Up to date on February twenty fifth, 2025 by Bob Ciura

The “Canines of the Dow” investing technique is a quite simple approach for buyers to attain diversification and earnings of their portfolios whereas remaining within the sphere of extra conservative blue chip shares.

The technique consists of investing within the 10 highest-yielding shares within the Dow Jones Industrial Common, an index of 30 U.S. shares.

Excessive dividend shares are shares with a dividend yield effectively in extra of the market common dividend yield of ~1.3%. With that in thoughts, we’ve got created a free record of over 200 excessive dividend shares with dividend yields above 5%.

You’ll be able to obtain your copy of the excessive dividend shares record beneath:

The “Canines of the Dow” technique produces above-average earnings and concentrates on shares that sometimes commerce at decrease valuations relative to the remainder of the DJIA.

Provided that the DJIA represents a few of the largest firms on this planet, its “canines” are sometimes firms with robust monitor data which have hit short-term issues.

It is a nice and easy technique for worth buyers trying to buy good companies which might be at present out of favor.

To implement this technique, take the sum of money you must make investments after which divide it equally among the many 10 highest-yielding shares within the DJIA.

Maintain these shares for a complete yr after which on the finish of 12 months, have a look at the 30 Dow shares once more and resort them by dividend yield from highest to lowest.

Rebalance and reallocate your capital accordingly and repeat the method. Along with the simplicity and give attention to high quality, worth, and earnings that this technique generates, it additionally improves self-discipline by stopping extreme emotion-driven buying and selling.

It additionally encourages buyers to reap the tax advantages from holding positions for not less than one yr earlier than promoting, thereby being taxed on the long-term capital positive factors tax charge as an alternative of the short-term charge.

The 2025 Canines of the Dow

The record of the 2024 Canines of the Dow is beneath, together with the present dividend yield of the top-ten yielding DJIA shares. Click on on an organization’s title to leap on to evaluation on that firm.

Canine of the Dow #10: Procter & Gamble (PG)

Procter & Gamble is a client merchandise large that sells its merchandise in over 180 nations. Notable manufacturers embrace Pampers, Luvs, Tide, Acquire, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Previous Spice, Daybreak, Febreze, Swiffer, Crest, Oral-B, Scope, Olay and plenty of extra.

Procter & Gamble has paid a dividend for 134 years and has grown its dividend for 68 consecutive years – one of many longest energetic streaks of any firm.

In late January, Procter & Gamble reported (1/22/25) monetary outcomes for the second quarter of fiscal 2025 (its fiscal yr ends June thirtieth).

Supply: Investor Presentation

Gross sales and its natural gross sales grew 2% and three%, respectively, over final yr’s second quarter, primarily due to 2% quantity development. Core earnings-per-share grew 2%, from $1.84 to $1.88, beating the analysts’ consensus by $0.02.

Procter & Gamble reaffirmed its steering for 3%-5% development of natural gross sales and 5%-7% development of earnings-per-share in fiscal 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on PG (preview of web page 1 of three proven beneath):

Canine of the Dow #9: Dwelling Depot (HD)

Dwelling Depot was based in 1978 and since that point has grown right into a juggernaut residence enchancment retailer with over 2,300 shops within the US, Canada and Mexico that generate round $153 billion in annual income.

Dwelling Depot reported third quarter 2024 outcomes on November twelfth, 2024. The corporate reported gross sales of $40.2 billion, up 6.6% year-over-year.

Nonetheless, comparable gross sales within the quarter decreased 1.3%. Web earnings equaled $3.6 billion, or $3.67 per share, in comparison with $3.8 billion, or $3.81 per share in Q3 2023. Adjusted EPS was $3.78.

The corporate spent $649 million on widespread inventory repurchases year-to-date, in comparison with $6.5 billion within the prior yr. Common ticket declined 0.8% in comparison with final yr, from $89.36 to $88.65.

Moreover, gross sales per retail sq. foot decreased 2.1% from $595.71 to $582.97.

Click on right here to obtain our most up-to-date Positive Evaluation report on HD (preview of web page 1 of three proven beneath):

Canine of the Dow #8: Worldwide Enterprise Machines (IBM)

IBM is a world data expertise firm that gives built-in enterprise options for software program, {hardware}, and companies.

