Comcast (preview of web page 1 of three proven beneath):

No. 9: McDonald’s Company (MCD)

Dividend Yield: 2.5%

Proportion of OUSA Portfolio: 3.38%

McDonald’s is the world’s main restaurant chain with 41,822 areas in about 119 nations at finish of 2022. The best retailer counts are within the US (13,449), China (5,903), Japan (2,982), France (1,560), and Canada (1,466).

Roughly 95% of the shops are franchised or licensed and the remainder are firm owned. Nonetheless, the corporate owns about 55% of the actual property and 80% of the buildings in its community.

Whole system gross sales had been roughly $129.5B in 2023 and whole income was round $25.5B in 2023.

On October twenty ninth, McDonald’s reported Q3 2024 outcomes. Whole income got here in at $6.87 billion, rising 3% on flat system-wide gross sales adjusting for forex headwinds. Diluted earnings dropped 1% to $3.13 per share in comparison with $3.17 per share in comparable intervals on pre-tax fees.

On a geographic foundation, comparable gross sales elevated 0.3% within the US, -2.1% within the Worldwide Operated Markets, and -3.5% within the Worldwide Developmental Licensed Markets.

Click on right here to obtain our most up-to-date Certain Evaluation report on MCD (preview of web page 1 of three proven beneath):

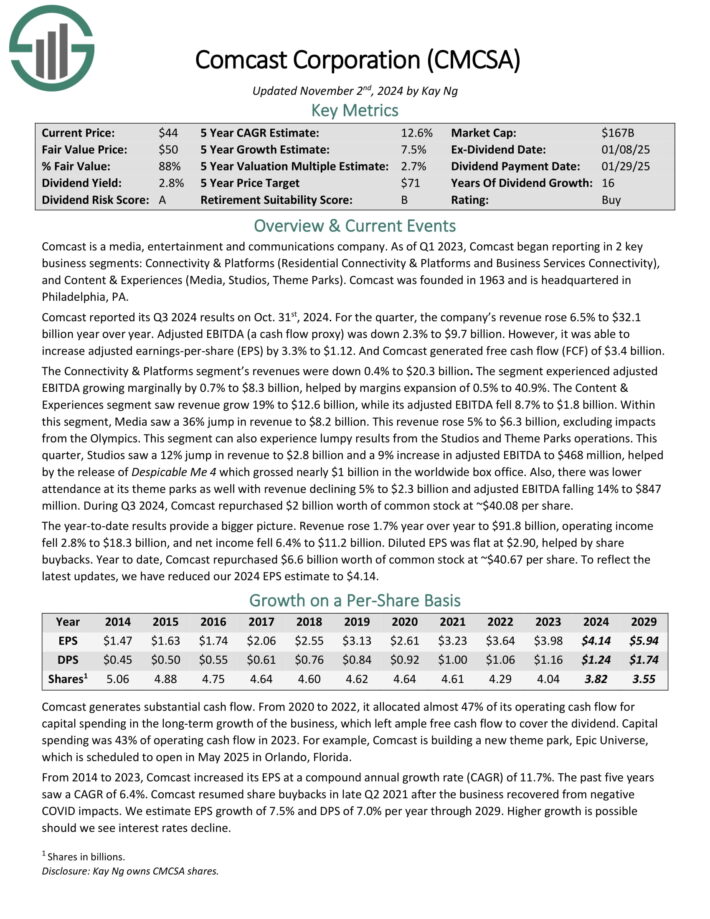

No. 8: MasterCard Inc. (MA)

Dividend Yield: 0.59%

Proportion of OUSA Portfolio: 3.96%

MasterCard is a world chief in digital funds. The corporate companions with 25,000 monetary establishments around the globe to offer an digital cost community. MasterCard has greater than 3.1 billion credit score and debit playing cards in use.

On October thirty first, 2024, MasterCard reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income grew 12.9% to $7.4 billion, which was $100 million above estimates.

Adjusted earnings-per-share of $3.89 in contrast favorably to $3.39 within the prior 12 months and was $0.14 greater than anticipated.

On an area forex foundation, gross greenback volumes for the quarter grew 10% worldwide to $2.5 trillion through the quarter, with the U.S. up 7% and the remainder of the world greater by 12%.

