Buyers are navigating volatility to uncover promising progress alternatives.

AI and media shares stand out as potential winners heading into 2025.

Reap the benefits of our Prolonged Cyber Monday provide—your final likelihood to safe InvestingPro at a 55% low cost!

The Federal Reserve’s newest delivered a predictable charge lower however an sudden twist. Whereas it lowered rates of interest by 25 foundation factors, the larger information was a discount within the projected charge cuts for subsequent 12 months—from 100 foundation factors to simply 50. This hawkish pivot jolted markets. The surged, and US indices tumbled, wiping out a lot of December’s good points.

Regardless of the market’s sharp response, it’s untimely to declare a full-blown correction or a long-lasting pattern reversal. Buyers nonetheless have alternatives to capitalize on shares displaying resilience and progress potential. With 2025 on the horizon, listed here are three shares price looking forward to short-term momentum and long-term promise.

1. TaskUs: Positioned for AI-Pushed Positive factors

Taskus (NASDAQ:), a know-how agency specializing in synthetic intelligence options like buyer help and content material moderation, has been a standout performer this 12 months.

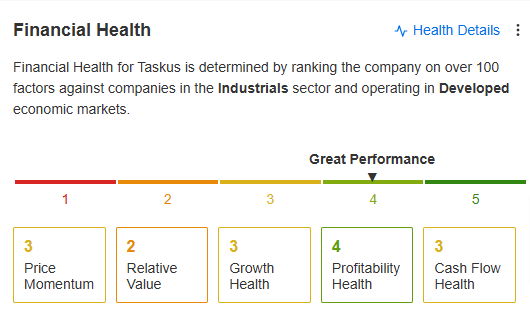

Regardless of market volatility, the inventory has climbed a formidable 21% year-to-date, underpinned by strong monetary well being and engaging valuation metrics.

Supply: InvestingPro

Over the previous two years, TaskUs has maintained regular income progress and earnings per share, strengthening its money stream and profitability. Its deepening partnerships with main shoppers sign a stable trajectory for future growth, making it a compelling decide for traders seeking to experience the AI wave.

2. Warner Bros. Discovery: Progress Momentum Meets Resistance

Warner Bros Discovery (NASDAQ:) continues to construct on its latest upward momentum, pushed by a strategic restructuring plan.

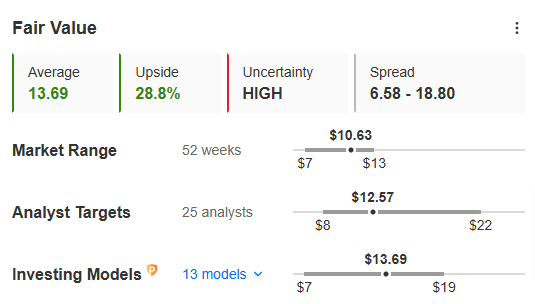

The corporate’s separation of streaming companies from conventional TV operations and aggressive cost-cutting measures have reignited investor optimism. In response to InvestingPro, analysts see practically 30% upside potential for the inventory.

Supply: InvestingPro

Nevertheless, Warner Bros. faces a crucial check on the $13 resistance degree. A breakthrough may pave the way in which for vital good points, however failure to clear this hurdle might result in a deeper pullback, with key help close to $9. For traders keen to navigate the volatility, the upside stays engaging.

3. Opera The AI Innovator to Watch

Opera (NASDAQ:) has emerged as a rising star within the AI sector, fueled by stellar Q2 and Q3 outcomes that despatched its inventory hovering by double digits after every earnings launch.

The corporate reported spectacular year-over-year progress in Q3, together with a 33% surge in new customers, a 13% bounce in searches, and a 26% enhance in advert income.

Central to Opera’s success is its AI-powered platform, Aria, which presents seamless entry with out requiring login credentials. This innovation positions Opera as a frontrunner in integrating AI into on a regular basis web use, solidifying its path for continued progress.

The Takeaway

The Fed’s hawkish tone might have rattled markets, nevertheless it additionally underscores the significance of selective stock-picking in a unstable atmosphere. Corporations like TaskUs, Warner Bros. Discovery, and Opera provide distinct alternatives for traders seeking to align with progress traits in AI and media. Staying targeted on resilience and momentum might be the important thing to thriving as 2025 approaches.

For this, InvestingPro can show a precious software. With state-of-the-art analysis instruments obtainable at your fingertips, you’ll be able to defy market volatility to seek out particular person shares that may shine regardless of macro headwinds.

Reap the benefits of our Prolonged Cyber Monday provide—your final likelihood to safe InvestingPro at a 55% low cost—and achieve insights into elite funding methods and entry over 100 AI-driven inventory suggestions each month.

? Click on on the banner under to find extra.

Disclaimer: This text is written for informational functions solely. It isn’t meant to encourage the acquisition of property in any manner, nor does it represent a solicitation, provide, suggestion or suggestion to take a position. I wish to remind you that every one property are evaluated from a number of views and are extremely dangerous, so any funding resolution and the related threat belongs to the investor. We additionally don’t present any funding advisory companies.