Its focus is working mission-critical programs for giant, multi-national clients and governments. IBM sometimes supplies end-to-end options.

The corporate now has 4 enterprise segments: Software program, Consulting, Infrastructure, and Financing.

IBM reported outcomes for This fall 2024 on January twenty ninth, 2025. Firm-wide income rose 2% in fixed foreign money whereas diluted adjusted earnings per share climbed 1% year-over-year.

Software program income elevated 11% year-over-year resulting from 12% development in Hybrid Platform & Options and an 11% improve in Transaction Processing. Income was up 17% for RedHat, 16% for Automation, 5% for Information & AI, and 5% for Safety.

Click on right here to obtain our most up-to-date Positive Evaluation report on Worldwide Enterprise Machines (IBM) (preview of web page 1 of three proven beneath):

Canine of the Dow #7: Cisco Methods (CSCO)

Cisco Methods is the worldwide chief in excessive efficiency pc networking programs. The corporate’s routers and switches enable networks world wide to attach to one another by way of the web. Cisco additionally provides information heart, cloud, and safety merchandise.

On February twelfth, 2025, Cisco introduced a 2.5% dividend improve within the quarterly fee to $0.41. That very same day, Cisco introduced outcomes for the second quarter of fiscal yr 2025 for the interval ending January twenty fifth, 2025.

For the quarter, income grew 9.4% to $13.99 billion, which beat estimates by $120 million. Adjusted earnings-per-share of $0.94 in contrast favorably to adjusted earnings-per-share of $0.87 within the prior yr and was $0.03 forward of expectations.

Excluding the corporate’s current acquisition of Splunk, whole income grew 11% for the quarter. Networking fell 3% whereas Safety grew 117%, Observability was up 47%, and Collaboration improved 1%. By area, the Americas elevated 9%, Europe/Center East/Africa was greater by 11%, and Asia-Pacific/Japan/China was up 8%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Cisco Methods (CSCO) (preview of web page 1 of three proven beneath):

Canine of the Dow #6: Coca-Cola (KO)

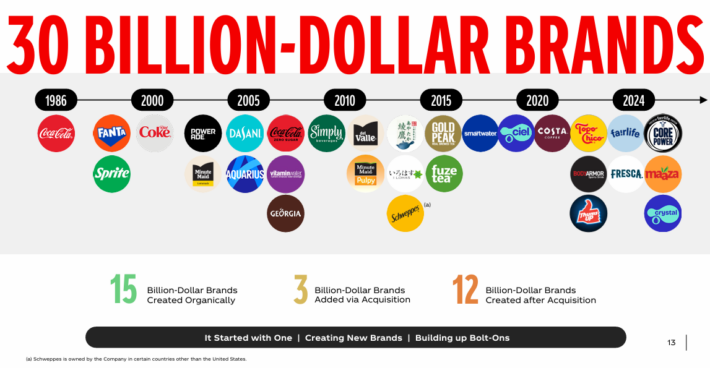

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. For the reason that firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate not less than $1 billion in annual gross sales.