Cross border volumes remained sturdy with development of twenty-two% from the prior 12 months and up from 17% development in Q2 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on Mastercard (preview of web page 1 of three proven beneath):

No. 7: Johnson & Johnson (JNJ)

Dividend Yield: 3.4%

Proportion of OUSA Portfolio: 4.10%

Johnson & Johnson is a diversified well being care firm and a pacesetter within the space of progressive medicines and medical gadgets Johnson & Johnson was based in 1886 and employs almost 132,000 folks around the globe. The corporate is projected to generate greater than $89 billion in income this 12 months.

On April sixteenth, 2024, Johnson & Johnson introduced that it was rising its quarterly dividend 4.2% to $1.24, extending the corporate’s dividend development streak to 62 consecutive years.

On Might thirty first, 2024, Johnson & Johnson accomplished its $13.1 billion buy of cardiovascular medical gadget firm Shockwave Medical.

On October fifteenth, 2024, Johnson & Johnson reported third quarter outcomes for the interval ending September thirtieth, 2024.

Supply: Investor Presentation

For the quarter, income elevated 5.4% to $22.5 billion, which topped estimates by $330 million. Adjusted earnings-per-share of $2.42 in comparison with $2.82 within the prior 12 months, however this was $0.21 higher than anticipated.

Excluding Covid-19 vaccine gross sales, the corporate’s income grew 5.6% within the third quarter. Income for Progressive Medicines grew 4.9% on a reported foundation, however improved 6.3% when excluding forex translation.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven beneath):

No. 6: Merck & Co. (MRK)

Dividend Yield: 3.2%

Proportion of OUSA Portfolio: 4.19%

Merck & Firm is without doubt one of the largest healthcare firms on the earth. Merck manufactures prescription medicines, vaccines, biologic therapies, and animal well being merchandise. Merck employs 68,000 folks around the globe and generates annual revenues of greater than $63 billion.

On Might twenty ninth, 2024, Merck accomplished its $1.3 billion buy of EyeBio, which has a pipeline of drug candidates that concentrate on retinal illnesses.

On October thirty first, 2024, Merck reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income grew 4.4% to $16.7 billion, which was $190 million above expectations. Adjusted earnings-per-share was $1.57 in comparison with $2.13 within the prior 12 months and was in-line with estimates.

Keytruda, which treats cancers similar to melanoma that can’t be eliminated by surgical procedure and non-small cell lung most cancers, continues to be the important thing driver of development for the corporate and had income development of 17% to $7.4 billion through the interval. The product generated $25 billion in 2023, up from $20.9 billion within the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on MRK (preview of web page 1 of three proven beneath):

No. 5: Alphabet Inc. (GOOGL)

Dividend Yield: 0.41%

Proportion of OUSA Portfolio: 4.47%

Alphabet is a expertise conglomerate that operates a number of companies similar to Google search, Android, Chrome, YouTube, Nest, Gmail, Maps, and plenty of extra. Alphabet is a pacesetter in most of the areas of expertise that it operates. On October twenty ninth, 2024, Alphabet reported third quarter outcomes for the interval ending September thirtieth, 2024.

As had been the case for a number of quarters, the corporate delivered higher than anticipated outcomes. Income grew 15.1% to $88.3 billion for the interval and beat analysts’ estimates by $2.05 billion. Adjusted earnings-per-share of $2.12 in contrast very favorably to $1.55 within the prior 12 months and was $0.27 above expectations.

As soon as once more, almost each side of Alphabet’s enterprise carried out properly through the quarter. Income for Google Search, the most important contributor to outcomes, elevated greater than 12% to $49.4 billion. YouTube advertisements grew 12.2% to $8.9 billion whereas Google Community declined 1.6% to $7.5 billion. Google subscriptions, platforms, and gadgets had been up nearly 28% to $10.7 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on GOOGL (preview of web page 1 of three proven beneath):

No. 4: Microsoft Company (MSFT)

Dividend Yield: 0.78%

Proportion of OUSA Portfolio: 4.91%

Microsoft Company manufactures and sells software program and {hardware} to companies and shoppers. Its choices embody working techniques, enterprise software program, software program growth instruments, video video games and gaming {hardware}, and cloud companies.

On October thirty first, 2024, MasterCard reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income grew 12.9% to $7.4 billion, which was $100 million above estimates.

Adjusted earnings-per-share of $3.89 in contrast favorably to $3.39 within the prior 12 months and was $0.14 greater than anticipated.

On an area forex foundation, gross greenback volumes for the quarter grew 10% worldwide to $2.5 trillion through the quarter, with the U.S. up 7% and the remainder of the world greater by 12%.

Cross border volumes remained sturdy with development of twenty-two% from the prior 12 months and up from 17% development in Q2 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on MSFT (preview of web page 1 of three proven beneath):

No. 3: Dwelling Depot (HD)

Dividend Yield: 2.2%

Proportion of OUSA Portfolio: 5.27%

Dwelling Depot was based in 1978 and since that point has grown right into a juggernaut dwelling enchancment retailer with over 2,300 shops within the US, Canada and Mexico that generate round $153 billion in annual income.

Dwelling Depot reported third quarter 2024 outcomes on November twelfth, 2024. The corporate reported gross sales of $40.2 billion, up 6.6% year-over-year.

Nonetheless, comparable gross sales within the quarter decreased 1.3%. Web earnings equaled $3.6 billion, or $3.67 per share, in comparison with $3.8 billion, or $3.81 per share in Q3 2023. Adjusted EPS was $3.78.

The corporate spent $649 million on frequent inventory repurchases year-to-date, in comparison with $6.5 billion within the prior 12 months. Common ticket declined 0.8% in comparison with final 12 months, from $89.36 to $88.65.

Moreover, gross sales per retail sq. foot decreased 2.1% from $595.71 to $582.97.

Click on right here to obtain our most up-to-date Certain Evaluation report on HD (preview of web page 1 of three proven beneath):

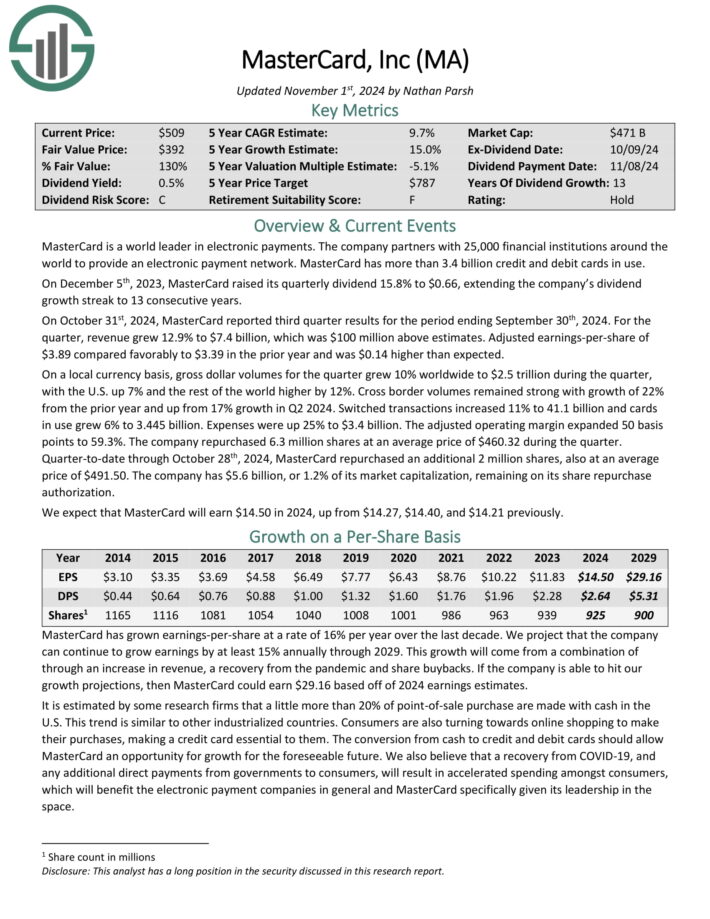

No. 2: Apple (AAPL)

Dividend Yield: 0.42%

Proportion of OUSA Portfolio: 5.28%

Apple designs, manufactures and sells merchandise similar to iPhones, iPads, Mac, Apple Watch and Apple TV. Apple additionally has a companies enterprise that sells music, apps, and subscriptions.

On October thirty first, 2024, Apple reported monetary outcomes for the fourth quarter of fiscal 12 months 2024. Whole gross sales grew 6% over the prior 12 months’s quarter, to a brand new fourth-quarter report of $94.9 billion, because of sustained development in iPhone, iPad and Wearables throughout all areas.