Supply: Investor Presentation

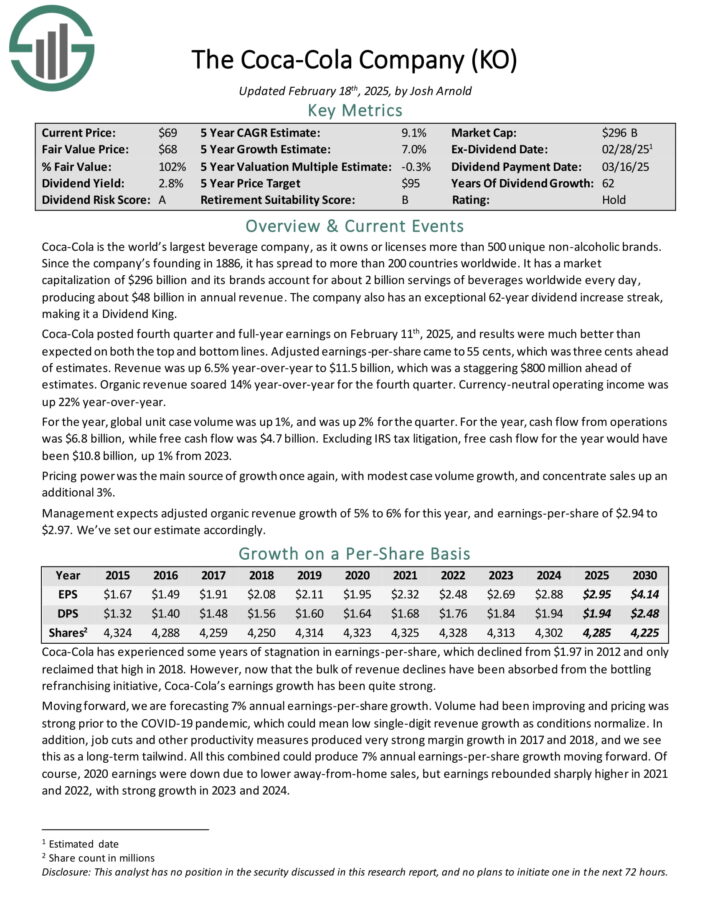

Coca-Cola posted fourth quarter and full-year earnings on February eleventh, 2025, and outcomes had been significantly better than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to 55 cents, which was three cents forward of estimates.

Income was up 6.5% year-over-year to $11.5 billion, which was a staggering $800 million forward of estimates. Natural income soared 14% year-over-year for the fourth quarter. Foreign money-neutral working earnings was up 22% year-over-year.

For the yr, international unit case quantity was up 1%, and was up 2% for the quarter. Excluding IRS tax litigation, free money movement for the yr would have been $10.8 billion, up 1% from 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on KO (preview of web page 1 of three proven beneath):

Canine of the Dow #5: Johnson & Johnson (JNJ)

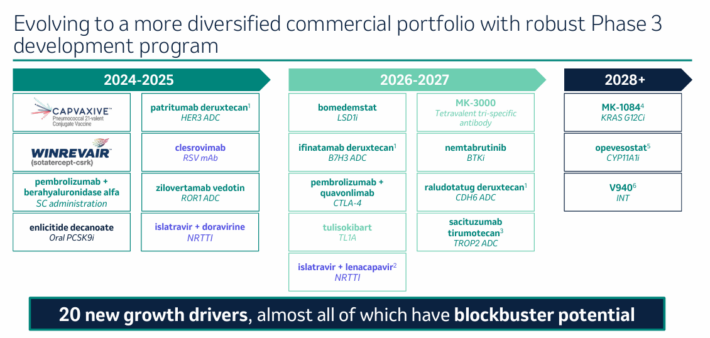

Johnson & Johnson is a diversified well being care firm and a frontrunner within the space of progressive medicines and medical gadgets Johnson & Johnson was based in 1886 and employs almost 132,000 folks world wide.

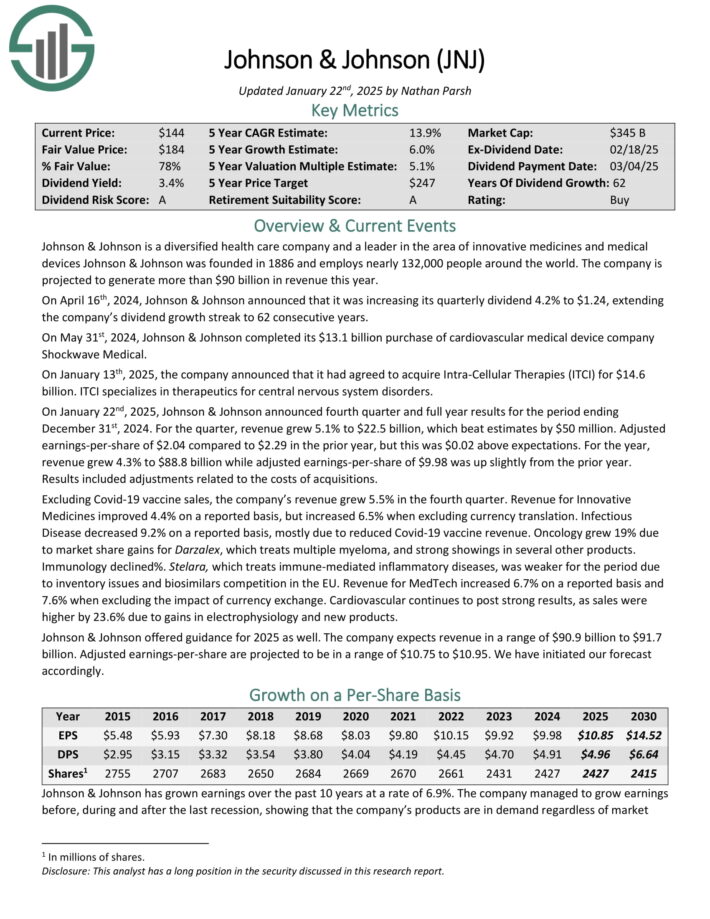

On January twenty second, 2025, Johnson & Johnson introduced fourth quarter and full yr outcomes for the interval ending December thirty first, 2024.

Supply: Investor Presentation

For the quarter, income grew 5.1% to $22.5 billion, which beat estimates by $50 million. Adjusted earnings-per-share of $2.04 in comparison with $2.29 within the prior yr, however this was $0.02 above expectations.

For the yr, income grew 4.3% to $88.8 billion whereas adjusted earnings-per-share of $9.98 was up barely from the prior yr. Outcomes included changes associated to the prices of acquisitions.

Click on right here to obtain our most up-to-date Positive Evaluation report on JNJ (preview of web page 1 of three proven beneath):

Canine of the Dow #4: Amgen Inc. (AMGN)

Amgen is the most important unbiased biotech firm on this planet. Amgen discovers, develops, manufactures, and sells medicines that deal with severe sicknesses.

The corporate focuses on six therapeutic areas: heart problems, oncology, bone well being, neuroscience, nephrology, and irritation.

Supply: Investor Presentation

On February 4th, 2025, Amgen introduced fourth quarter and full yr earnings outcomes. Income grew 11% to $9.1 billion, which was $230 million greater than anticipated. Adjusted earnings-per-share of $5.31 in contrast favorably to $4.71 within the prior yr and was $0.23 forward of estimates.

For the yr, income grew 19% to $33.4 billion whereas adjusted earnings-per-share of $19.84 in comparison with $18.65 in 2023.

Amgen had a profitable 2024 as 21 merchandise achieved report gross sales. For the quarter, development was primarily resulting from a 14% improve in volumes. Excluding the addition of Horizon Therapeutics, product gross sales improved 10% and quantity was up 15%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Amgen Inc. (AMGN) (preview of web page 1 of three proven beneath):

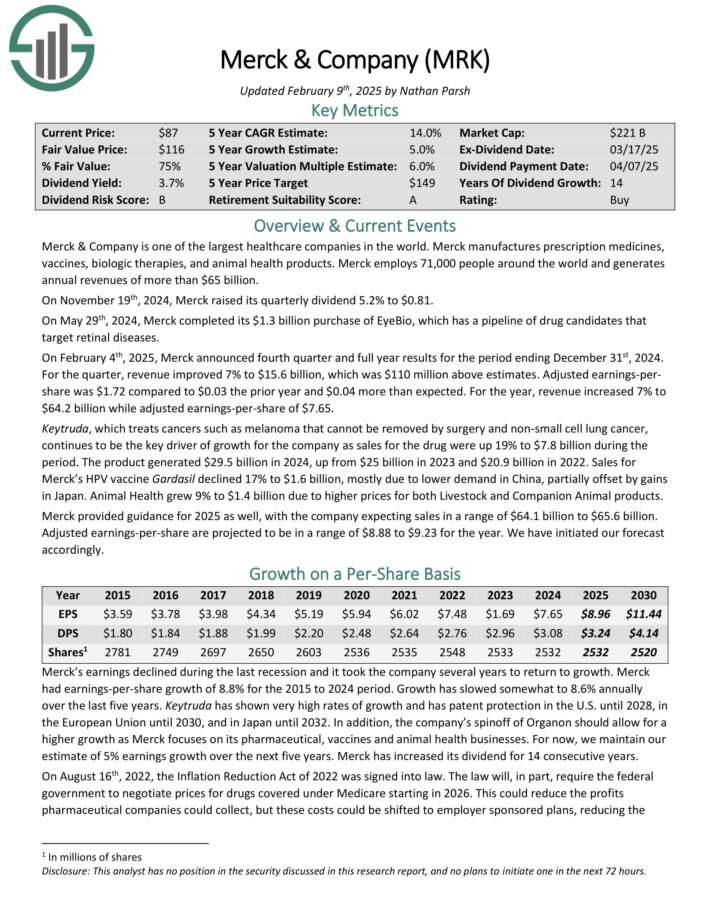

Canine of the Dow #3: Merck & Firm (MRK)