Earnings-per-share grew 12%, from $1.46 to $1.64, and exceeded the analysts’ consensus by $0.04.

Click on right here to obtain our most up-to-date Certain Evaluation report on AAPL (preview of web page 1 of three proven beneath):

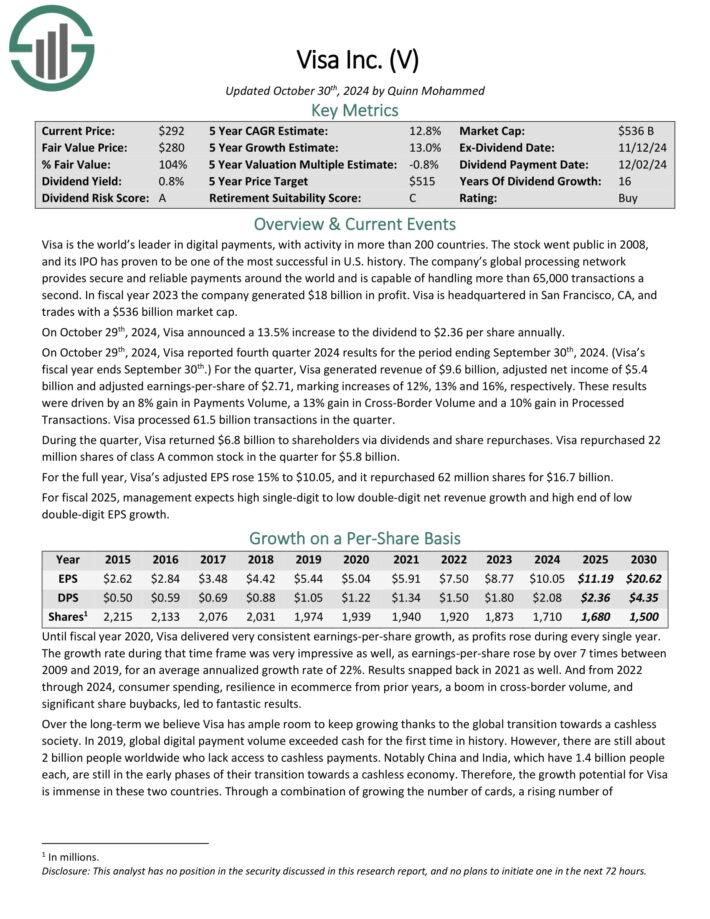

No. 1: Visa Inc. (V)

Dividend Yield: 0.75%

Proportion of OUSA Portfolio: 5.45%

Visa is the world’s chief in digital funds, with exercise in additional than 200 nations. The corporate’s world processing community supplies safe and reliable funds around the globe and is able to dealing with greater than 65,000 transactions a second.

On October twenty ninth, 2024, Visa introduced a 13.5% enhance to the dividend to $2.36 per share yearly. It additionally launched quarterly earnings the identical day.

For the quarter, Visa generated income of $9.6 billion, adjusted web revenue of $5.4 billion and adjusted earnings-per-share of $2.71, marking will increase of 12%, 13% and 16%, respectively.

These outcomes had been pushed by an 8% achieve in Funds Quantity, a 13% achieve in Cross-Border Quantity and a ten% achieve in Processed Transactions.

Visa processed 61.5 billion transactions within the quarter. In the course of the quarter, Visa returned $6.8 billion to shareholders through dividends and share repurchases. Visa repurchased 22 million shares of sophistication A standard inventory within the quarter for $5.8 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on Visa (preview of web page 1 of three proven beneath):

Closing Ideas

Kevin O’Leary has develop into a family identify on account of his appearances on the TV present Shark Tank. However he’s additionally a widely known asset supervisor, and his funding philosophy largely aligns with Certain Dividend’s.

Particularly, Mr. Fantastic usually invests in shares with giant and worthwhile companies, with sturdy stability sheets and constant dividend development yearly.

Not all of those shares are at present rated as buys within the Certain Evaluation Analysis Database, which ranks shares primarily based on anticipated whole return on account of a mixture of earnings per share development, dividends, and adjustments within the price-to-earnings a number of.

Nonetheless, a number of of those 10 shares are invaluable holdings for a long-term dividend development portfolio.

Extra Assets

In case you are enthusiastic about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases shall be helpful:

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.