Merck & Firm is likely one of the largest healthcare firms on this planet. Merck manufactures prescription medicines, vaccines, biologic therapies, and animal well being merchandise.

Merck employs 68,000 folks world wide and generates annual revenues of greater than $63 billion.

Supply: Investor Presentation

On February 4th, 2025, Merck introduced fourth quarter and full yr outcomes for the interval ending December thirty first, 2024.

For the quarter, income improved 7% to $15.6 billion, which was $110 million above estimates. Adjusted earnings-per-share was $1.72 in comparison with $0.03 the prior yr and $0.04 greater than anticipated.

For the yr, income elevated 7% to $64.2 billion whereas adjusted earnings-per-share of $7.65.

Keytruda, which treats cancers corresponding to melanoma that can’t be eliminated by surgical procedure and non-small cell lung most cancers, continues to be the important thing driver of development for the corporate as gross sales for the drug had been up 19% to $7.8 billion in the course of the interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on MRK (preview of web page 1 of three proven beneath):

Canine of the Dow #2: Chevron Company (CVX)

Chevron is likely one of the largest oil majors on this planet. The corporate sees the majority of its earnings from its upstream section and has the next crude oil and pure gasoline manufacturing ratio than most of its friends.

Chevron has elevated its dividend for 38 consecutive years, putting it on the Dividend Aristocrats record.

In 2023, Chevron agreed to Purchase Hess (HES) for $53 billion in an all-stock deal. If the deal closes, Chevron will buy the extremely worthwhile Stabroek block in Guyana and Bakken belongings and thus it would drastically improve its output and free money movement.

In late January, Chevron reported (1/31/25) outcomes for the fourth quarter of 2024. Manufacturing dipped -1% over the prior yr’s fourth quarter resulting from downtime in some fields, regardless of report Permian output after the acquisition of PDC Power.

As well as, the value of oil decreased and refining margins plunged to regular ranges after two years of blowout ranges. Because of this, earnings-per-share fell -40%, from $3.45 to $2.06, lacking the analysts’ consensus by $0.05.

Click on right here to obtain our most up-to-date Positive Evaluation report on Chevron Company (CVX) (preview of web page 1 of three proven beneath):

Canine of the Dow #1: Verizon Communications (VZ)

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is likely one of the largest wi-fi carriers within the nation.

Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a few quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

On January twenty fourth, 2025, Verizon introduced fourth quarter and full yr outcomes. For the quarter, income grew 1.7% to $35.7 billion, which beat estimates by $360 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $1.10 in contrast favorably to $1.08 within the prior yr and was in-line with expectations. For the yr, grew 0.6% to $134.8 billion whereas adjusted earnings-per-share $4.59 in comparison with $4.71 in 2023.

For the quarter, Verizon had postpaid telephone web additions of 568K, which was higher than the 449K web additions the corporate had in the identical interval final yr. Retail postpaid web additions totaled 426K.

Wi-fi retail postpaid telephone churn charge stays low at 0.89%. Wi-fi income grew 3.1% to $20.0 billion whereas the Client section elevated 2.2% to $27.6 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on VZ (preview of web page 1 of three proven beneath):

Ultimate Ideas

Given the descriptions above, the Canines of the Dow are clearly a really various group of blue-chip shares that every get pleasure from vital aggressive benefits and prolonged histories of paying rising dividends.

Because of this, this investing technique is a superb, low-risk approach for unsophisticated buyers to strategy dividend development investing.

Whereas it might not outperform the broader market yearly, it’s just about assured to supply buyers with a mixture of enticing present yield with steadily rising earnings over time.

If you’re concerned with discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Positive Dividend sources will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.